What Happens When A Mortgage Goes To Underwriting

See what happens when a mortgage goes to underwriting and how an expert broker can help you navigate the process

Ask us a question

We know everyone’s circumstances are different, that’s why we work with mortgage brokers who are experts in all different mortgage subjects.Ask us a question and we’ll get the best expert to help.

Author:Pete Mugleston– Mortgage Advisor, MD

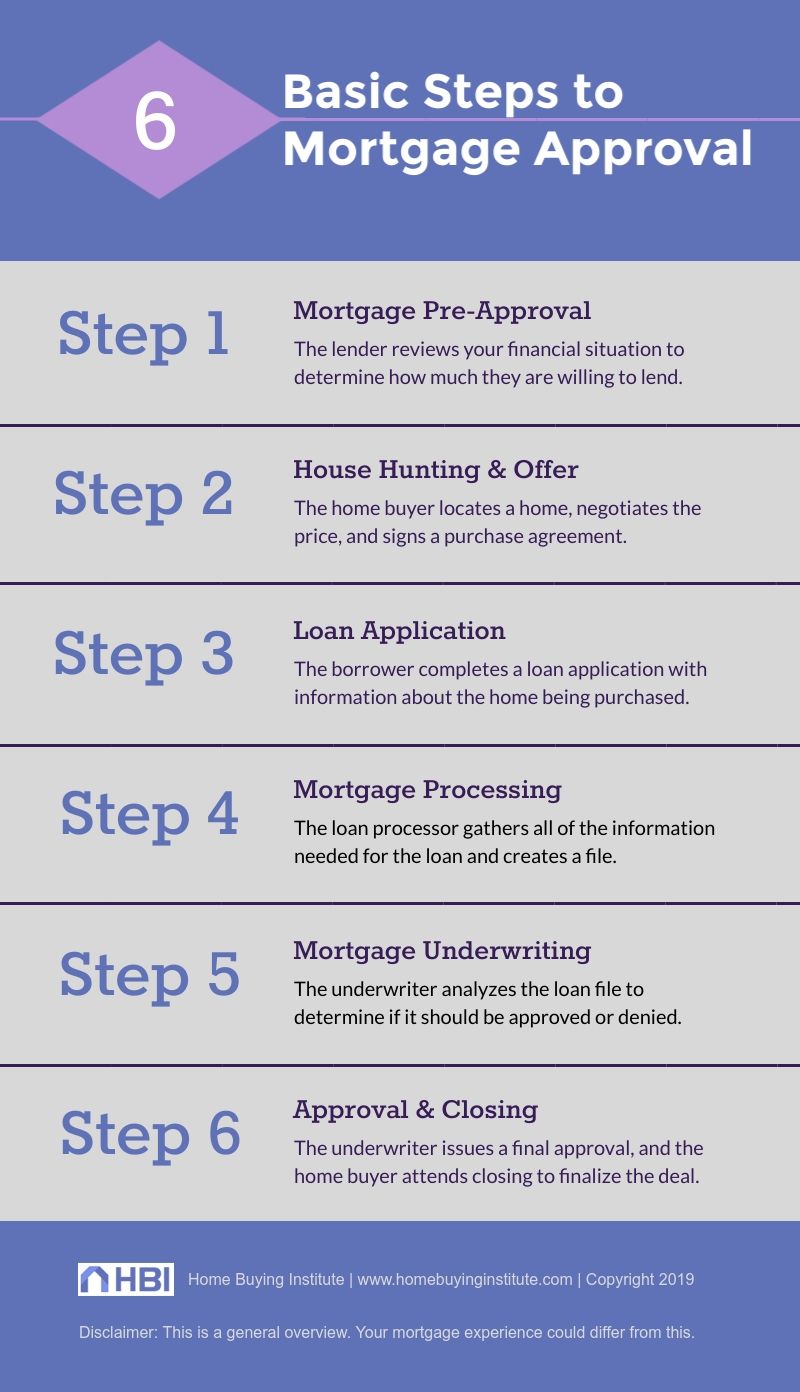

As you go through the process of buying a property, there are a number of different stages before contracts are exchanged and you receive the keys to your new home. One of those stages is the mortgage underwriting process. Its an important part of any mortgage application and can take some time.

When youre planning to buy a home its helpful to have an idea of how long it could take and which processes can take longer and what they entail. Mortgage underwriting is an essential part of any home purchase that requires a mortgage, no matter what mortgage you apply for.

Weve written this article to give you a better idea of what happens during the mortgage underwriting process in the UK and what steps are taken during it.

What are you looking for?

Understanding the mortgage underwriting process

The Underwriter Will Make An Informed Decision

The underwriter has the option to either approve, deny or pend your mortgage loan application.

