How To Calculate Your Home Buying Budget On A $50000 Salary

As you can see in the examples above, two different borrowers who both earn $50,000 a year could have very different home buying budgets.

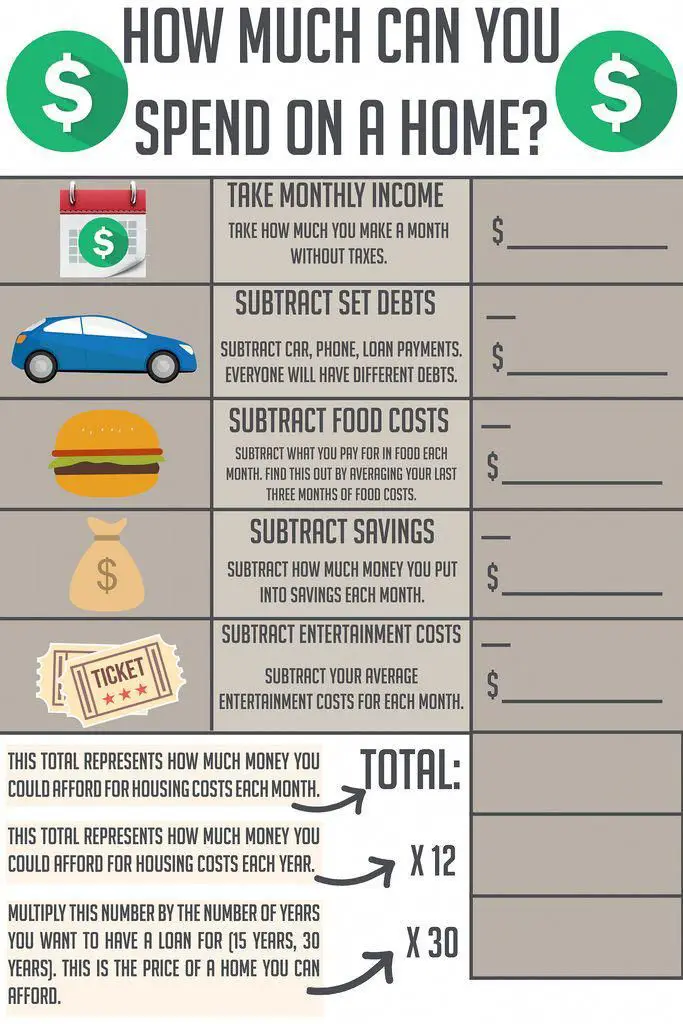

To figure out how much house you can afford, you need to factor in your own income, debts, down payment savings, and projected housing costs like homeowners insurance and property taxes.

Remember, principal and interest on the mortgage arent the only costs youll pay each month as a homeowner.

Luckily, you dont have to do all that math on your own. You can use an online mortgage calculator one that includes taxes and insurance to estimate your monthly mortgage payment.

How Much Of Your Income Should Go To Ongoing Housing Costs

Next, it’s time to figure out how much you can afford to pay each month for ongoing costs.

Financial experts generally recommend you spend no more than 30% of income on housing. If you exceed this percentage, the government classifies this is a housing-cost burden.

Apply the 30% rule when deciding how much income you can devote each month toward monthly expenses, including your mortgage, property taxes, and homeowners insurance. If you make $3,000 monthly, for example, you could afford to spend no more than $900.

Unfortunately, around 39 million American households are burdened with housing costs exceeding 30% of their pay. This is a big problem. If your total housing expenditures take up so much of your paycheck, you’ll have a lot of trouble fulfilling any other financial goals.

If you want to save the recommended 20% of income — and you should — you’d have less than 50% of your money left over for every other expense if you exceed this 30% ratio.

Example Of Mortgage Payment Percentage

Based on the 28 percent and 36 percent models, heres a budgeting example assuming the borrower has a monthly income of $5,000.

- $5,000 x 0.28 = $1,400

- $5,000 x 0.36 = $1,800

Going by the 28 percent rule, the borrower should be able to reasonably afford a $1,400 mortgage payment. However, factoring in the 36 percent rule, the borrower would also only have room to devote $800 to their remaining debt obligations. Applied to your own financial situation, this may or may not be feasible for you.

You May Like: How Long Is The Mortgage Process

Elizabeth Warren’s 50/30/20 Rule Can Help You Manage Your Budget

Lindsay VanSomeren is a credit card, banking, and credit expert whose articles provide readers with in-depth research and actionable takeaways that can help consumers make sound decisions about financial products. Her work has appeared on prominent financial sites such as Forbes Advisor and Northwestern Mutual.

The 50/30/20 rule of thumb is a way to allocate your budget according to three categories: needs, wants, and financial goals. Its not a hard-and-fast rule but rather a rough guideline to help you build a financially sound budget.

To better understand how to apply the rule, well look at its background, how it works, and its limitations, plus go through an example. In other words, well show you how and why to set up a budget using the 50/30/20 rule of thumb yourself.

