How Do I Lock In A Mortgage Rate

Once youve selected your lender and are moving through the mortgage application process, you and your loan officer can discuss your mortgage rate lock options. Rate locks can last between 30 and 60 days, or even more if your loan doesnt close before your rate lock expires, expect to pay a rate lock extension fee.

How Do I Pay For Cmhc Insurance

Your lender is actually the party responsible for payingCMHC insurancecosts. In the majority of cases, your lender will pass these costs down to you by adding the CMHC insurance premium to your mortgage loan amount. This will slightly increase your monthly or bi-weekly payment.

In some cases, your lender may allow you to pay CMHC insurance costs as a lump-sum, or not pass down the cost to you at all. Contact your lender for more details.

Whats The Difference Between A Fixed And Variable Rate

- A fixed interest rate will not change during your mortgage term.

- A variable interest rate can change during your mortgage term.

Having a fixed rate means that your mortgage rate will not change until your mortgage term is over. You can choose to get a fixed-rate mortgage for a long term length if you think rates will increase soon, or for a short term length if you think rates will stay the same or decrease. The 5-year fixed rate mortgage is the most popular mortgage type in Canada.

On the other hand, avariable mortgage ratecan change at any time. Your mortgage payments will still stay the same, but what changes is the percentage of your payment that goes towards paying off the mortgage principal. If rates decrease, a larger amount of your monthly payments will be going towards your principal. This means that if interest rates decrease, youll be able to pay off your mortgage faster with a variable rate.

If interest rates rise, a larger amount of your monthly payments will go towards your mortgage interest. Your monthly payment amount is fixed for the duration of your term, so you wont have to pay more money if rates rise. However, your mortgage payments must be enough to cover at least your monthly interest cost. If interest rates increase significantly, where your mortgage payment no longer covers the interest cost, then your mortgage payment amount will need to be increased.

Recommended Reading: Mortgage Rates Based On 10 Year Treasury

What Are Origination Fees

An origination fee is what the lender charges the borrower for making the mortgage loan. The fee may include processing the application, underwriting and funding the loan as well as other administrative services. Origination fees generally do not increase unless under certain circumstances, such as if you decide to go with a different type of loan. For example, moving from a conventional to a VA loan. You can find origination fees on the Loan Estimate.

Jumbo Mortgage Interest Rate Moves Up +025%

The average jumbo mortgage rate today is 5.45 percent, up 25 basis points from a week ago. This time a month ago, the average rate on a jumbo mortgage was higher, at 5.51 percent.

At the average rate today for a jumbo loan, youll pay a combined $561.53 per month in principal and interest for every $100k you borrow. Compared to last week, thats $14.89 higher.

Recommended Reading: Chase Mortgage Recast

What Is A Good Loan Term

One important thing you should consider when choosing a mortgage is the loan term, or payment schedule. The most common loan terms are 15 years and 30 years, although 10-, 20- and 40-year mortgages also exist. Another important distinction is between fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are the same for the life of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only stable for a certain amount of time . After that, the rate adjusts annually based on the current interest rate in the market.

When choosing between a fixed-rate and adjustable-rate mortgage, you should take into consideration how long you plan to live in your home. For people who plan on living long-term in a new house, fixed-rate mortgages may be the better option. While adjustable-rate mortgages might offer lower interest rates upfront, fixed-rate mortgages are more stable over time. However you might get a better deal with an adjustable-rate mortgage if you only have plans to to keep your house for a few years. The best loan term is entirely dependent on an individual’s situation and goals, so be sure to consider what’s important to you when choosing a mortgage.

Find the Best Refinance Rates with the CNET Rate Alert

The Impact A Good Mortgage Rate Can Have

Your mortgage rate is the interest you pay on your remaining loan balance. Its expressed as a percentage, and if its fixed, it will never change. Adjustable mortgage rates are fixed for a limited amount of time, perhaps 3-10 years, and then typically reset every year after the introductory period.

The longer your mortgages repayment period, the more interest youll pay overall. For a traditional 30-year mortgage, you could end up paying over 50% of what you initially borrowed just in interest. Heres what youd pay in interest for a $150,000 30-year mortgage at 3.3% and 4.3%, according to NextAdvisors mortgage calculator.

| Loan Term |

|---|

| $117,345 |

Don’t Miss: Mortgage Recast Calculator Chase

Should I Use An Ontario Mortgage Broker

Ontario mortgage brokers often have the lowest rates in the province, particularly for default-insured mortgages. And theyre generally free of charge for qualified borrowers. Ontario brokers also tend to provide better advice than many lender representatives since they specialize in mortgages and deal with multiple lenders. Note that all brokers must be licensed by the Financial Services Regulatory Authority of Ontario. Heres a link to see if your broker is licensed.

