Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

What Is A Credit Rating

Your credit rating is a ranking that indicates your financial health at a specific point in time. It compares the risk you pose for lenders to that of other Canadians.

Your overall credit rating is an important factor in determining the type and amount of credit you may be eligible to receive at any given time. That’s why it’s so important to establish and maintain the highest rating possible.

Can I Include Any Bonuses Overtime Pay Or Commission As Part Of My Total Earnings

Yes, this may be possible. However, unlike your basic salary not all mortgage lenders will necessarily accept the total amount of these additional forms of income. For earnings such as regular bonuses, overtime and commission payments most mortgage lenders will accept 50%, some will accept 75% and a few will accept 100%.

Documentary evidence is usually required in order to clarify the amounts used and a whole-of-market broker can help you find the mortgage provider who takes the most flexible approach to your income type.

Read Also: How To Apply For A House Mortgage

Canadian Home Mortgage Qualification Tips

If you are a first-time home buyer looking for the right price on a home in Canada, the real estate market in most metropolitan areas continues to be priced in such a way that it remains affordable to those making an average wage or above.

The resiliency of the market place over the past several years combined with a fairly good economy have created the type of environment that should encourage you to participate by buying.

Can I Declare Any Additional Income On A Mortgage Application

In addition to a basic wage, many employees have the opportunity to earn additional income. Luckily there are lenders who offer mortgages with bonuses, overtime and commission factored in. You can also receive financial allowances for items such as a car, a house, or for relocation purposes, and there are mortgage providers who will take this into account, too.

Don’t Miss: How To Understand Mortgage Payments

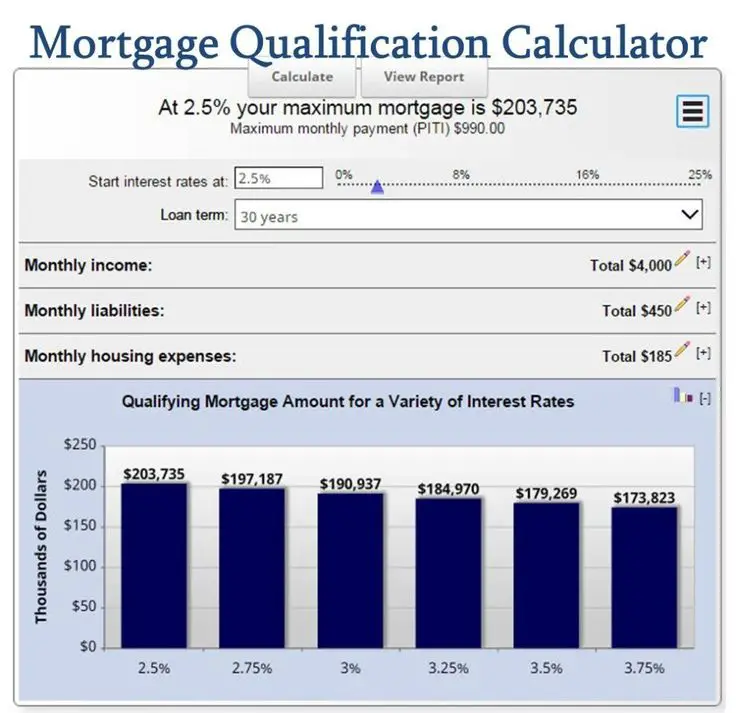

Calculate Your Mortgage Qualification Based On Income

In this calculator you can inclue investments, annuities, alimony, government benefit payments in the other income sources. Be sure to select the correct frequency for your payments to calculate the correct annual income.

- daily: 365 times per year

- weekly: 52 times per year

- biweekly: 26 times per year

- semi-monthly: 24 times per year

- monthly: 12 times per year

- bimonthly: 6 times per year

- quarterly: 4 times per year

- semi-annually: 2 times per year

- annually: 1 time per year

This calculator defaults to presuming a single income earner. If your household has 2 income earners then you can expand the “spouse or partner” section to enter their income information. We calculate the mortgage qualification ranges using the following maths:

