Fees And Taxes In Quebec

The land transfer tax in Quebec is a percentage of the homes purchase price or the homes value as evaluated by the municipality. Depending on the homes value, the percentage ranges from 0.5 to 1.5 percent, or 0.5 to 2.0 percent in Montreal. For more information, see Ratehub.cas Quebec Land Transfer Tax page.

Did You Know A Smaller Down Payment Can Lead To A Lower Mortgage Rate

Mortgages with a down payment of less than 20%, orhigh-ratio mortgages, usually have lower mortgage rates than low-ratio mortgages with a down payment of 20% or higher. This is because borrowers will pay for mortgage insurance , which offsets most of the risk to the lender. As a result, lenders often offer thelowest mortgage ratesfor low or minimum down payment mortgages.

How Much Income Is Needed For A 200k Mortgage

A $200k mortgage with a 4.5% interest rate over 30 years and a $10k down-payment will require an annual income of $54,729 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a broader range of interest rates.

Don’t Miss: Can You Mortgage A House You Own

How Much Income Is Needed For A 250k Mortgage

A $250k mortgage with a 4.5% interest rate for 30 years and a $10k down-payment will require an annual income of $63,868 to qualify for the loan. You can calculate for even more variations in these parameters with our Mortgage Required Income Calculator. The calculator also gives a graphical representation of required income for a wider range of interest rates.

How Much Do I Need To Earn For A 100000 250000 Or 500000 Mortgage

Our calculator shows that for a £100,000 mortgage you will need to earn at least £22,500 as a single applicant or between you if youre applying for a joint mortgage. Bear in mind that a £100,000 mortgage can result in different LTVs and therefore different rates, depending on the amount of deposit you have and the overall value of the property.

For a £250,000 mortgage you will need to earn at least £56,000 as a single applicant or between you if applying as a couple, while for a £500,000 mortgage you will need a earn at least £111,500 as a single applicant or as joint income for a shared mortgage.

Recommended Reading: How To Shorten Your Mortgage Term

Benefits Of Cmhc Insurance

Benefits of CMHC Insurance CMHC insurance allows you to make a down payment as low as 5% of the value of the home for homes less than $500,000, or 5% on the first $500,000 and 10% on the remainder for homes over $500,000 and less than $1 million. Since the mortgage is insured, mortgage lenders will often offer lower mortgage rates for insured mortgages.

Quebecs Regulations Taxes And Fees

In addition to the above federal regulations, Quebec also has its own taxes and mortgage rates. Quebec has unique land transfer taxes, fees, and mortgage rates compare to other provinces that home buyers must be aware of. Quebec also charges PST on CMHC insurance that homebuyers must pay along with their closing costs.

Also Check: How Do I Qualify For A Mortgage With Bad Credit

Down Payment And Closingcost Assistance

What if youre having trouble saving for a down payment andclosing costs? Even if you qualify for a low down payment home loan, it can behard to save the cash required in todays real estate market.

Luckily, you dont have to go it alone. There are manydifferent ways to get assistance with your upfront home buying costs.

Here are a few good strategies to explore:

Most lenders are familiar with all these programs and willing to help borrowers who dont have a big down payment saved up.

Your loan officer, broker, or agent can walk you through the steps to apply for and receive assistance.

What Amortization Period Should I Choose

Here are some general guidelines for choosing an amortization period for your mortgage:

- Most mortgages in Canada have an amortization period of 25 years. Unless you require a longer amortization period due to cash flow concerns, or you can afford to shorten your amortization, a 25 year amortization works well in most cases.

- Choosing a shorter amortization means that youll be paying off your mortgage principal balance faster. This will lower your lifetime interest cost, but it will also result in a higher monthly or bi-weekly mortgage payment.

- Insured high-ratio mortgages cannot have an amortization that is over 25 years. If you choose an amortization period of over 25 years, you must make at least 20% down payment.

Don’t Miss: What Is The Benefit Of Refinancing A Mortgage

My Mortgage Payment Plan

This line graph shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.

Find out how much you can save by changing your payment frequency.