Canada Vs Usa Mortgage Terms

Canadas mortgage term lengths are relatively short when compared to mortgages in the United States. The most common mortgage in the U.S. is the 30-year fixed mortgage, which means that homeowners dont need to renew their mortgage for the entirety of their amortization. This is a large departure from the Canadian mortgage market, where homeowners expect to renew and renegotiate their mortgage rates often.

Don’t Miss: Requirements For Mortgage Approval

What Is A Discount Point

A discount point is a fee you can choose to pay at closing for a lower interest rate on your mortgage. One discount point usually costs 1% of your mortgage, and it reduces your rate by 0.25%. So if your rate on a $200,000 mortgage is 3.5% and you pay $4,000 for two discount points, your new interest rate is 3%.

Year Mortgage Rate Forecast For 2021 2022 2023 2024 And 2025

| Month |

| 31.1% |

30 Year Mortgage Rate forecast for .Maximum interest rate 3.14%, minimum 2.96%. The average for the month 3.05%. The 30 Year Mortgage Rate forecast at the end of the month 3.05%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.07%, minimum 2.89%. The average for the month 3.00%. The 30 Year Mortgage Rate forecast at the end of the month 2.98%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.02%, minimum 2.84%. The average for the month 2.94%. The 30 Year Mortgage Rate forecast at the end of the month 2.93%.

Mortgage Interest Rate forecast for .Maximum interest rate 2.98%, minimum 2.80%. The average for the month 2.90%. The 30 Year Mortgage Rate forecast at the end of the month 2.89%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.10%, minimum 2.89%. The average for the month 2.97%. The 30 Year Mortgage Rate forecast at the end of the month 3.01%.

Mortgage Interest Rate forecast for May 2022.Maximum interest rate 3.25%, minimum 3.01%. The average for the month 3.11%. The 30 Year Mortgage Rate forecast at the end of the month 3.16%.

30 Year Mortgage Rate forecast for .Maximum interest rate 3.37%, minimum 3.16%. The average for the month 3.24%. The 30 Year Mortgage Rate forecast at the end of the month 3.27%.

Mortgage Interest Rate forecast for .Maximum interest rate 3.42%, minimum 3.22%. The average for the month 3.31%. The 30 Year Mortgage Rate forecast at the end of the month 3.32%.

Read Also: Rocket Mortgage Conventional Loan

When Should I Lock In A Mortgage Rate

You should lock in a mortgage rate if you find a rate you’re comfortable with and you can afford the monthly payments. In some cases, home buyers will wait to lock in their mortgage rate just in case interest rates go down. But because interest rates are unpredictable, this is risky.

A mortgage rate lock guarantees your interest rate for a certain period of time, typically until your closing date. It usually lasts from the initial loan approval until you get the keys to your new home.

Locking in your rate isn’t necessarily just about getting the best rate. A lock also protects you against any rate hikes that happen before closing. It can let you know from the beginning of the process what your monthly payments will be and help you avoid surprises come closing day.

It may seem like there’s a lot to learn about buying a home, especially if you’re a first-time buyer. If you’re still feeling overwhelmed, check out our beginner’s guide to home loans. It can help you navigate all the steps, including how to find the best mortgage rates today.