- Approved: You may get a clear to close right away. If so, it means theres nothing more you need to provide. You and the lender can schedule your closing. However, if your approval comes with conditions, youll need to provide something more, such as a signature, tax forms or prior pay stubs. The process may take a little longer, but nothing to worry about if youre prompt in responding to any requests.

- Denied: If an underwriter denies your mortgage application, youll need to understand why before deciding on next steps. There are many reasons for the denial of an application. Having too much debt, a low or not being eligible for a particular loan type are some examples. Once you know the reason for the decision you can take steps to address the issue.

- If you dont provide enough information for the underwriter to do a thorough evaluation, they may suspend your application. For example, if they can’t verify your employment or income. It doesnt mean you cant get the loan, but youll need to provide further documentation for them to decide.

How Long Does It Take To Process And Close A Mortgage

It typically takes one-to-two months to close a mortgage depending on many factors including your lender, loan program, mortgage type, loan amount, property type, market conditions and other considerations.

Your lender dictates the mortgage process and different lenders take different lengths of time to close loans. Some lenders have more staff available to process loans which enables them to close mortgages faster. Additionally, some lenders utilize more technology which allows them to process mortgages more efficiently.

The lenders underwriting process also influences timing. Mortgages that can be reviewed using automated underwriting require less time while mortgages that require manually underwriting, for example if you are requesting an exception to an application guideline, take longer to process.

Review our Mortgage Process Timeline to understand the steps involved to process and close a mortgage

Your loan program is another factor that affects how long it takes to close your mortgage. Conventional programs are usually faster and easier to process as compared to government-backed mortgage programs such as FHA, VA and USDA loans. Some low down payment programs may also take longer because they require applicants to submit additional paperwork. Additionally, niche programs such as bank statement loans or non-owner occupied mortgages may require extra time and documentation to close.

- Top Lenders

You May Like: Is Closing Cost Part Of Mortgage

Receive Final Mortgage Approval

How long it takes: 2 to 3 weeks

Getting pre-approved for a loan isnt the same thing as a guarantee that youll be given one. You still need to officially apply for the loan and lock in your interest rate.

According to Ellie Maes , it takes 45 days, on average, to close on a home once a loan application has been submitted. You can help speed up the process by completing the lenders requests as quickly as possible.

After all of the conditions for your loan have been met the lender will issue you a final loan approval, what they call the clear to close in the industry. Usually, this happens within a few days of your closing. And as long as nothing substantial changes with your finances and credit profile before closing, you should be able to close on your loan and home purchase with few, if any, issues.

Where Can I Get A Mortgage Broker

A mortgage broker can give invaluable mortgage advice when buying a home. Their service can be especially important if you are a first time buyer, or want to speed up the process of getting a mortgage.

A mortgage broker will help you get the correct documents prepared, and check over your mortgage applications forms. As errors in a mortgage application lengthen the mortgage application timelines, a broker can help you get a mortgage much quicker.

A mortgage broker will also be experienced with the different mortgage lenders on the market and their deals. They will know what bank or building society is most likely to approve you, given your personal situation and current mortgage rates.

When purchasing a property, you can find a broker service and solicitor online. However, be sure that any service you use is authorised and regulated by the financial conduct authority.

Also Check: Can A Locked Mortgage Rate Be Changed

Watch Out For Gazumping And Gazanging

You and the seller are not legally bound to complete the purchase until you have reached exchange of contracts. Until you reach that milestone, there is always a risk of being gazumped or gazanged.

Here’s what these terms mean:

Sadly, there’s little you can do to avoid either of these, as they’re both dependent on the actions of the seller, and can end up losing you a lot of money, especially if it happens just before exchange of contracts where your solicitor have already carried out a lot of work.

The most you can do is to be as quick as you possibly can be between having your offer accepted and exchanging contracts and this means getting your solicitor and mortgage lender or broker to hurry things up.

Communication Is Key To A Smooth Mortgage Approval

As we proceed through this sequence, our office provides automated-email progress updates to you, your Realtor, and to your lawyer, keeping everyone informed. In a mortgage transaction there are often multiple balls in the air at the same time and effective communication ensures that no balls get dropped. Please read and fulfill all requests carefully to avoid having to repeat steps. Cooperation and communication ensure a smooth, stress-free and quick mortgage approval process. If you have any questions or uncertainties, we are never more than a phone call away.

Read Also: How Much Do You Pay Back On A Mortgage

Ensure Your Application Is Complete

To make the approval process as quick and easy as possible, you should make sure that your application is complete. This involves checking that all your personal information is correct, that your income and expense details are accurate, and that any requested documents are supplied. If youre not sure that everything is in order, please chat to your Suncorp Bank Home Loan Specialist or mortgage broker. Better to double-check everything now than run into a hurdle later.

