Work On Improving Your Credit Score

While this is not the answer borrowers want to read or hear, its the most practical and can save you thousands in interest payments.

Not only will you have more mortgage options, but you might be able to get your loan with a lower income requirement and down payment.

Of course, as stated above, if you have a score below 500, you probably wont be able to do anything except wait until you increase your score.

If you have a bankruptcy on your credit, you will need to wait at least 2 years before a lender will start considering you for a new mortgage.

You can take the necessary steps to grow your score by understanding the following:

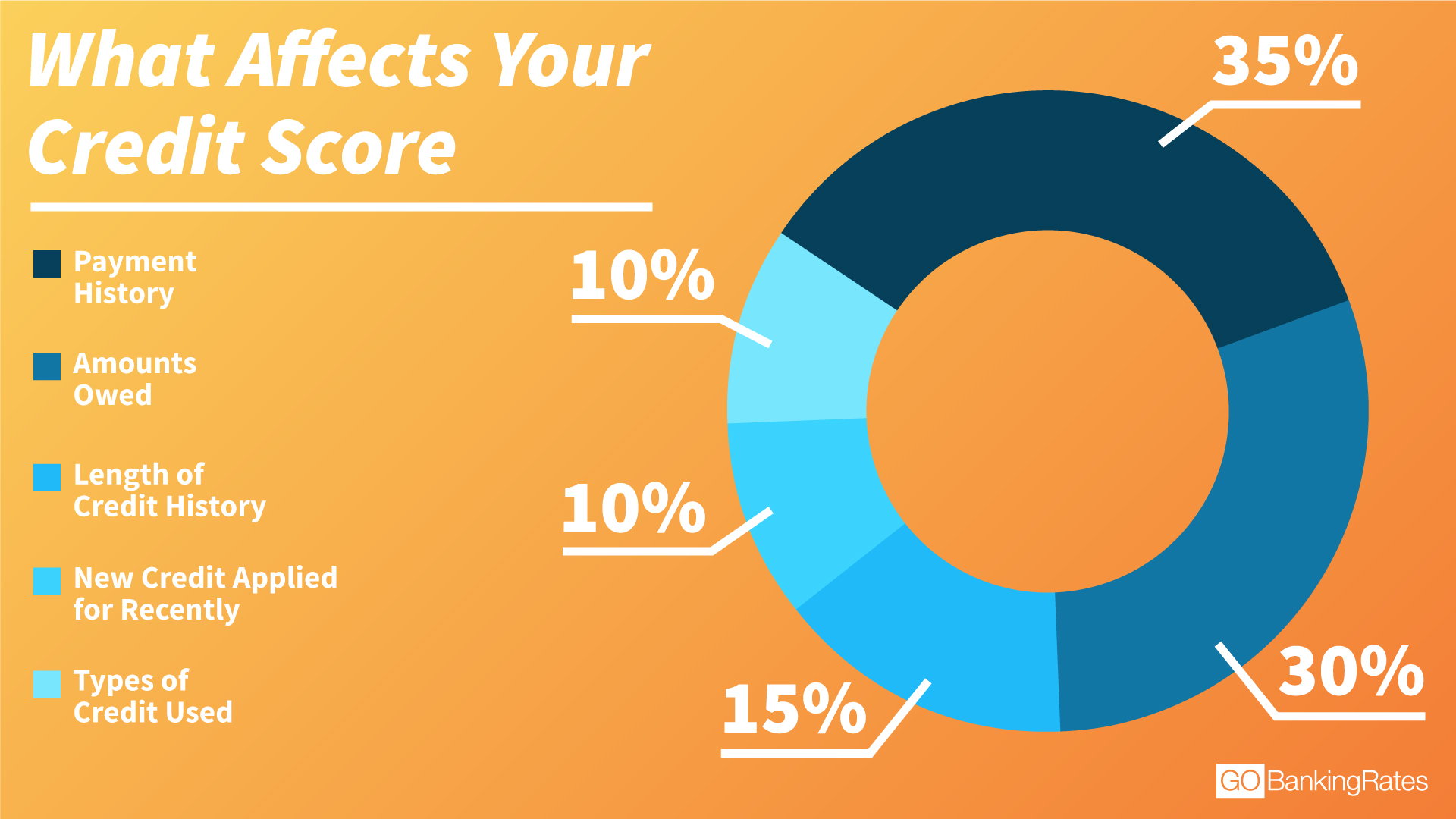

Payment history : Your payment history is responsible for 35% of your score. This is the main reason why people are continually saying pay your bills on time when it comes to your credit score.

The amount of credit you are currently using is also known as your credit utilization and is responsible for 30% of your score. The more credit youre using, the higher your credit utilization, the lower your score can become. It would help if you looked to keep your total credit usage under 30%.

