Do I Always Have To Pay Pmi If I Put Less Than 20% Down

No. It depends on the lender and the type of mortgage. PMI is most commonly a requirement on conventional mortgages. If you have an FHA loan, youll be required to purchase a different type of mortgage insurance, known as a mortgage insurance premium . And, if youre using a private lender, like a mortgage lending company, relative or private home seller, your lender may not require PMI. One thing to keep in mind is its a good idea to compare the interest rates these types of lenders offer to what youd pay with a traditional lender.

There are many other types of mortgages that dont require PMI. For example, Navy Federal Credit Union offers its members certain mortgages that have no PMI requirement, even if you put less than 20% down.

Pmi Buster No : Add Value To Your Home

If you want to speed up the process and start saving money in the long run, you may have to shell out some cash up front. Adding value to your home with upgrades is one way to help decrease you loan-to-value ratio. Remember, if your house is worth more money and you owe the same amount on the loan, you are getting closer to that 80% LTV where you can request that the PMI be removed from your loan.

Not every type of home improvement adds substantial value to your home. In fact, many upgrades dont even bring you any return beyond what you spent making the upgrades.

Typically kitchen and bathroom remodels add value, whereas things like adding pools do not. According to the National Association of Realtors, exterior remodel projects such as adding a new entry door and repainting the stucco tend to get home owners the most return on their investment. After exterior projects, minor kitchen remodels and adding attic bedrooms bring the next best return on your money.

If youre lucky, the increase in value of your neighborhood will assist you in adding value over time without you actually having to do anything. That was a big help for me. I put 5% down on my home purchase in 2012 and was able to remove the Private Mortgage Insurance in 2013 without making any additional payments or refinancing. I did a lot of upgrades to the house and bought at the right time as the market was rising.

Related: Why Personal Loans Make Sense For Small Home Improvement Projects

Is Mortgage Insurance Included In Your Mortgage

Mortgage insurance isn’t included in your mortgage loan. It is an insurance policy and separate from your mortgage. Typically, there are two ways you may pay for your mortgage insurance: in a lump sum upfront, or over time with monthly payments. That said, its not uncommon to have the monthly cost of your PMI premium rolled in with your monthly mortgage payment. This way you can make one monthly payment to cover both your mortgage loan and your mortgage insurance.

If you want to know whether a lender requires mortgage insurance, how you pay it, and how much it will cost, check the loan estimate1 you get from a lender for details and ask questions. You can also do your own research by visiting an online resource such as the Consumer Financial Protection Bureau. Youll want to look for information that explains the closing disclosures on your loan estimate to better understand what PMI may be required, and whether youd pay premiums monthly, upfront or both.

The good news is, if you do need mortgage insurance, you may be able to cancel PMI after you make enough payments on your loan to reach more than 20 percent equity in your home. Check with your lender to find out when and how you can get out of PMI2 when you no longer are required to have PMI.

Read Also: What Is A Satisfaction Of Mortgage

How Do I Know If Pmi Is Right For Me

Private mortgage insurance isntfor everyone, but home buyers should check potential returns before theyautomatically refuse it.

Check your home loan options to see what you can afford and how much mortgage insurance would actually cost you.

Popular Articles

Step by Step Guide

The Benefits Of Lender

The most significant benefit of LPMI is that it can yield lower monthly payments than borrower-paid PMI.

LPMI can be a money-saver for short-term homeowners. If you plan to sell before you have 20 percent equity, you can take the short-term savings and not worry about longer-term costs.

Finally, LPMI is fully tax-deductible. LPMI is paid through a higher interest rate. And, when you itemize your returns, mortgage interest is deductible.

Also Check: How Do You Get A Mortgage To Build A House

How Do Pmi Payments Work

PMI is usually included in your mortgage payment. You may choose to pay PMI in one lump sum at the start of your loan. Or, you can opt for your lender to cover your PMI, but that means a higher interest rate on your mortgage. Understand that if you select the lender-paid option, you may pay more interest on your loan than you would including PMI in your monthly mortgage payment or paying in full.

Pmi Buster No : Pay Down Your Mortgage

The easiest, albeit slowest, way to get rid of your PMI is by making your mortgage payments on time each month. Once your loan-to-value ratio reaches 80%, you can contact your lender to begin the process of taking off the PMI.

Obviously, this will take some time depending on how much money you originally put down on the house. If you put no money down, its probably going to take at the very least several years more than if you put 5% or 10% down at the time of purchase.

Remember, you are aiming for 20% equity. Federal law requires mortgage lenders to notify homeowners at closing approximately how long it will take for them to reach the 80% loan-to-value assuming they make their regular monthly payments.

If you want to get the PMI off of your loan faster, pay down what you owe quicker by making one extra mortgage payment each year or putting your annual bonus towards your mortgage.

Read Also: How Much Of Your Monthly Income For Mortgage

How To Avoid Pmi

How you can avoid PMI depends on what type you have:

- Borrower-paid private mortgage insurance, which youll pay as part of your mortgage payment.

