How Direct Lenders Work

Direct lenders including banks, credit unions, and online lenders use their own money to fund mortgages. And their loan officers, processors, and underwriters all work for the same company.

That means you can go right to thesource if you want a loan from a direct lender. For instance, if you want a homeloan from Rocket Mortgage, you can go directly to Rocket and fill out a loanapplication.

Loan officers serve as thebank or lenders sales force. They usually earn commissions for originatingmortgage loans, and the prices they charge may not be negotiable.

In addition, bank loan officers can only offerloan programs in their own portfolio, and that can limit the options availableto you.

For example, if a direct lender isnt approved to do zero-down USDA mortgages, its loan officers will never be able to offer you one. They might not even mention a USDA loan as an option even if youre eligible.

Banks can still be flexible withmortgage pricing, though.

Loan officers can offer the same mortgage at various price points, from no-closing-cost loans with higher rates, to loans with discount points that cost more upfront but have reduced interest rates.

When youre shopping with directlenders, its up to you to ask about the pricing options available andnegotiate the rate-and-fee structure you want.

Pros of mortgage banks

Here are the pluses of dealingwith a mortgage bank or direct lender.

Cons of mortgage banks

The Mortgage Market Is Now Dominated By Non

Most borrowers, whether they are purchasing property or refinancing their home, focus on their mortgage rate and loan terms rather than the type of lender they choose.

Yet the landscape of the lending market has shifted dramatically over the past few years from domination by big banks to a market where more loans are made by non-banks financial institutions that only make loans and do not offer deposit accounts such as a savings account or checking account.

For consumers, it doesnt really matter whether you get your loan through a bank or a non-bank, although in some ways non-banks are a little more nimble and can offer more loan products, says Paul Noring, a managing director of the financial-risk-management practice of Navigant Consulting in Washington. The impact is bigger on the housing market overall, because without the non-banks we would be even further behind where we should be in terms of the number of transactions.

In 2011, 50percent of all new mortgage money was loaned by the three biggest banks in the United States: JPMorgan Chase, Bank of America and Wells Fargo. But by September 2016, the share of loans by these three big banks dropped to 21percent.

Non-banks are regulated in every state where they are licensed to provide loans, says David Norris, chief revenue officer for loanDepot in Foothill Ranch, Calif.

During the last housing boom, many non-bank lenders targeted subprime borrowers, he says.

Quicken Debts Evaluation Vs Guild Home Loan Testimonial

Guild financial is more superior whether you have a reduced consumer credit score , because it accepts renewable loan info like electric bills. Guild has the benefit of way more kinds of residential loans, in order to make use of it if you require a USDA financial, treat mortgage, or repair funding.

Its also important to hire Quicken Financial products if you live in nyc or New Jersey, though, because Guild loan doesnt operate in those countries.

Recommended Reading: Can You Get A Mortgage To Buy A Foreclosed Home

What Do Loan Officers Do

A loan officer is usually an employee of an institutional bank, credit union or mortgage lender. They review financial documents and can recommend a loan for preapproval to an underwriter who works for a mortgage bank or lender.

A loan officer originates mortgage loans and there are two types: a licensed professional loan originator and a registered loan originator, Andrews said.

Licensed professional loan originators must take extra education, pass a national test and meet the licensing requirements of the states they do business in. Registered loan originators typically work for federally chartered institutions like banks and dont have to meet the same education and testing requirements as licensed MLOs.

Loan officers offer only the mortgage products of one financial institution. The lenders they work for lend the money, and youll typically make payments to the same company after closing.