Age of credit history : This is most often referred to as your Average Age of Accounts and is one of the few factors you have almost no control over. Your credit history is basically the age of your oldest credit account, new credit accounts and the average ages of all the accounts on your credit report.

Get your free credit report and score.

Can You Get A Mortgage With A Bad Credit Score

It’s possible to get approved for a mortgage with poor credit. But just because you can, it doesn’t necessarily mean you should. As previously discussed, even a small increase in your interest rate can cost you tens of thousands of dollars over the length of a mortgage loan.

If you’re planning on buying a home and you have bad credit, here are a few tips that can help you potentially score a decent interest rate:

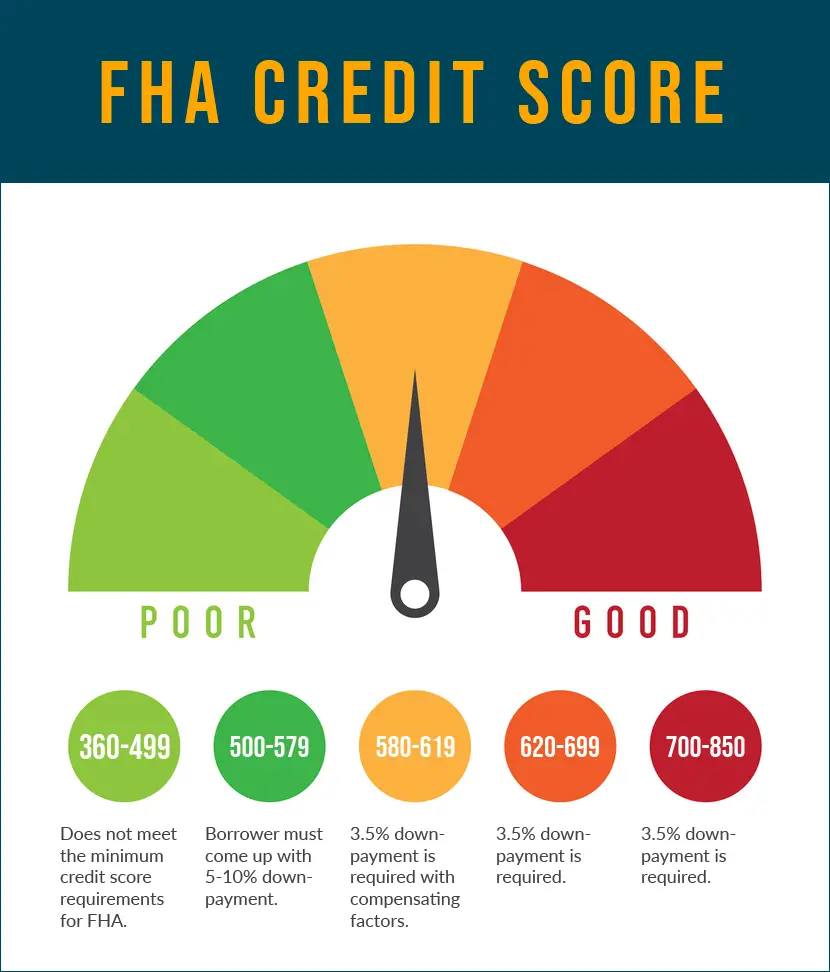

- Consider applying for an FHA loan, which you can get with a credit score as low as 500though to get approved with a score below 580, you’ll need a 10% down payment.