Borrowing For A Mortgage

The amount you can borrow for a home depends on a couple of things: how much you can afford to repay on your current income, and how much a lender will lend on a property. Lenders want to be sure that youll be able to keep up with your repayments and still have enough money left over to live on. They dont all use the same method to work this out, however.

Also Check: Does Bank Of America Do Mortgage Loans

How Much Can I Afford To Repay

Percentage of income

Some say that fixed payments should be no more than 3040% of gross income.

If you know your income and what your existing fixed payments are, you can work backwards to find the level of mortgage repayment a lender will allow. Then you can experiment and see what size loan you could afford with these repayments.

Its important to consider the impact on your ability to meet your repayments if interest rates go up. Not sure how to calculate mortgage repayments? Our mortgage calculator will help you see what the payments would be if the interest rate went up by 1%, 2% or more.

Some lenders also have calculators on their websites to give a rough idea of how much they may lend. These calculators may not take into account your current debt situation, so youll need to contact the bank or a mortgage broker directly to get a better indication.

Minimum surplus

Some lenders calculate a minimum surplus that we should have left over each month after fixed payments and a living allowance are deducted. This is called UMI and varies from bank to bank.

For a couple, the calculations are based on combined income. For someone with children, lenders will expect to see less surplus.

Flatmates helping with the bills

Planning to get flatmates in to help pay the mortgage? Some lenders will count 70% to 80% of their rent towards your income. Other lenders won’t include any.

How To Decide How Much To Spend On Your Down Payment

Buying a home is exciting. Its also one of the most important financial decisions youll make. Choosing a mortgage to pay for your new home is just as important as choosing the right home.

You have the right to control the process. Check out our other blogs on homebuying topics, and join the conversation on Facebook and Twitter using #ShopMortgage.

One of the toughest parts of buying a home for the first time is coming up with a down payment. You may have heard that in order to buy, you should have 20 percent of the total cost of the home saved up for the down payment. Actually, you can choose how much to put down based on what works best for your situation.

Putting 20 percent down has a lot of benefits. However, saving enough money for a 20 percent down payment can be challenging, especially for first-time homebuyers.

Read Also: How To Apply For A House Mortgage

Ways To Lower Your Total Monthly Debt Payments

The key to reducing your debts is to create a budget and debt payment plan. By creating a list with your total monthly income on one side and all of your expenses on the other, you can quickly identify unnecessary expenditures, eliminate them and allocate extra funds to paying off your loans early. After coming up with your budget, you can use one of the following debt payment plans to chip away at your debts.

Although you can choose to focus on either increasing your monthly income or lowering your debts, its recommended that you do both simultaneously. Doing so will enable you to improve your DTI faster and ensure you can qualify for a mortgage when its time to apply.

Ways To Increase Your Gross Monthly Income

Because your DTI is a ratio that calculates the percentage of your income thats spent on paying off debt, any extra money you make will automatically improve your DTI. Its helpful to begin lowering your DTI by increasing the amount of money you take home each month. Here are some ways that you can boost your take-home pay:

Also Check: Can There Be A Cosigner On A Mortgage

How To Get The Best Interest Rate For My Loan

The best interest rate is often the lowest interest rate. Lower interest can drastically change your mortgage debt over time. Minor changes to your interest rate could mean big savings or significant spendings. If youre trying to answer the question of how much can I spend on a house? it has a lot to do with the interest rate your loan comes with.

So, how do you get the best rate? First is to watch current trends on mortgage rates. Rates are updated daily, so its important to keep an eye on them to know when you call your mortgage lender and ask them to lock you into a newly dropped rate. You should also take control of your credit score. Buyers with higher credit scores get approved for lower rates. You can also buy your interest rate down a point or two by paying extra cash up front. If you dont qualify for a low rate, talk to your lender about buying a point to reduce all future payments.

Calculate An Affordable Home Purchase Price

Combine your cash down payment with the amount of money youre prepared to borrow and youll have a maximum purchase price. However, dont hesitate to revise this estimate as you shop for houses and mortgages. Figuring out how much to spend on a house changes as the variables change.

For instance, lets say you get your heart set on a fixer-upper. Youll probably need to reduce the size of your down payment to have more cash available for renovations. Do the homes youre looking at have lower property tax bills or higher association fees than you expected? Have you found the perfect lender offering a lower interest rate?

Go back to the mortgage calculator, and revise your borrowing power.

You May Like: Can A Locked Mortgage Rate Be Changed

Ugh This Is Making My Head Hurt

Yup. Mortgages arent fun. Still, a house is one of, if not the, most expensive thing youll ever spend money on so its best to give it a ton of consideration. Being saddled with an unruly mortgage will affect you for years and years. To that end, the more thought you give it now, the less worry youll have later. So remember, the question isnt just How much mortgage can I afford? but How much mortgage do I want? for the long term.

