How Much Will It Cost To Complete The Refinancing

Depending on your lender and your loan terms, you may pay as little as a few hundred dollars or as much as 2% to 3% of the new loan value to complete a refinancing. If its going to cost you $3,000 to complete the refinance and it will take four years to recoup that money, it may not make sense for you.

Alternatively, if you can refinance and pay only $1,000, and have no plans to sell anytime soon, its very likely worth paying that $1,000 to save over time. In addition, some lenders allow you to roll your closing costs into the amount of the loan, so you dont have to come up with money out of pocket for closing costs.

Too Busy To Visit A Branch

Meet with a Mortgage Specialist at your home, workplace, coffee shop or other convenient location.

Need to talk to us directly?Contact us

Follow TD

Super: TD presents Asking for a FriendWhy Would You Refinance?

Welcome to Asking for a Friend. Lets see who could use some financial advice today.

Dear Asking for a Friend,My neighbour was talking about refinancing her home so she can borrow more money to build an extension, and it got me wondering…what exactly IS refinancing and why do people refinance?Sincerely,Next Door Nancy

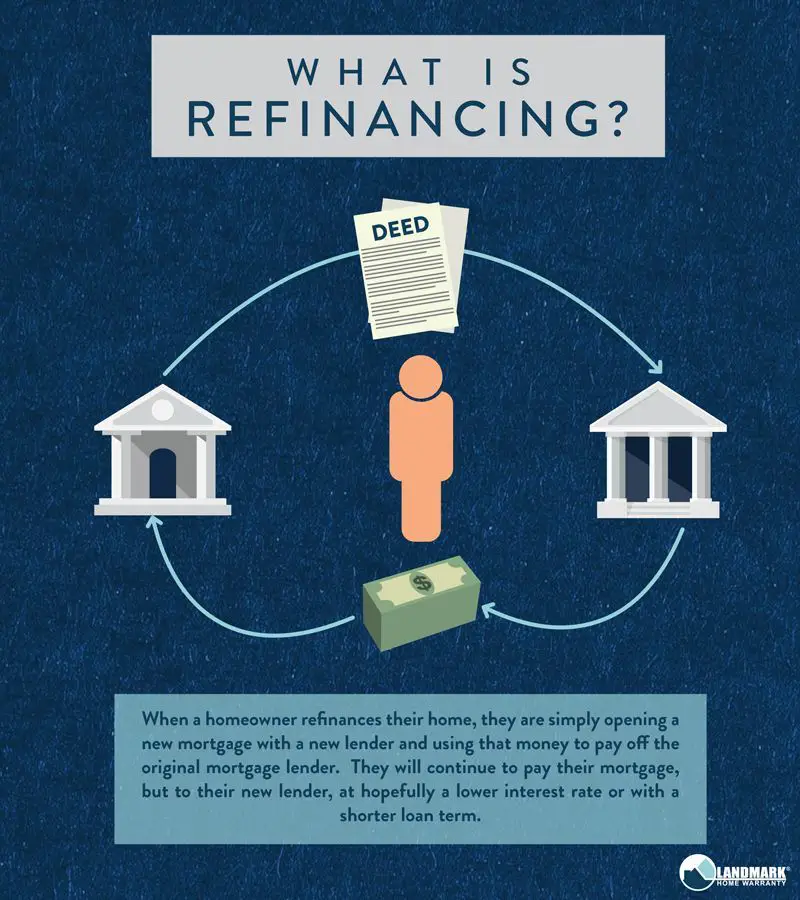

I hear you, Nancy. First, what is refinancing?

Refinancing means renegotiating your existing mortgage loan agreement, usually to use any available equity in your home.

So what does that mean in real terms? Let’s say the value of your home is $500,000.

Super: $500,000

80% of home value 0.8 x $500,000 $400,000Outstanding balance of your mortgage $300,000How much you can borrow $100,000

Subject to the bank’s approval, you could borrow up to 80% of the value of your home less the outstanding balance of your mortgage.