This table shows how your mortgage debt decreases over your amortization period. It also shows how much faster you’ll pay off your mortgage by increasing your mortgage payment or payment frequency.| Amortization |

|---|

* These calculations are based on the information you provide they are approximate and for information purposes only. Actual payment amounts may differ and will be determined at the time of your application. Please do not rely on this calculator results when making financial decisions please visit your branch or speak to a mortgage specialist. Calculation assumes a fixed mortgage rate. Actual mortgage rates may fluctuate and are subject to change at any time without notice. The maximum amortization for a default insured mortgage is 25 years.

** Creditor Insurance for CIBC Mortgage Loans, underwritten by The Canada Life Assurance Company , can help pay off, reduce your balance or cover your payments, should the unexpected occur. Choose insurance that meets your needs for your CIBC Mortgage Loan to help financially protect against disability, job loss or in the event of your death.

Mortgage Calculator: Fees And Definitions

The above mortgage calculator details costs associated with loans or with home buying in general. But many buyers dont know why each cost exists. Below are descriptions of each cost.

Principal and interest. This is the amount that goes toward paying off the loan balance plus the interest due each month. This remains constant for the life of your fixed-rate loan.

Private mortgage insurance . Based on recent PMI rates from mortgage insurance provider MGIC, this is a fee you pay on top of your mortgage payment to insure the lender against loss. PMI is required any time you put less than 20% down on a conventional loan. Is PMI worth it? See our analysis here.

Property tax. The county or municipality in which the home is located charges a certain amount per year in taxes. This cost is split into 12 installments and collected each month with your mortgage payment. Your lender collects this fee because the county can seize a home if property taxes are not paid. The calculator estimates property taxes based on averages from tax-rates.org.

Homeowners insurance. Lenders require you to insure your home from fire and other damages. This fee is collected with your mortgage payment, and the lender sends the payment to your insurance company each year.

Loan term. The number of years it takes to pay off the loan . Mortgage loans most often come in 30- or 15-year options.

Interest rate. The mortgage rate your lender charges. Shop at least three lenders to find the best rate.

You May Like: Can I Get A Mortgage Before I Sell My House

Should I Choose A Fixed Or Variable Rate

A variable rate lets you benefit from decreases in market interest rates, but it will cost you more if interest rates rise. Fixed rates are a better option if interest rates will rise in the future, but it can lock you in at a higher rate if rates fall in the future.

Of course, its not possible to exactly predict future interest rates, but a2001 studyfound that variable interest rates outperform fixed interest rates up to 90% of the time between 1950 and 2000. If youre comfortable with taking on risk, a variable mortgage rate can result in a lower lifetime mortgage cost.

How Much Does Cmhc Insurance Cost

Your CMHC insurance cost is calculated as a percentage of your purchase price. The exact percentage depends on your down payment amount and decreases for larger down payments. Insurance premiums range from as low as 0.6% of the total mortgage for down payments of 35% or more, to as high as 4.00% of the total mortgage for down payments of 5%.

Using aCMHC insurance calculatorcan help you determine the cost of CMHC insurance premiums that will apply to you, along with applicable sales tax. Provincial sales tax is added to insurance premiums in Ontario, Quebec, Manitoba, and Saskatchewan.

You May Like: Are Online Mortgage Calculators Accurate

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.

What Happens If I Have A Late Mortgage Payment

Missing a mortgage payment, whether you forgot to make a payment, you had insufficient funds in your account, or for other reasons, is something that can happen. A mortgage payment is considered to be late if it’s not paid on the date that it is due.

Missing a mortgage payment means that you need to catch-up by making a double payment the next month. Otherwise, you will be one month behind on your mortgage payments and have them all considered to be late.

Your lender will try to contact you if you miss a mortgage payment. They will let you know how your missed payment can be made, such as taking the payment before the next payment due date or doubling the payment at the next payment date.

Depending on your mortgage contract, you might be charged a late payment fee or a non-sufficient funds fee.

As long as your mortgage payment hasn’t been late for a long period of time, and you pay back the missed payment promptly, then your lender may not report it to the credit bureaus. Even so, missing your mortgage payment by one day is still enough to have it considered to be a late payment. If you miss multiple mortgage payments, your lender can report it, which will negatively affect yourand will stay on your credit report for up to six years.

