Loans Which Dont Use Dti For Approval

Mortgage lenders use Debt-to-Income to determine whether homes are affordable for a U.S. home buyer. They verify income and debts as part of the process. However, there are several high-profile mortgage programs which ignore the DTI calculation.

Among these programs is the popular suite of streamline refinances available via the FHA, the VA and Fannie Mae and Freddie Mac.

Finance Your Home With Assurance Financial

Still confused about how to calculate your estimated mortgage payment? Contact Assurance Financial today or check out our Mortgage Calculator Tool. Our team of loan officers is dedicated to making the loan process as easy as possible for you.

At Assurance Financial, we want to help you secure the right mortgage for your dream home. Financing your home should be an exciting, memorable time in your life, and we want to make every step in the process as smooth and enjoyable for you as possible. When you contact us, well put you in touch with a loan officer who will help you secure the right mortgage for your dream home.

Use Our Calculator To Estimate Your Monthly Payment

Most people need a mortgage to finance a home purchase. Use our mortgage calculator to estimate your monthly house payment, including principal and interest, property taxes, and insurance. Try out different inputs for the home price, down payment, loan terms, and interest rate to see how your monthly payment would change.

Mortgage Calculator Results Explained

To use the mortgage calculator, enter a few details about the loan, including:

You May Like: How Big A Mortgage Can I Get With My Salary

How To Get A Lower Monthly Mortgage Payment

If youve got more debt, you might need to take on a lower monthly payment to keep your DTI ratio at 43%. Thankfully, there are a few strategies you can use to lower your monthly payment.

Although there are many tips and tricks to lowering your monthly mortgage payment, the top three are highly recommended and also effective: improving your credit score, taking a longer mortgage term and saving up for a 20% down payment.

Is The House Too Expensive

Another thing a mortgage calculator is very good for is determining how much you can afford. This is based on things like your income, credit score and your outstanding debt. Not only is the monthly payment important, but you should also be aware of how much you need to have for a down payment.

As important as it is to have this estimate, its also critical that you dont overspend on the house by not considering other things like emergency funds and your other financial goals. You dont want to put yourself in a position where youre house poor and can never afford to go on vacation or retire.

Recommended Reading: Who Offers 20 Year Mortgages

Mortgage Loan Calculator United Bank Of Union

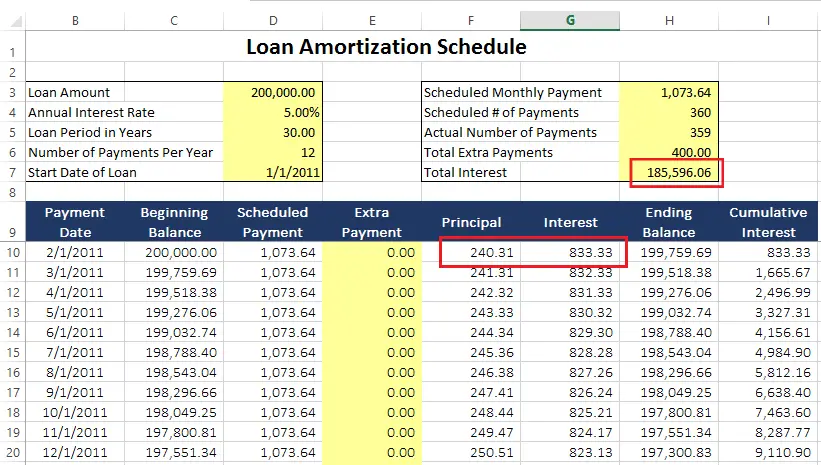

Quickly see how much interest you could pay and your estimated principal balances. Enter prepayment amounts to calculate their impact on your mortgage.

Note 1 This amount does not include escrow, homeowners insurance, property taxes, insurances, HOA fees and other costs associated with owning a home. This

Calculate how much house can I afford with our mortgage calculator. Find out what you can realistically afford before you start looking.

Tell us what you can afford each month and use our home loan calculator to estimate the loan amount.

