Am I Eligible For A New Mortgage Deal

If you want to remortgage your property to a new provider, theyll carry out an assessment of your financial circumstances, which will include an affordability and credit check.

It may be harder to get a deal if your financial circumstances have changed: for example, your employment status is different, youre on a lower income or theres been a significant increase in your monthly outgoings.

You can use our to help you find out how much you may be able to borrow and what your monthly repayments might be. Our can show you how much you could save by remortgaging.

Can I Sell My Mortgage To Another Bank

Mortgages may be sold or transferred to other institutions under federal banking laws. You are not required to obtain consumer consent before obtaining a mortgage from a lender.

If you are concerned that you are selling your mortgage, there are a few options. Your lender should be able to assist you in this regard. Many lenders have policies in place to keep borrowers from losing their homes as a result of the sale of their mortgages. Second, conduct a thorough research into your rights. You might be able to negotiate a clause in your loan that prevents the sale of your mortgage. If you are concerned about your legal rights, you should consult with a lawyer. You may need a lawyer to learn more about your options and protect them.

What Are The Alternatives To A Car Loan Transfer

If youre not yet sure if a car loan transfer is the best option for you, you may have to check out some alternatives.

- Car Loan Refinancing If you can no longer afford to make payments on your car loan but you still have a good credit score, you should consider a car loan refinancing. Getting your auto loan refinanced will allow you to get better repayment terms and maybe even lower interest rates.

- Sell The Car If you have accumulated a decent amount of positive equity in your car, you can sell the vehicle and use part of the proceeds to pay off your outstanding car loan balance. Plus, you can use the remaining amount to buy a cheaper car if you want to.

Don’t Miss: What Is A Good Home Mortgage Rate

Compare The Fees And Charges

A mortgage broker or a comparison website can help you find out what’s available.

Comparison websites can be useful, but they are businesses and may make money through promoted links. They may not cover all your options. See what to keep in mind when using comparison websites.

Compare these fees and charges:

|

Fixed rate loan |

How Does A Mortgage Transfer Work

A mortgage can be transferred from one lender to another, from one servicing company to another and from one borrower to another. It is even possible for a borrower to transfer an existing mortgage from one property to another. Any of these transfers can take place without affecting the basic terms of the mortgage, such as the balance, interest rate, term and payment. Lets break down how a mortgage transfer works.

A financial advisor can help you put a financial plan together for your home buying needs and goals.

Also Check: Can You Pay Off A Mortgage Early

How To Upgrade Your Car When You Still Have A Loan

Whether its a change in lifestyle, accident damage or a great sales deal, there are times when changing cars is a major priority. But what happens if you want to get a new car when youre still paying off your old one?

When you first take our a car loan, you sign a legally-binding contract and agree to pay back the full amount, including interest and fees specified in the product disclosure statement. That means you will have to deal with this loan if you want to buy another car and trade-in or resell your current one. As insurance company Allianz explains on its website:

If you fail to repay a secured loan, the lenders are entitled to repossess and sell your car as a means to cover their losses. If the vehicle sale doesnt cover the full amount of the loan, you will have lost your car and still have money owing.

The above scenario is exactly what we want to avoid. But paying off the existing vehicle and a new one is also something most people want to avoid especially when you could get a better price for a new car by reselling or trading in the one you currently drive.

In most cases the ideal outcome is to get rid of the existing loan and get a new one to suit your new car. In order to do this, St George says the existing loan needs to be paid out in full at or before time of sale .

On This Page

What Should I Do Before I Switch Mortgage Providers

Speak to your current provider first to see if they can offer you a more competitive deal. Its normally easier to complete a mortgage transfer than it is to change providers. But if its not the right deal for you, its often worth the effort to move on.

Before you start the switching process youll need to:

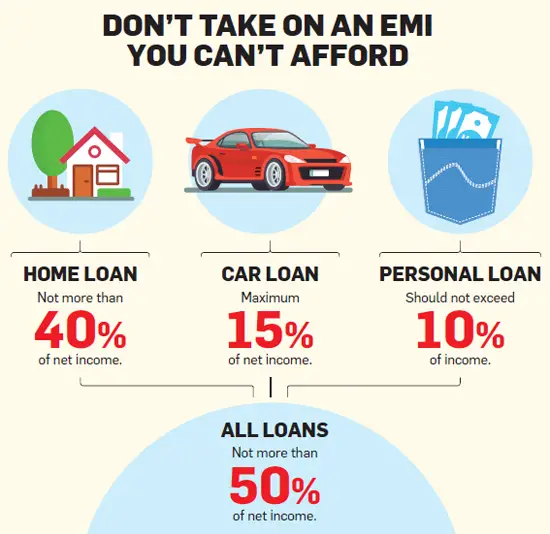

Your mortgage is likely the biggest loan youll ever have in your life, so before you switch providers or change deals, its worth asking an independent mortgage advisor for advice. Theyll look at your personal circumstances, including your income, expenses, everyday spending and other debts, to calculate what mortgage payments you can afford. Theyll also weigh up your propertys valuation against the amount you have left to pay on your mortgage to see what interest rates you can expect. Mortgage advisors will also be familiar with the current deals available in the market.

