Will Interest Rates Rise In 2021

It is unlikely that rates will increase this year, despite the fact that the Bank of England expects inflation could head above 4% by the end of 2021.

However with higher energy, fuel, transport and food costs, the inflationary pressures appear to be getting worse and not better which might make a rise in interest rates in 2022 more likely, according to the governor Andrew Bailey.

One aspect holding the Bank of England back on a rise through fear of choking off a recovery might be the recent slowdown in the growth of the UK economy.

A central banks job is to keep inflation in check and it can do this by altering interest rates in an economy. It aims for a healthy inflation rate of 2%.

When rates are low, inflation tends to rise and when rates are high, inflation tends to fall. So if the central bank increases interest rates, inflation should fall.

We explain more on the relationship between interest rates and inflation here.

The Bank Of Canadas Impact On Mortgage Rates

One of the most important influences on mortgage rates is the Bank of Canadas interest rate. A change to the Bank of Canadas rate generally results in an equal adjustment to the prime rates of mortgage providers, although not always. This is because the Bank of Canada is a reserve bank, backed by the federal government.

Unlike the retail banks, the Bank of Canada tends to change rates proactively, rather than reactively. If theres an economic downturn coming, the Bank of Canada will often cut rates early on. Cutting rates makes it cheaper to borrow money, which stimulates economic activity. Conversely, the Bank will increase interest rates if inflation is getting too high, for the opposite reason.

Mortgage Rate Forecast For Next Week

Despite Thursdays report from the Labor Department, citing unemployment claims dropping to a new pandemic low, it looks like low mortgage rates should remain in place for the remainder of the summer.

Thursdays jobs report was better than expected. Showing that the surge in COVID-19 cases caused by the Delta variant has yet to lead to widespread layoffs.

That said, on Thursday, September 9, Sam Khater, Freddie Macs Chief Economist stated, While the economy continues to grow, it has lost momentum over the last two months due to the current wave of new COVID cases that has led to weaker employment, lower spending and declining consumer confidence.

Therefore, we expect rates to stay in the sub-3% range for next week.

