Miscalculating Repair And Renovation Costs

First-time home buyers are frequently surprised by high repair and renovation costs. Buyers can make two mistakes: First, they get a repair estimate from just one contractor, and the estimate is unrealistically low. Second, their perspective is distorted by reality TV shows that make renovations look faster, cheaper and easier than they are in the real world.

How to avoid this mistake: Assume that all repair estimates are low. James Ramos, owner of Re/Max Bay to Bay, a real estate brokerage in Tampa, Florida, recommends doubling the estimates to get a more realistic view of costs.

Seek more than one estimate for expensive repairs, such as roof replacements. A good real estate agent should be able to give you referrals to contractors who can give you estimates. But you also should seek independent referrals from friends, family and co-workers so you can compare those estimates against ones you receive from contractors your agent refers.

State And Local Mortgage Assistance Programs

There are also a slew of programs designed to help first-time homebuyers with closing costs, down payments, and other expenses.

Some are provided as grants , while others come in the form of second loans though many are forgiven if you stay in the home long enough.

Tip:

Instances Where You’ll Commonly Be Accepted As A First

Let’s get the above answer out of the way first: If you are a single person who has never owned a home before anywhere in the world, you will be regarded as a bona fide first-time buyer. Same applies to couples where both partners have never previously bought a home.

What about if you own, or have owned, commercial property? Good news! Providing you’ve never owned a home before, you’ll qualify for first-time buyer status, too. Confusion abounds over this point as you are effectively a property owner. However, the first-time buyer rules apply only to property used as a home, so, if you own, or have owned, a shop or a restaurant, for example, but have never bought a home before, you will indeed be classified as a first-time buyer.

The only caveat here is whether or not the commercial property you own, or have previously owned in the past, has living quarters attached to it. If it does, you will not be entitled to first-time buyer status, unfortunately.

Recommended Reading: Should I Have A Mortgage

Can I Keep My Spouses Name Off The Title

If you live in a common-law state, then you have the freedom to leave your spouses name off of the houses title. The title is different from the mortgage in that the name on the mortgage shows who is responsible for paying back the loan. The name is on the title dictates who owns the property. Some might consider leaving their spouses name off the house title in order to keep their finances separate, to personally manage their life estate, or to protect their home from lenders if their spouse has a poor credit history.

One Spouses Income Doesnt Meet The Requirements

According to Villasenor, 2/2/2 is a general rule for all documentation requirements. This simply means that youll need 2 years of W-2s, 2 years of tax returns, and 2 months of bank statements. Depending on your situation, more documentation may be required. Conversely, less documentation may be required depending on the type of loan youre getting, but you should be prepared with these documents just in case.

Now, if one spouse doesnt meet these requirements say this spouse doesnt have 2 years of W-2s then it might make sense to leave this spouse off the mortgage. If your spouse is self-employed, they will usually need 2 years of business returns . If your spouse is unable to provide this documentation for instance, if they have only been in business for a year then it may make sense to leave this spouse off the loan.

You May Like: Can You Include Renovation Costs In A Mortgage

Can I Be A First Time Home Buyer If My Wife Owns A Home

Many states, including California, offer tax credits to first-time homebuyers. Such tax credits are generally restricted to individuals who have never owned a home before, or at least within the past three years. Federal and state homebuyer tax credit programs address eligibility rules for homeowner spouses.

When Should I Apply For A First

Before you start looking at properties, its advisable to get an agreement in principle from one or two lenders. This isnt a guaranteed mortgage offer, but it gives you a good idea of what you could buy. Its likely that estate agents will ask you to get an agreement in principle before you can start making offers. Getting an agreement in principle only needs a soft credit check, so your credit score wont be affected. Theyre also commitment free, which means that youre under no obligation to take the mortgage if you change your mind. An agreement in principle is usually valid for up to 90 days. Once youve got your agreement in principle, you can start searching more seriously and think about making offers. When youve found the home youre interested in buying, you can agree the finer details and get an official mortgage offer.