What Is A Good Mortgage Interest Rate

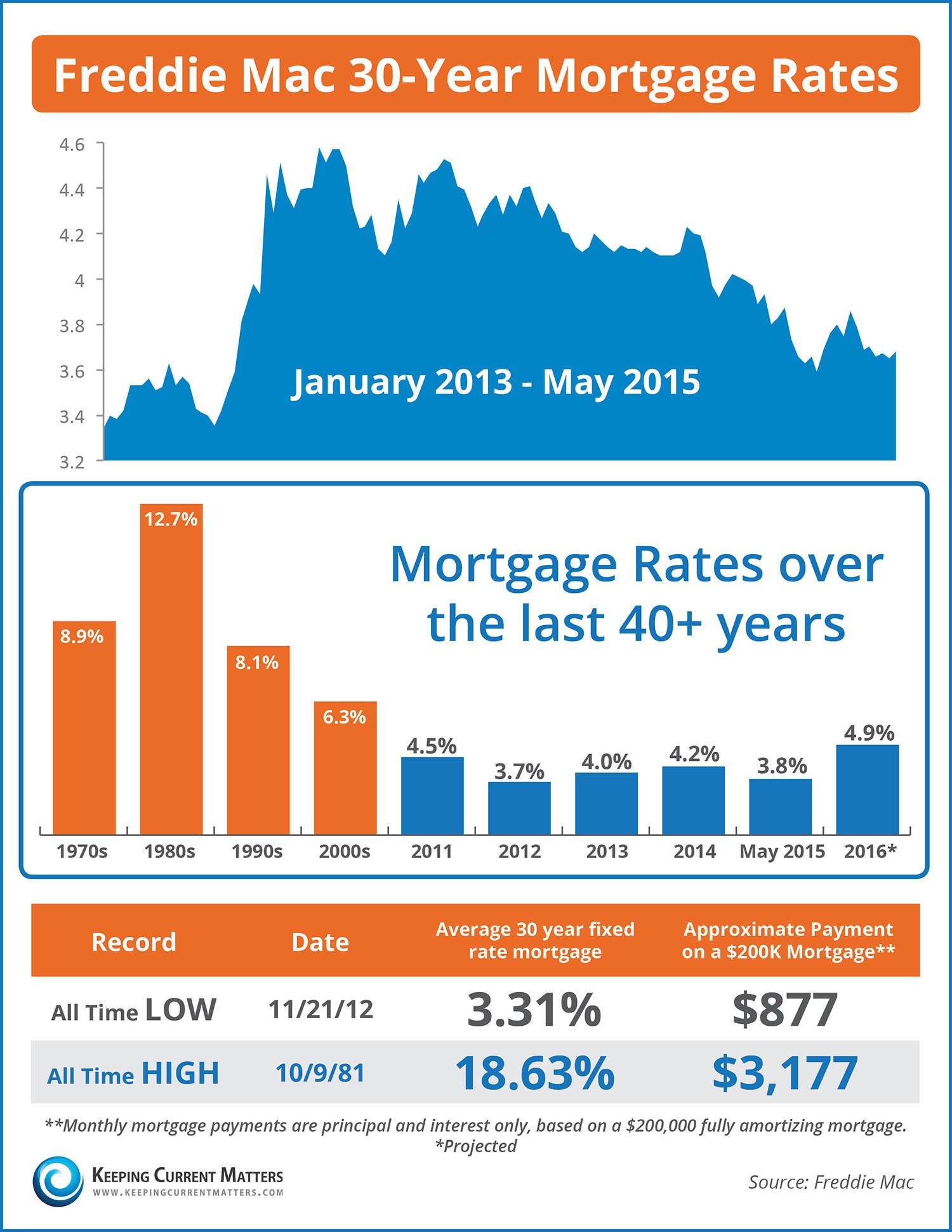

![Mortgage Rates & Payments by Decade [INFOGRAPHIC] Mortgage Rates & Payments by Decade [INFOGRAPHIC]](https://www.mortgageinfoguide.com/wp-content/uploads/mortgage-rates-payments-by-decade-infographic-tami-savage-realtor.png)

In general, you can consider a good mortgage rate to be the average rate in your state or below. This will vary depending on your credit score better scores tend to get better mortgage rates. Overall, a good mortgage rate will vary from person to person, depending on their financial situation. In 2020, the US saw record-low mortgage rates across the board, and it’s expected they’ll stay low throughout 2021.

You May Like: 10 Year Treasury Yield Mortgage Rates

Why Is My Mortgage Rate Higher Than Average

Not all applicants will receive the very best rates when taking out a new mortgage or refinancing. Credit scores, loan term, interest rate types , down payment size, home location and the loan size will all affect mortgage rates offered to individual home shoppers.

Rates also vary between mortgage lenders. It’s estimated that about half of all buyers only look at one lender, primarily because they tend to trust referrals from their real estate agent. Yet this means that they may miss out on a lower rate elsewhere.

Freddie Mac estimates that buyers who got offers from five different lenders averaged 0.17 percentage points lower on their interest rate than those who didn’t get multiple quotes. If you want to find the best rate and term for your loan, it makes sense to shop around first.

What Controls A Variable Interest Rate

Your variable interest rate is directly controlled by your lender via theirPrime Rate. Each lender can choose to increase or decrease their own prime rate, in turn increasing or decreasing your variable interest rate.

Lenders will usually adjust their prime rate to reflect changes in theBank of Canadas Policy Interest Rate. This means that lenders will tend to have similar or identical prime rates. All major Canadian banks currently have a prime rate of 2.45%.

You May Like: Rocket Mortgage Payment Options

Adjustable Rates Offer Greater Flexibility

The adjustable rate programs do allow you more flexibility in how you can receive your funds.

First option would be a cash lump sum.

This is not advised on the adjustable product as a cash lump sum request is usually associated with fixed interest rates, however it is available.

Second option would be a line of credit.

The HECM line of credit is not the same as a Home equity Lines of Credit or that you can get at your local bank.

The Reverse Mortgage line of credit grows in available on the unused portion and cannot be frozen or lowered arbitrarily as the banks can and have done recently on the HELOCs.

