Timing Your Mortgage Application

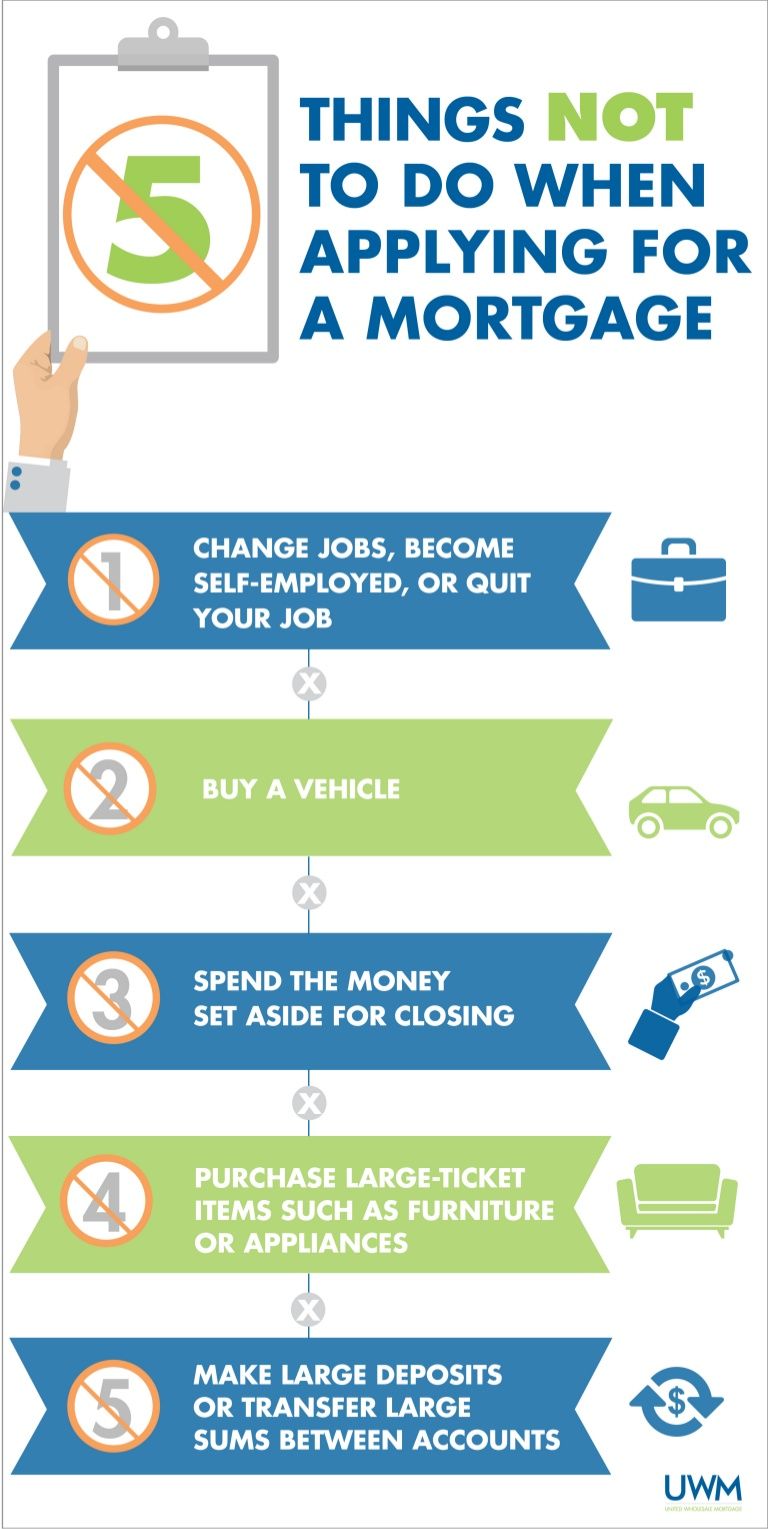

If you have just changed jobs or recently become self-employed you might find it more difficult to get a mortgage. Many lenders want to see proof of earnings over a specific period of time before they will accept an application.