Buying a home? Use our free mortgage calculator to help you estimate your monthly mortgage payments and evaluate a range of borrowing amounts.

Not sure how much mortgage you can afford? Use the calculator to discover how much you can borrow and what your monthly payments will be.

What Other Expenses Does Homeownership Entail I = Interest rate on the mortgage N = Number of periods . A good way to remember

A fixed rate mortgage will keep your monthly payments at the same amount and a variable rate mortgage could mean less interest, depending on how the market is

Read Also: How To Apply Loan In Sss

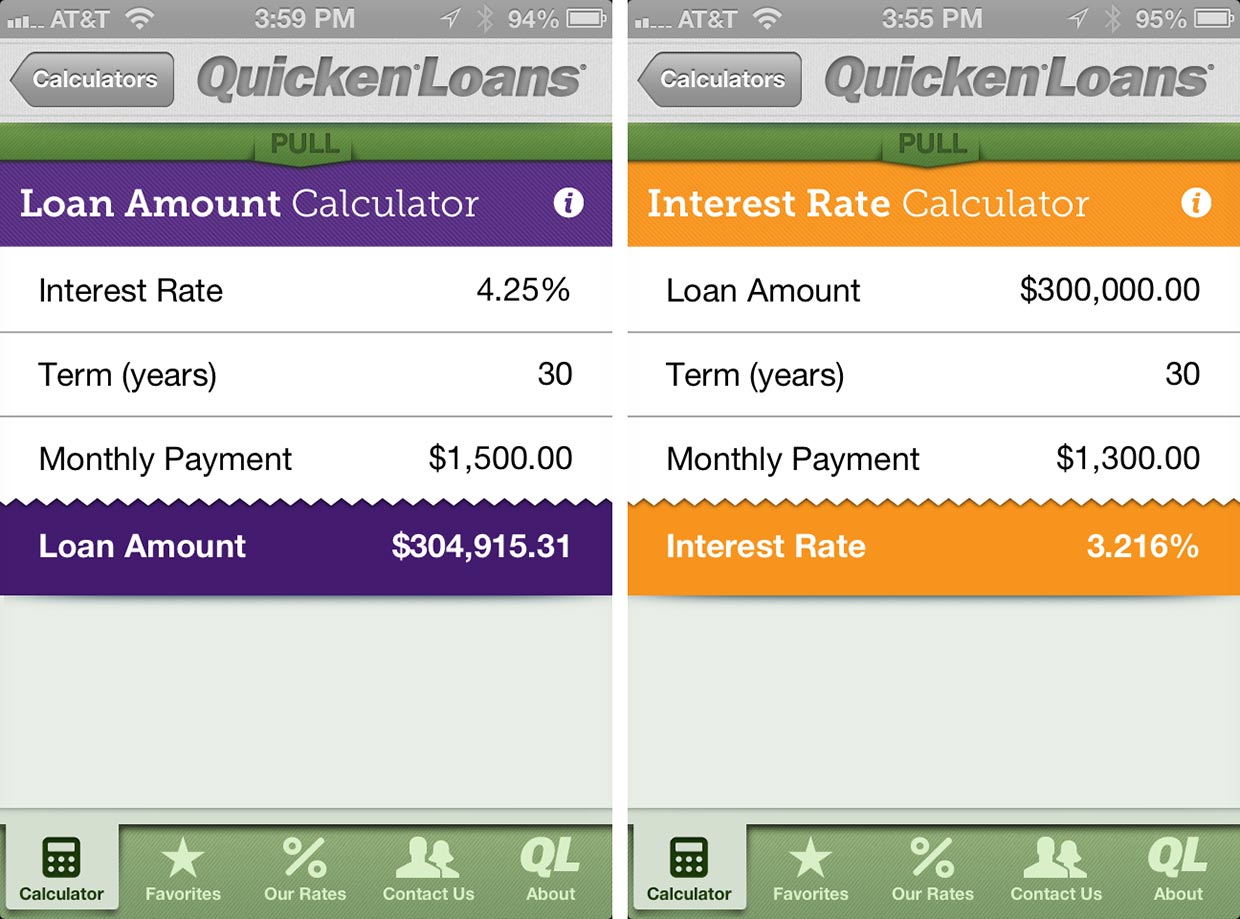

Types Of Mortgage Calculators

In addition to a calculator that helps you determine the amount of your monthly mortgage payment, there are others that help you analyze various scenarios when it comes to your mortgage. Well give the basics on each of them before digging a little deeper regarding the information you need to make the most use of the calculator.