Weve partnered with London & Country Mortgages Ltd ** to provide you with fee-free mortgage advice. Get in touch with one of their advisers here.

Read Also: What’s The Going Mortgage Interest Rate

How To Transfer Personal Loan

The process to shift to a new Bank takes 5-7 days and its easy if your track on the Personal loan is good and you have a good credit history.

So if you have the option- and even if the process takes 1-2 days of your work we recommend that this should be done as it will save you a lot and at least more than the 2 days of work.

- Every consumer after 2-3 years should review rates and shift to a better lender if required.

- A consumer should also approach his own Bank if he feels the rates are higher as sometime the existing Bank on a fear of loosing good customer matches the new Bank rates with nominal one time fee.

How To Refinance To Pay Off Debt

Whether you’re tired of dealing with unhelpful customer service with your current mortgage lender or just hoping to get a better rate, transferring your mortgage can sometimes be a good financial strategy. To transfer your mortgage, you’ll need to refinance with a new bank. Some people refinance to get shorter mortgage terms or lower mortgage rates, and if the term of the mortgage with the new bank is the same length as with the previous bank, you’ll effectively be extending the length of your mortgage if you’ve been paying toward the current mortgage for a few years.

Read Also: How To Calculate Private Mortgage Insurance

Why Transfer Your Mortgage To Another Person

Transferring mortgages between individuals can be complicated, and is not something you see often in the UK. However, if youre considering adding or removing individuals on your mortgage, this is something that can be looked at.

There are many reasons for doing this. For example, you may want to:

- Change from a single to joint mortgage

- Move from a joint to single mortgage

- Remove a borrower

These things should not increase the borrowed amount, but be aware that you may have to pay a fee for the transfer.

How Easy Is Moving Your Mortgage To Another Bank

Of course a bank that you are considering switching to will make it as easy as possible to move with them. Many banks simply require proof of income, details of debts and expenses and some form of ID.

If youre buying property whilst switching, then additional information such as a registered valuation, proof of deposit and other sales agreement documents will be required as well.

Moving away from your existing bank tends to be where complications lie, although with appropriate support this too can be a seamless and stress free process.

Recognise that you will incur a break fee for ending the terms of your contract with your current bank prior to the agreement being due to end. Additional legal fees should be expected as well, to go through the finer details of this.

Some fees may be waived through the agreement with your new bank and by working with a mortgage advisor, we can point you in the right direction to cut as many costs as possible.

You May Like: How Do You Qualify For A Mortgage Modification

How To Switch Mortgage Companies

Switching mortgage companies is fairly straight forward. First, speak with a mortgage broker. I am biased as a mortgage broker. Speak with me even, but if you don’t speak with me , then find a mortgage broker to review your options.

If you visit a bunch or different banks yourself, you may be able to compare rates but you may not know all the questions to ask and the subtle differences between the mortgages being offered.

A mortgage broker can highlight all the different options available to you with each lender, including many of the terms and options that we discussed earlier in this article.

To switch to another bank , you will be complete an application. The new lender will also want to review your documents to ensure that you qualify for the mortgage. They may have to complete an appraisal

The new lender will check your credit, check your income documents, verify that your property taxes are being paid as part of the switch process. Once you are approved, then you will receive a commitment with the rate and terms, etc.

This is when you should do the math. If you are getting better terms and a better interest rate, then switch. If you are getting a better interest rate but not such good terms, then you need to weigh your options.

You could just renew with your current bank. That’s always an option.

To Obtain A Lower Mortgage Rate

If another lender can offer you a lower mortgage rate than what your current mortgage provider has, switching would save you from having to pay potentially thousands of dollars in interest charges.

For example, lets say you have a home worth $400,000 and a $315,000 mortgage amortized over 25 years. Your current lender offers to renew you for a 5-year term at a fixed rate of 2.59%. With that, youll have a monthly mortgage payment of $1,425, and at the end of this 5-year term you will have paid $37,606 in interest.

However, you decide to shop around and find another lender who offers you a 5-year term at a fixed rate of 2.39%. If you make the switch, your new monthly mortgage payment will be $1,394, and by the end of this 5-year term you will pay only $34,650 in interest.

Also Check: What Is Mortgage Debt To Income Ratio

Can You Transfer A Mortgage To Another Person

- You might be able to get a mortgage transfer depending on your circumstance and mortgage type.

- The due-on-sale clause lets you transfer a mortgage in specific circumstances.

- If you dont have an assumable mortgage, refinancing may be a possible option to pursue.

- Read about the different types of mortgages on Insider.

Unplanned circumstances happen in life. If youre going through a divorce or unexpected illness, you might not want to continue paying for a mortgage if it isnt reasonable for your situation.

Some lenders permit a mortgage transfer if you have an assumable mortgage, and if your situation falls into one of the exceptions listed in the due-sale clause.