Your employment situation might mean you need to put a mortgage application on the back burner for a short while at least. But if you are satisfied that the costs are within your budget and the timing is right, then you can begin your application.

Is It Possible To Get A House Mortgage If I Have A Lot Of Debt

Owning a home is the number one financial goal for many Canadians. Many Canadians, on the other side, have a large amount of debt, including . As a result, an often asked question here in Canada is Is it possible to get a house mortgage if I have a lot of debt?.

The answer depends on how high your gross debt service ratio is. In the process of reviewing your mortgage application, bank or mortgage lender will determine your gross debt service ratio or, in other words, your ability to make monthly payments on your debts, and decide if you are eligible for the mortgage.

For example, based on your income, the bank may determine that you can afford to pay $1,000 per month in debt payments. That means that if you have no other debt, you can afford a mortgage with $1,000 per month in payments however, if you are already paying $600 per month towards your , you will only qualify for a mortgage with a monthly payment of $400 per month.

Obviously, unless you have a large down payment, it is difficult to find a house in most places in Canada that only carries a $400 per month mortgage payment.

If you want to buy a house but your debts are too high, you must first get out of debt, and then save for a down payment. Only once your gross debt service ratio is improved and you have a down payment it does make sense to purchase a house. How can you achieve that?

First, try to pay off your debts on your own: cut your expenses to free up cash and then use that money to repay your debt.

How To Request Forbearance

As a homeowner with a federally-backed mortgage loan, you will need to contact your loan servicer to request forbearance. You do not need to submit extensive documentation, mainly only affirmation of your financial hardship, which can be done over the phone. Your initial forbearance can be for up to 180 days. Depending on when your initial forbearance began, you can extend forbearance an additional 180 or even 360 days.

Landlords of multi-family units must have been current on payments as of Feb. 1, 2020, to be approved for forbearance relief. If applicable, landlords should submit an oral or written request to their servicer who can approve the initial 30-day forbearance, with subsequent extensions of up to an additional 60 days.

You May Like: How Much Is The Mortgage On A $300 000 House

Check Your Credit Reports

Before you get too deep into the mortgage application process, its a good idea to take a step back and check your credit reports first. The health of your credit will play a big part in getting a good deal on a home loan, or even getting approved at all.

Start by pulling your credit reports from each of the three major credit bureaus: Experian, Equifax and TransUnion. The easiest way to do this is by visiting annualcreditreport.com, the only website thats authorized by federal law to provide free credit reports once per year.

Next, review your reports to ensure there are no errors or accounts that arent yours listed that may have damaged your credit. For example, review your personal information such as name, address and Social Security number for accuracy. Also check that the credit accounts and loans listed on your reports have been reported properly, including the balance and status. Double-check that there are no mysterious accounts opened, which would signal possible identity theft.

If you find an error, you can dispute it with the bureau thats reporting the incorrect information by visiting its website. Once you submit a dispute, the bureau is required to investigate and respond within 30 days.