- Lender-paid private mortgage insurance, which your lender will pay upfront when you close, and youll pay back by accepting a higher interest rate.

Lets review how each type works in more detail, and what steps you can take to avoid paying either one.

When Do I Pay Pmi Premiums

When you are required to pay your private mortgage insurance premium depends on your specific loan policy. But typically, paying your mortgage insurance premiums monthly happens right along with your mortgage payment for your current loan . Lenders may also have a policy that allows you to pay your PMI on a lump sum basis either in cash at closing or finance the premium in your loan amount.

Don’t Miss: Can I Refinance My Mortgage Within A Year

Example : A Slow Rate Of Home Price Appreciation

The tables below compare the monthly payments of a stand-alone, 30-year, fixed-rate mortgage with PMI vs. a 30-year, fixed-rate first mortgage combined with a 30-year/due-in-15-year second mortgage.

The mortgages have the following characteristics:

In the table below, the annual rates of home-price appreciation are estimated.

Notice that the $120 PMI payment is dropped from the total monthly payment of the stand-alone first mortgage in month 60 when the LTV reaches 78% through a combination of principal reduction and home price appreciation.

The table below shows the combined monthly payments of the first and second mortgages. Note that the monthly payment is constant. The interest rate is a weighted average. The LTV is only that of the first mortgage.

Using the first and second mortgage, $85 dollars can be saved per month for the first 60 months. This equals a total savings of $5,100. Starting in month 61, the stand-alone first mortgage gains an advantage of $35 per month for the remaining terms of the mortgages. If we divide $5,100 by $35, we get 145.

In other words, in this scenario of slow home price appreciation, starting in month 61, it would take another 145 months before the payment advantage of the stand-alone first mortgage without PMI could gain back the initial advantage of the combined first and second mortgages.

How Will You Pay For Mortgage Insurance

If you have a mortgage, you will generally pay your monthly mortgage payments. Mortgage lenders pay the premiums for you and incorporate the cost into your mortgage payments. The money will typically go into an escrow account before it’s distributed to the insurance company.

Conversely, mortgage insurance payments can come in a variety of forms:

- Conventional loans: When the mortgage isn’t guaranteed or insured by the federal government, a lender will typically require you to pay private mortgage insurance. PMI can be baked into your premium or paid in one lump sum at closing. You can ask your lender to cancel your PMI when you’ve reached a loan-to-value ratio of 80%.

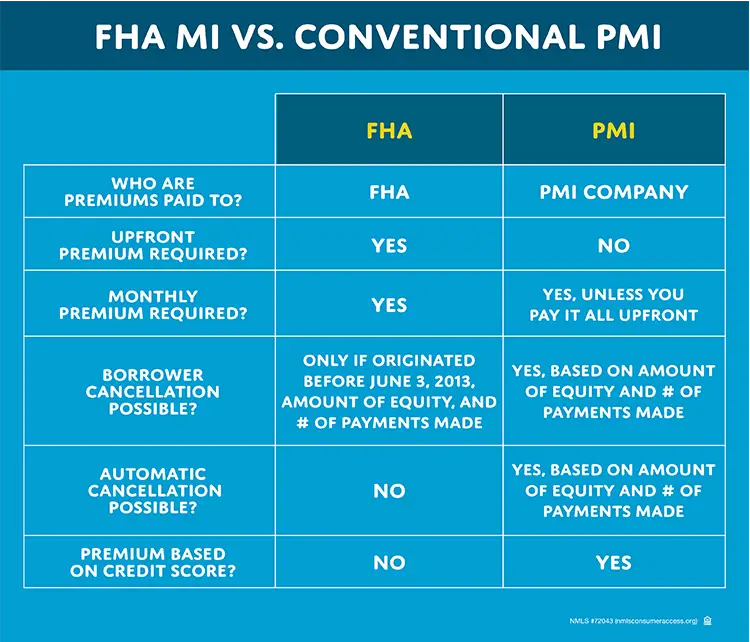

- FHA loan: If your mortgage is insured by the Federal Housing Administration, you’ll pay two forms of mortgage insurance: an upfront premium and a monthly payment . FHA loans are suited for borrowers who want to make low down payments or have lower credit scores. The mortgage insurance covers the risks associated with this type of loan.

Recommended Reading: How Does A 5 1 Arm Mortgage Work

Is It Worth Refinancing To Get Rid Of Pmi

It ultimately depends on your break-even point with closing costs. If you plan to remain in your current home for the foreseeable future, getting rid of PMI can lead to significant savings in the long run. That said, such a move may not be in your best interest if you’re considering a move in the next few years.

When Can I Stop Paying Pmi

PMI is typically no longer required once you have at least 20% equity in your home — whether from paying down the principal or an increase in your home’s value.

However, some lenders may have further requirements you must meet before satisfying your PMI obligations. These might include making a set number of mortgage payments, getting a new appraisal or owing less than 80% of your loan principal.

Though this process may differ slightly by lender, you can usually request PMI cancellation in writing once you have reached the 80% loan-to-value threshold. You must meet specific requirements as laid out by the Consumer Financial Protection Bureau, including:

- A record of good payment history

- Current loan status

- The equity must not be subject to a subordinate loan.