- Make sure you have a large down payment, plus a good amount of cash reserves beyond that.

- Work on paying down other debts to reduce your DTI.

- Consider asking someone with good or exceptional credit to apply with you as a cosigner.

There’s no guarantee that these actions will help you qualify for a mortgage loan with good terms, but they can improve your odds.

Mortgage Rates By Credit Score

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Your credit score is one of the most important factors when applying for a mortgage. It influences your monthly mortgage payment, the total amount of interest you pay on your mortgage loan, and ultimately the total amount you pay for your home. Because your interest rate is based on your credit score, you should make sure your credit is in the best shape possible before applying for a mortgage.

Recommended Reading: What Is Excellent Credit Score For Mortgage

Going From Fair Credit To Good Credit

It may well be that you have fair credit today, but this need not be a permanent condition. Your credit standing can change, and it can change with some speed.

The pioneering FICO-brand credit scoring system uses five factors to rate your financial standing. Each factor has a certain weight on your credit score.

- Amount owed on credit

- Length of credit history

- New credit

These categories suggest three quick steps you can take to get better credit.

First, do not open new accounts. When a retailer offers $10 off if you will use their credit card, youre being asked to open a new line of credit. Dont be tricked. Since new accounts hold down credit scores, youre better off paying the $10.

Second, credit history is important, but most important of all is recent credit history what youve done in the past few months.

Make a point to pay all bills in full and on time. This is not only good for your credit standing, but will also end costly and unnecessary late payment penalties.

Third, review your credit report. A 2013 study by the Federal Trade Commission found that five percent of consumers had errors on one of their three major credit reports that could lead to them paying more for products such as auto loans and insurance.

How big an error? At least 25 points enough to change an individuals credit standing.

Fixing Or Preventing Bad Credit

Having bad credit is not the end of the world. It still may be possible for lenders to give you a loan, provided your credit score is not too low. But be aware that you may pay a higher interest rate and more fees since you are more likely to default . So its in your best interest to improve your credit score in order to get a lower interest rate, which can save you thousands in the long run.

Mortgage lenders look at the age, dollar amount, and payment history of your different credit lines. That means opening accounts frequently, running up your balances, and paying on time or not at all can impact your credit score negatively. Just changing one of these components of your spending behavior can positively affect your credit score.

There are ways you can improve your credit score, such as paying down your debts, paying your bills on time, and disputing possible errors on your credit report. But on the flip side, there are ways you can also hurt your score, so remember:

- DONT close an account to remove it from your report .

- DONT open too many credit accounts in a short period of time.

- DONT take too long to shop around for interest rates. Lenders must pull your credit report every time you apply for credit. If you are shopping around with different lenders for a lower interest rate, there is generally a grace period of about 30 days before your score is affected.

Read Also: How To Know How Much Mortgage I Can Afford

What Credit Score Is Needed For A Va Loan

Qualifying service members, veterans and surviving spouses can buy homes with little or no down payment and no private mortgage insurance requirements, thanks to housing benefits from the U.S. Department of Veterans Affairs, commonly known as VA loans. Issuers of VA loans have some discretion in setting minimum credit score requirements, but they may accept applications from borrowers with FICO® Scores as low as 620.

What Interest Rate Can I Get With My Credit Score

While a specific credit score doesnt guarantee a certain mortgage rate, credit scores have a fairly predictable overall effect on mortgage rates. First, lets assume that you meet the highest standards for all other criteria in your loan application. Youre putting down at least 20% of the home value, you have additional savings in case of an emergency and your income is at least three times your total payment. If all of that is true, heres how your interest rate might affect your credit score.

- Excellent Your credit score will have no impact on your interest rate. You will likely be offered the lowest rate available.