Third option is a monthly payment option which can be set over a specific period and then cease or as a tenure which would be a monthly payment guaranteed for life.

Fourthly, a homeowner could choose any combination of the three options listed previously.

The adjustable rates are currently much more flexible to meet borrowers needs.

Mortgage Interest Rate Forecast

Mortgage rates have fluctuated consistently over the past year. The rate on a 30-year fixed-rate mortgage dipped as low as 2.65% in January 2021 and reached a high of 3.18% on April 1.

So, what can we expect over the next year?

As long as the economic expectations of a strong rebound and an increase in inflation continue to pan out, the risk will be toward the side of higher interest rates rather than lower rates, says Greg McBride, Chief Financial Analyst at Bankrate.com. But with a much slower growth pace expected in 2022, that might trigger a pullback at some point in the second half of the year. Either way, expect mortgage rates to remain in the 3% 3.5% range throughout.

According to Freddie Macs most recent quarterly report, rates are expected to rise slowly but consistently throughout the year. Reaching 3.2% in quarter two, 3.3% in quarter three, and 3.4% in quarter four.

Mortgage rates are largely tied to the economy. And as the economy continues to improve from the pandemic, mortgage rates will rise. First, the American Rescue Plan Act of 2021 helped increase consumer confidence, as well as the amount of money that families had in the bank.

The early months of 2021 have also seen an increase in the labor market and a decrease in unemployment, helping move the economy in the right direction. And with the most recent CDC updates regarding vaccination numbers and mask guidelines, Americans can see the light at the end of the tunnel for the pandemic.

Read Also: Bofa Home Loan Navigator

When Should I Lock My Mortgage Rate

Right now mortgage rates are historically low, so its a good idea to lock your rate as early in the mortgage application process as possible. Rates move up and down from day to day, and knowing exactly where theyll move is impossible. A rate lock will protect you from potential interest rate increases, which could unexpectedly increase the cost of your home loan.

If youre concerned about interest rates dropping after you lock in your rate, you can ask your lender if it offers the option to change your rate if it drops, this is also called a float down. With this option, youll need to pay attention to the fine print. Typically, you can only reduce your mortgage rate if it drops by a certain percentage, and there are likely to be fees associated with this option.

Check Your Refinance Options Even If Youre Not Sure Youd Qualify

According to Black Knights September Mortgage Monitor, nearly 12 million homeowners could still qualify to refinance and cut their interest rate by at least 0.75%.

And yet, many homeowners hesitate to refinance because they dont think theyd be eligible or because refinance closing costs are too high.

Lenders recognize these challenges. And Fannie Mae and Freddie Mac are working to address homeowners refi concerns.

Two new refinance programs, Fannie Maes RefiNow and Freddie Macs Refi Possible, are expanding refinance opportunities to low- and moderate-income homeowners.

If you make average income for your area and have a high mortgage interest rate, you might qualify to refinance with reduced closing costs.

To learn more about these programs and check your eligibility, read:

Don’t Miss: Recasting Mortgage Chase

Average Mortgage Interest Rate By Credit Score

National rates aren’t the only thing that can sway your mortgage rates personal information like your credit history also can affect the price you’ll pay to borrow.

Your is a number calculated based on your borrowing, credit use, and repayment history, and the score you receive between 300 and 850 acts like a grade point average for how you use credit. You can check your credit score online for free. The higher your score is, the less you’ll pay to borrow money. Generally, 620 is the minimum credit score needed to buy a house, with some exceptions for government-backed loans.

Data from credit scoring company FICO shows that the lower your credit score, the more you’ll pay for credit. Here’s the average interest rate by credit level for a 30-year fixed-rate mortgage of $300,000:

| FICO Score |

According to FICO, only people with credit scores above 660 will truly see interest rates around the national average.

What Credit Score Do You Need To Get A Mortgage

Most conventional loans require a credit score of 620 or higher, but Federal Housing Administration and other loan types may accommodate lenders with scores as low as 500, depending on your down payment. If you have a high credit score, you may be offered a lower interest rate and more modest down payment. Improving your credit score before applying for a mortgage can save you money even if you already qualify for a loan.

” is the biggest factor in interest rates on both mortgages and all other lending products, so making sure credit balances are below 30% is key to maximizing a credit score,” says Lotz. “If a person finds errors on their credit report, they should dispute them to ensure the most accurate history.”

Don’t Miss: Chase Recast

Fixed Interest Rate Mortgage

Fixed interest rates stay the same for your entire term. They are usually higher than variable interest rates.

A fixed interest rate mortgage may be better for you if you want to:

- keep your payments the same over the term of your mortgage

- know in advance how much principal youll pay by the end of your term

- keep your interest rate the same because you think market interest rates will go up