Read Also: Why Would A Mortgage Be Declined

Where Mortgage Interest Rates Are Headed

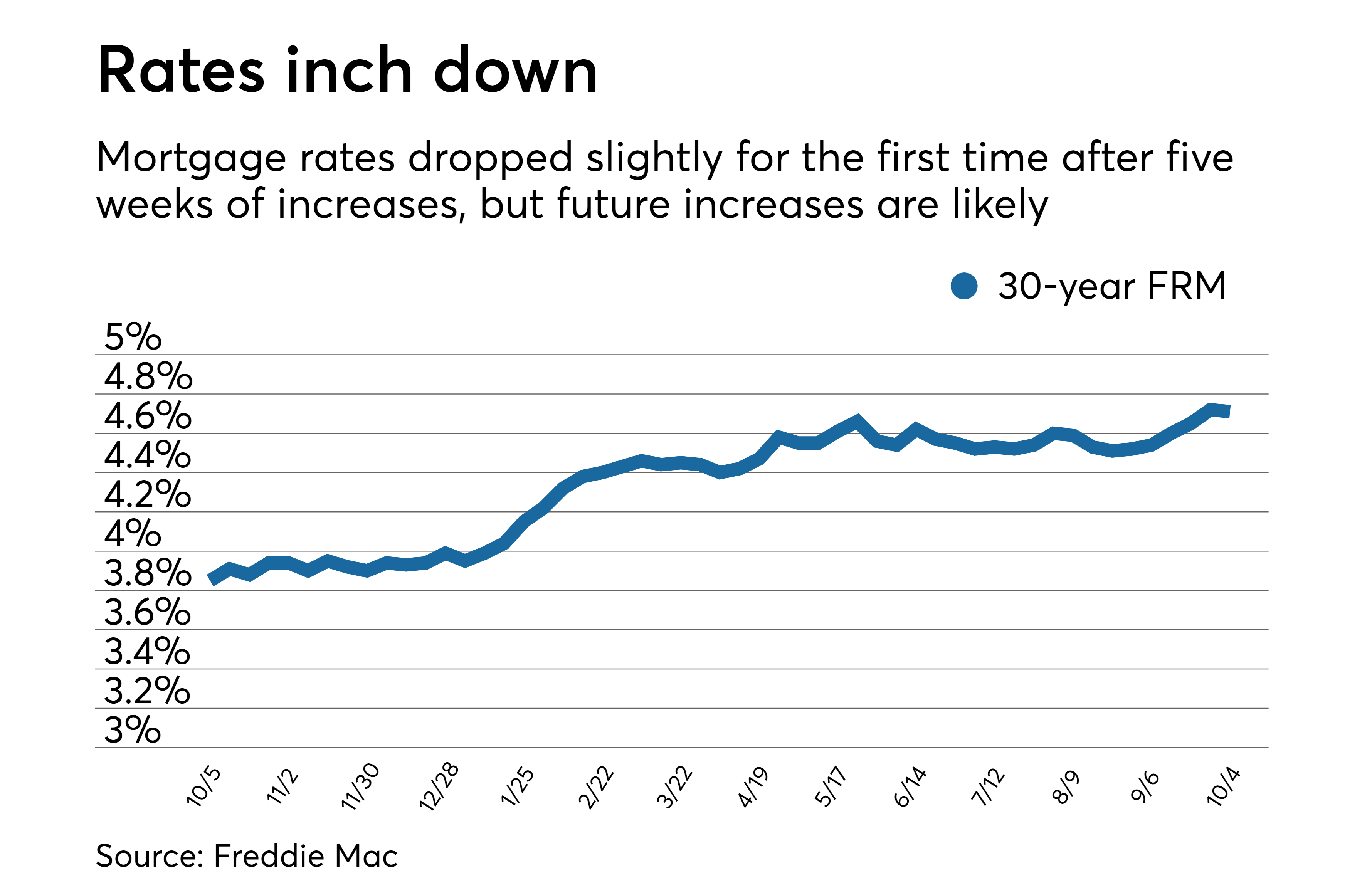

All of this is fueling speculation about mortgage interest rates. And though a climb would likely be slow and not always linear, experts expect an overall increase over the coming months. Waiting around too long in order to grab the lowest rate may cost you in the long run.

“If somebody waits to refinance and rates go up, the natural human inclination is to chase the lower rates — it’s the gambler’s fallacy and everyone’s prone to it,” McKay said.

If you haven’t refinanced your mortgage because you don’t know how to do it, there are plenty of resources out there to help you through it.

“If refinancing makes financial sense for somebody, yes, they should do it today, they should do it tomorrow, they should do it immediately,” McKay said. “Not because I think rates are going to go up or down, but because it makes financial sense.”

Housing Construction Trends & Homebuilder Confidence

Residential construction had ended in 2020 on a strong note. Housing starts rose 5.8% to 1.67 million annualized units in December. Total starts were 2.8% higher than a year ago. Privatelyowned housing units authorized by building permits in August were at a seasonally adjusted annual rate of 1,728,000. This is 6.0 percent above the revised July rate of 1,630,000 and is 13.5 percent above the August 2020 rate of 1,522,000.

Singlefamily authorizations in August were at a rate of 1,054,000 this is 0.6 percent above the revised July figure of 1,048,000. Authorizations of units in buildings with five units or more were at a rate of 632,000 in August. Privatelyowned housing starts in August were at a seasonally adjusted annual rate of 1,615,000.

This is 3.9 percent above the revised July estimate of 1,554,000 and is 17.4 percent above the August 2020 rate of 1,376,000. Singlefamily housing starts in August were at a rate of 1,076,000 this is 2.8 percent below the revised July figure of 1,107,000. The August rate for units in buildings with five units or more was 530,000.

It is becoming increasingly difficult for them to meet this housing demand due to supply delivery issues and rising material costs. NAHB Housing Market Index is a gauge of builder opinion on the relative level of current and future single-family home sales. It is a diffusion index, which means that a reading above 50 indicates a favorable outlook on home sales below 50 indicates a negative outlook.

Read Also: What Lender Has The Lowest Mortgage Rates

Nz Interest Rates Forecast: Why Are Interest Rates So Low

Ben Bernanke, who served two terms as Chair of the Federal Reserve, wrote

Low interest rates are not a short-term aberration, but part of a long-term trend. As the figure below shows, 10-year government bond yields in the United States were relatively low in the 1960s, rose to a peak above 15% in 1981, and have been declining ever since. That pattern is partly explained by the rise and fall of inflation, also shown in the figure. All else equal, investors demand higher yields when inflation is high to compensate them for the declining purchasing power of the dollars with which they expect to be repaid.

Ben Bernanke

If inflation rises, interest rates will follow. But as we all know, we live in a low-inflation environment. Todays low bond yields simply reflect economists and investors expectations that inflation will remain low.

The Fed Starts To Taper

To counter the economic fallout of the COVID-19 pandemic, the Fed cut interest rates and accelerated its purchasing of government-backed bonds. Since then, the Fed has been buying $40 billion of mortgage-backed bonds each month. But as the US economy continues to recover, the Fed has indicated that it will “soon” taper its investment in mortgage-backed securities. In September, Chairman Jerome Powell indicated that the Fed could start tapering around the time of its next meeting in November.