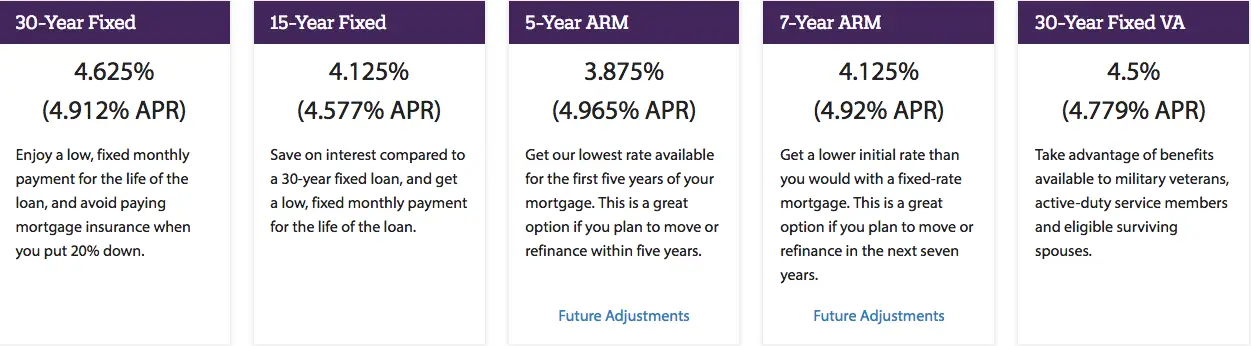

Quicken Loans Interest Rates

On the Quicken Loans website, select “Mortgage Rates” on its menu. It shows you interest rates and APRs on 30-year and 15-year fixed conforming mortgages, 30-year VA mortgages, and 30-year FHA mortgages. It also compares today’s rates with rates yesterday and one year ago.

You can read the assumptions for these rates on the website. For example, the 30-year rates shown are for $200,000 loan amounts and cover 1.75 points at closing.

You can also sign up for email and text updates about current Quicken Loans mortgage rates.

Popular Articles

You May Like: How Much Is Personal Mortgage Insurance

Rocket Mortgage Review 2021

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: What Is The Highest Interest Rate On Mortgage

Does A Loan Servicer Own The Loan

Oftentimes, lenders will sell your loan so you could end up with a different servicer or your original lender might also hire a different company to service your loan. When the servicer receives your payment, it distributes the money: Principal and interest go to the bank or the investor that owns the loan.

Quicken Funding Rates Of Interest

The Quicken money website, locate loan numbers on their eating plan. It explains rates and APRs on 30-year and 15-year predetermined conforming residential loans, 30-year VA mortgages, and 30-year FHA mortgages. In addition analyzes the current prices with numbers past plus one annum back.

You can read the presumptions for those rates online. Including, the 30-year numbers demonstrated are generally for $200,000 financing levels and cover 1.375 things at completion.

You may also subscribe to mail and article features about recent Quicken Loans finance charges.

Common Pages

Unlike with the right on the internet creditors, its not possible to connect your information to view a more tailored rates on the website. You will have to make a merchant account to reach tailor-made charge.

Today, the 30-year and 15-year conforming money numbers on Quicken financing website are actually a bit of above the average prices listed on the national Reserves site.

Recommended Reading: How To Reduce My Monthly Mortgage Payment

Just How Quicken Debts Really Works

Quicken Lending products was an on-line lender. Might incorporate through their electronic platform Rocket home loan, and Quicken Personal loans will underwrite your loan. Quicken finance comes in all 50 US countries, and youll take advantage of the correct loan equipment:

If you are replacing, youll be able to choose from here choices:

- Conventional rate-and-term re-finance

- FHA reduces costs of re-finance

- VA IRRRL, whether it is on the primary household

Some mortgage offer substitute for apply with renewable financing data. By way of example, you may show evidence you only pay statements prompt whether you have really reasonable or no overall credit score. Quicken Loans doesnt enable you to utilize with renewable info, though, so it is a significantly better alternative for people with an effective consumer credit score. Minimal credit score rating criteria count on which type of home loan find.

You can actually chat on line with an automated assistant 24/7. Chat on the web with a live representative saturday through tuesday from 7:00 a.m. ET to midnight Ainsi,, or sundays from 9:00 a.m. to midnight ET.

If you wish to talk about a whole new finance, you can easily talk to a person over the phone wednesday through weekend from 8:00 a.m. to 10:00 p.m. Ainsi,, Saturday from 9:00 a.m. to 8:00 p.m. ET, or Sunday from 10:00 a.m. to 7:00 p.m. ET.

