How Frequently Does The Arm Adjust

An ARMs initial interest rate will stay the same for a period of time usually three, five, or seven years. After that, most ARMs adjust their rate every year to reflect market conditions.

Make sure your ARMs introductory period lasts long enough to create the savings youre aiming for. Remember that refinancing your mortgage loan requires closing costs, so youll have to pay to exit your ARM.

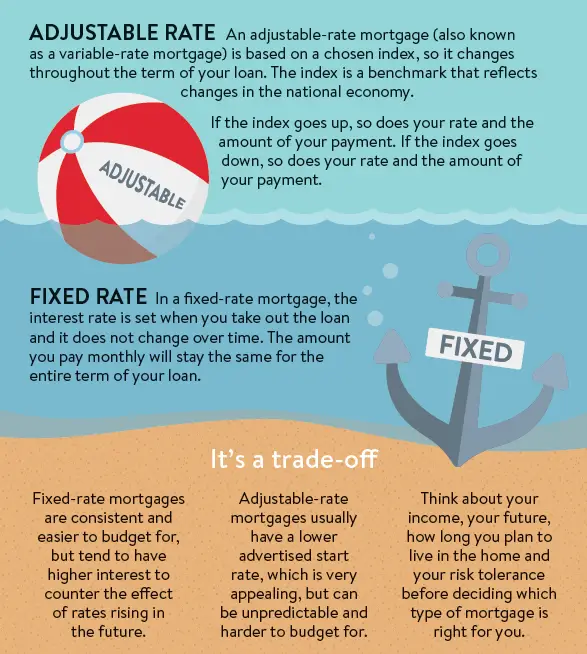

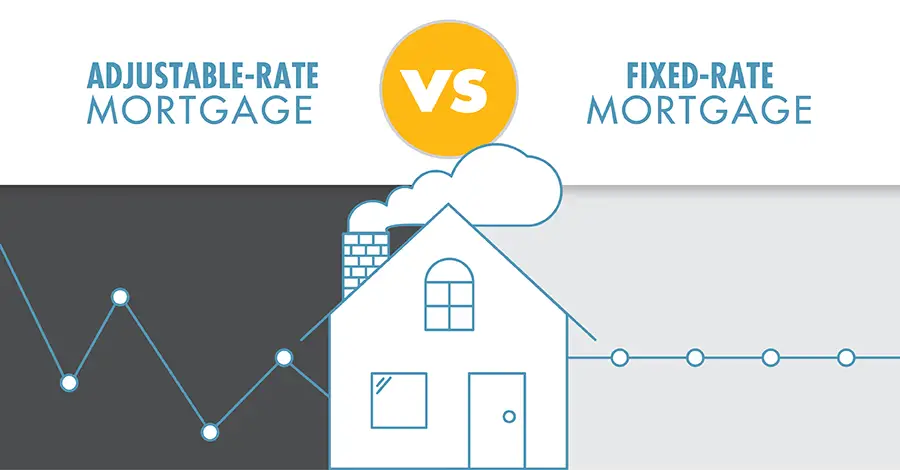

Whats Better Fixed Or Changeable Speed

Interest rates were a tad bit more complex than simply better or worse. You can find pros and cons to both set and variable rates interest levels. The major advantageous asset of creating a set rates is you will know exactly what youre having to pay, no shocks. This is why economic preparing smoother and may supply satisfaction. Proper exactly who appreciates predictability within funds or cant pay the likelihood of a variable price loan, a set rates financing may be the proper possibility.

However, for those who have a varying interest rate financing, there is the potential for saving cash. For a lasting financing like a mortgage, it is possible that the interest prices will drop across term of ones mortgage. Therefore during the time youre settling the borrowed funds your interest levels could lessening, helping you save revenue. However, theres furthermore the specific potential that rates of interest could rise, indicating credit is actually much more pricey than your originally think. People prepared to make the hazard, varying price interest financing include a potentially good option. Knowing you will be able to pay off your loan quickly a variable rate interest mortgage might be best because beginning rates are often below which were fixed rates financial loans, this can be built to stabilize any additional hazard for individuals.