That means if your home is worth $500,000 and you have an outstanding balance of $300,000 on your mortgage, you may be able to borrow an additional $100,000 .

So WHY do people refinance?

Super: To consolidate debts.

Super: Provide flexibility to pay for big ticket items.

Book an appointment and get financial advice for what you feel is most essential, through TD Ready Advice

Endslate: Visit td.com/readyadvice

Original Vs New Monthly Payment When Refinancing

| Original principal | |

|---|---|

|

3.25% |

$870 |

Dont just look at the monthly payment, though. How much will each loan cost you in total interest assuming you pay off the mortgage and dont sell your home or refinance again?

To get this information, select the calculators option to view the amortization table. At the bottom, youll see the total interest for the new mortgage. Write that number down.

Then, do a new calculation with the mortgage calculator. Enter your:

- Original principal amount

- Current interest rate

- Current loan term

Then, view the amortization table for that calculation and see what your current total interest over the life of the loan will be. How much will you save in the long run by refinancing?

Recommended Reading: How Do You Apply For A Mortgage

Here Are Some Mortgage Refinance Options That May Suit Your Unique Needs

Tags:Mortgage,Home,Refinance,Loans

Refinancing your mortgage could save you money, help you pay off your home faster or unlock the equity in your home if the time is right. Knowing your refinancing options is key to gaining the maximum benefit from your decision. Learn whether home mortgage refinancing is right for you.

There are many mortgage refinancing options for many needs, but whatever your goals are, a mortgage loan officer can answer your questions and help you find the home mortgage refinancing thats right for you!

Mortgage and Home Equity products are offered by U.S. Bank National Association. Loan products are offered by U.S. Bank National Association and subject to normal credit approval.

Investment and Insurance products and services including annuities are:Not a Deposit Not FDIC Insured May Lose Value Not Bank Guaranteed Not Insured by any Federal Government Agency

U.S. Wealth Management U.S. Bank and U.S. Bancorp Investments is the marketing logo for U.S. Bank and its affiliate U.S. Bancorp Investments.

U.S. Bank, U.S. Bancorp Investments and their representatives do not provide tax or legal advice. Your tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

For U.S. Bank: Equal Housing Lender.

U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments, Inc.

Does Home Refinancing Hurt Your Credit

Mortgage refinances have the potential to affect your credit score, but in most cases the impact is temporary and minimal.

When lenders conduct a credit check during the loan application process, this appears as a hard inquiry or hard pull on your credit report, briefly lowering your VantageScore or FICO score by a few points. When you finalize your refi, this will also move the needle a bit. A few months of uninterrupted payments is usually all thats needed for your credit score to return to normal or even improve.

You May Like: Are There Any Mortgage Lenders For Bad Credit

Can You Get Denied For A Refinance

There are a few reasons a homeowner might not qualify for mortgage refinancing.

A low credit score, weak credit history or high debt-to-income ratio could lead to a denial. If this happens, focus on paying your bills on time and paying down existing debts, starting with credit cards and other forms of revolving credit. Once your credit improves, you can reapply for the loan.

If you have inconsistent employment or your income documents show that your income is too low to manage the payments on the new mortgage, your lender may not approve the refinance. In addition, you may not qualify for a refinance if you have less than 20% equity in your home.

You might also be denied because of an involuntary lien on your home. This most often occurs due to unpaid property taxes. You will need to resolve the issue and file a Release of Lien at your local recorders office before you can proceed with a refinance.

Finally, you might not qualify for a refinance if your mortgage is underwater. Also known as negative equity, this means that you owe more on your original mortgage than your home is currently worth, either because the property has decreased in value or because youve missed mortgage payments. If youre in this situation, investigate current government mortgage relief programs that could lend you a helping hand.

To Reduce Monthly Payments

Standard interest rates change and your credit score may have improved since you were first approved for a mortgage. Refinancing can lower your monthly mortgage payments through a better fixed interest rate.

You can also refinance for a longer-term mortgage for lower monthly payments, though you may end up paying more interest charges overall.