Recommended Reading: Can You Take Out Two Mortgages

Why Use The Maximum Mortgage Calculator

Once you input your monthly obligations and income, the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment that you can afford, based on your current financial situation. This calculator will also help to determine how different interest rates and levels of personal income can have an effect on how much of a mortgage you can afford.

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

Also Check: How To Negotiate The Best Mortgage Rate

Avoid The Pitfalls When Determining How Much House You Can Afford

When determining how much house they can afford, people tend to use two basic strategies. Most base their assessment on how large of a loan lenders are willing to give them. But others use their current rent to determine how much they can afford to spend on monthly mortgage payments. The problem with these two approaches is that they tend to lead people to overestimate their budgets.

To know how much house you can afford, you not only need to think about how much you have saved but how much youll be spending. Even though youll no longer be spending money on rent, youll have a slew of new payments that you need to consider, such as closing costs, property taxes, homeowners insurance and fees. And if the home you purchase needs work, youll also have to factor in the cost of home improvements.

Ways To Increase Your Gross Monthly Income

Because your DTI is a ratio that calculates the percentage of your income thats spent on paying off debt, any extra money you make will automatically improve your DTI. Its helpful to begin lowering your DTI by increasing the amount of money you take home each month. Here are some ways that you can boost your take-home pay:

You May Like: Are Current Mortgage Rates Good

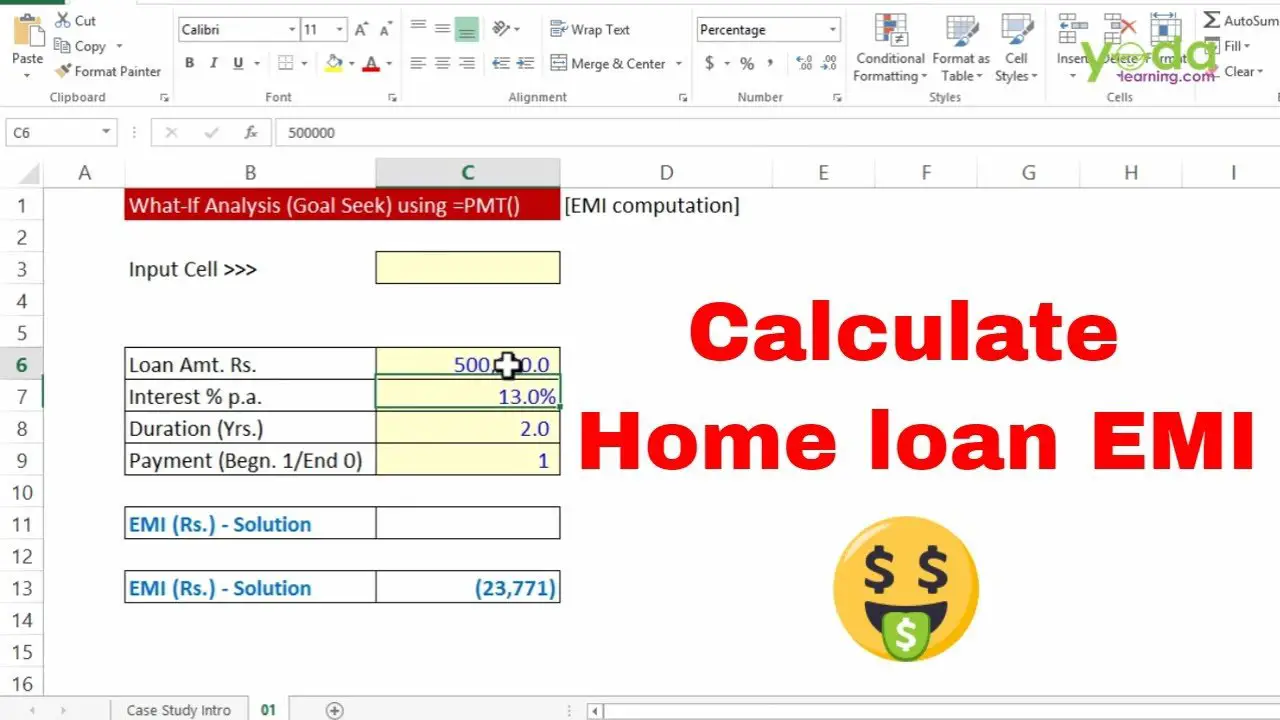

Calculate The Number Of Payments

The most common term for a fixed-rate mortgage is 30 years or 15 years. To get the number of monthly payments you’re expected to make, multiply the number of years by 12 .

A 30-year mortgage would require 360 monthly payments, while a 15-year mortgage would require exactly half that number of monthly payments, or 180. Again, you only need these more specific figures if you’re plugging the numbers into the formula an online calculator will do the math itself once you select your loan type from the list of options.

How Much Mortgage Can I Afford

Generally speaking, most prospective homeowners can afford to finance a property that costs between two and two-and-a-half times their annual gross income. Under this formula, a person earning $100,000 per year can only afford a mortgage of $200,000 to $250,000. However, this calculation is only a general guideline.

Ultimately, when deciding on a property, you need to consider several additional factors. First, it’s a good idea to have some understanding of what your lender thinks you can afford . Second, you need to have some personal introspection and figure out what type of home you are willing to live in if you plan on living in the house for a long time and what other types of consumption you are ready to forgoor notto live in your home.

While real estate has traditionally been considered a safe long-term investment, recessions and other disasters can test that theoryand make would-be homeowners think twice.

Read Also: Can You Pay Back A Reverse Mortgage Early

When Mortgage Payments Start

The first mortgage payment is due one full month after the last day of the month in which the home purchase closed. Unlike rent, due on the first day of the month for that month, mortgage payments are paid in arrears, on the first day of the month but for the previous month.

Say a closing occurs on January 25. The closing costs will include the accrued interest until the end of January. The first full mortgage payment, which is for the month of February, is then due March 1.

As an example, lets assume you take an initial mortgage of $240,000, on a $300,000 purchase with a 20% down payment. Your monthly payment works out to $1,077.71 under a 30-year fixed-rate mortgage with a 3.5% interest rate. This calculation only includes principal and interest but does not include property taxes and insurance.

Your daily interest is $23.01. This is calculated by first multiplying the $240,000 loan by the 3.5% interest rate, then dividing by 365. If the mortgage closes on January 25, you owe $161.10 for the seven days of accrued interest for the remainder of the month. The next monthly payment, which is the full monthly payment of $1,077.71, is due on March 1 and covers the February mortgage payment.

The Value And Condition Of The Home

Finally, lenders want to make sure the home you’re buying is in good condition and is worth what you’re paying for it. Typically, a home inspection and home appraisal are both required to ensure the lender isn’t giving you money to enter into a bad real estate deal.

If the home inspection reveals major problems, the issues may need to be fixed before the loan can close. And, the appraised value of the home determines how much the lender will allow you to borrow.

If you want to pay $150,000 for a house that appraises for only $100,000,, the lender won’t lend to you based on the full amount. They’ll lend you a percentage of the $100,000 appraised valueand you’d need to come up with not only the down payment but also the extra $50,000 you agreed to pay.

If a home appraises for less than you’ve offered for it, you’ll usually want to negotiate the price down or walk away from the transaction, as there’s no good reason to overpay for real estate. Your purchase agreement should have a clause in it specifying that you can walk away from the transaction without penalty if you can’t secure financing.