Old Faithful: The Fixed

A fixed-rate mortgage is what most people think of when they imagine how to finance a home purchase. When youget a fixed-rate mortgage, youll commit to a single interest rate for the life of the loan. That rate depends on market interest rates, on your credit score and on your down payment.

If interest rates are high when you get your mortgage, your monthly payments will be high too because youre locked in to the fixed rate. And if interest rates later go down youll have torefinance your mortgage in order to take advantage of the lower rates. To refinance, youll have to go through the hassle of putting together your paperwork, applying for a mortgage and paying for closing costs all over again.

The big draw of the fixed-rate mortgage, though, is that it gives the homebuyer some certainty in an uncertain world. Lots of things can happen over the life of your mortgage: job loss, uninsured illness, tax increases, etc. But with a fixed-rate mortgage, you can be sure that a hike in the interest you pay each month wont be one of those financial snags.

With a fixed-rate mortgage, the lender bears the risk that interest rates will go up and theyll miss out on the chance to charge you more each month. If rates go up, theres no way they can increase your payments and you can rest easy. In other words, the fixed-rate mortgage is the dependable option.

Also Check: How Much Do You Owe On Your Mortgage

Rate Caps Limit How Much Your Arm Can Change

An ARM has another important series of numbers that set limits on how much your loan rate can change. This series of numbers shows your rate caps.

For example, if you have an ARM with a 2/2/5 cap, your rate cannot change by more than:

- 2% after the fixed-rate period ends

- 2% for each adjustment period

- 5% over the life of the loan

So, with a 2/2/5 cap on a 5/1 ARM with an introductory interest rate of 3%, your loans rate:

- Would remain at 3% for the five-year introductory period

- Could reach as high as 5% after the intro rate expires

- Could increase by up to 2% at each subsequent yearly adjustment

- Could never surpass 8% during the life of the loan

These lifetime caps on ARMs protect borrowers from out-of-control rate increases, but even a 5% rate increase would mean much higher monthly payments.

Youd want to refinance out of your ARM before its intro rate expires, especially during a high-rate environment.

How Are Arm And Fixed

Believe it or not, ARMs and fixed-rate mortgages do have a few things in common.

Term Length

Both ARMs and fixed-rate loans offer the same term lengths. A term length is the number of years youll spend paying off your loan. For example, ARMs and fixed-rate loans are both available with common 30-year term lengths.

Whether you apply for an ARM or a fixed rate, your lender will look at more than just your income. Your plays a major role in your ability to get any type of mortgage.

Your credit score is the numerical representation of your credit history. Its a three-digit number that expresses how consistent a borrower is when paying back debts. Most lenders and financial institutions consider good credit to be a score of 700 or above. The higher your credit score, the more likely youll be able to get either an ARM or a fixed-rate mortgage.

You May Like: How To Check Credit Score For Mortgage

May Be More Readily Available To Those With Poor Credit

Bearing these risks in mind, one of the biggest appeals of ARMs may be that borrowers with limited or poor credit histories may have a better chance of getting one than they would a fixed-rate loan. ARMs are the most common type of subprime mortgages, but their initial affordability and availability also makes them popular among borrowers with fair to good credit.

How Does An Arm Work Reading The Numbers

When youre considering an adjustable-rate mortgage, be sure to learn all of the loans details so youre not surprised by a rate change.

Most importantly, youll want to know how long the initial interest rate will last before the rate adjustments begin.

An ARM will tell you this detail in its series of numbers. In a 5/1 ARM, for example, the first number tells you the length of the loans introductory period. In this case, youd have a fixed interest rate for five years before the rate increases or decreases.

The second number shows how often the loans rate can change. In a 5/1 ARM, your rate could change each year after the five-year introductory period expires.