How Long Does Underwriting Take

The underwriting process may take a few days, or it could take a few weeks. There’s no standard time period for this part of the mortgage process. The length of the underwriting process depends on a few factors, including:

- Your financial situation: If your financial situation is complicated and you have a lot of income sources, assets and debts, the process may take longer since the underwriter has to verify each part of your financial picture.

- Your home loan type: Some mortgage types may have stricter requirements, which can take more time to complete. For example, government-backed FHA, USDA or VA loans may have more complex rules.

- The completeness of your application: The process takes longer each time the underwriter asks you to provide an additional document. If your application is complete when you first submit it, the underwriter can work more quickly.

- The appraisal or title search process: Delays with the title search, title insurance and appraisal process can all make underwriting take longer.

- The state of the housing market: Applying for a mortgage during the homebuying busy season can make the underwriting process longer. Your underwriter may have several applications to process at once, which can increase your wait.

Don’t Miss: How Much Is The Mortgage On A $300 000 House

A Word About Home Closing Times And Rate Locks

When you finance a home using a mortgage, your interest rate is based on time-to-close the fewer days it takes to get you from rate lock to closing, the lower your mortgage rate will be.

This is true for purchase mortgages and for refinance loans, too.

For every 15 additional days it takes to close your loan, in general, your quoted mortgage fees increase by 12.5 basis points .

The fewer days it takes to get you from rate lock to closing, the lower your mortgage rate is likely to be.

However, you dont get the liberty of choosing the shortest possible mortgage rate lock, then extending 15 days at a time as needed.

At the beginning of the mortgage approval process, mortgage lenders require borrowers to state for how long theyd like to lock their loan.

The typical mortgage rate locks last for 30 days, 45 days, or 60 days with extended mortgage rate locks available upon request.

Ideally, borrowers should choose the shortest rate lock period that allows the lender to complete the loan process and, for the purchase of a home, that extends through the homes closing date.

Negotiate A Completion Date

Your solicitor will update you on the results of the searches. If all is good, the next step is to come to an agreement on a completion date with the seller. The completion date is the date the keys get handed over. This needs to be a date that suits both you and the seller.

Try and be flexible here. Many sellers will want to time it for the start or end of a month to chime in with their mortgage payments.

Of course, if you’re selling your current property too, you’ll need to take into consideration when you’re completing with your buyers. See our Selling your property guide for more tips on the process of selling your home.

