How Much A $200000 Mortgage Will Cost You

For a $200,000, 30-year mortgage with a 4% interest rate, youd pay around $954 per month. But the exact costs of your mortgage will depend on its length and the rate you get.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Your mortgage size depends on the homes price and the down payment youre making. If you buy a home priced at $255,000, for example, and put down a 20% down payment , youll need a mortgage worth $200,000.

Youll then pay off that balance monthly for the rest of your loan term which can be 30 years for many homebuyers.

Before you start shopping around, though, youll want to get pre-approved. Getting pre-approved will let you know if you can afford a $200,000 mortgage and demonstrate to sellers that youre a serious buyer. Credibles pre-approval process is simple it only takes a few minutes to see if you qualify for a streamlined pre-approval letter, and it wont affect your credit score.

Learn more about what goes into those payments and how much a $200,000 mortgage loan will cost you:

What Kind Of Mortgage Deal Will You Be On

If youre on a fixed rate mortgage, the size of your repayments will be the same for the duration of the deal period . If youre on a variable rate mortgage then your interest rate and therefore your repayments can vary. However, the very lowest interest rates are often found with tracker mortgages, if the Bank of England base rate is low. If youre ready to take the risk, this could make your mortgage more affordable.

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

You May Like: What You Need For A Mortgage

What Is Principal And Interest

The principal is the loan amount that you borrowed and the interest is the additional money that you owe to the lender that accrues over time and is a percentage of your initial loan. Fixed-rate mortgages will have the same total principal and interest amount each month, but the actual numbers for each change as you pay off the loan. This is known as amortization. You start by paying a higher percentage of interest than principal. Gradually, youll pay more and more principal and less interest. See the table below for an example of amortization on a $200,000 mortgage.

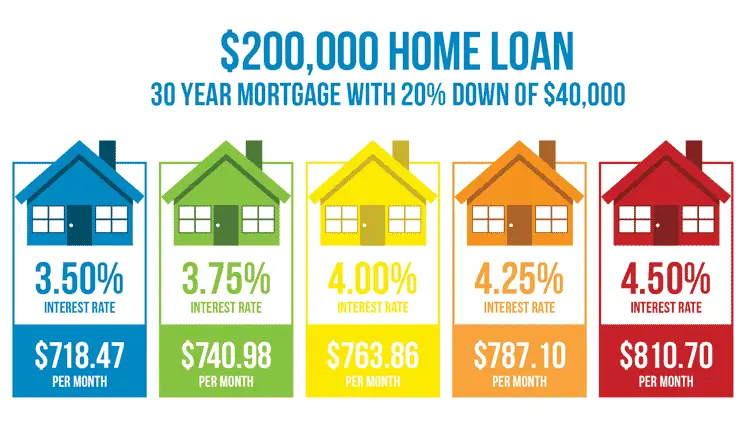

Monthly Payments On A 200000 Mortgage

At a 4% fixed interest rate, your monthly mortgage payment on a 30-year mortgage might total £954.83 a month, while a 15-year term might cost £1,479.38 a month.

Note that your monthly mortgage payments will vary depending on your interest rate, taxes and PMI, among related fees.

-

See your monthly payments by interest rate.

Interest

Recommended Reading: Is The Property Tax Included In Mortgage Payments

What Will My Mortgage Cost

See examples of costs for different mortgage types, payment terms and interest rates.

The monthly payment and rate you’ll pay until your introductory period ends.

Follow-on payments and rate

The payments and rate you’ll pay after your introductory period ends if you dont change anything.

Use the annual percentage rate of charge to compare the cost of our mortgages, including interest and fees, with those from other lenders.

Mortgage fee

You can pay this fee when you submit a mortgage application, or add it to the amount you borrow.

Total of monthly payments

The information below shows roughly how your monthly payments will affect your mortgage balance over time. But they don’t include any other fees or payments you may need to make.

Loan to value

The percentage of the property value that you’re going to borrow. We divide your mortgage amount by the property value to work out the LTV.