Quicken Funded Nearly $52 Billion In The First Quarter

- Detroit-based Quicken Loans originated $51.7B in home loans during Q1

- Company increased their lending slightly from the fourth quarter

- San Francisco-based Wells Fargo only managed $48B over same period

- A near-20% decline from the fourth quarter of 2019

In the first quarter, Quicken Loans reported $51.7 billion in home loan originations, pushing it to the top of the rankings of the first time ever, per new figures from Inside Mortgage Finance.

While the Detroit-based nonbank lender has been referring to itself as Americas Largest Mortgage Lender since overtaking Wells on retail originations, it is now truly the #1 mortgage lender across all lending channels.

Quicken Loans only saw a modest increase in first-lien mortgage production from quarter to quarter, but it was more than enough to finally give them the out-and-out crown.

Thats because Wells Fargo saw originations slip 20% from the fourth quarter of 2019 to $48 billion, despite a year-over-year improvement of 45%.

| Wells Fargo first mortgages |

Recommended Reading: How Much Would I Get Pre Approved For A Mortgage

How Do I Get Preapproved For A Mortgage

Mortgage preapproval represents a lenders offer to loan the buyer money based on certain financial circumstances and specific terms. Start by gathering documents your lender will need, including a copy of your Social Security card and recent W-2 forms, pay stubs, bank statements and tax returns. The lender you select will then guide you through the preapproval process.

Two Mortgage Lenders Moving In Opposite Directions

- Wells Fargo became top mortgage lender in 2008 after Countrywide Financial went under

- Retained that lead overall until the first quarter of this year thanks to strong correspondent lending business

- Quicken Loans has seen production grow tremendously thanks to Rocket Mortgage brand

- Wells Fargo also has a digital mortgage youve probably never heard of, and those scandals didnt help either

Wells Fargo became the largest mortgage lender all the way back in the second quarter of 2008 when Countrywide Financial went under during the Great Recession.

And amazingly, they had been in the top spot for over a decade before finally being dethroned, though again, it was mostly due to their correspondent lending figures.

Take the first quarter numbers Wells did $48 billion total, with only $23 billion of it retail production and the remaining $25 billion via correspondent.

Given the current environment, its likely Wells will see even lower correspondent numbers as it scales back with its lending partners due to COVID-19.

The company has also faced a lot of issues over the past few years, including a number of fake account scandals and even a mortgage rate lock scandal.

Meanwhile, Quicken Loans has been surging higher and higher thanks to its Rocket Mortgage unit, which has proven to be highly successful with consumers.

Ultimately, Quicken has built a brand around Rocket Mortgage technology, while Wells Fargo has kind of just been the old guard, with no exciting fintech to speak of.

Read Also: What Is Wells Fargo Current Mortgage Rates

Online Lenders: Faster Andsometimescheaper

Generally speaking, the home loan application process through online lenders is a bit dumbed-down compared to going to a large financial institution or meeting one-on-one with a mortgage broker. Thats one of the main reasons they are so popular who doest want to apply for a mortgage while watching TV and eating dinner at the same time?

With an online lender, there is no need to have time-consuming in-person meetings, which can save time.

Online lenders tend to undercut traditional mortgage brokers on rates and fees, too. Due to the tough competition for online lending, these lenders realize the best way to grab more customers is by offering the lowest interest rates and most flexible payment terms out there. They also have low closing costs because they dont have to pay for the same type of expenses as mortgage brokers do.

If your credit score is lower than 700, its another reason you may want to try applying for a loan with an online lender. They dont always use the same underwriting investors as the big banks do, so you may be able to qualify for a loan even if you were rejected by a local bank.

Best Lender For First

LoanDepot completed more than 366,000 mortgage originations over the past five years, according to data from S& P. This puts them second among all online mortgage lenders, trailing Quicken Loans by a slight margin. However, LoanDepot also saw its loan volume increase by over 24% over the same period, making them one of America’s fastest growing online mortgage lenders. As it rapidly expands, LoanDepot aims to challenge Quicken’s dominance in the online lending space.