| Your Mortgage Qualification |

|---|

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

Don’t Miss: What Is Tip In Mortgage

How Much House Can I Afford

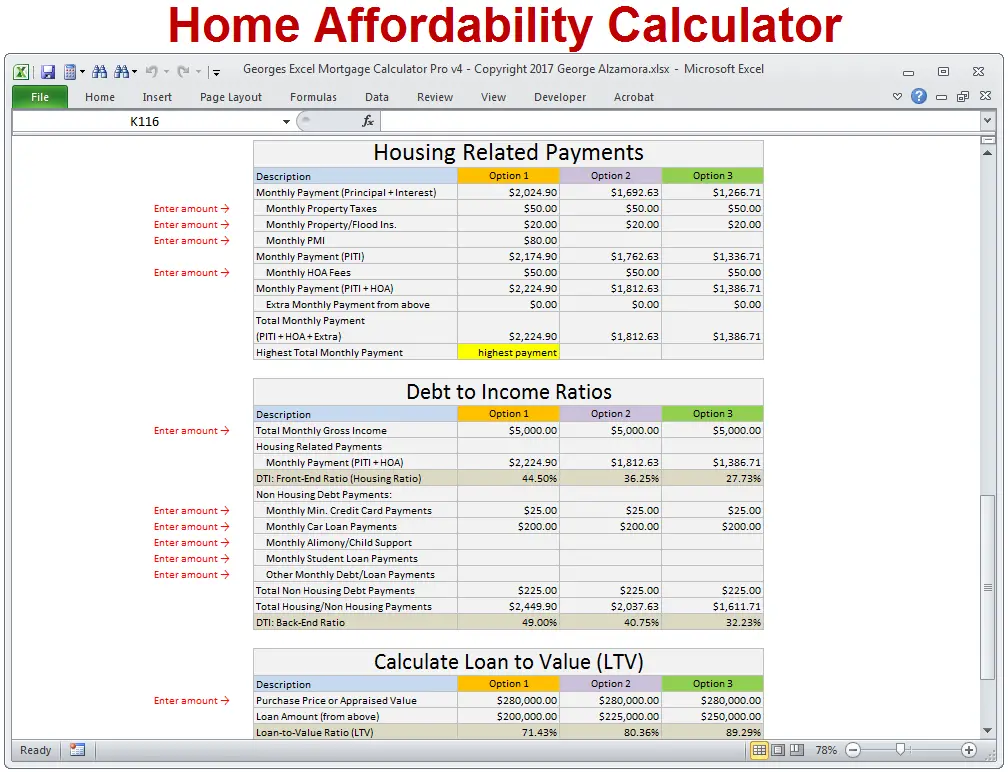

While you may have heard of using the 28/36 rule to calculate affordability, the correctDTI ratio that lenders will use to assess how much house you can afford is 36/43. This ratio says that your monthly mortgage costs should be no more than 36% of your gross monthly income, and your total monthly debt should be no more than 43% of your pre-tax income.

For example, if you make $3,000 a month , you can afford a mortgage with a monthly payment no higher than $1,080 . Your total household expense should not exceed $1,290 a month .

How Do Lenders Assess My Affordability

When deciding how much of a mortgage to offer, lenders will spend some time assessing your financial situation, looking at how long youve been in a job, lived at your current address and had a bank account.

Essentially, they want to be sure of your ability to make the monthly mortgage repayments and will therefore look at how reliably you have paid back any borrowings in the past which will involve reviewing your in depth.

Most Agreement in Principle only require a soft search on your credit file, which means other lenders will not see this search on your file.

A real mortgage application, however, will leave a mark on your credit file that all other lenders will be able to see.

Each lender has its own scoring system . In general, having more marks can count against you because it could suggest you are desperate for credit. Being turned down for a loan product will also have a negative impact on your credit file.

It is therefore important to apply to each of the 3 main credit agencies: Experian, Equifax and TransUnion for your credit file before submitting any mortgage applications. This will enable you to check the information held and correct any errors.

Try to avoid applying for anything that will require a credit search while applying for a mortgage, as it can make you look desperate for credit.

Don’t Miss: What Is Loan To Value Mortgage

How Much Should I Spend On A House

An affordability calculator is a great first step to determine how much house you can afford, but ultimately you have the final say in what you’re comfortable spending on your next home. When deciding how much to spend on a house, take into consideration your monthly spending habits and personal savings goals. You want to have some cash reserved in your savings account after purchasing a home. Typically, a cash reserve should include three month’s worth of house payments and enough money to cover other monthly debts. Here are some questions you can ask yourself to start planning out your housing budget:

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Recommended Reading: Can You Get A 30 Year Mortgage On Land

Higher Outgoings Reduce How Much You Could Borrow

Your regular household expenses, debts and insurances can all affect what a mortgage lender will let you borrow. Outgoings that a lender may take into consideration include:

Loan and credit card repayments Council tax Domestic utilities Insurances Car running costs Child maintenance payments

Some lenders also apply a reduction to the amount you can borrow for the number of children you have , while others have started to take things like discretionary spending into account. They’ll also require you to prove that you can afford the repayments in the event of an increase to interest rates, so make sure you have suitable means to ensure that ideally through reducing your unnecessary expenditure as this could have a clear impact on the amount of mortgage you’ll be able to borrow.

How Much Mortgage Can I Get

You can usually borrow around 4 to 5 times your salary.

Some lenders offer up to 6 times your salary, but they will be very strict about who they lend this amount to.

Lenders have different rules and the amount they times your income by can depend on many things.

They include:

-

salary and source of income

-

using a government homeownership scheme

-

extra benefits

-

deposit size

-

length of mortgage

-

leasehold costs

Read our reviews of UK mortgage lenders to find out how much each lender may lend you.

Use our mortgage calculator to get an idea of how much you could borrow.

Mortgage calculators are a good way of finding out how much you might be able to borrow.

Calculators do not take everything into account. Itâs important to know what they include to work out how much mortgage you can afford.

Each mortgage calculator is different, but basic online mortgage calculators will look at:

-

how many people are paying the mortgage

-

salaries

Most mortgage calculators do not look at:

-

monthly expenses

-

costs of getting a mortgage

-

interest rate changes

-

life changes such as losing your job

Unlike calculators, most lenders look at every issue that could affect your repayments.