“When the Fed starts tapering it off, that’s most likely going to cause interest rates to go up unless there’s suddenly a big push from the secondary market — Wall Street, basically — to buy mortgage-backed securities at these low interest rates,” according to McKay.

While no official decision has been made, Chairman Powell also indicated that Fed members are unified around the decision to wrap up the tapering effort by mid-2022 — as long as the economic recovery remains on track. The Fed is also expected to increase interest rates around the end of 2022 or early 2023, according to Chairman Powell’s speech at the Committee hearing.

Also Check: Are Mortgage Rates Going To Rise

Corelogic Forecasting Low Rates Through 2023

Another mortgage company that focuses entirely on housing market data, CoreLogic, sees 2021 being another fantastic year for mortgage rates.

In fact, they believe interest rates will remain pretty close to current levels through 2023. In other words, youve got time to buy a home or refinance your mortgage.

While they dont provide a quarter-by-quarter analysis, they did say they expect 30-year fixed-rate loans to remain below 3% during early 2021 and average about 3.2% during the next three years.

Simply put, flat rates in 2021 with some gentle rising seen over the next few years, but certainly nothing to fear.

Do The Math For A Refinance

In many ways, refinancing a mortgage is much easier than purchasing a home, especially in this market. However, you should approach a mortgage refinance with the same due diligence as you would a home purchase. Paying attention to your refinance rate, the fees and also how long you plan to keep the new loan.

One general guideline to follow is to refinance your home loan when you can reduce your interest rate by 1% or more. However, there are other factors to consider on top of that. You want to make sure that youll be keeping your home long enough for the savings from refinancing to outweigh upfront closing costs. One way to calculate this is to take the upfront fees and divide them by your monthly savings. So if you had $10,000 in refinance closing costs and your monthly payment is $300 less, then it would take roughly 34 months, or just under three years, to break even.

The loans repayment term affects not only your monthly payment, but also your mortgage rate. Shorter-term mortgages typically have lower interest rates than longer-term loans. So a 15-year mortgage will have a better rate than a 30-year mortgage, if all else is equal.

The tradeoff with the lower rate you can get with a shorter mortgage term is that the monthly payment will be higher. Although, a higher monthly payment will allow you to pay off your mortgage more quickly. So ultimately, the decision needs to line up with your current financial situation and your long-term goals.

Read Also: What Salary Do I Need For A 200k Mortgage

How To Tell If Interest Rates Are Going Up Or Down

Its extremely hard to know for sure if rates will rise or fall, but there are ways to make educated guesses. Knowing whether mortgage rates will rise or fall comes down to understanding the state of the national economy, the world economy, and the current social and political circumstances you find yourself in.

That sounds complicated, we know, but dont fret. Below weve explained some of the main factors that affect interest rates and what to look for in each one. Consider each of the factors below and you should get a pretty good idea of whether mortgage rates are rising or falling.

Mortgage Interest Rate Faq

What are current mortgage rates?