- Very good Your credit score may have a minimal impact on your interest rate. You could be offered interest rates 0.25% higher than the lowest available.

- Good Your credit score may have a small impact on your interest rate. This means rates up to .5% higher than the lowest available are possible.

- Moderate Your credit score will affect your interest rate. Be prepared for rates up to 1.5% higher than the lowest available.

- Poor Your credit score is going to seriously affect your interest rates. You may be hit with rates 2-4% higher than the lowest available.

- Very Poor This is trouble. If you are offered a mortgage, youll be paying some very high rates.

More from SmartAsset

You May Like: How To Get Approved For Mortgage With Low Income

Fair Credit & Lender Standards

If you think that mortgage requirements have gotten tighter during the past few years, youre right.

Only the best borrowers are getting loans today and these loans are so thoroughly scrubbed and cleaned before theyre made that hardly any of them end up going into default, reports the Urban Institute. A near-zero-default environment is clear evidence that we need to open up the credit box and lend to borrowers with less-than-perfect credit.

While lender requirements may have tightened, there are two important points to be made: First, there are loans available to those with fair credit. Second, you can improve your credit standing with a little strategic planning.

What Does It Mean To Have No Credit

Having no credit, also known as being “credit invisible,” means you don’t have enough recent credit activity to get a credit score. Since checking a credit score is often the first step lenders take when evaluating your creditworthiness, the lack of a credit score can complicate the mortgage application process.

There are several circumstances that lead to lack of credit. The most common is lack of credit experience, which is something generally experienced by people just coming of age and entering the workforce. But retirees and others who have paid off debts and who haven’t used a credit card or other financing in two years or more cannot be assigned a FICO® Score or VantageScore® either. Recent immigrants to the U.S., even those with extensive credit histories in other countries, cannot get a credit score when they arrive in the U.S. because they have no at the three national credit bureaus.

Important to remember, however, is that lack of credit is not the same as poor credit, and no credit score is not the same as a low credit score. A low credit score typically indicates a spotty history of credit management, marked by late or missed payments , and accounts in collection, foreclosure or a recent bankruptcy .

Also Check: What Banks Look For When Applying For A Mortgage

Is A 681 Fico Score Good

A credit score of 681-720 is good: You’re in the pocket. With a score in this range, you’ll get plenty of credit card offers, qualify for loans with good rates, and pay lower insurance premiums. A credit score of 720-850 is excellent: At this level you get the best rates on credit cards, car loans, and home mortgages.

How Bad Is A 613 Credit Score

613613 credit scorebadscore

How can I raise my credit score 100 points? Steps Everyone Can Take to Help Improve Their Credit Score Bring any past due accounts current. Pay off any collections, charge-offs, or public record items such as tax liens and judgments. Reduce balances on revolving accounts. Apply for credit only when necessary.

Recommended Reading: How Long Can I Lock In A Mortgage Rate

What Should You Do Before Home Refinance

You cant blindly opt for a refinancing option. Thorough research has to be conducted, and you definitely should talk to a professional regarding your options. If you have bad credit or a less than perfect credit score, it is in your best interest to improve your credit before refinancing, as mentioned above. Get your free credit score and credit report card . Here is what else you samantha-brookes-touchedld do:

- Check your payment history.

- Make 12 consecutive months of on-time payments for all your bills, including your utilities and phone bill.

- If you havent done so in the last year, go through your credit report in detail and dispute any errors. Rectifying errors could take time, so dont neglect it. Once corrected, your credit score might go up, which in turn gets you lower rates when you refinance.

What Is Considered A Good Credit Score

Since different credit agencies use different rating systems, a good score will vary from one agency to the next. For Experian, a score of 881-960 is considered good, and a score of 961-999 is considered excellent. For Equifax, a score of 420-465 is considered good, and a score of 466-700 is considered excellent. For TransUnion , a credit score of 604-627 is considered good, and a score of 628-710 is considered excellent.