Recommended Reading: Why Does My Mortgage Payment Keep Going Up

How Much Income Do I Need For A $500 000 Mortgage

4.3/5mortgageincomeincome$500,000question here

To afford a house that costs $800,000 with a down payment of $160,000, you‘d need to earn $138,977 per year before tax. The monthly mortgage payment would be $3,243. Salary needed for 800,000 dollar mortgage.

Also, how much income do you need to qualify for a $200 000 mortgage? Example Required Income Levels at Various Home Loan Amounts

| Home Price |

|---|

| $76,918.59 |

Thereof, what’s the monthly payment on a $500 000 mortgage?

Monthly payments on a $500,000 mortgageAt a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total $2,387.08 a month, while a 15-year might cost $3,698.44 a month.

How much do I need to make to afford a 450k house?

A $450,000 loan for 30 years at 4% would cost about $2150/month. With taxes and insurance it’d be around $2650/month. Assuming no mortgage insurance and $2650/month as the payment, you’d need to make $102k per year. A lender will let you use about 31% of your gross income for a monthly payment.

can700can

| Home Price |

|---|

Down Payments And Mortgageinsurance

The size of your down paymenthelps determine your loan type and home affordability. But it affects your mortgagein other ways, too.

The biggest one is mortgageinsurance.

Borrowers who put down lessthan 20% of the homes value typically have to pay for mortgage insurance. Thiscoverage protects the mortgage lender in case the borrower defaults on the loan.

There are two main types ofmortgage insurance:

- Private mortgage insurance Required on conventional home loans with less than 20% down, PMI can be canceled once the homeowner has at least 20% equity

- Mortgage insurance premium Required on all FHA loans, regardless of down payment size. MIP cannot be canceled, but homeowners with 20% equity and good credit can often refinance out of their FHA mortgage and into a conventional loan with no PMI

USDA loans also chargeongoing mortgage insurance, although the rates are typically lower than forconventional and FHA loans.

VA mortgages have an upfrontfunding fee, but no monthly mortgage insurance, which is one of the biggestbenefits of VA financing.

Should I try to avoid PMI with a 20% down payment?

Many home buyers try to save a 20% down payment so they can avoid mortgage insurance. This might seem wise since PMI and MIP can be expensive often $100-$300 per month.

But when you look at thelong-term financial impact of PMI, it can actually have a great return oninvestment.

Run the numbers youll likely find the benefits of mortgage insurance far outweigh the cost.

Recommended Reading: How To Get A 15 Year Fixed Mortgage

Can I Cancel My Mortgage Life Insurance

Canadas major banks all allow you to cancel your mortgage life insurance at any time, and to receive a refund if you cancel your plan within the first 30 days. This 30-day free look or 30-day review period is important as it lets you change your mind should you decide that mortgage life insurance isn’t right for you.

To cancel, you can call your lender’s insurance helpline, complete a form at a branch, or send a written request by mail.