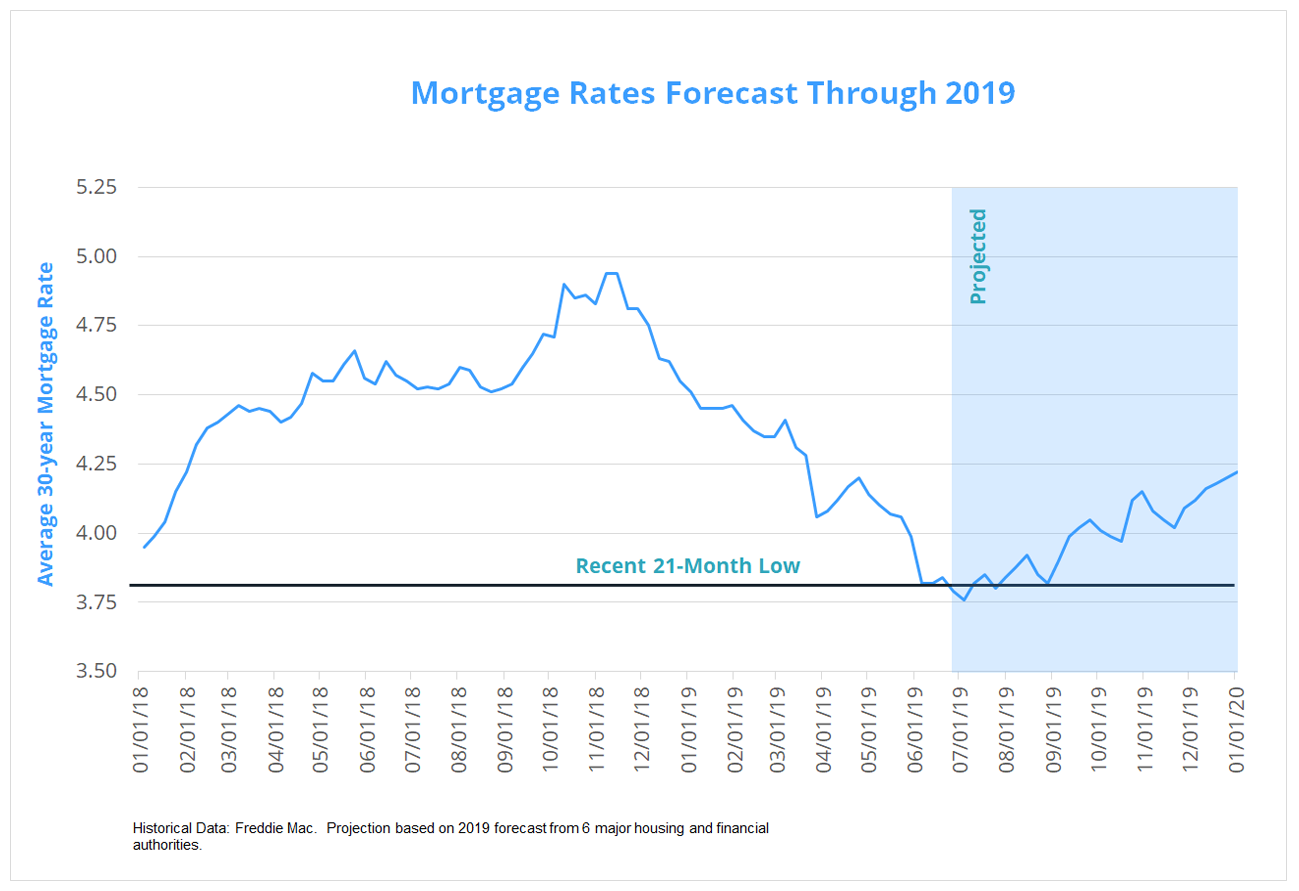

Current mortgage rates are averaging 3.14 percent for a 30-year fixed-rate loan, 2.37 percent for a 15-year fixed-rate loan, and 2.56 percent for a 5/1 adjustable-rate mortgage, according to Freddie Macs latest weekly rate survey. Your own rate could be higher or lower than average depending on your credit score, down payment, and the lender you choose to work with, among other factors.

Will mortgage rates go down next week?

Mortgage rates are not likely to go down next week . The Federal Reserves policy committee, the FOMC, meets on Tuesday and Wednesday. If they announce a plan to start tapering mortgage support, as most experts expect, mortgage rates could increase sharply.

Will mortgage interest rates go down in 2022?

Its unlikely mortgage rates will go down in 2022. The ultra-low rates enjoyed by homeowners and buyers in 2020-2021 were largely driven by the Covid pandemic. And as the pandemic continues to recede in 2022, rates should keep on climbing.

Will mortgage interest rates go up in 2022?

Yes, its very likely mortgage rates will increase in 2022. Along with a decline in new Covid cases, were seeing positive growth in the U.S. economy. Increased consumer spending, low unemployment, and a strong real estate market could all help push rates up. Not to mention, the Fed expects to have completely withdrawn its pandemic-era mortgage support by mid-2022. And that means it will no longer be keeping mortgage rates artificially low.

Don’t Miss: Can You Take A Cosigner Off A Mortgage

Take Advantage Of The Fall And Winter Home Buying Market

Its no secret that 2021 has been a tough time to buy a home. Low inventory and skyrocketing prices have pushed many would-be buyers out of the market.

But things could look a little better in fall and winter.

As Realtor.com said, The 2021 homebuying season has aligned with pre-pandemic seasonal patterns, with a familiar sweet spot for buyers expected in the fall.

Thats when competition typically wanes, and price gains cool off a little. And 2021 should be no exception in that regard.

Plus, mortgage rates are on the upswing. So buyers who manage to find a home before the end of 2021 may be able to secure some of the last pandemic-era rates.

In short: If youre still house hunting, dont give up. You might have better luck during the colder months. And cheap financing is still available, too.

Nz Interest Rates Forecast: Term Deposit Interest Rates Today

As if one needed any more proof, take a look at the following graph of 1-year NZ bank term deposit savings/investment rates in New Zealand from January 2008 to April 2021, a time span of over 13 years.

