How Does Payment Frequency Affect My Mortgage Payments

More frequent mortgage payments means that each mortgage payment will be smaller. However, mortgage payments do not scale linearly. For example, a bi-weekly mortgage payment amount is not exactly half of amonthly mortgage payment amount. Instead, bi-weekly payments are slightly less than half of a monthly payment.

For example, for a $500,000 mortgage with a 25-year amortization and a mortgage rate of 2%, a monthly payment would be $2,117, while a bi-weekly payment would be $977.

A bi-weekly payment of $977 is equivalent to paying $1,954 per month, but choosing a mortgage with a monthly payment frequency will require a monthly payment of $2,117. Thats because with bi-weekly payments, youll be making 26 bi-weekly payments per year. That is equivalent to 13 months of mortgage payments per year, accelerating your payment schedule. Your more frequent payments will also reduce your mortgage principal faster, allowing you to save on interest and pay down more off your principal with each payment.

For example, 12 months of $2,117 monthly payments will result in roughly $25,400 being paid in a year.

26 bi-weekly payments of $977 will result in roughly $25,400 being paid in a year. The total amount paid per year is the same.

The table below compares monthly payments, bi-weekly payments, and weekly payments for a mortgages total cost of interest for a 25-year amortization at a 2% mortgage rate.

Comparing Mortgage Payment Frequency

| $134,166 | $134,009 |

There are slight interest savings to be had from increasing your mortgage payment frequency. This keeps your mortgage amortization the same, which is why you wont realize as much interest savings.

Many mortgage lenders offer accelerated payment frequencies, such as accelerated bi-weekly and accelerated weekly mortgage payments. With accelerated payments, you will be paying the equivalent monthly payments, which means that you will be making an extra payment per year. In the above table, a monthly payment would have been $2,117.

To calculate the accelerated bi-weekly payment amount, you would divide $2,117 in half to get $1,058.50. Your accelerated bi-weekly payments will be $1,058, higher than the regular bi-weekly amount of $977. This increased amount allows you to pay off your mortgage faster, which shortens your amortization and saves you interest.