You May Like: Is It Better To Get Mortgage From Credit Union

You Have Concerns About Your Arm Adjusting

Adjustable rate mortgages vary over the life of the loan. The rates depend on not only market conditions, but also the type of loan you have. Some ARMs adjust once a year, while others adjust after five or seven years. In most cases, youll pay less interest with an adjustable rate mortgage and have lower monthly payments early in your loan term.

If your existing mortgage is at a fixed-rate and you anticipate that interest rates will continue falling, you might consider switching to an adjustable rate mortgage. If you plan to move within a few years, changing to an ARM may make the most sense for your situation since you wont be in your home long enough to see the loans interest rate rise.

Alternatively, the most unsettling thing about ARMs is when its time for the loan to adjust, interest rates and payments may skyrocket. Refinancing and switching over to a fixed rate mortgage may be a good option for you if youre worried you wont be able to afford your payments when your loan adjusts.

Also Check: How Do You Calculate Self Employed Income For A Mortgage

Why Should You Not Refinance Your Home

-

Refinancing increases the time that you will need to repay the loan. It will take a longer duration to pay back before you can start saving. Half of your money will go into the closing costs. Some take refinancing that costs them even more. Thus, in the end, you will pay much more than your current mortgage value.

-

Although you will have more time to pay, it increases the interest rate. If you already have to make mortgage payments, things may become even more complicated.

-

If you go for a lower interest rate, it does not mean that you will save more. It can be lower than your current mortgage rate, but you need additional funds for your closing amount. It includes a certain percentage of the loan that is significant. Change in job or life circumstances may lead you to shift to a new location as well.

Don’t Miss: How To Apply For Mortgage Assistance

Shop The Best Refinance Rates

Now for a little legwork or more likely web work and phone calls. You want to shop for your best refinance rate and get a Loan Estimate from each lender. Each potential lender is required to issue the estimate within three days of receiving your basic information.

The Loan Estimate is a simple three-page document that details the loan terms, projected payments, estimated closing costs and other fees.

Compare the loan details from each lender and decide which one is best for you. This is a good time to work that mortgage refinance calculator.

What Do Todays Mortgage Rates Mean For Your Home Buying Plans

The big increase in mortgage rates this year has taken a lot of potential homebuyers out of the market. That could present opportunities for you if you can afford the higher cost of borrowing money.

Homebuyers are facing less competition and prices are down compared to their all-time highs earlier this year, but theyre still high. If you can find a deal you can afford, it can still be a good opportunity. After all, nobody knows what mortgage rates and prices will be like next year, and buying a home is a lifestyle decision, not just a financial one.

If they find a house that they love, then they should absolutely pull the trigger, says Joe Allen, a senior mortgage lending officer at Quontic Bank, an online community development financial institution.

Don’t Miss: What Is The Current Interest Rate For Interest Only Mortgages

What Is A Cash

A cash-out refinance is a mortgage refinancing option that lets you convert home equity into cash. A new mortgage is taken out for more than your previous mortgage balance, and the difference is paid to you in cash.

In the real estate world, refinancing in general is a popular process for replacing an existing mortgage with a new one that typically extends terms to the borrower that are more favorable. By refinancing a mortgage, you may be able to decrease your monthly mortgage payments, negotiate a lower interest rate, renegotiate the periodic loan terms, remove or add borrowers from the loan obligation, and, in the case of a cash-out refinance, access cash from the equity in your home.

How Mortgage Refinancing Works

How do you refinance your mortgage? The basic mechanism is simple. When you initially buy a home and obtain a mortgage, the loan amount is paid to the seller. When you refinance, you get a new mortgage and that loan amount is used to pay off the balance of the old mortgage.

If you have sufficient equity in your home, you may choose to borrow more than you owe on the old mortgage and pocket the difference. This is known as a cash-out refinance and it can be helpful for consolidating higher-interest debt, making home repairs, or covering other major life expenses.

The mortgage refinance process requires you to qualify and apply for a loan much like the first time around. Once you receive an offer, you can compare it to the terms of your existing loan and determine if its a better deal.