Recommended Reading: Can I Roll My Down Payment Into My Mortgage

Why The Different Definitions

The question that comes up is why do mortgage programs often have a three-year standard for determining who is a first-time buyer.

The answer is that some degree of flexibility is built into the system as a way to balance the incentives for first-time home buyers and the realities of modern life. If someone is married, buys a home with a spouse, and later gets divorced, we want to help them both re-start their lives.

The three-year non-ownership period is a way to say that help is available when things dont quite turn out as planned.

Gst/hst New Housing Rebate

If you buy your home before itâs built, or if you substantially renovate an existing home, you could qualify for a rebate a portion of the sales tax. The amount of the GST/HST new housing rebate depends on the purchase price of the home, and can only be claimed if the net purchase price is $450,000 or less. While this rebate is often taken advantage of by first-time buyers, this rebate is available to all Canadians who qualify regardless of whether theyâve owned a home before.

Recommended Reading: What Does A Mortgage Consist Of

The Proportunity Equity Loan

Proportunity offers an equity loan, simply described as a private version of the Help To Buy scheme, except it isnt restricted to a new build and customers have to pay monthly interest on the loan from the get-go. You dont have to be a first-time buyer to use the proportunity equity loan.

The Proportunity loan increases customer affordability by up to 15%, while still costing less per month than a traditional mortgage, allowing you to purchase a property up to 10 years earlier. Moreover, Proportunity uses AI to identify future growth areas, and only invests in properties that it expects to beat the market, giving you a bit more comfort about your purchase.

Like Help to Buy, when a customer sells the house or remortgages, they can repay Proportunity equity loan at current market price. Therefore if the price of the house has gone up, the amount the customer pays back will have also increased. If the price has gone down, Proportunity also loses money.

The Proportunity equity loan ranges from 5% to 15% of the house price and the price caps depends on each individual customer and your borrowing power .

The way the Proportunity equity loan works is:

You come in with at least 5%

Proportunity boost your deposit to 20%

You get a better priced 80% LTV mortgage with a high street lender

A few more points on the Proportunity Equity Loan:

How Homebuying As A Couple Differs From Buying A House Alone

Buying a home as a couple means you can use both of your incomes when applying for a mortgage. However, it also means that both , as well as the amount of debt each person has, is also included. As a single borrower, you only need to depend on your income, your personal financial history and your credit score.

While there are many factors that may be included in a mortgage application, lenders place a high value on the following:

- If one persons credit score is significantly lower than the others, you may have more difficulty qualifying for a mortgage. When you and your spouse both apply, your lender will use the lower of the two credit scores to determine your eligibility.

- Income: Using the combined income of both spouses means you can usually expect to be eligible for a larger mortgage.

- Debt to income ratio: Your debt to income ratio considers the amount of your current debt divided by how much pre-tax money you earn each month . If one spouse is carrying a lot of debt, it could lower your mortgage eligibility.