Qualifying For A Lower Mortgage Rate

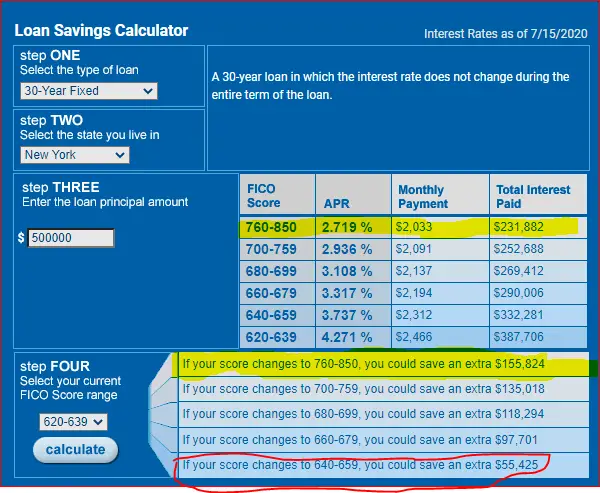

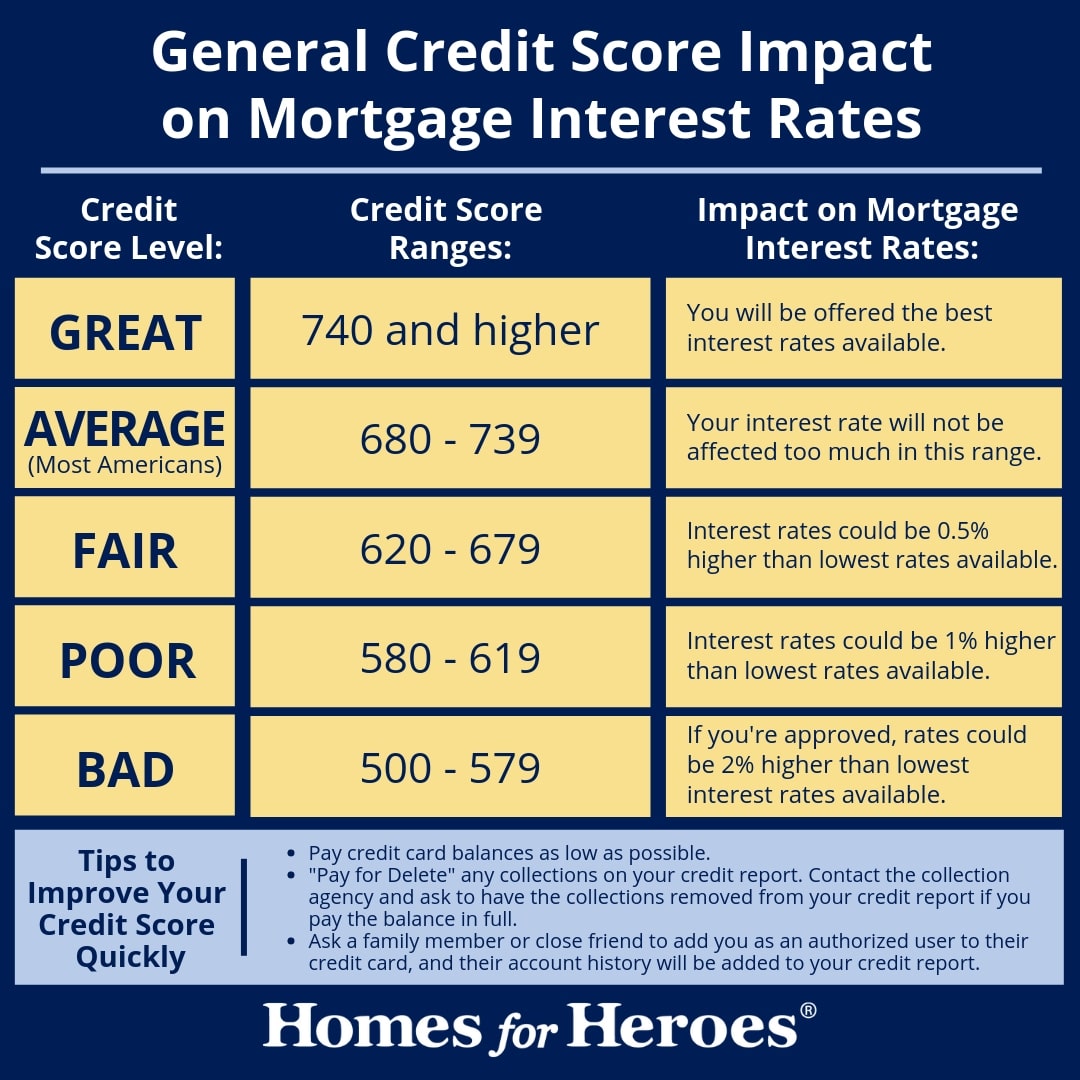

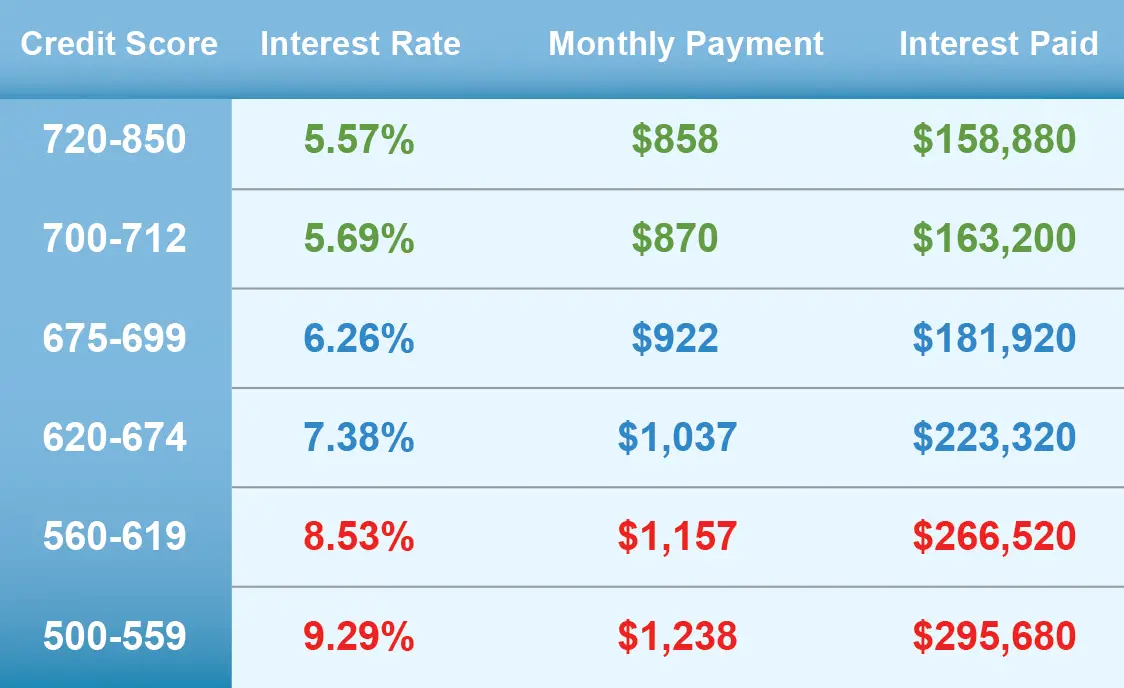

It may be helpful to improve your credit score before applying for a mortgage so you can qualify for a lower mortgage rate and save tens of thousands of dollars over the life of the mortgage. The money you save on your mortgage is well worth the time and effort to improve your credit score.

If you have a low credit score, review your credit reports to see the items that are affecting your credit score. You can raise your credit score by making timely payments on all your bills, paying down your credit card debt, removing errors from your credit report, and paying off outstanding delinquent balances. In some cases, just a few points can make a big difference in your mortgage rate.

Continue to monitor your credit score in the weeks leading up to your mortgage application to see how your credit score improves.

Recommended Reading: What Is The Current Interest Rate On An Fha Mortgage

Canadian Interest Rate Forecast To 2023

HIGHLIGHTS

-

Long-term government bond rates have risen from 0.3% to 1.0% since January. This has a knock-on effect on mortgage rates which have risen roughly half a percent.

-

At its May announcement, the Bank of Canada signalled it might start raising short-term interest rates in late 2022, as a result of a brighter outlook for the Canadian economy. At its announcement in June, the BoC confirmed this economic and rate outlook.

-

5-year mortgage rates are expected to remain low by historical standards, but they are expected to continue rising.

-

A majority of forecasters anticipate the economic recovery will not gain full traction until late 2021 or 2022.

-

Short-term variable interest rates at their lower bound and are not expected to fall any further.

Every economist surveyed expects the Bank of Canada will keep its Target Rate at the effective lower bound of 0.25% until the second half of 2022.

According to a recent Reuters report, Money markets expect two Bank of Canada rate hikes in 2022.