As with first mortgages, there are typically closing costs, and youll need to factor these into your decision to refinance. When you refinance with Union Home Mortgage, you may have the option to finance closing costs rather than pay them upfront.

Your lender can help you understand all your financing options and give you the information you need to make the right choice for your specific situation.

Also Check: Why Not To Refinance Mortgage

Submit A Loan Application

Once you understand what your goals are, its time to shop your refinance rate around by requesting quotes from multiple lenders. You may even be able to obtain official Loan Estimates from more proactive mortgage providers without having to submit a formal mortgage application.

With rate quotes and Loan Estimates in-hand, evaluate the multiple offers to see which lender can give you the best deal on your new mortgage loan.

Shop And Apply For Refinance Loans

Contact multiple lenders and inquire about rates, fees and lender qualification criteria. If you request it, each lender can provide you with a Loan Estimate, which includes the terms of the loan, projected payments if you were to take out the loan and a summary of loan costs and fees. You can compare the Loan Estimate from multiple lenders to compare the costs associated with taking out a loan and make an informed decision that works best for you.

Common fees for refinancing a mortgage:

- A list of liabilities

Read Also: How To Get Mortgage License In Florida

Refinancing To Get A Shorter Loan Term

If you refinance from a 30-year to a 15-year mortgage, your monthly payment will often increase. But not only is the interest rate on 15-year mortgages lower shaving years off your mortgage will mean paying less interest over time. The interest savings from a shorter loan term can be especially beneficial if youre not taking the mortgage interest deduction on your tax return.

That said, with mortgage interest rates so low, some people prefer to spend more years paying off their home so they have more cash to invest at a higher rate and more years for their investment earnings to compound.

In 2019, 78% of borrowers refinanced from a 30-year fixed-rate mortgage into the same loan type, according to Freddie Mac. Another 14% went from a 30-year to a 15-year fixed. And 7% went from a 30-year to a 20-year fixed.

Refinance To Consolidate Debt

Unsecured debt can become a huge burden for homeowners. Personal and retail credit cards often come with interest rates as high as 24%. In 2018, the average credit card interest rate was 15.32%. This is nearly four times greater than recent average mortgage interest rates. Making minimum payments on high-interest credit cards can cost thousands of dollars. By using the funds received as a result of a cash-out refinance to pay off high cost credit card debt, you could have significant monthly savings. In addition, consolidating your debt will decrease the number of monthly bills you have, essentially replacing multiple bills with a single mortgage payment. This can also help avoid hefty credit card late fees.

Don’t Miss: Is It Better To Get A 15 Year Mortgage

/1 Arm Interest Rates

A 5/1 ARM has an average rate of 5.49%, a fall of 13 basis points from the same time last week.

An ARM is ideal for households who will sell or refinance before the rate changes. If thats not the case, their interest rates could end up being remarkably higher after a rate adjusts.

For the first five years, a 5/1 ARM will typically have a lower interest rate compared to a 30-year fixed mortgage. Keep in mind that your payment could end up being hundreds of dollars higher after a rate adjustment, depending on the terms of your loan.