You might also need to pass a lenderâs âstress testâ before theyâll give you a mortgage.

This is to make sure youâll be able to pay your mortgage if something happens that affects your repayments.

This could include:

-

being ill

-

a change in interest rates

Also Check: What Documents Do I Need To Get A Mortgage

Mortgage Calculator For The Self

Use our self-employed mortgage calculator to work out how much you might be able to borrow, based on the nature of your employment, your income and other factors. Please note that the mortgage amount provided by the calculator is for illustrative purposes only. The actual amount you will be able to borrow can vary from lender to lender and will be based on your unique individual circumstances, income sources and credit history. To discuss your mortgage needs in more detail, contact us today.

How Much Deposit Do You Need For A Mortgage

It depends on how much of a risk the lender sees you as.

When you apply for a mortgage, the company will decide how much of a risk you are by assessing your affordability and your credit history. They’ll usually look at things like:

- Information from your â this helps them see if you’ve repaid credit successfully in the past

- Your income and regular expenditure â this helps them see how much you can afford to repay each month

- Your other financial commitments, such as credit cards and loans â this helps them understand how much debt you already have

Generally, companies will see you as higher risk if you have a poor credit score. You can get an idea of how companies may see you by checking your free Experian Credit Score.

The size of your deposit can also affect your mortgage interest rate and how much you pay each month â a larger deposit usually means better rates and smaller monthly payments. It’s possible to get mortgages with a 5% or 0% deposit, but they generally come with high interest rates, and you may need a guarantor to get one.

You May Like: Who Can Get A Fha Mortgage

Budget For Mortgage Set

Mortgage set-up fees typically include the product arrangement fee and booking fee. To determine the mortgages annual interest calculation, lenders include valuation fees and redemption fees. The valuation fees are often referred to as the overall cost for comparison. When you apply for a mortgage, all your fees must be specified under the key facts illustration. This is a document prepared by the lender to outline the details of your mortgage and what they recommend during the early stages of application.

Take note of the following fees when you apply for a mortgage:

How Do Lenders Assess Affordability

The way lenders assess affordability wont be exactly the same for each provider, but essentially, they follow the same principles. Theyll look at your situation in more detail than our calculator does. Although our calculations give a good estimate, a lender may come to a slightly different conclusion.

Essentially, the mortgage lender have their own mortgage calculators and their scorecard will look at things like:

- The amount of money you want to borrow

- How much deposit you have

- Your employment status and job security

- Your income and lenders may view things like overtime, commission and bonuses differently from basic salary as theyre not guaranteed

- Your outgoings the money you spend on bills and on your lifestyle

- Any existing debts

- Your credit report

When looking at your credit report, its not just your overall score that potential mortgage lenders consider. Theyll also look in detail at:

Lenders are likely to look at your bank statements for the last three to six months to show them what your spending is going on and how well you manage your money and finances. Youll need your most recent P60 as proof of earnings too. You could also provide information about your savings accounts and other assets like shares, on your application form, as evidence of your ability to save and manage money.

Don’t Miss: How To Get A 15 Year Fixed Mortgage

How Your Dti Affects Your Mortgage Rate And Ability To Qualify For A Home Loan

- An ideal DTI of 28 /36 or better generally qualifies you for the most selective home loan programs and the lowest rates.

- If your back-end DTI is in the 40 -50% range, you will probably only be able to qualify for an FHA loan and will almost certainly pay a much higher rate.

- If your back-end rate is above 50%, you will need to reduce your monthly expenses, lower your monthly house payment, or wait until your income increases to qualify.

How To Calculate A Down Payment

The down payment is the amount that the buyer can afford to pay out-of-pocket for the residence, using cash or liquid assets. Lenders typically demand a down payment of at least 20% of a homes purchase price, but many let buyers purchase a home with significantly smaller percentages. Obviously, the more you can put down, the less financing youll need, and the better you look to the bank.

For example, if a prospective homebuyer can afford to pay 10% on a $100,000 home, the down payment is $10,000, which means the homeowner must finance $90,000.

Besides the amount of financing, lenders also want to know the number of years for which the mortgage loan is needed. A short-term mortgage has higher monthly payments but is likely less expensive over the duration of the loan.

Homebuyers need to come up with a 20% down payment to avoid paying private mortgage insurance.

Also Check: How Much Interest Do I Pay On A Mortgage

Mortgage Calculator: How Much Can I Borrow

Use our mortgage calculator to work out how much you can borrow in the UK as a first time buyer, house mover or if youre looking to remortgage. Explore our guide to find out how much you can afford based on your financial situation, as well as understand how lenders assess your affordability.

Who is this mortgage for?

How Much Can I Afford

How much you can afford to spend on a home in Canada is most determined by how much you can borrow from a mortgage provider. That is unless you have enough cash to purchase a property outright, which is unlikely. Use the above mortgage affordability calculator above to figure out how much you can afford to borrow, based on your current situation.

Don’t Miss: How To Purchase A House That Has A Reverse Mortgage