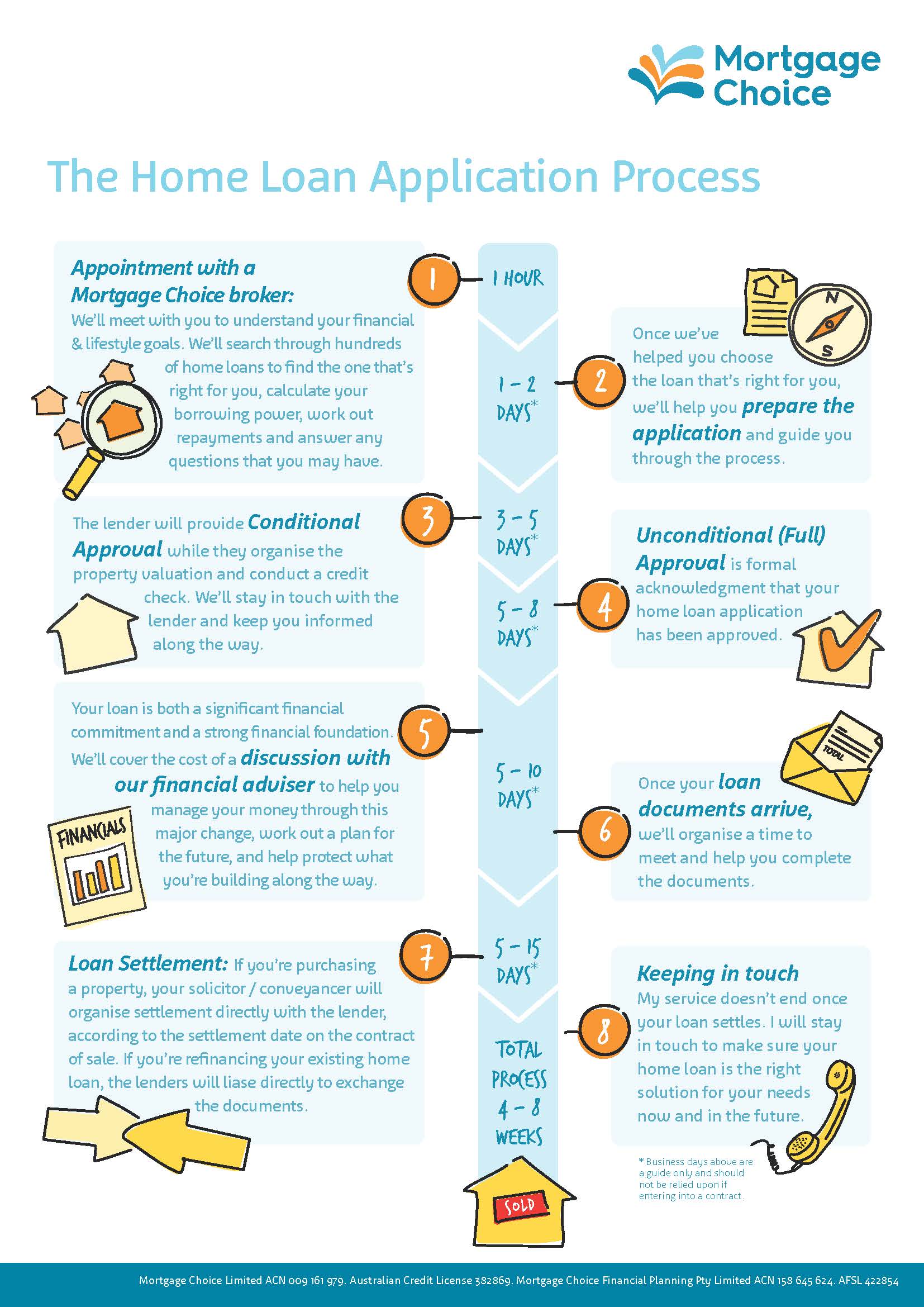

How Long Does A Mortgage Application Take

The length of the mortgage application process can take anything from one to six weeks. How long it takes depends on whether there are any hold ups while youre applying.

For example, the process of applying for a mortgage should only take a couple of hours. However, the lender will usually take a few weeks to look over your finances, as well as arranging a valuation of the home you want to buy.

Also Check: What Is A Good Dti For A Mortgage

Apply For A Mortgage When Youre Ready

Theres really no one right time to apply for a mortgage. Your friend might be ready to apply for a home loan when they have enough saved to put 10% down and they have a credit score of 760. You might not feel ready to make the jump into homeownership until you have at least 20% saved for a down payment and your credit score is at least 800. Your income also plays a big role in helping you determine when youre ready. If your housing payment will be more than 25 to 28% of your monthly income, you might want to hold off on purchasing until your income is higher or you have more saved up, since a larger down payment would bring down your monthly payment.

If your credit is very good or excellent, you have a stable income and you have enough saved up, you might still decide to hold off on applying for a mortgage due to your current lifestyle. You might not be sure how long youll stay in an area, for example. Usually, its a good idea to wait to buy until youre sure that youll be staying put for at least a few years. What you plan on doing with your life over the next few years might also influence whether or not youre ready to buy a home and get a mortgage. Having a child or getting married are usually two life changes that cause people to seriously consider homeownership.