The Bank of Canada says it will keep variable interest rates low until the economy has recovered and inflation has reached roughly 2 percent. Thats great, but they havent stopped fixed mortgage rates from rising significantly.

While low rates are intended to help borrowers weather the economic storm, many Canadians appear to be using them to buy larger homes. The expectation of prolonged lower interest rates shows the economy is unlikely to recover fully until late 2022.

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

Read Also: How To Calculate What Mortgage You Can Qualify For

How Does A Mortgage Work

A mortgage is a type of secured loan where the property often your home is the collateral. So youll never be able to take out a mortgage without having some sort of real estate attached to it. Mortgage loans are issued by banks, credit unions, and other different types of lenders.

Aside from paying the loan back, you pay for a mortgage in two ways: fees and interest. Interest is paid on your loan balance throughout the life of the loan, and is built into your monthly payment. Mortgage fees are usually paid upfront, and are part of the loans closing costs. Some fees may be charged annually or monthly, like private mortgage insurance.

Mortgages are repaid over what is known as the loan term. The most common loan term is 30 years. You can also get a mortgage with a shorter term, like 15 years. Short-term loans have higher monthly payments, but lower interest rates. Mortgages with longer terms have lower monthly payments, but youll typically pay a higher interest rate.

How Do I Get The Best Mortgage Rate

Shopping around is the key to landing the best mortgage rate. Look for a rate thats equal to or below the average rate for your loan term and product. Compare rates from at least three, and ideally four or more, lenders. This lets you make certain youre getting competitive offers. Check with a variety of types of lenders large banks, credit unions, online lenders, regional banks, direct lenders and mortgage brokers. Bankrate offers a mortgage rates comparison tool to help you find the right rate from a variety of trusted lenders.