Read Also: Does My Husband Have To Be On The Mortgage

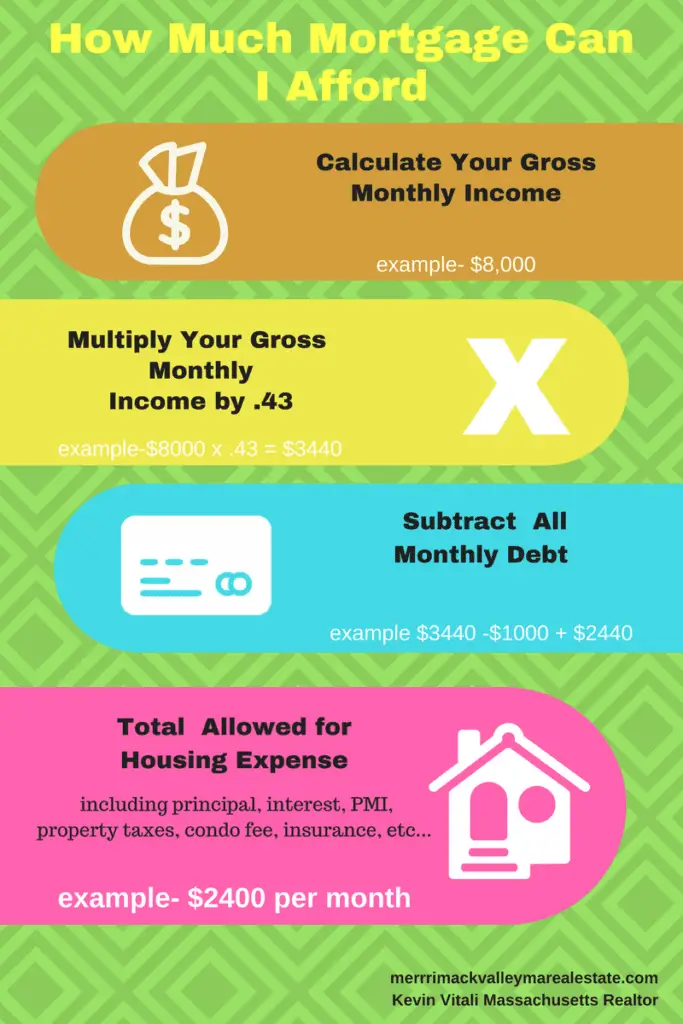

Not Figuring Out How Much House You Can Afford

Without knowing how much house you can afford, you might waste time. You could end up looking at houses that you can’t afford yet, or visiting homes that are below your optimal price level.

For many first-time buyers, the goal is to buy a house and get a loan with a comfortable monthly payment that won’t keep them up at night. Sometimes it’s a good idea to aim low.

How to avoid this mistake: Use a mortgage affordability calculator to help you know what price range is affordable, what’s a stretch and what’s aggressive.

» CALCULATE: How much house can I afford?

Divorce And Being A First

Something many people do not think about is the borrowers who were once married and are now divorced. If they lived in a home that their spouse owned, they assume they are not a first-time buyer. However, if the borrower was on the title to the home, but not on the mortgage itself, this constitutes a first time home buyer.

Knowing this can help those going through a divorce, especially the party that did not have ownership in the home. When you are a first-time buyer, it opens up many opportunities for down payment assistance as well as other grants that make home ownership possible.

Read Also: Should I Refinance My Mortgage To Pay Off Debt

What Properties Qualify For The Hbtc

Almost all types of properties you buy as your main residence in Canada qualify for the HBTC, including:

- Single-family houses

- Condo units

- Apartments in duplexes, triplexes, fourplexes or apartment buildings

- An ownership share in a housing co-op that gives you an equity interest in the co-op

Homes under construction also qualify. You must move into the finished property within one year of the purchase closing date.

Before you buy a home or property, look for other money-saving tools or programs like the HBTC. Another Canadian government initiative, the Home Buyers PlanOpens in a popup., lets you withdraw money from your RRSP without triggering tax if you follow plan guidelines. When choosing a mortgage, a larger mortgage payment amount and shorter amortization periodOpens in a popup. can also save you money. These reduce the interest amount you pay on the principal.

For more information about the HBTC, go to Canada Revenue AgencyOpens a new window in your browser..

How Bad Credit May Affect Your Application

Getting a mortgage with bad credit can be an issue if youre married and apply in just your name. Here are some of the main issues and considerations to be aware of

- If you or your spouse have a bad credit rating, a single mortgage may be worthwhile although, depending on the severity of the issue, lenders may need a higher deposit.

- Its still worth considering a joint mortgage as some of the rates and criteria for mortgages with bad credit are very attractive and much more competitive than you might think. All you need is the right broker.

- Your broker can help you understand the advantages of getting a mortgage, married vs single, from a tax or poor credit rating point of view.

