Your Down Payment Affects How Much You Can Borrow For A Mortgage

While having fun with our mortgage calculator, we thought wed show you how big a difference your down payment makes to the value of the home you can afford.

Were going back to the assumptions we used in our first example, and changing only the monthly inescapable expenses and the size of the down payment.

The salary and mortgage rate remain the same.

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Ok So Theyve Got My Information And Done Some Math Now What

From there, the lender will determine what length of loan and interest rate they feel comfortable giving you. To figure this out, theyll take a look at your credit score, which ranges from 300 to 850 . As youd expect, the higher your credit score, the lower the interest rate youll generally get, though the amount of your down payment also gets factored in.

Its difficult to say what constitutes an ideal credit score for taking out a mortgage , but a number between 700 and 740 seems to be a good range. In general 620 is considered the lowest acceptable score that will get you the green light.

If your credit score isnt where you want it, it might be useful to try to boost your number a bit before applying for a mortgage. The difference between a 3-percent and 5-percent rate might not sound huge, but all that interest adds up over the 15 or 30 years of the loan to some pretty significant money.

Also Check: What Mortgage Amount Do I Qualify For

My Result Shows I Can Afford My New Home What Should I Do Next

First of all, congratulations! You are now one step closer to owning the home you desire. The next step is to reach out to our team of top-notch mortgage lenders and get started on securing yourself the perfect deal.

Click Get FREE Quote, answer a few simple questions about yourself and the loan you are seeking to obtain personalized rate quotes from lenders doing business in your area. This service is totally FREE of charge and makes it easy to comparison shop for your best deal on a home loan. Take your next step today – it couldnt be simpler!

I’m Not Sure What My Interest Rate Will Be What Should I Do

Fortunately, you don’t have to have a specific mortgage rate in mind to use the Mortgage Qualifying Calculator. You can choose an approximate rate, enter the rest of your information, then use the sliding tool to see how a higher or lower rate will affect your results. That includes changing your amortization table and the interest paid over the life of the loan. You can adjust other values as well to see what effect a different figure there would have.

Recommended Reading: Are Home Mortgage Rates Going Down

Why Buying A House Is A Bad Investment

In reality, its usually a terrible investment, he says. Thats because, at the end of the day, owning a home takes money out of your pocket: Youre paying property taxes, youre paying maintenance, youre paying insurance. There are all of these other things that happen with your home that youve got to pay for.

How Do Lenders Work Out How Much I Can Borrow Based On My Income

Typically, lenders will determine how much you can borrow by multiplying your salary by four and a half or five times. So, for example, if you had an annual salary of £20,0000, you could be eligible for a mortgage of up to £100,000. On an interest rate of 3.92% over a 25-year term, your monthly mortgage payments could be £523.

Mortgage lenders will then conduct an affordability test to make sure you have enough monthly earnings to meet other living expenses.

There are however, lenders that may be willing to loan up to six times your annual salary, although this is usually in exceptional circumstances for borrowers with a good credit history and higher annual income.

Many borrowers apply for a joint mortgage with another applicant, whether that be a partner, relative or friend, which means that more than one income can be taken into consideration when calculating affordability.

For example, if two people applied for a mortgage and they both earned £20,000 a year, the lender would calculate their overall annual salary as £40,000. If the lender agreed to loan the pair 5 x this amount, they could borrow £200,000.

Recommended Reading: Can You Get A Mortgage With A Fair Credit Score

Factors That Impact Affordability

When it comes to calculating affordability, your income, debts and down payment are primary factors. How much house you can afford is also dependent on the interest rate you get, because alower interest ratecould significantly lower your monthly mortgage payment. While your personal savings goals or spending habits can impact your affordability,getting pre-qualified for a home loancan help you determine a sensible housing budget.

Factors That Determine How Much House You Can Afford

The tables above illustrate how different factors affect the amount of house you can buy. Lets explain the math a bit:

- Annual salary: Having a higher annual salary will naturally increase your homebuying budget.