Runner-up comparison

|

Highlights LoanDepot’s mortgage products run the gamut between conventional fixed-rate loans to government-backed FHA, VA and USDA home loans. Licensed to lend in all 50 states, they make an excellent choice for your first home purchase, whether you’re a first-time homebuyer, veteran or rural homebuyer. LoanDepot also ranks among America’s top FHA lenders by volume, which offers fixed- or adjustable-rate mortgage loans for as little as 3.5% down.

- FHA and VA mortgage loans through LoanDepot can have you qualified for a home with 0% or 3.5% down.

- LoanDepot is one of the few online lenders that offers home equity loans.

- Offers the FHA 203K loan, which allows borrowers to finance their home and cash out on home equity for home improvements.

Read Also: Can You Do A 40 Year Mortgage

How Much Should I Save For A Down Payment

There are two different pieces to this. Theres what youre required to save and then the best down payment for you given your situation.

- If you qualify for a USDA or VA loan, no down payment is required.

- If youre getting an FHA loan, the minimum down payment is 3.5%.

- If you qualify for a conventional loan through either Fannie Mae or Freddie Mac, down payments start at 3% and in no event would you have to put down more than 5% of the purchase price on a primary residence.

However, there are plenty of reasons to make a higher down payment if you can afford it.

On a conventional loan, if you put 20% down, you can avoid having to pay for private mortgage insurance . Otherwise, you can ask that it be canceled once you reach 20% equity.

On an FHA loan, youll pay mortgage insurance premiums for the life of the loan if you make a down payment of less than 10%. Otherwise, it comes off after 11 years.

Your interest rate is determined in part by a combination of your median FICO® score and the size of your down payment, so holding all other factors equal, a higher down payment should mean a lower rate.

Given this, the real answer to this question is that you should put down as much as you can comfortably afford without compromising other financial goals.

Just keep in mind youll probably have to furnish the house, as well.

What To Expect When Working With A Mortgage Broker

From start to finish, brokers can walk you through the process of applying for a loan:

- If you are shopping around, it can take some time to apply with different lenders. A mortgage broker is likely more familiar with how different lenders handle mortgage applications and may be able to help speed the process up.

- Once youve selected a lender, a broker can also act on your behalf to handle the back-and-forth conversations with the lender.

- When its time to close on your loan, your broker will work with you, your lender and your real estate agent to make sure you close your loan smoothly and on time.

If you decide to work with a mortgage broker, its important to know youre working with an ethical, experienced broker. Just like contractors, plumbers, attorneys or other independent businesses, there are knowledgeable brokers who will work hard to get you the best loan possible, while others may not offer a consistent or efficient service.

You May Like: What Is Needed For Mortgage Application

Whats The Main Difference Between A Mortgage Lender And A Mortgage Broker

When it comes to a mortgage lender vs. a mortgage broker, itâs relatively straightforward. While lenders like banks and other lending institutions can only offer their own mortgage products, mortgage brokers can provide various mortgage options from multiple lenders.

Someone must be licensed as a mortgage specialist to become a mortgage broker. Brokers who gain these credentials get access to many different mortgage products to ensure youâre not missing out on something. On the other hand, lenders will provide you with the products they have directly.

How Much House Can I Afford

While being prequalified or getting a verified mortgage approval will help you define the top end of their budget, it doesnt mean that you should immediately go looking at houses in the upper end of your price range.

You dont want to end up spending so much on your house payment each month that youre unable to save for any emergencies that might come up. You also want to leave room in your budget for whatever sparks joy in your life. You should still be able to take the occasional trip and go to dinner with friends once a week, if thats your thing.

You can use your mortgage approval as a starting point for sure, but dont stop there. Before you hit the pavement to look at homes, youll want to take a hard look at your budget as well to determine a house payment you would feel comfortable with.

Keep in mind theres more to your house payment than the mortgage itself , and you also want to save between 1% 2% of the purchase price for maintenance costs.

If youre looking for a guideline, its generally a good idea to spend no more than 33% of your monthly budget on housing costs. Any more than that, and you might be overextending yourself.

Read Also: Who Is Rocket Mortgage Owned By