Don’t Miss: Do Multiple Mortgage Applications Hurt Credit

What Is A Joint Mortgage

A joint mortgage is a mortgage you take out with someone else. This could be a family member, friend, husband or wife, or partner. Both people are responsible for a joint mortgage, which means youll both be liable for any missed repayments or making up the balance if one of you is unable to pay.

While joint mortgages are usually just for two people, some lenders will allow up to four people to take out a mortgage. Just keep in mind that the more people you share the responsibility with, the more people youre liable for.

Land Transfer Tax Refunds

First-time home buyers may also be eligible for a land transfer tax refund of up-to $4,000, depending on when the home was purchased, and if it is a resale or newly constructed home. To determine if you qualify for a rebate, you should consult a lawyer. More information can also be found on provincial rebates in topic #396 Land Transfer Tax, or from the Ontario Ministry of Finance. More information on federal programs available to first-time home buyers is available from Canada Mortgage and Housing Corporation.

Don’t Miss: What Salary Do I Need For A 200k Mortgage

Do You Have To Pay Stamp Duty If Your Partner Is A First Time Buyer

If youre married, youre considered as one person for stamp duty purposes. So, if buying a property jointly, you both need to be first-time buyers to qualify for this relief. The fact that you already own a property will mean that you will pay an extra 3 per cent stamp duty for purchasing a second property.

Questions Unmarried Couples Should Ask Before Buying A House

May 21, 2021

In the past two decades, the number of unmarried couples living together has nearly tripled from 6 million to 17 million, according to the United States Census Bureau. Whether they’re renting apartments or buying homes, many couples decide to live together without tying the knot. If youre forgoing marriage but are considering purchasing a home with your partner, there are a few key factors you should consider first.

You May Like: How To Go About Getting Pre Approved For A Mortgage

About Our Broker Partner Service

Advice is provided by London & Country Mortgages Ltd who are authorised and regulated by the Financial Conduct Authority . L& C are not part of BGL Group Limited of which Compare the Market Limited forms part.

Compare the Market receive a % of the commission our partner London and Country earns through customers who use this service. All applications are subject to lending and eligibility criteria. L& C will not charge you a broker fee should you decide to proceed with a mortgage.

What Are The Benefits Of Being Considered A First

If youre buying your very first home, you count as a firsttime home buyer by default. But you might also count as a firsttime buyer if you havent owned a home in the past three years.

Provided you are considered a firsttime buyer, here are the main benefits you might receive, depending on your situation.

Down payment assistance programs

This is where someone who qualifies as a firsttime home buyer can really score. Down payment assistance programs offer help with your upfront costs including the down payment and often closing costs as well.

Requirements vary by program, but many accept firsttime home buyers with low or moderate income.

With these, you can apply for help in the form of a:

There are more than 2,000 DPA programs across the U.S. And theres bound to be at least one covering where you want to buy.

Assistance options

Some down payment assistance programs let you choose the help you need. For example, the Florida Housing Finance Corporation lets Floridians choose from:

Rules for firsttime versus repeat buyers

Read Also: What Does Points Mean Mortgage

Who Is Applying For The Mortgage

Buying a houseis a major commitment. Therefore, before you begin searching for a home, you should compare mortgage options and determine who is applying for the mortgage. Unmarried couples will apply for a mortgage as individuals. This means the partner with the stronger financials and credit score may want to purchase the home to get better mortgage terms and interest rates.

To decide who should apply for the mortgage, you may want to review each others , debt-to-income ratios, incomes, employment statuses and additional assets. For instance, most lenders require a credit score of at least 580, but having a credit score of at least 620 may give you better options. If one partner has a credit score higher than 620, they may qualify for better terms and interest rates. By qualifying for the best rates and terms, you can save money on interest throughout your loan repayment.

Some lenders may allow both parties to apply for a mortgage together. This may help you and your partner qualify for a larger mortgage since youre combining two incomes. However, if one partner has a weak credit score, the lender may base their lending decision on the lower credit score. In this case, it might be best for one party to apply for a mortgage.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.