- Debt-to-income ratio: The previous tables assume a best-case scenario where you dont have other monthly debt payments, like a student loan, credit card payment, or car loan. The more pre-existing debt you have, the less you can afford to spend on a home.

- Down payment: A larger down payment will allow you to buy a more expensive home or enjoy a lower monthly mortgage payment.

- Interest rate: The lower your mortgage rate, the more you can borrow and the more house you can buy.

Related: How to Buy a House in 2021: 8 Tips for Winning the COVID Homebuying Season

You May Like: What Is The Grace Period On A Mortgage

Make A Sizable Down Payment

Because the down payment is only one of several requirements you must meet, a large down payment alone cannot guarantee you a loan. However, offering a down payment of 25 percent can improve the affordability of the loan. For example, when your down payment is larger, the total loan balance decreases, which lowers the monthly payment. Likewise, offering a down payment of 25 percent brings your loan-to-value ratio to 75 percent. With a 75 percent loan-to-value ratio, you may not need private mortgage insurance, which lowers your monthly payment even further.

How To Calculate How Much House You Can Afford

To produce estimates, both Annual Property Taxes and Insurance are expressed here as percentages. Generally speaking, and depending upon your location, they will generally range from about 0.5% to about 2.5% for Taxes, and 0.5% to 1% or so for Insurance.

Front End and Back End debt ratios are to determine how much of your monthly gross income can be used for your mortgage debt and how much can be used to satisfy all your regular obligations . The 28% and 36% ratios are standard in the mortgage world, but lenders may have other combinations available, such as 33%/38%.

You May Like: What’s A Conventional Mortgage

How Much Mortgage Can I Afford On My Salary Calculator

The only way to know for sure how much mortgage you can afford on your salary is by talking to a lender. Theyll look at every piece of your financial picture to calculate the exact amount you can borrow.

But if youre still in the researching phase, you can skip the phone call and get a good estimate of your budget by using a mortgage calculator.

This by income mortgage calculator will estimate what you can afford based on your salary, down payment, existing debts.

If you want to better understand how each of those factors affects your max mortgage amount, read on.

How Does Your Debt

An important metric that your bank uses to calculate the amount of money you can borrow is the DTI ratio comparing your total monthly debts to your monthly pre-tax income.

Depending on your , you may be qualified at a higher ratio, but generally, housing expenses shouldnt exceed 28% of your monthly income.

For example, if your monthly mortgage payment, with taxes and insurance, is $1,260 a month and you have a monthly income of $4,500 before taxes, your DTI is 28%.

You can also reverse the process to find what your housing budget should be by multiplying your income by 0.28. In the above example, that would allow a mortgage payment of $1,260 to achieve a 28% DTI.

Don’t Miss: How Long Does It Take To Do A Reverse Mortgage

How Much Is A 50000 Mortgage

If you are looking for a mortgage for £50,000, you may be wondering how much the actual repayments on a 50k mortgage are. We have hopefully made this easier for you to understand and have given you an indication on how much a 50k loan could cost you each month by devising the following tables.

The monthly costs are broken down for you, showing different interest on £50,000 and different term lengths. The tables also display values of 50k+ loans, for example if you were looking for a £55,000 mortgage.

| 1% |

|---|

| £344.91 | £316.72 |

Please note that these figures for repayments on a 50k mortgage are not definitive and lenders may provide slightly different values on loans for £50,000.

How Much Home Loan Can I Get On My Salary

Home»Articles»How Much Home Loan Can I Get on My Salary?

Also, read this article in , , , , , and

How much home loan can I get on my salary? If you are a salaried employee and you plan to own a house, this is the first question that pops up in your mind. This article will explain to you what part of your salary is considered while calculating eligibility, what are the common salary slabs & their eligibility amounts, what are the other factors affecting your eligibility and finally how easy it is to apply for a home loan.