Recommended Reading: What Salary Is Required For A Mortgage

Accomplishing Your Other Goals

If you choose to refinance to a fixed-rate loan, you may also have the opportunity to make additional changes to your loan at the same time. Depending on your circumstances, you may also be able to lower your monthly payments, shorten your loan term or borrow from a portion of your available home equity. Talk to your lender about what youd like to accomplish and see whats achievable for your situation.

Fixed Rate Or Adjustable Rate: Which Loan Is Right For You

If youre like most homebuyers, youll want the predictability of a fixed interest rate.

After all, with a fixed rate on a 30-year mortgage, the payment on your principal and interest wont change for three decades.

So how will you know if an ARM could save you money? Answering these questions can help:

Read Also: How Big A Mortgage Can I Get With My Salary

Historical Prime Lending Ratesfrom 1935

The Bank of Canada adjusts the prime rate depending on the state of the economy, as determined by the economic factors introduced above. Together, combinations of unemployment, export, and manufacturing values shape the inflation rate. Generally speaking, when inflation is high, the Bank of Canada will increase the prime rate to make the act of borrowing money more expensive. Conversely, when inflation is low, the Bank of Canada will decrease the prime rate to stimulate the economy and improve the attractiveness of borrowing.

In terms of the discount/premium on the prime rate applied to variable rates, mortgage lenders set this based on their desired market share, competition, marketing strategy and general credit market conditions. These are the same factors that drive the spread between lenders’ fixed mortgage rates and bond yields.

Which Loan Is Best Suitable

When choosing a mortgage, theres a wide range of personal factors to consider according to the economic realities of an evolving marketplace.

To decide between the fixed-rate mortgage and adjustable-rate mortgage, ask yourself the following questions:

- How much mortgage payment can you afford?

- Will you be able to afford an ARM if the interest rates increase?

- How long do you plan to live on the property?

Recommended Reading: What Is The Mortgage On 1.4 Million

Locked In If Interest Rates Fall

Like all interest rates, mortgage rates rise and fall with market conditions. U.S. interest rates have been remarkably low over the past decade, and mortgage rates have largely followed suit. If you can nab a low rate when you take out your loan, this will be beneficial in the long run.

However, if you lock in a 30-year fixed-rate loan during a period of high interest rates, it can be very costly. If interest rates go down significantly, it may be possible to refinance a high interest loan by taking out another mortgage at a lower rate, but fees and services involved in that process can cost thousands of dollars. It may be worthwhile to save tens of thousands of dollars over the life of the loan, but it’s still a major expense.

Which Loan Is Right For You

When choosing a mortgage, you need to consider a wide range of personal factors and balance them with the economic realities of an ever-changing marketplace. Individuals personal finances often experience periods of advance and decline, interest rates rise and fall, and the strength of the economy waxes and wanes. To put your loan selection into the context of these factors, consider the following questions:

- How large a mortgage payment can you afford today?

- Could you still afford an ARM if interest rates rise?

- How long do you intend to live on the property?

- In what direction are interest rates heading, and do you anticipate that trend to continue?

If you are considering an ARM, you should run the numbers to determine the worst-case scenario. If you can still afford it if the mortgage resets to the maximum cap in the future, an ARM will save you money every month. Ideally, you should use the savings compared to a fixed-rate mortgage to make extra principal payments each month, so that the total loan is smaller when the reset occurs, further lowering costs.

If interest rates are high and expected to fall, an ARM will ensure that you get to take advantage of the drop, as youre not locked into a particular rate. If interest rates are climbing or a steady, predictable payment is important to you, a fixed-rate mortgage may be the way to go.

Read Also: How Do You Buy Down A Mortgage Rate

Whats Better Fixed Or Changeable Rate

Rates are a little more intricate than just best or worse. Discover pros and cons to both solved and changeable price interest rates. The big advantageous asset of having a set rate is that you will usually know precisely what you are having to pay, no shocks. This is why economic thinking smoother and can offer you satisfaction. For anyone who appreciates predictability in their funds or can not pay the risk of a variable speed mortgage, a hard and fast speed financing is the correct selection.