Heres what youll need to check to see if your mortgage is transferable, and what to do if you cant.

How Is Switching Cheaper

Three main reasons. One, a rule of thumb that home loan experts go by: if your mortgage is 2-3 years old, your interest rate is high. That means you could get a better deal on the same loan today, or a better deal by refinancing . This is why many money experts recommend reviewing your mortgage every two years .

Two, the economic recession has dragged interest rates down to all time lows. Just last November, the Reserve Bank of Australia announced their decision to slash interest rates in response to the recession brought on by the pandemic. The official cash rate is expected to stay at 0.1% until 2024.

Some banks and lenders have honoured this change and reduced their rates. For example, Suncorp is now offering a 1.89% two-year fixed home loan rate . Unless you got a home loan in the last two months, it wont compete with the offers out there now.

Three, new customers always get better rates than existing customers. We know this as ex-bankers ourselves. Banks, especially the big retail ones, are known for giving new customers significantly better rates. This is because gaining new customers adds value to their company. In comparison, existing customers are charged more for the same product. Think of it as youre paying for the convenience of staying with one bank. Only, youre often paying a lot for that convenience, so ask yourself: is it worth the cost difference?

Also Check: How Long Does It Take To Prequalify For A Mortgage

What Is The Process To Change Lenders

Before changing lenders, you must get your mortgage preapproved by your new lender. This step is relatively quick and is usually completed before the offer is made. If you already have a mortgage, you will have gone through a preapproval at least once before. You will need to repeat this process if you decide to change lenders.

When looking for a new mortgage lender, be transparent about the reasons for the change with your real estate agent and the home seller. Sellers may become suspicious of your ability to get a mortgage if they dont hear about the change from you directly. Additionally, provide a new preapproval letter to your real estate agent, if one is involved, in your change of lenders.

The home seller might become alarmed if youre switching from a conventional to an FHA loan because of the FHAs stricter appraisal process. Ultimately, be transparent about your intentions to the sellers and communicate early and often.

The Pros And Cons Of Selling Your Mortgage To A New Bank

When you transfer your mortgage to a new bank, you must re-refidel it. You must reapply for a whole new loan after the bank has taken over your mortgage. Aside from the fact that you already own the property, refinancing your loan is nearly identical to remortgaging your first mortgage. Not only do selling mortgages increase cash flow quickly, but they also reduce liabilities on the balance sheet. You do not have to be quick on the cash registers, but you should be quick on the profit. Banks are required to collect commissions on loans sold by them. In contrast, the interest your bank earns on your mortgage over the course of your loan will take decades to collect. The primary goal of banks selling mortgages is to allow lenders to lend money to new home buyers. Mortgages can be sold to raise funds for additional lending, which is a common practice.

Don’t Miss: Can You Lower Your Mortgage Payment

How To Apply For A Mortgage Refinance With Favourable Rates

The process of applying for a mortgage refinance typically varies by lender. The process may be completely digital, it may be mostly online with some mailed documents to sign or require a fully paper application.

Still, the documentation you will need to complete your refinance application is typically the same across lenders. Lenders will typically want to see:

- Bank statements

- Pay stubs or verification of income

- Documentation of the source of your down payment

- W-2s, if applicable

| View Rates |

Based in Atlanta, Georgia, AmeriSave Mortgage Corporation has established itself as one of the premier names in the mortgage loans and refinancing industry. The company was established in 2002, and has since expanded its service to 49 states and the District of Columbia. Today, the company offers a quick and straightforward way for potential homeowners and prospective buyers to uncover the loans they need and access funds efficiently. AmeriSave has expanded to employ more than 500 mortgage specialists, and funds billions in home loans every year. Moreover, the company offers a wide variety of mortgage options, including conventional, jumbo, FHA, VA and USDA loans.

AmeriSave MortgageView Rates

Quicken LoansView Rates

How Do People Benefit From Mortgage Switch Deals

One of the usual reasons why we see people transferring their mortgage to another bank is because they are looking to either increase or reduce their repayment amounts and end up changing banks whilst doing this.

Banks, like any other business, compete with one another constantly. They offer their customers the best deals so that they can maintain your loyalty. Take the time to keep your eyes and ears open to any promotions that would financially benefit you whilst considering whether the time is right to leap at the chance to pursue some additional personal goals.

We can help you to decide whether it would be advantageous for you to restructure your loan and move it to another bank to benefit from certain offers.

Restructuring your loan for personal reasons is usually why you would consider moving your mortgage to another bank. These personal reasons are varied, but generally offer you an advantage in doing so.

Some reasons include but are not limited to:

- Fixed interest rate term is ending

- Cash back schemes

Although banks often appear identical on the surface, they are all very different. Each bank has unique lending policies, and their own mortgage calculators will provide you with wildly different options. In addition to internal policy differences they use different property valuation techniques sometimes a switch to a new bank can move you out of low equity penalty rates or let you access enough equity to buy an investment property.

Read Also: How Much Is A Mortgage On A 265 000 Home