Buying an own house in ones lifetime is considered as the major step towards achieving the state of being settled especially in Indian culture. However, for the majority of the salaried population, with real estate prices beyond their reach, this dream can be only achieved late in their lifespan once they have accumulated sufficient savings. This is where availing a home loan can catapult oneself to achieve their homeownership dream at an early age.

Understand your salary:

Salary is widely quoted as either gross or net . It is important to understand the difference between them as financial institutes often consider the net component of ones salary while arriving at their home loan eligibility. Salary structure differs across various organizations, however, it is broadly divided into the following components:

How Much Home Loan Can I Get?

Rate of Interest: 10% per annum

Tenure: 20 years

Existing EMIs: None

Don’t Miss: Is Quicken Loans A Mortgage Broker Or Lender

Oh Perfect That Was Easy Off To Go Take Out A Mortgage Now Bye

Woah, slow down! Were just getting started here. Remember? We said this was supposed to be painful, laborious and even depressing. Lets continue:

There are two things that you need to consider when figuring out the answer to how much mortgage can I afford. First, theres how much debt you are willing to take on and the second is how much debt a lender is willing to extend to you. The former is definitely important but the latter is what were going to discuss here.

So we are trying to determine how much your lender thinks you can afford. After all, theyre the one taking the risk by loaning you the money. Theyre going to be very concerned about your job, how much money you make in a year, how much money you can put down up front, your credit score and more.

Your lender is going to take all your information and come up with two figures to guide them: your back-end ratio and your front-end ratio.

How Much Mortgage Payment Can I Afford

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

Recommended Reading: How Much Mortgage Protection Insurance Cost

What Are The Income Requirements For Refinancing A Mortgage

Mortgage refinancing options are reserved for qualified borrowers, just like new mortgages. As an existing homeowner, youll need to prove your steady income, have good credit, and be able to prove at least 20 percent equity in your home.

Just like borrowers must prove creditworthiness to initially qualify for a mortgage loan approval, borrowers have to do the same for mortgage refinancing.

Pay Down Some Of Your Existing Debt

The minimum payment on your credit accounts determines your debttoincome ratio. By paying down your credit card debt or eliminating a car payment, you can qualify for a bigger home loan.

For example, in the scenario above, reducing your monthly obligations by $200 could increase your maximum price from $234,000 to $270,600.

You May Like: What Is A Good Ltv For Mortgage

Borrow Up To 6 Times Your Salary If You Have No Other Debt

Take a look at two borrowers, whose profiles are identical except for their debt-to-income ratios.

| $668,000 | $445,000 |

*Home buying budgets estimated using The Mortgage Reportsmortgage calculator. Your own rate and budget will vary

In this scenario, Borrower One has been admirably prudent and has no ongoing debt.

Borrower Two, on the other hand, has a car payment and personal loan payment totaling $1,000 per month. This drastically affects how much they can borrow for a mortgage.

Note, both loans aim for a 36% DTI, which is typical for a conventional mortgage. However, many popular loans with a max DTI of 43% to 45%.

Its even possible to buy a home with a DTI of close to 50%. But many mainstream lenders wont approve such loans.

And remember, the higher your DTI, the higher your mortgage rate.

So its in your best interest to keep debts low and even pay some off if possible when youre shopping for a mortgage.

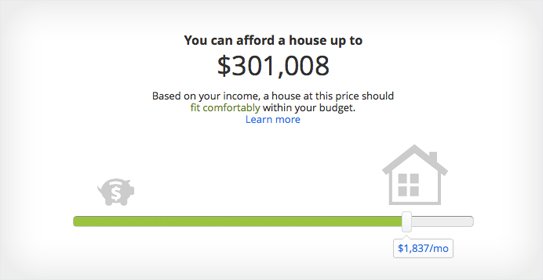

Likely Rate: 3022%edit Rate

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Confirm your affordability with a lender. Based on your inputs, we recommend the following lenders:

Getting ready to buy a home? Well find you a highly rated lender in just a few minutes.

Enter your ZIP code to get started on a personalized lender match.