If theres a big change in your life, later on, you can always make adjustments, such as selling your home and upgrading to a bigger property, as needed.

When To Apply For A Mortgage

Estate agents might ask that you have an Agreement in Principle before theyll show you properties, so you may want to apply for one before you start your search for a home. Bear in mind that Agreements in Principle usually last for 90 days, so if you havent found your dream home by then, you might have to apply for another.

Also Check: How To Purchase A House That Has A Reverse Mortgage

Is Lenders Mortgage Insurance Refundable

Lenders mortgage insurance is not refundable, at least not for loans settled after 2012. So if you switch to another lender or exit your home loan entirely, you wont be eligible for a lenders mortgage insurance refund. To avoid paying lenders mortgage insurance entirely, try to pay a deposit of at least 20%.

Questions To Ask Your Lender Or Broker When Getting Preapproved

When getting preapproved, ask your broker or lender the following:

- how long they guarantee the preapproved rate

- if you will automatically get the lowest rate if interest rates go down while youre preapproved

- if the pre-approval can be extended

Ask your lender or broker about anything you dont understand.

Read Also: How Much Interest Do I Pay On A Mortgage

Already Have A Natwest Mortgage

If you’re already a NatWest mortgage customer, you won’t need to resubmit paperwork, such as evidence of income, unless your circumstances have changed.

Log in to Manage Your Mortgage, see what offers are available and apply online.

All you need are your mortgage account number, name, date of birth and your postcode.