Recommended Reading: Who Has The Best Reverse Mortgage Rates

Get Todays Mortgage Rates

For todays U.S. home buyers, Debt-to-Income ratio plays an outsized role in the loan approval process. Buyers with a high DTI are less likely to get approved for a loan than buyers with a low DTI.

Thankfully, low mortgage rates help to hold DTI down and todays mortgage rates remain near all-time lows. See how low your mortgage rate can be. Getting a rate quote is free and no-obligation.

Popular Articles

Step by Step Guide

Why Should I Calculate Mortgage Interest

Mortgages are among the largest financial obligations most Canadians hold. The calculation of interest is quite complex, but it is important to consider because it can help you plan, make financial choices and catch errors. In addition, knowing your mortgage interest amount means you know the real cost of financing which can be ambiguous at face value. Once you know the cost, you can make educated financial decisions, such as whether to refinance, ask for different conditions or choose another mortgage lender. By the end of this guide, youll know how to calculate interest on a mortgage.

You May Like: How To Know How Much Mortgage I Can Afford

When Do You Pay Pmi

There are a few ways to handle PMI payments. Some lenders may let you choose a payment method. Others require you to agree to a specific option. The most common PMI payment methods include:

- Monthly premium: Paying a monthly premium is the most common PMI option. In this case, your lender automatically adds PMI to your monthly mortgage payment. You wont have to make a large upfront payment, but your monthly payments will be higher.

- Upfront premium: Rather than paying every month, you may have the option to pay the full cost at once. In this case, your lender arranges for you to pay PMI when you close on the loan. While it’s an additional closing cost, your monthly mortgage payment will be lower.

- Monthly and upfront premiums: Alternatively, your PMI might come in a combination of the two methods above. In this case, your lender arranges for you to pay a portion of your PMI at closing and adds the rest to your monthly mortgage payments.

Getting Started With Calculating Your Mortgage

People tend to focus on the monthly payment, but there are other important features that you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly, and over the life of the loan

- Tallying how much you actually pay off over the life of the loan, versus the principal borrowed, to see how much you actually paid extra

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

How Do Mortgage Lenders Calculate Monthly Payments

For most mortgages, lenders calculate your principal and interest payment using a standard mathematical formula and the terms and requirements for your loan.

Tip

The total monthly payment you send to your mortgage company is often higher than the principal and interest payment explained here. The total monthly payment often includes other things, such as homeowners insurance and taxes. Learn more.

What Is The Maximum Mortgage Calculator

Our maximum mortgage calculator helps you calculate the maximum monthly mortgage payment and total mortgage amount you can afford. The calculator also helps you determine the effects of different interest rates and levels of personal income on how much mortgage you can afford. This calculator is for you if you are reviewing your financial stability as you get ready to purchase a property.

Don’t Miss: Is Quicken Loans A Mortgage Company

How Forbes Advisor Estimates Your Monthly Mortgage Payment

Forbes Advisors mortgage calculator makes it easy to estimate your monthly mortgage payment using your home price, down payment and other loan details. Based on that information, it also calculates how much of each monthly payment will go toward interest and how much will cover the loan principal. You can also view how much youll pay in principal and interest each year of your mortgage term.

To make these calculations, our tool uses this data:

- Home price. This is the amount you plan to spend on a home.

- Down payment amount. The amount of money you will pay to the sellers at closing. This amount is subtracted from the home price to determine the amount youll be financing with the mortgage.

- Interest rate. If youve already started shopping for a mortgage, enter the interest rate offered by the lender. If not, check out the current average mortgage rate to estimate your potential payments.

- Loan term. The loan term is the length of the mortgage in years. The most popular terms are for 15 and 30 years, but other terms are available.

- Additional monthly costs. In addition to principal and interest, the calculator considers costs associated with property taxes, private mortgage insurance , homeowners insurance and homeowners association fees.