You can see a huge drop of nearly 5% in NZ bank 1-year term deposit rates following the GFC, followed by a short-lived 1% bounce back, and then a continuation of the downward trend right through to today.

With the exception of a few small blips along the way, thats 12 years of declining term deposit interest rates. The interest rate train has had no brakes and been running downhill for a very long time. Its now running along the valley floor but has so much momentum we dont expect it to stop any time soon.

1-year NZ Bank Term Deposit Interest Rates in NZ

1-year term deposit rates in NZ from January 2008 to April 2021

Term deposit rates today

The following list details the best current term deposit rates for $10,000+ in New Zealand for the major NZ trading banks today

Current NZ Bank Term Deposit Interest Rates Today

| 1 yr | |

| 1.9% | 2.0% |

Note: After flatlining at historically low rates from late 2020 until May 2021, term deposit rates have since been inching upwards in micro-movements. In context, though, the rates have increased from not much to not much more.

The average 12-month term deposit rate at the beginning of 2019 was 3.36% . Current rates are therefore down to less than one-third of 2019s rate.

Also Check: How Much Is A Mortgage A Month

Housing Sales Trends 2021

Homes for sale in August continued to sell more quickly than last year, as buyer demand remained on a strong footing. The average home stayed on the market for 43 days in September, down 11 days from last year. While homes continue to be snapped up quickly as demand remains high, the average time a listing spends on the market is beginning to conform to seasonal norms.

In the 50 largest U.S. metros, the typical home spent 37 days on the market, and homes spent 7 days less on the market, on average, compared to last September. Among these 50 largest metros, the time a typical property spends on the market has decreased most in large metros in the South , followed by the Midwest and West , and Northeast .

Homes saw the greatest decline in time spent on the market compared to last year in:

- Miami

- Raleigh

- Jacksonville

Five metros saw time on market increase: Washington, D.C. , San Diego , Philadelphia , Buffalo and Baltimore .

Total existing-home sales that include single-family homes, townhomes, condominiums, and co-ops, fell 2.0% from July to a seasonally adjusted annual rate of 5.88 million in August, according to the National Association of Realtors®. Year-over-year, sales dropped 1.5% from a year ago . Distressed sales foreclosures and short sales represented less than 1% of sales in August, equal to the percentage seen a month prior and equal to August 2020.

Mortgage Rate Forecast : 475% Range By The End Of 2016

Brad Yzermans, California loan officer and creator of HomeLoanArtist.com

In 2016, I am confident that mortgage rates will rise by at least .375% and likely be in the 4.75% range by the end of 2016. Here are the primary reasons for that forecast.

1. Janet Yellen, the Federal Reserve Chairperson, announced in the fall of 2015 that she intends to change the governments stimulus policy and raise the Federal Funds rate despite there being many financial indicators and reports that reveal our economy is much weaker than we all know that it really is.

2. The conspiracy theorist in me thinks the economic data will somehow find a way to report that our economy is growing and cause bond and treasury prices to soften.

3. Freddie Mac forecasted mortgage rates would rise above 4% by the end of 2015 and they did. Now it anticipates an increase to 5% by the end of 2016. I figure those guys have a fairly good idea of whats going on, so perhaps we should listen to them.

Will the 2016 Presidential Election Impact Mortgage Rates?

There is no historical evidence that supports mortgage rates consistently go either up or down in a presidential election year.

But one prediction I know will be 100% correct is that mortgage brokers and loan officers across the country will use fear and claim mortgage rates always rise in an election year in order to persuade people to take action and refinance or buy.

Is it Possible Mortgage rates Could go Down?

How will Higher Rates in 2016 Impact us?

Don’t Miss: What To Expect When Applying For A Mortgage Loan

How Banks Set Mortgage Rates

At their core, mortgage providers are retailers. They offer a service that they sell for more than it costs. Instead of buying a mortgage, youll pay a given interest rate for the service over time, which has to account for a lenders costs, plus any profit it plans to make.

The main cost your bank needs to account for is the funding cost, which is the cost of borrowing the money that it will lend to you . Even if, hypothetically, the bank funded your mortgage with cash it had on hand, that money will be tied up in your mortgage instead of some other investment. In that case, the funding cost is an opportunity cost, the amount that it lost by investing in you and not elsewhere.

On top of the funding cost, mortgage providers need to earn enough to cover operating costs: staff, real estate, dividends to shareholders, etc. It also needs to make a certain amount of profit, which has to be enough to account for the risk that some borrowers will default on their mortgages .

Of course, these costs are variable, and change over time. To understand why that is, youll need to look at the wider economy.