Recommended Reading: How Much Is The Mortgage On A $300 000 House

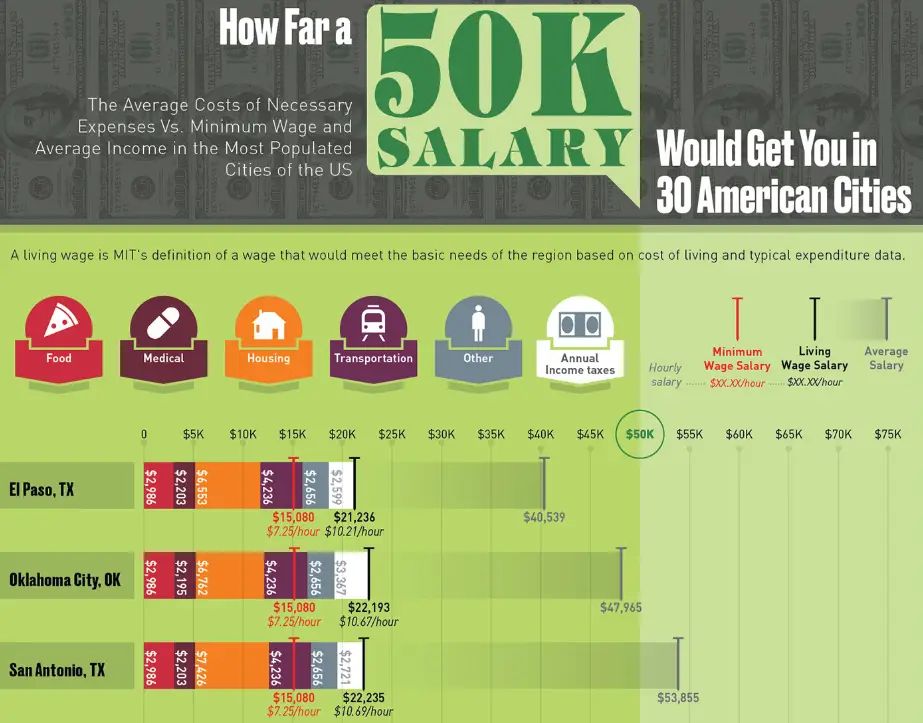

Is 50k Per Year Good Enough Money To Make You Happy

Did you know, money can buy happiness to a point? During a survey of over 450,000 people, maximum happiness is achieved at a yearly income of $75,000.

After $75,000, happiness begins to taper off. Therefore, you cannot expect money to bring you more happiness after earning a $75k salary.

So, how does earning $50k per year affect your happiness? People with a salary of $50k are still considered happy individuals, but have room for improvement. Unhappiness is significantly greater in people earning less than $40k per year.

Who Can Help You In The Mortgage Market

There are many lenders in Canada serving the mortgage market: banks, other large financial institutions & mortgage brokers. Most mortgage brokers in your town or city have access to a broad range of local & nationwide lenders. A good mortgage broker is normally able to put you into a program at a competitive rate. Banks like the Bank of Nova Scotia are national and can also provide immediate financing for your loans. In practice, however, most buyers end up pre-qualifying with a bank or a realty institution through their real estate agent or mortgage broker. In that process, your needs and requirements are taken into consideration and matched with a lender that can provide the best service for you. In other words, you may end up with a completely different bank holding your paper than when you started. As long as the loan is backed and it meets your terms, you should feel confident in signing it.

You May Like: How Much Mortgage 200k Salary

How Much Can I Afford To Spend On A House

The home affordability calculator will provide you with an appropriate price range based on your situation. Most importantly, it takes into account all of your monthly obligations to determine if a home is comfortably within financial reach.

However, when banks evaluate your affordability, they take into account only your present outstanding debts. They do not take into consideration if you want to set aside $250 every month for your retirement or if youre expecting a baby and want to save additional funds.

NerdWallets Home Affordability Calculator helps you easily understand how taking on a mortgage debt will affect your expenses and savings.