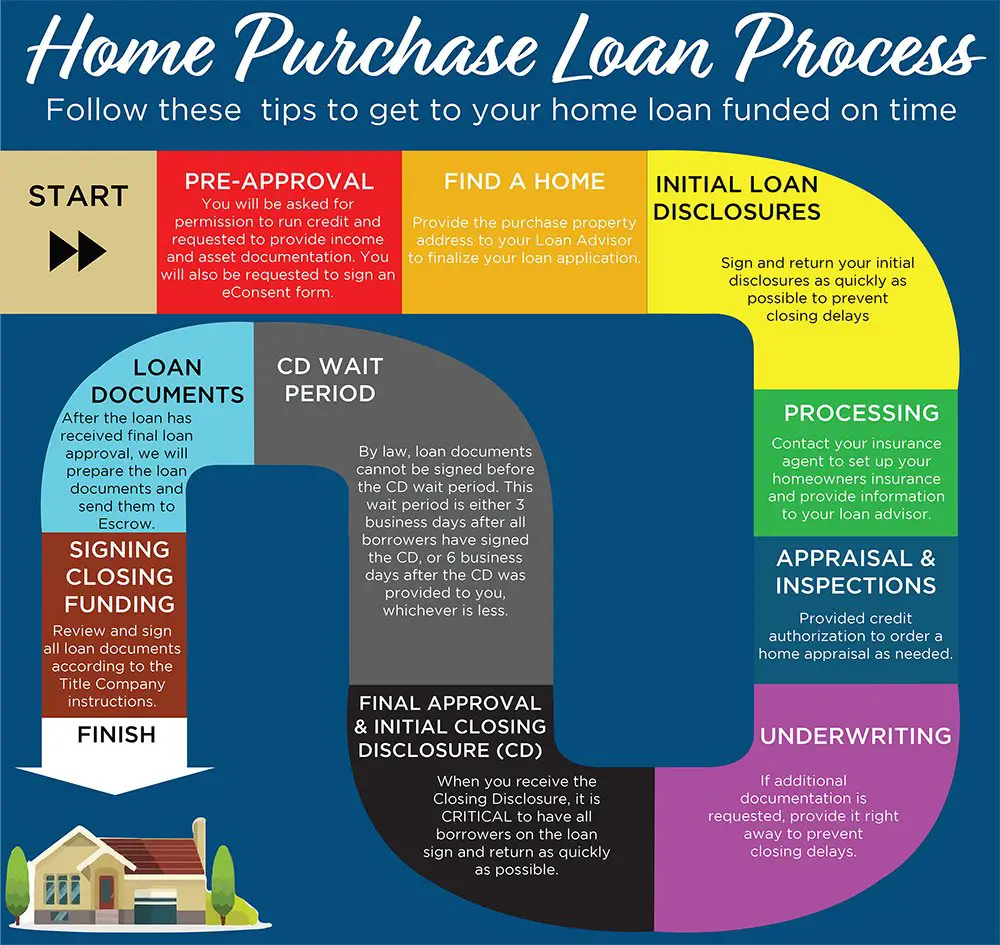

Loan Processing Takes Over

Time: 2-3 weeks

You

Every statement you made on your mortgage application goes under the microscope in this stage. Brace for questions and document requests. Responding promptly keeps everything moving forward.

The lender

You said you make $50,000 per year at Acme Software? The processor looks at your pay stubs and calls Acmes HR department to verify. You said your self-employment brings in $65,000 per year? The processor pulls your tax records to confirm.

Time: 24-48 hours

You

Your job now is to sit tight. If youre needed at all, it will be to answer more questions and produce more documents.

The lender

The underwriters job is to judge the risk of lending money to you on this property. Whats your loan-to-value ratio? Do you have the cash flow to make the monthly payments? How about your credit character? Whats your history of making payments on time? Is the home valued correctly, the condition good and title clear? Is it in a flood zone?

Recommended Reading: Is 3.99 A Good Mortgage Rate

Live Your Life Without A Worry With Your Home Loan

Home is the biggest investment of many people in Finland. When banking affairs run smoothly, your daily life will also go smoothly, and you can repay your loan without worries. As an OP cooperative bank owner-customer, youll get benefits throughout your life and for things that matter most in your life. Your student loan brings you OP bonuses that are used, for example, for your new homes insurance premiums. Youll also get considerable discounts on banking services and insurance policies as well as renewed benefits from investment

Check Your Credit Report Before Applying

Your credit score can affect your interest rate, closing cost, and the maximum amount for which you will qualify.

In that case, you should work on improving your credit score before applying for a home loan. Its not always easy to do, especially if you already have some credit issues, but there are ways to do it. Pay all your bills on time, dont open new accounts, and keep old ones active. Remember that it takes several months before changes in your score show up.

But now, with the accreditation of standalone bodies like First Central Credit Bureau and CRC Bureau Limited who keep records of individual and organizational FISCO scores in Nigeria, many people would ignorantly fall victim to a high rate of bad credit scores with as little as N5000 loan from the quick loan apps.

Most of these quick loans apps are usually terrible for you because they literally destroy your image by posting your name and tagging you as a fraudster to your contact lists, including strangers who do not know you, business associates, schoolmates, etc.

Above all, it also can send reports to these credit monitoring organizations to keep records which, when you need important loans, lenders might see before considering you.

Don’t Miss: Who Is Rocket Mortgage Owned By

How To Qualify For A Mortgage

8-minute read

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

Are you ready to make the jump from renting a home or apartment to owning a home? The first step is applying for a mortgage, but how can you tell ahead of time if youll qualify?

Well introduce you to some of the factors that lenders look at when they consider mortgage applications. Well also share a few tips to make your application stronger.

How To Qualify For A Habitat Home

Habitat homeowners must be active participants in building a better home and future for themselves and their families. Every Habitat home is an investment. For us, it is one answer to a critical need, and we believe that stronger homes will create stronger communities.

- Prospective Habitat homeowners must demonstrate a need for safe, affordable housing. Need will vary from community to community.

- Once selected, Habitat homeowners must partner with us throughout the process. This partnership includes performing sweat equity, or helping to build their own home or the homes of others in our homeownership program. Sweat equity can also include taking homeownership classes or performing volunteer work in a Habitat ReStore.

- Homeowners must also be able and willing to pay an affordable mortgage. Mortgage payments are cycled back into the community to help build additional Habitat houses.