- Proof of value, if requested .

Borrowers with Fannie Mae or Freddie Mac mortgage have a different threshold for removing PMI if the mortgage is between 2 and 5 years old. For these borrowers, the equity must be at least 25% before PMI can be terminated.

You May Like: How Much Can You Get On A Reverse Mortgage

Or Wait For Them To Contact You

The Homeowners Protection Act states that mortgage lenders are required to cancel your private mortgage insurance once your loan has been paid down to 78% of the principal loan amount, as long as you are current on your payments. This does not apply for all FHA loans, but it does for conventional Fannie and Freddie Mac owned loans. So if youre not in a rush and youd rather wait for your lender to get the process started, just keep paying and they will contact you when the time comes.

If you cannot put 20% down towards a new home, PMI is a necessary evil. The sooner you can get it off your loan, the more money youll put back in your pocket to put towards other savings goals.

How Do I Pay For Pmi

There are several different ways to pay for PMI. Some lenders may offer more than one option, while other lenders do not. Before agreeing to a mortgage, ask lenders what choices they offer.

The most common way to pay for PMI is a monthly premium.

- This premium is added to your mortgage payment.

- The premium is shown on yourLoan Estimate andClosing Disclosure on page 1, in the Projected Payments section. You will get a Loan Estimate when you apply for a mortgage, before you agree to this mortgage.

- The premium is also shown on yourClosing Disclosure on page 1, in the Projected Payments section.

Sometimes you pay for PMI with a one-time up-front premium paid at closing.

- This premium is shown on yourLoan Estimate andClosing Disclosure on page 2, in section B.

- If you make an up-front payment and then move or refinance, you may not be entitled to a refund of the premium.

Sometimes you pay with both up-front and monthly premiums.

- The up-front premium is shown on yourLoan Estimate andClosing Disclosure on page 2, in section B.

- The premium added to your monthly mortgage payment is shown on yourLoan Estimate andClosing Disclosure on page 1, in the Projected Payments section.

Lenders might offer you more than one option. Ask the loan officer to help you calculate the total costs over a few different timeframes that are realistic for you.

Don’t Miss: How Do Mortgage Loan Officers Make Money

Can You Reduce Or Eliminate Pmi

If you’re concerned about this extra expense, you’ll be relieved to know that PMI usually ends before your loan does since lenders only require you to pay PMI while your LTV is above 80%. Once your LTV is below 80%, you can request to stop paying PMI.

To determine when your loan will reach the point where you no longer need PMI, lenders use an amortization schedule. If you opted to pay PMI at closing, your lender already used this schedule to calculate your total PMI amount. In most cases, you can’t reduce or get a refund for part of your upfront premium.

If you pay a monthly premium, you may be able to eliminate PMI a little early since lenders end PMI automatically when you’re scheduled to reach the 78% LTV point. You may qualify for early PMI termination if you meet the following criteria:

- Your LTV is 80% or lower

- Your loan started on or after July 29, 1999, when the Homeowners Protection Act began

- You’re current on your mortgage payments

Call your lender to cancel PMI early if you meet these qualifications. Typically, your lender will request a broker price opinion to confirm the current market value of your home. Your lender needs this data to calculate your current LTV. If the value of your home has decreased significantly, your LTV may have increased, which could disqualify you for early PMI termination.

How Credit Scores Affect The Cost Of Pmi

Credit scores don’t just affect mortgage and homeowners insurance rates, they also affect PMIS. Here is an example of how factors such as creditworthiness impact the cost of mortgage insurance: Consider two individuals who each want to buy a home valued $100,000 and can each put down $10,000 or 10% of the value of the home. Although they can make the same down payment, their are major determinants when it comes to the cost of their mortgage insurance policies. To show this, we graphed the price difference across credit score silos for a mortgage insurance policy offered by Radian. The policy is for a borrower-paid mortgage insurance policy that covers a fixed rate loan with a term longer than 20 years. You can see that if Borrower A has a FICO credit score of 760 or higher and Borrower B has a score lower than 639, Borrower Bs mortgage insurance premiums would cost 4x Borrower As.

Recommended Reading: How Can I Mortgage My House

Next Steps: Dont Drain Your Bank Accounts To Escape Pmi

While paying PMI each month or as a lump sum each year is no financial joyride, homeowners should be careful not to make their finances worse by hustling to get rid of PMI.

Most financial experts agree that having some liquidity, in case of emergencies, is a smart financial move. So before you tap your savings or retirement funds to reach that 20 percent equity mark, be sure to speak with a financial adviser to make sure youre on the right track.

There seems to be a philosophical aversion to PMI on the part of many buyers that is misplaced, McBride says. As long as youre not taking an FHA loan, youre not married to the PMI. You can drop it once you achieve a 20 percent equity cushion, which may only be a few years away depending on home price appreciation. But do not feel the need to use every last nickel of cash to make a down payment that avoids PMI, only to leave yourself with little in the way of financial flexibility afterwards.

With additional reporting by Jeanne Lee