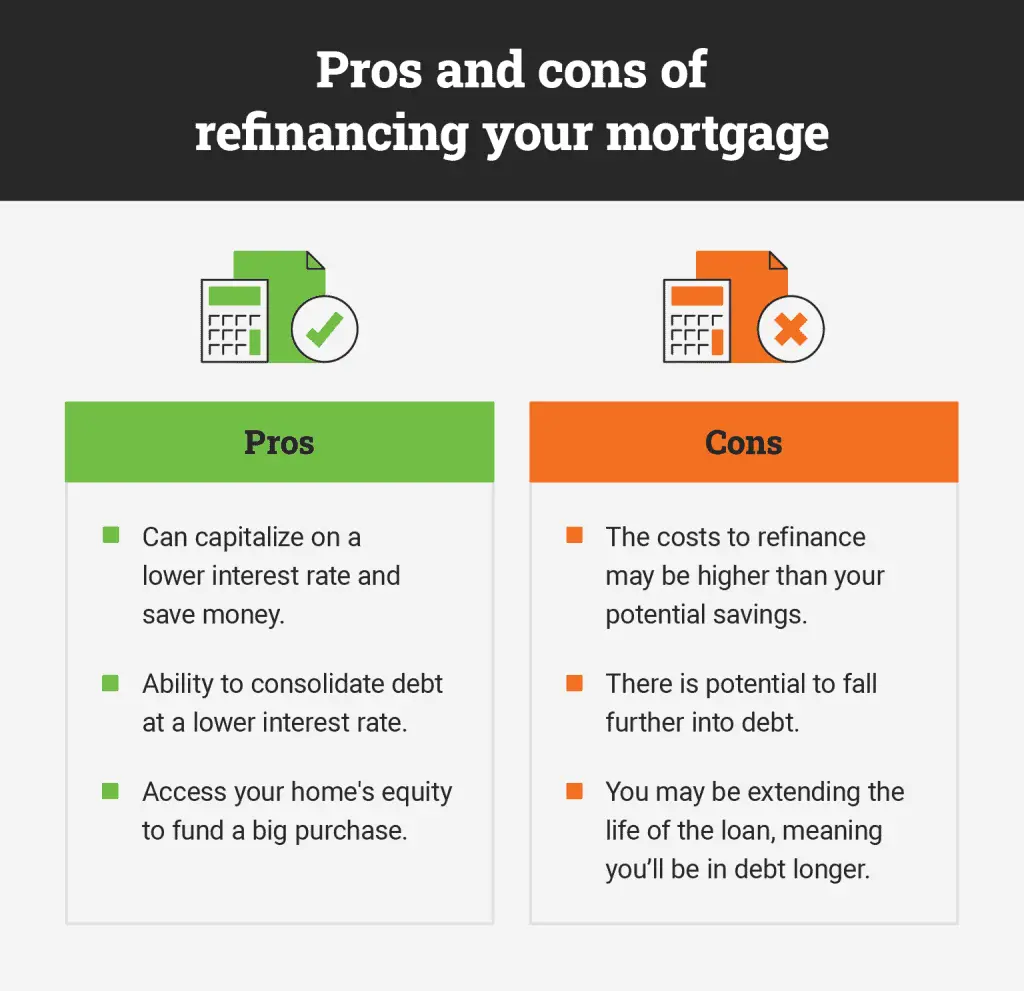

Pros And Cons Of A Mortgage Refinance

A mortgage refinance is best suited for homeowners that have home equity and are looking to borrow a large amount at a fixed rate. This allows homeowners to borrow money cheaply, but this would only be the case if the amount being borrowed is significant enough or if current mortgage rates are low enough to offset the costs of refinancing.

For borrowers that need quick access to money, or need to borrow small amounts at a time, a mortgage refinance might not be the best method to borrow money. Applying and being approved for a mortgage refinance can take time. The costs of a mortgage refinance will also deter those looking to borrow a small amount.

Some pros and cons of a mortgage refinance include:

Advantages

- Access your home equity at a low rate

- A fixed mortgage rate lets you lock in a lower mortgage rate

- You can borrow a large amount of money all at once

- You can extend your mortgage amortization to lower your monthly payments

Disadvantages

- Rates can be higher than mortgage renewals

- You will be charged penalties if you refinance before your mortgage is up for renewal

- You will need to pass the mortgage stress test in order to be approved, and approval takes time

- Frequently resetting your amortization can cause you to pay more interest

Recommended Reading: How Much Per 1000 On Mortgage

Drop Your Private Mortgage Insurance

Private mortgage insurance drops automatically once you pay down your loan to 78% of the purchase price. However, if your property appreciates in value, you can drop PMI sooner by refinancing into a new loan.

If you have a 30-year FHA mortgage that closed in 2013 or later, you dont get to drop mortgage insurance no matter what your loan-to-value is. The only way to avoid that expensive coverage is to refinance.