Early repayment charge

The amount you’ll pay if you want to pay off the mortgage early or make an overpayment that’s more than we’ve agreed to.

Fixed-rate

Your rate stays the same for a set period, so your monthly payments remain the same even if our base rate changes.

Tracker

Your rate is a certain amount above our base rate. If base rate goes up or down, your payments will too .

Offset

Money you have in another account with us is used to lower the mortgage balance we charge interest on. All our offset mortgages are trackers.

Filter your results

Do Mortgage Calculators Require A Credit Check

No, you wont need to undergo a when using mortgage calculators, as the only information youre inputting is your basic salary no other personal details are required. This means therell be no searches appearing on your credit report and no impact on your score, but if youre concerned that your current score may be holding you back from getting the best deals, nows the time to work on improving it. Find a free credit check service.

Also Check: How Much Mortgage Can I Afford Florida

How Much Income Do I Need To Qualify For A 200k Mortgage

As weve already touched on, it can come down to more than just the numbers on your wage slip. However, to give you a rough idea, some lenders cap the amount you can borrow based on x4.5 your salary, others go up to x5 and a minority to x6, under the right circumstances.

So, to give a ballpark figure, assuming two applicants, each would need a combined salary of between £33,000 and £50,000, although this does not include other varies lenders take into account when assessing affordability, such as how much deposit you have and your credit rating.

You can read more about affordability assessments here.

Average Length Of A Mortgage

As mortgages are the biggest loan youre likely to get, theyre often the longest, too.

Mortgages normally take 25, 30 or 35 years to pay back. Historically, the most popular length people opt for is 25 years, but in recent years the 30- and even 35-year mortgages are becoming more popular.

The reason longer mortgages are attractive is because they lower your monthly mortgage repayments. This makes is easier for people to afford a mortgage, helping people to get on the property ladder. Remember though, a longer mortgage means you end up paying substantially more over the lifetime of the mortgage.

Mortgage pay-off times actually vary a bit. This is for a few reasons.

Often people will remortgage every few years. This means you go back to a mortgage lender and thrash out a new mortgage deal, taking into consideration how much of your homes value youve paid off. Sometimes its possible to knock a couple of years off the total time youre paying your mortgage, as you could get a better deal.

Most people though will take the chance to lower their monthly repayments instead of shortening their mortgage term.

Some people also overpay each month on their mortgage. This means that the overall mortgage is lower, which makes the interest charged against it lower. All this means the mortgage itself can be paid off earlier.

Be careful though. Some mortgages charge fees for overpayments, or have a limit of how much can be paid. Go over the limit and you could get charged a fee.

Recommended Reading: How Is Mortgage Amount Determined

Does Bad Credit Affect How Much Deposit I Need For A 200000 Mortgage

Unfortunately yes, though it doesnt have to be a deal-breaker.

A history of bad credit means that lenders will look upon you as a higher risk. The worse your credit history, the greater the risk, which often means a larger deposit and less favourable rates.

Of course, every lender is different and will treat each issue differently. As a result, each will offer different rates and ask for different deposit sizes for a bad credit mortgage.

Some issues are generally seen as lower risk by most lenders. For example, if you have a low credit score and a few late payments on your record, some lenders may be happy to offer you a higher loan-to-value ratio and better rate.

But if you have something more serious, such as a recent bankruptcy or repossession, many of them will be much more cautious requesting a higher deposit or higher rate of interest on your loan.

Other providers adopt a case-by-case approach when it comes to lending. You may have to submit a written document regarding the circumstances of your adverse in order for the lender to make a full assessment, and your application may have to go through an additional underwriting evaluation.

See our table below to see how your credit rating could affect your mortgage:

| Risk Profile – Low |

|---|

| £200,000 | £100,000 |

The above is for demonstrative purposes only and you should consult your broker or lender for the most up-to-date information and rates.