You May Like: What Do I Need To Become A Mortgage Broker

How Can You Protect Your Credit Score During The Covid

Taking steps to protect your credit score is more crucial than ever during the coronavirus crisis. Thats especially true if youre planning on buying a home.

So its important to stay on top of your finances during this challenging time. That includes paying your bills on time, and contacting lenders and service providers if you do run into trouble. Here are a few things you can do:

- Create a budget to know where you stand. The Barclays Budget Planner can help.

- If you foresee problems paying your loan or credit cards, contact them right away to explore your options.

- If you think youll be late paying your phone, utilities or other service providers, contact them to let them know and to discuss a possible arrangement. You can also find helpful advice at Barclays money management.

- To help you manage during this period, you can also find valuable ideas and resources at Barclaycard coronavirus help and support about protecting yourself from fraud and managing your finances.

- Youll also find other information about managing your Barclaycard account during the crisis at the Frequently Asked Questions page.

Can I Refinance With A 660 Credit Score

refinancingrefinancingFICOScores660refinance

. Keeping this in consideration, can I get a mortgage with a 660 credit score?

If your is a 660 or higher, and you meet other requirements, you should not have any problem getting a mortgage. The types of programs that are available to borrowers with a 660 credit score are: conventional loans, FHA loans, VA loans, USDA loans, jumbo loans, and non-prime loans.

Secondly, can I refinance with a 600 credit score? Your lender will check your before approving you for a streamline FHA refinance loan. Many lenders expect applicants to have a minimum of 640. But you may be able to qualify with a as low as 600. Streamline refinance programs are also available for borrowers with VA and USDA loans.

Correspondingly, what credit score do you need for refinance?

Conventional Loan RefinanceThe average minimum for conventional refinancing programs is 620 to 680, although the best rates are generally available to homeowners with scores of 740 or higher. Conventional refinances are always fully documented.

What credit card can I get with a 660 score?

Here are the easiest unsecured cards to get:Overall: Fingerhut Account. Rewards: One Bank® Platinum Visa® for Rebuilding . Small Business: Capital One® Spark® Classic for Business. Limited : Petal® Visa® .

You May Like: What Are The Interest Rates On A Mortgage

Do I Need A Credit Score To Get A Mortgage

Most mortgage lenders will want you to have a credit score before theyll be willing to offer you a mortgage. But there are specialist mortgage lenders who will consider you with a very low or even no credit score. Theres a few reasons you might not have a credit score, for example, if youve never taken out any kind of credit like a utility bill in your name, or maybe youre still living at home with parents so havent yet had a chance to build a credit profile.

Generally, itll be specialist lenders wholl be willing to consider your mortgage application if you dont have a credit score yet. To find a specialist lender, youll need a specialist mortgage broker. Get matched to your perfect mortgage broker, go to our homepage and click Get started.

Understanding The Refinance: How It Works

A refinance is a loan that replaces your current mortgage with new terms, a new interest rate or a different loan balance. Refinancing means that you first pay off your old loan with your new loan, then make payments on your new loan.

There are a number of reasons why you might want to refinance your mortgage loan. You can:

- Change your loan terms. Are you having trouble making your monthly mortgage payments? You can refinance your loan to a longer term, which gives you more time to pay back what you owe while lowering your monthly payments. You can also refinance to a shorter term if you want to pay off your loan faster. You may also be able to refinance to a lower interest rate to save money over the life of your loan.

- Remove mortgage insurance. Do you have an FHA loan? If so, you may already be aware that you must pay a Mortgage Insurance Premium for as long as you have your FHA loan, if you put less than 10% down on the home. Many homeowners hold their FHA loans only until they reach 20% equity, then refinance to a conventional loan. This allows them to forgo the mortgage insurance requirement and save money.

- Take cash out of your property. A cash-out refinance allows you to accept a loan with a higher principal balance than you owe and take the rest out in cash. The cash you get from a cash-out refinance can help you pay off debt, cover home repair costs and more.

Recommended Reading: Is 3.99 A Good Mortgage Rate