However, when you have a variable rate of interest loan, there is the possibility of saving money. For a long-lasting mortgage like a home loan, its likely that the attention rate will decrease within the label of your mortgage. Which means at that time youre paying down the mortgage your interest rates could lessen, helping you save money. However, theres furthermore the unique chances that the interest levels could increase, meaning borrowing from the bank is far more high priced than you initially thought. For all those ready to make hazard, variable speed interest financing tend to be a potentially good choice. Once you know its possible to repay your loan quickly a variable rates interest loan could possibly be better since the starting costs are usually below which were solved price financing, this is certainly made to stabilize the excess danger for borrowers.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Read Also: What Is The Effect Of Paying Extra Principal On Mortgage

Hybrid Adjustable Rate Mortgages

Though fixed rate mortgages and ARMs are the most common, hybrid ARMs may offer a best of both worlds solution for some homebuyers.

Hybrid ARMs start with a fixed interest rate for a certain time period before they convert into a traditional ARM contract. The longer the initial term, the higher the interest rate for that amount of time.

The initial fixed interest rate is still generally lower than a traditional fixed-rate mortgage, but the starting rate for hybrid ARMs typically doesn’t get as low as conventional ARMs.

Hybrid ARMs work well for people expecting to earn a higher income in the future, but want to find a way to secure a more affordable mortgage payment in the near-term. This is very common when people upgrade from their first home to their second home. The idea is that you take advantage of the lower temporary fixed rate until you can refinance into a fixed-rate mortgage at a later date.

This is a particularly important concept when buying a home in a competitive market. When house hunting in a sellers market, you can easily find yourself stretching your budget to buy the home you want. A hybrid ARMs lower initial rate can help you get into a more expensive home so long as you can sell or refinance before the adjustable part kicks in and you risk having your variable rate rise.

Why Is An Adjustment Rate Mortgage A Bad Idea

Buying a home with an ARM would be a bad idea if:

This combination could increase your monthly payment significantly. It could make your home unaffordable.

Also Check: How Much Should Mortgage Payment Be Compared To Income

Is An Arm Or Fixed

Choosing between an ARM and a fixed-rate mortgage is all about risk versus reward. With a fixed-rate mortgage, the borrower locks in a rate for the life of the mortgage. With an adjustable-rate, the borrower takes on the risk of their rate rising in the future. In exchange for the increased risk, the borrower typically gets a lower starting interest rate.

Whether an ARM or fixed-rate mortgage is better depends on your individual financial situation, goals, and tolerance for risk. For most people, the chance of getting a slightly lower interest rate up front isnt worth the instability of an ARM or the risk of significantly increased costs in the future. This is especially true in the current rate environment, where low rates across the board mean that the difference between fixed and ARM rates may be minor.

Also, with a fixed-rate mortgage, you have the flexibility to choose a shorter repayment term, like a 15-year loan. Compared to a 30-year mortgage, a 15-year home loan will have a lower interest rate but higher monthly payments. You may potentially pay more per month, but borrowers are willing to do this to pay off the debt faster and save thousands of dollars in interest payments over the life of the loan, says Nadia Alcide, a mortgage professional with Mortgage Biz of Florida. And the option to take a shorter term mortgage isnt typically available with an ARM.

What’s The Difference Between Fixed And Variable Rates

With a fixed rate mortgage, the mortgage rate and payment you make each month will stay the same for the term of your mortgage . With a variable rate mortgage, however, the mortgage rate will change with the prime lending rate as set by your lender. A variable rate will be quoted as Prime +/- a specified amount, such a Prime – 0.45%. Though the prime lending rate may fluctuate, the relationship to prime will stay constant over your term.

Recommended Reading: How Much Money Do Mortgage Brokers Make