Can You Afford A 10000000 Mortgage

Is the big question, can your finances cover the cost of a £100,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £100,000.00

Do you need to calculate how much deposit you will need for a £100,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Recommended Reading: How Many Times Can I Apply For A Mortgage

Average Mortgage Interest Rates

When it comes to mortgages, as with any loan, the interest rate is one of the most important factors. Unlike most other loans though, mortgages are very big often theyll be the biggest loan youll ever take out in your life.

There are also different types of mortgage, which makes getting the average mortgage interest rate a little tricky.

Statista has a useful graph showing the most up to date mortgage rates depending on if you are going for a fixed or variable mortgage.

Loan to value is the relationship between the current value of the property that the mortgage is paying for, and the actual amount the mortgage is. The mortgage value divided by the property value = LTV. Dont be scared of the maths, pull out your phone or use the Which? LTV calculator.

You also need to think about mortgage fees, which can be anything from £500 to £2,000 or more. Some mortgage providers will let you add the fees to the mortgage itself. This means you dont need to shell out the money when you first get the mortgage.

The con of doing this though is that the interest then applies to the fee, so you end up paying more overall, as well as more per month. Our advice: pay the fees upfront.

What Are The Different Loans And Programs For First

While the 28/36 rule applies most conventional mortgage lenders, certain programs designed to help first-time homebuyers, veterans and certain low-income home buyers allow some exceptions:

- Mortgages backed by the Federal Housing Administration, known as FHA loans, are designed to help first-time homebuyers qualify for mortgages and allow back-end DTIs of up to 43%.

- Mortgages known as VA Loans, issued through the U.S. Department of Veterans Affairs, are geared toward veterans, service members and qualifying spouses, and allow back-end DTIs of 41%.

- The maximum back-end DTI allowed on USDA Loansmortgages issued under guidelines set by the U.S. Department of Agriculture to help low-income borrowers buy homes in certain rural areasis 46%.

- State and national programs designed to assist with homeownership may be able to help if you’re having trouble meeting the down-payment requirements for a loan, or if your income falls below the level needed to secure some conventional loans.

The factors that determine the amount of a monthly mortgage loan, including your credit score and history and down payment amount, along with your monthly non-housing debt expenses, play a major role in determining how much income you’ll need to afford a mortgage. Understanding DTI and the 28/36 rule can help you anticipate your needs and plan for the mortgage-application process.

If you need to improve your DTI, there are two things you can do:

Recommended Reading: What Is The Mortgage On A 3 Million Dollar Home

When Should You Lock Your Interest Rate

The bigger question here is probably when should you lock your rate? You probably want to do what you can to avoid the fees to extend the rate. But how do you know when to lock it?

Start with the proposed closing date in your purchase contract. Count backward from that date and then add a cushion. If you are 60-days out, you may want to wait as locks much longer than 30 days can get costly. You wont be able to secure nearly as low of a rate if you take a rate lock for 60 days.

If you can wait until you are closer to the 30-day mark, youll give yourself a better chance at securing low-interest rates. Just make sure you are certain that your loan will close within that time. If it wont, dont lock it you are better off waiting.

Talk with your lender about when you should lock your interest rate. They will usually be pretty honest with you about what they think you should do. While no one can predict what rates will do in the future, lenders have enough experience behind them to be able to tell what rates might do based on the markets history.

What Is The Mortgage On 1 Million Dollars

Monthly mortgage payments on a 1 million dollar home will depend on several factors, including your credit score, down payment, term, and interest rate. Generally speaking, on a 30-year mortgage with 20% down, you can expect to pay around $4,500 in monthly mortgage payments on a million-dollar home.

Read Also: What Is Needed For Mortgage Application

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

What Can I Afford For A House

To calculate how much house can I afford, a good rule of thumb is using the 28%/36% rule, which states that you shouldnt spend more than 28% of your gross monthly income on home-related costs and 36% on total debts, including your mortgage, credit cards and other loans like auto and student loans.

Also Check: What Is Loss Mitigation Mortgage

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.