Don’t Miss: How Much Do You Pay Back On A Mortgage

Stay In Touch With Your Lender And Respond When Needed

Once you decide to accept an offer for a mortgage, it could take weeks for that loan to close. That’s because your lender will need to process your application and verify your financial information via a process known as underwriting. Be sure to stay in contact with your lender to make sure things are moving along, and be prepared to provide additional documentation as needed. If you’re self employed, for example, you may need to take extra steps to provide proof of income. See our guide to self-employed mortgages for more information on this topic.

Is It Hard To Get A Second Mortgage

Getting a second mortgage is considered more difficult than getting a mortgage to buy a property. Adding more debt to a single asset is risky and therefore lenders are less willing to do so. However, it is far from impossible with many individuals and families securing second mortgages each year for a host of reasons.

You should also expect the interest rate on a second mortgage to be higher than the interest rate on your first mortgage. Although this is not certain, it is the norm, due to an increased debt to income ratio and because the first mortgage gets priority during foreclosure proceedings.

Don’t Miss: Can There Be A Cosigner On A Mortgage

Commit To A Lender And Wait For Approval

Time estimate: Up to a few weeks

Choose the best offer, and let your loan officer know youre ready to move forward with the process. They may request additional documentation along the way, so make sure you respond quickly to prevent your loan from getting delayed.

Your loan will soon move into underwriting, when all your financial information is double-checked and verified. The underwriter will look to assess your overall risk as a borrower.

Specifically, your loans underwriter will be looking at:

- Your credit history

- Your propertys value and condition

- Your debts and assets

- Your financial reserves

Using this information, theyll work to verify that you 1) meet the requirements for the loan youre applying for and 2) can afford the mortgage payment that comes with it.

Close And Get Your Keys

- Loan amount

- Lender contact information

- Costs

Interest rate

Closing costs

Related:

Insurance and ownership costs

Other fees you may have to pay at closing or later include:

- Annual assessment if you belong to a homeowners association.

- Private mortgage insurance if the down payment is less than 20%. This can cost from 0.55% to 2.25% of the purchase price.

- Government loan fees, such as 1.75% of the loan amount for an FHA loan fee.

- Owners title insurance, about 0.5-1% of the purchase price. This protects you from title problems or claims made on the home after closing and lasts as long as you own the property.

Related:

Don’t Miss: Does Chase Allow Mortgage Recast

Apply For Your Mortgage

Congratulations on finding your future home! Once youve found the home you love, your next step is to apply for a mortgage online in the U.S. Bank Loan Portal. There, youll securely apply, submit loan documents and connect with a trusted mortgage loan officer.

The U.S. Bank Loan Portal allows you to apply for a mortgage in a convenient way. After you sign up, youll answer simple questions along a guided path, easily import or upload documents and complete your application on your own in one secure spot.

How Much Do You Need For A First Mortgage Deposit

The higher your deposit, the easier you will find getting a mortgage as a first time buyer. A smaller deposit means your mortgage will have to cover more of the property’s total price.

For example, if you saved £20,000 for a deposit on a £200,000 home, this would cover 10% of the cost. You would need a mortgage for the remaining £180,000, meaning its loan to value is 90% of the purchase price.

However, fewer mortgages are available with a high LTV, and the deals you can get usually have higher interest rates and upfront fees.

You can get first time buyer mortgages with an LTV of up to 95%. There are some 100% mortgage deals available with no deposit, including guarantor mortgages, which require a family member or friend to be named on them.

Don’t Miss: What Is Loan To Value Mortgage

Choose The Right Type Of Mortgage Lender

Make a list of mortgage companies and get loan estimates from at least three to five lenders. Or use a rate comparison tool to have lenders contact you before completing a mortgage loan application. Luckily, youll have no shortage of options, including:

Mortgage bankers. Mortgage banks offer a wide variety of programs, and the entire mortgage process is usually handled in-house. This could translate to a faster closing and more flexibility to work with borrowers who have unique situations.

Mortgage brokers. Mortgage brokers work with multiple lenders to provide more options than a single mortgage bank. However, brokers generally rely on the banks to approve and fund your loan, and dont have any say in whether your loan is approved or denied.

Institutional banks. Your local bank may offer mortgages with a lower rate if you carry a large deposit balance. Depending on the bank, though, loan offerings may be limited.