More from SmartAsset

How Do Lenders Determine How Much Mortgage I Qualify For

Before you figure out how much house you can afford, its useful to know how lenders calculate whether you qualify for a mortgage. Mortgage lenders determine your qualification based on your credit score and debt-to-income ratio .

Your DTI enables lenders to evaluate your qualifications by weighing your income against your recurring debts. Based on this number, lenders will decide how much additional debt youll be able to manage when it comes to your mortgage.

To see if youll qualify for a mortgage, you can begin by calculating your DTI:

Once you have calculated your DTI, you can evaluate whether its low enough to get approved for a mortgage. The lower your DTI, the more likely youll get approval.

If your total monthly debt is $650 , and your monthly income is $4,500 before taxes, your DTI would be 14%. A DTI of 14% is quite low, so youd be likely to obtain a mortgage.

Very rarely will mortgage lenders give a loan to an individual whose DTI is above 43%. After calculating your DTI ratio, if you find that its over 43%, youll need to work on lowering it.

Recommended Reading: What Is Loan To Value Mortgage

How Much Can I Afford To Borrow For A Mortgage

Find out how much you can afford to borrow for a mortgage and how much house you can afford without over-stretching yourself or committing to repayments that you cant meet.

When buying a home, often the first step is understanding how much you can afford to borrow for a mortgage. Most people want to buy as much house as they can afford, without being overstretched or with too little money to pay the monthly bills.

Many Americans Spend More Than They Should On Housing These Guidelines Can Help You Avoid That Trap

Buying a new home is a big decision that involves a whole lot of smaller ones. Many people focus on the number of bedrooms or the quality of the kitchen appliances as they contemplate where they want to live.

But new homebuyers shouldnt let considerations like those persuade them to buy a home thats more expensive than they can comfortably afford.

With home prices on the rise in many parts of the U.S., keeping things affordable is getting harder to do. In May the median listing price for a home rose 6 percent from the previous year, to $315,000, a record high, according to a report by Realtor.com. Meanwhile, the number of homes priced above $750,000 rose 11 percent from a year ago.

Buyers say that those high prices are forcing them to spend more than they planned. One-third of buyers report that they spent more than they expected to on their home, and nearly one-third put down a higher down payment than they anticipated, according to a by CoreLogic, a real estate data analytics firm.

Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget. Yet the average married couple with children between the ages of 6 and 17 spends 32 percent of their budget on housing, and single people spend almost 36 percent, according to data from the Bureau of Labor Statistics.

To make sure you dont spend more than you should, here’s some advice on getting a mortgage you can afford.

Also Check: How To Purchase A House That Has A Reverse Mortgage

Negotiate With The Seller

There is no reason you cant ask for seller contributions instead of negotiating for a lower purchase price. Depending on the type of mortgage you choose, the seller can contribute 3 to 6 percent of the home price in closing costs.

This can make all the difference when you want to buy a new home and stop renting. Seller contributions can cover closing costs, buy your interest rate down to a more affordable level, or make a onetime payment to cover your mortgage insurance.

How Down Payment Size Impacts Home Equity

| Percentage | |

|---|---|

| $250,000 | $0 |

The rule of thumb still stands: 20% of the home value is the ideal amount of money for a down payment. This amount buys you equity in the home, which helps secure the loan. When you donât have a least 20% to put down, you have to find alternate means to secure the mortgage.

This can mean private mortgage insurance , which is an added monthly charge to secure your loan. If you donât have enough money for a down payment, many lenders will require that you have mortgage insurance. Youâll have to pay your monthly mortgage as well as a monthly insurance payment, so itâs not the best option if your budget is tight.

Youâll stop paying PMI when your mortgage reaches about 78% of the homeâs value. While certain homebuyers can qualify for little or no down payment, through VA loans or other 0% down payment programs, most homeowners who donât have a large enough down payment will have to pay the extra expense for PMI.

You May Like: Is Citizens Bank Good For Mortgages

Learn About Your Mortgage Options

Home buyers can typically choose from two main types of mortgages:

- A conventional loan that is guaranteed by a private lender or banking institution

- A government-backed loan

When choosing a loan, youll want to explore the types of rates and the terms for each option. There may also be a mortgage option based on your personal circumstances, like if youre a veteran or first-time home buyer.

Conventional loans

A conventional loan is a mortgage offered by private lenders. Many lenders require a FICO score of 620 or above to approve a conventional loan. You can choose from terms that include 10, 15, 20 or 30 years. Conventional loans require larger down payments than government-backed loans, ranging from 5 percent to 20 percent, depending on the lender and the borrowers credit history.

If you can make a large down payment and have a credit score that represents a lower debt-to-income ratio, a conventional loan may be a great choice because it eliminates some of the extra fees that can come with a government-backed loan.

Government-backed loans

Buyers can also apply for three types of government-backed mortgages. FHA loans were established to make home buying more affordable, especially for first-time buyers.

Rate types

First-time homebuyers