How Much House Can I Afford To Build

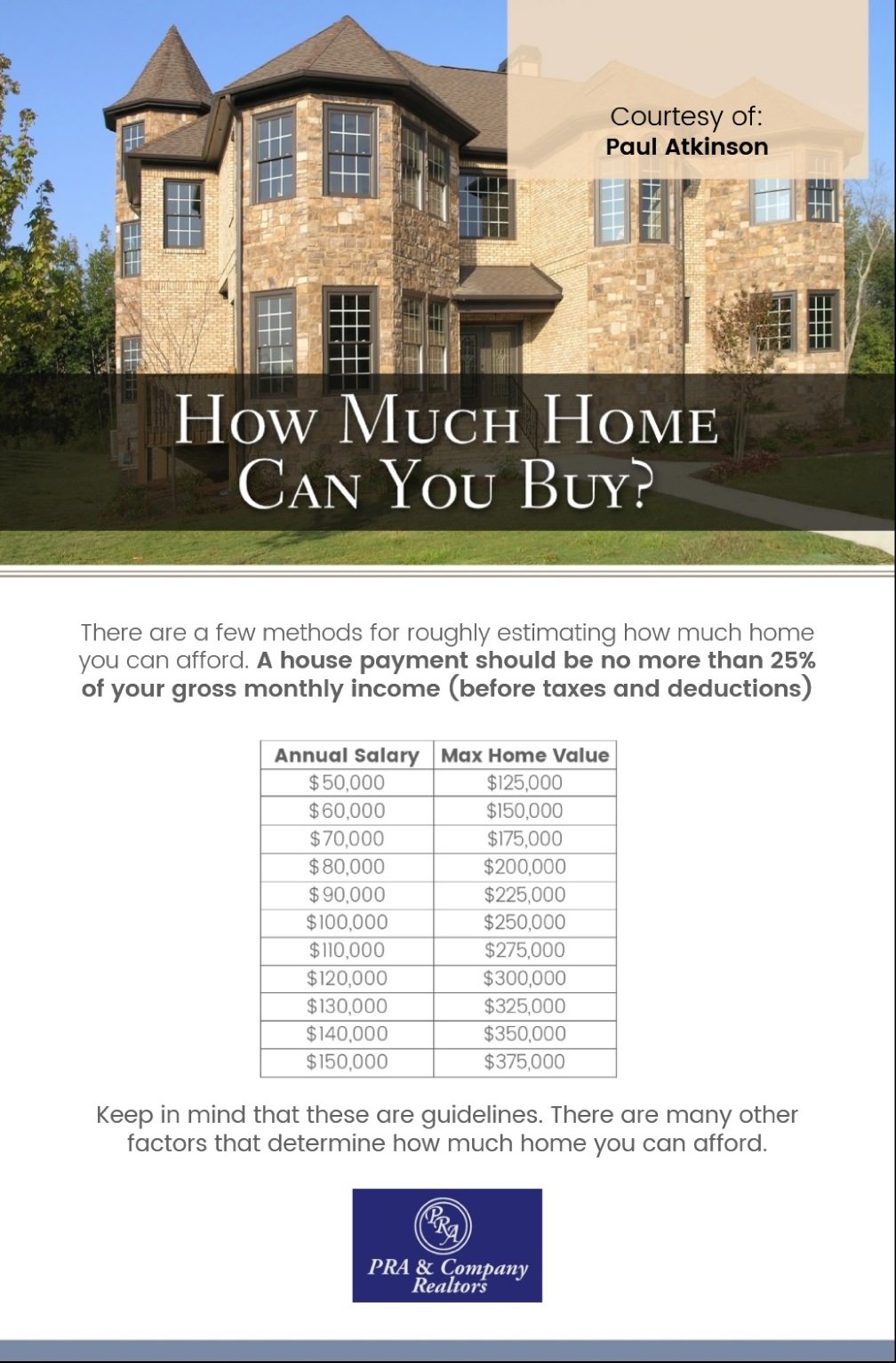

To determine how much house you can afford, most financial advisers agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt that includes housing as well as things like student loans, car expenses, and credit card payments.

Read Also: Can You Get A Mortgage To Buy A Foreclosed Home

How Much Income Do I Need For A 200000 Mortgage

Lets say your ideal home is worth £225,000 and youre able to put up a £25,000 deposit. For a £200,000 mortgage youll need to earn a minimum of £44,500, though to be more comfortably offered this level of mortgage youd probably need to earn closer to £50,000 or above. Its also worth noting that this mortgage would equate to a loan-to-value of 88.9% in this scenario, which means first-time buyer mortgage dealswould be your best bet.

Need to work out your LTV, use our LTV calculator.

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

You May Like: What Are The Fees For A Reverse Mortgage

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

What Happens At The End Of A Term

You will need to either renew orrefinance your mortgageat the end of each term, unless you are able to fully pay off your mortgage.

- Renewing your mortgage means that you will be signing another mortgage term, and it may have a different mortgage interest rate and monthly payment.Mortgage renewalsare done with the same lender.

- Refinancing your mortgagemeans that you will also be signing another mortgage term, but youll also be signing a new mortgage agreement. This allows you to switch to another lender, increase your loan amount, and sign another term before your current term is over. This lets you take advantage of lower rates from another lender, borrow more money, and lock-in a mortgage rate early.

You May Like: How To Calculate Principal And Interest For Mortgage