Interest rates and terms can vary significantly among lenders depending on how much they want your business and how busy they are processing loans. Many lenders staffed up during the refinancing boom of 2020 and in 2021 are lowering their profit margins to keep enough new mortgages in the pipeline. As online and non-bank lenders take an ever-greater share of the mortgage market, expect to see the deals get even better no matter where interest rates go.

Keep in mind that mortgage rates change daily, even hourly. Rates move with market conditions and can vary by loan type and term. To ensure youre getting accurate rate quotes, be sure to compare similar loan estimates based on the same term and product.

You May Like: Is It Better To Use A Mortgage Broker

How To Find The Best Mortgage Lender

The best mortgage lender for you will be the one the can give you the lowest rate and the terms you want. Your local bank or credit union probably writes mortgage loans with rates close to the current national average. A loan officer in your local branch could guide you through the process.

Online lenders have expanded their market share over the past decade. You could get pre-approved within minutes. Your loan amount combined with current mortgage rates could define your price range for home prices in your area. Many online lenders also assign a dedicated loan officer to offer continuity as you shop.

Shop around to compare rates and terms, and make sure your lender has the loan option you need. Not all lenders write USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s veracity, ask for its NMLS number and search for online reviews.

How Mortgage Rates Are Determined: A Guide

Most people dont think about the mortgage market unless theyre working to purchase or refinance a home. If you dont know much about the mortgage market, it can sometimes seem like mortgage rates are set based on a sort of mysticism not meant to be understood by mere mortals. However, the goal here is to help you understand how mortgage rates are determined.

Mortgage rates are determined by a combination of market factors such as overall economic health, and personal factors such as your credit score, how you occupy your home and the size of your loan compared to the value of the property youre purchasing.

While thats the long and the short of it, well jump into the details in the rest of this post so that you can be fully confident in your knowledge of mortgage rates and what you can do to get a favorable one.

Read Also: Is A Reverse Mortgage Good Or Bad

What Term Should I Choose

The most common term length in Canada is 5 years. Unless you have specific concerns, a 5-year term generally works well. Longer terms will have higher mortgage rates, which can be bad for those struggling to pass themortgage stress testas you may be tested at a higher mortgage rate. This is a particularly significant issue for homebuyers inTorontos housing marketor inVancouvers housing market. However, you wont have to worry about requalifying for a mortgage as often as a short mortgage term. Each lender will offer different options for term length and rates contact your lender or broker for more details.

Are The Lowest Mortgage Rates Usually Online

For the last few years, the best rates in Canada have usually been found online. Thats because internet-based lenders have been more competitive and often accept smaller profit margins. Even big banks are now joining the bandwagon with special pricing for online mortgage shoppers. RATESDOTCA tracks dozens of lenders and aggregates the best deals all in one place.

Also Check: How Much Is Mortgage On 1 Million

Lowest Mortgage Rates In Alberta

Alberta is one of the provinces where mortgage shoppers can find the most competitive mortgage rates. This is due in part to the higher incomes that traditionally came from the oil and gas sectors. They allow for bigger mortgages, which are more highly coveted.

Rates are also sharp thanks to the competitive mortgage broker market in the province, as well as competition from brokers outside of Alberta.

Some say the higher income per capita in the province, as well as lower educational levels , make Albertans slightly less rate sensitive than other provinces. But we think this is a generalization that does not reflect our readership. We encourage all to aggressively research the lowest mortgage rates possible.

Personal Factors That Affect Mortgage Rates

There are several factors unique to you and your situation that affect your mortgage rate. Among them are your credit score, the down payment or equity amount you bring into the transaction and how you plan to occupy the home. Finally, what youre looking to accomplish also has an effect on your interest rate.

Recommended Reading: When Paying Off A Mortgage Early

What Drives Changes In 5

When Canada bond yields rise, sourcing capital to fund mortgages becomes more costly for mortgage lenders and their profit is reduced unless they raise mortgage rates. The reverse is true when market conditions are good.

In terms of the spread between the mortgage rates and the bond yields, mortgage lenders set this based on their desired market share, competition, marketing strategy, and general credit market conditions.