Read Also: What Banks Look For When Applying For A Mortgage

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

How Long Will It Take To Get Your Mortgage Approved

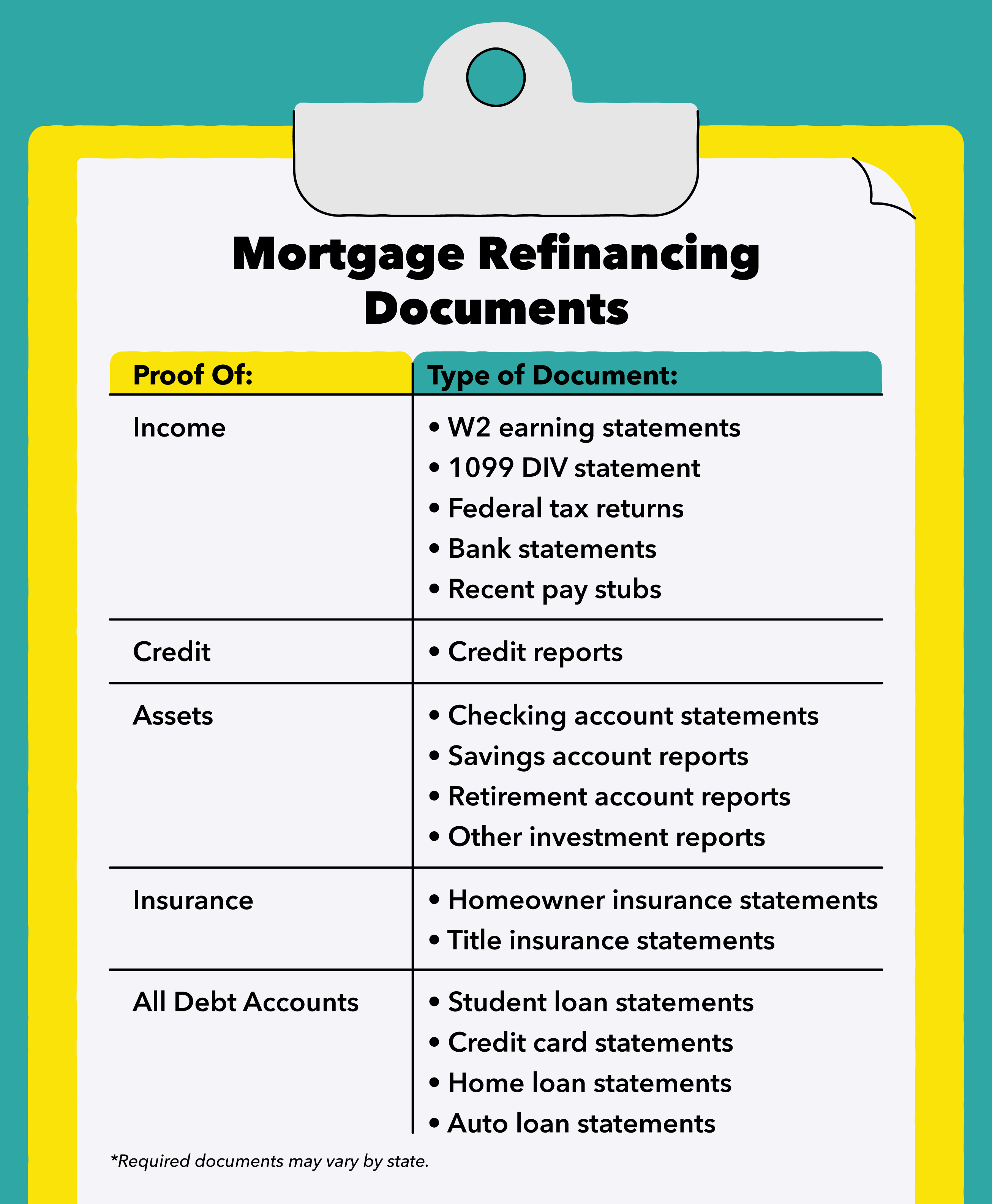

You’ve sent in copies of your last two paycheck stubs. You’ve provided a letter from your employer verifying your job status. You’ve made copies of your tax returns from the last two years.

Now how long will you have to wait before earning approval on your mortgage loan?

The answer? It depends.

Weve all seen commercials from mortgage lenders who promise to make the application process easier. But just because you can submit a loan application with the press of your computers Return key doesnt mean that your approval will be coming in any faster.

Ellie Mae, in its latest report, said that it all mortgage loans an average of 49 days to close during November. Ellie Mae reported that it took mortgage refinances an average of 51 days to close and purchase loans an average of 47 days.

What causes loans to take so long to close? There are plenty of factors.

The underwriting process — the process by which mortgage lenders determine if you are a good risk for a mortgage loan — can be delayed if you don’t provide all the necessary documents that lenders need to verify your income and savings. Marks on your credit report such as late or missed payments can delay the process, too.

You May Like: How To Get Approved For Mortgage With Low Income

How Quick Does A Mortgage Application Take

The time it can take for a mortgage application will differ from one mortgage lender to another. The time a mortgage application takes will differ based on the strength of the mortgage application, the complexity of the mortgage application, the circumstances of the borrower, the type of mortgage and the average processing time of the mortgage lender.

A mortgage application can take from between 18 to 40 days to process on average.

As mentioned before a Leeds Building society mortgage application will take on average 3 weeks to process.

How To Get A Mortgage With The Best Rate

There can be several reasons for needing a mortgage. Maybe you are about to buy a new property or move home. maybe you are looking at paying off a credit card or carry out home improvements. Is your existing fixed-rate coming to an end? Whatever your circumstances are there is one thing for sure and that is you will want to find the best mortgage rate for you!

Many people leave arranging a mortgage deal to the last minute. You may have found your dream home and are now panicking about how to find the right mortgages with a great interest rate! Your existing deal with your lender may be coming to an end and you may have left it to the last minute to sort out a new deal. Dont panic! YesCanDo Money is a whole of market free mortgage broker with access to nearly every mortgage lender and the best mortgage rates.

Read Also: Who Is Rocket Mortgage Owned By

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What Is A Mortgage Offer In Principle

A mortgage agreement in principle is an initial prediction of what you might be offered for your property.However, it in no way guarantees you an amount, or even that you will find a mortgage.

An agreement in principle is something a buyer can get on the day they meet with an advisor, theoretically. Sometimes, it can take just a couple of hours to generate an agreement in principle.

A lender or advisor will ask you for certain details, such as your credit score, to assess whether you could get a mortgage, and for what amount. However, as it is not a full or complete mortgage application, it does not mean you will definitely get this amount.

Also Check: How Much Interest Do I Pay On A Mortgage

How Have Closing Times Changed Over Time

As of February 2019, closing times have maintained a tight range of 42 to 48 days averaged across all loan types over the past 18 months. This indicates that despite seasonal market fluctuations and shifting housing trends, it takes approximately six to seven weeks to close on a mortgage loan.

Improvements in underwriting procedures combined with a shift to digitized mortgage lending have sped up closing times on average. However, while many online lenders boast expedited closing times, your experience may vary widely depending on your financial profile as well as the capabilities and capacity of your chosen lender.