What Is The Base Rate

Its the rate the Bank of England charges other banks and other lenders when they borrow money, and its currently 0.10%. The base rate influences the interest rates that many lenders charge for mortgages, loans and other types of credit they offer people. For example, our rates often rise and fall in line with the base rate, but this isnt guaranteed. You can visit the Bank of England website to find out how it decides the base rate.

You May Like: Does Rocket Mortgage Affect Your Credit Score

Find Albertas Best Mortgage Rates

Alberta is one of Canadas three Prairie provinces and boasts a population of 4.3 million, as of 2019.

Its natural beauty encompasses a diverse range of geography, including the prairies to the west, the desert badlands to the south, the Rocky Mountains to the west and vast boreal forests in the north.

Thanks in part to its historically strong energy sector, particularly oil and gas, Alberta is among the most active mortgage markets in Canada, alongside British Columbia and Ontario. This has allowed Albertans to benefit from ample competition in the mortgage market, and as a result more competitive rates compared to your average province.

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadas Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.

Recommended Reading: How To Sell A Mobile Home With A Mortgage

Today’s Featured Mortgage Rates

Get answers to common questions from homebuyers like you.

- What is Mortgage First?

Mortgage First is a preapproval program that allows you to get preapproved on your home loan before you start shopping for your new home.

- What is the advantage to being preapproved?

- What documents do I need to provide to apply for Mortgage First?

You will complete the credit application and provide your income, asset, and credit documentation for review in order to get preapproved.

Don’t see the answer you need?

Call Rocket Mortgage at

Mon.-Fri., 8 a.m. 9 p.m. ET Sat. 8 a.m. 4 p.m. ET

In order to participate, the borrower must agree that the lender, Rocket Mortgage, may share their information with Charles Schwab Bank and Charles Schwab Bank will share their information with the lender Rocket Mortgage. Nothing herein is or should be interpreted as an obligation to lend. Loans are subject to credit and collateral approval. Other conditions and restrictions may apply. This offer is subject to change or withdraw at any time and without notice. Interest rate discounts cannot be combined with any other offers or rate discounts. Hazard insurance may be required.

Qualifying assets are based on Schwab brokerage and Schwab Bank combined account balances, including:

4. “Rocket Mortgage, America’s Largest Mortgage Lender” Based on Rocket Mortgage data in comparison to public data records.

What Is The Best Credit Score To Get A Mortgage

Lenders reserve their most competitive rates to borrowers with excellent credit scores usually 740 or higher. However, you dont need spotless credit to qualify for a mortgage. Loans insured by the Federal Housing Administration, or FHA, have a minimum credit score requirement of 580, although youll probably need a score of 620 or higher to qualify.

To score the best deal, work to boost your credit score above 740. While you can get a mortgage with poor or bad credit, your interest rate and terms may not be as favorable.

Also Check: Are Mortgage Rates Going To Rise

What Are Mortgage Interest Rates Based On

No government entity sets or directly regulates mortgage rates. Rather, theyre based on a number of broader market factors. Everything from the demand for housing to inflation and the overall health of the economy can influence mortgage rates as well as refinance rates.

Typically, when the economy is strong and unemployment rates are low, rates will rise because demand is higher. But during a recession like the one were currently experiencing rates will often decline as lenders try to entice a smaller pool of borrowers looking to spend.

Monetary policies set by the Federal Reserve can also have a significant impact on mortgage rates, even though they dont directly set rates. When the Federal Reserve lowers the federal funds rate or purchases large quantities of Treasury bonds it puts downward pressure on mortgage rates.

Home Price And Loan Amount

Homebuyers can pay higher interest rates on loans that are particularly small or large. The amount youll need to borrow for your mortgage loan is the homeprice plus closing costs minus your down payment. Depending on your circumstances or mortgage loan type, your closing costs and mortgage insurance may be included in the amount of your mortgage loan, too.

If youve already started shopping for homes, you may have an idea of the price range of the home you hope to buy. If youre just getting started, real estate websites can help you get a sense of typical prices in the neighborhoods youre interested in.

Enter different home prices and down payment information into the Explore Interest Rates tool to see how it affects interest rates in your area.

You May Like: Is A Timeshare Considered A Mortgage