Rule : Consider Your Total Housing Payment Not Just The Mortgage

Most agree that your housing budget should encompass not only your mortgage payment , but also property taxes and all housing-related insurancehomeowners insurance and PMI. To find homeowners insurance, we recommend visiting . Theyre what we call an insurance aggregator, which means they compile all the best rates from around the online marketplace and present you with the best ones.

As for just how big a percentage of your income that housing budget should be? It all depends on whom you ask.

What Should I Do If The Lender Refuses To Give Me A Big Enough Mortgage

If various lenders reject your application, its a sign that they dont think you can afford such a big mortgage. Should this be the case, its best to scale down your aspirations rather than desperately search for the one lender that will say yes.

This may be frustrating, but its in your best interest to ensure that youre not financially overstretched because you dont want to have your home repossessed in the future.

Related guides

Avoid The Pitfalls When Determining How Much House You Can Afford

When determining how much house they can afford, people tend to use two basic strategies. Most base their assessment on how large of a loan lenders are willing to give them. But others use their current rent to determine how much they can afford to spend on monthly mortgage payments. The problem with these two approaches is that they tend to lead people to overestimate their budgets.

To know how much house you can afford, you not only need to think about how much you have saved but how much youll be spending. Even though youll no longer be spending money on rent, youll have a slew of new payments that you need to consider, such as closing costs, property taxes, homeowners insurance and fees. And if the home you purchase needs work, youll also have to factor in the cost of home improvements.

You May Like: Are Mortgage Rates Going To Rise

How Much Can I Afford To Spend On A House

The home affordability calculator will provide you with an appropriate price range based on your situation. Most importantly, it takes into account all of your monthly obligations to determine if a home is comfortably within financial reach.

However, when banks evaluate your affordability, they take into account only your present outstanding debts. They do not take into consideration if you want to set aside $250 every month for your retirement or if youre expecting a baby and want to save additional funds.

NerdWallets Home Affordability Calculator helps you easily understand how taking on a mortgage debt will affect your expenses and savings.

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to this top balance transfer card secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt. Read The Ascent’s full review for free and apply in just 2 minutes.

Recommended Reading: What Does A Cosigner Do For A Mortgage

How To Get The Best Interest Rate For My Loan

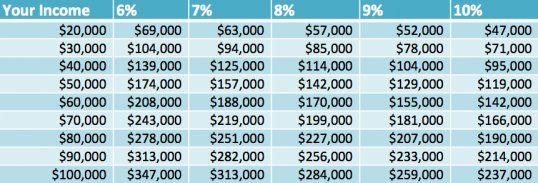

The best interest rate is often the lowest interest rate. Lower interest can drastically change your mortgage debt over time. Minor changes to your interest rate could mean big savings or significant spendings. If youre trying to answer the question of how much can I spend on a house? it has a lot to do with the interest rate your loan comes with.

So, how do you get the best rate? First is to watch current trends on mortgage rates. Rates are updated daily, so its important to keep an eye on them to know when you call your mortgage lender and ask them to lock you into a newly dropped rate. You should also take control of your credit score. Buyers with higher credit scores get approved for lower rates. You can also buy your interest rate down a point or two by paying extra cash up front. If you dont qualify for a low rate, talk to your lender about buying a point to reduce all future payments.

Your Credit Is Key When Buying A House

There are a lot of moving parts in the mortgage process, and lenders will review a lot of variables to determine whether you qualify for a mortgage and how much you can afford. Your credit score is one of the most important of these variables, so it’s crucial that you take time to improve it before you apply for a mortgage loan.

Start by checking your and to see where you stand and which areas you need to address. Then start taking the necessary steps to do so.

This may include getting caught up on past-due payments, paying down credit card debt, disputing inaccurate credit report information and more. Use your credit report as a guide to decide how to build your credit score.

Read Also: Can You Refinance Mortgage Without A Job

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

So Should I Buy A Home

The answer to that question depends on your financial status and your goals. Just because a lender is willing to give you money for a home doesnât necessarily mean that you have to jump into homeownership. Itâs a big responsibility that ties up a large amount of money for years.

Itâs important to remember that the mortgage lender is only telling you that you can buy a house, not that you should. Only you can decide whether you should make that purchase.

Also Check: Can I Get A 30 Year Mortgage

How Much Of Your Income Should You Spend On A Mortgage In The Uk

TL DR: You should try to spend no more than 35% of your gross income on your mortgage. A more conservative recommendation is no more than 25% of your gross income.

If you are currently in the market for a house you will first need to figure out exactly how much you can afford.

There are a lot of costs that go into buying a house and even a scrupulous planner can get overwhelmed by costs if they dont plan properly.

Inorder to figure out how much you can afford to spend on a house, youwill need to figure out:

- Your gross income

- Net cash flow

- How long of a mortgage you want

All of these factors go into determining how much you should be paying each month on your mortgage.

Before we go into specific recommendations for mortgage payments, were going to cover the major types of mortgages and how monthly mortgage payments are calculated.

Know Your Local Housing Market And Plan Accordingly

The real estate market is in an unpredictable place. Home sales went largely on pause during the global COVID-19 pandemic, a struggling stock market caused many in-contract sales to fall through and changes in the short-term rental market might mean former rentals go on the market as homes for sale.

On the one hand, mortgage rates were trending down at the time this was written . They might stay low, keeping monthly payments quite affordable. If thats the case, you could afford to put in a larger offer than youd expected. On the other hand, real estate in your area could come back with a vengeance and drive prices up.

If your maximum spend on a home is $250,000, but desirable homes in your area have been selling for 5% above the asking price, its time to recalibrate. Anticipate going over by 5% and crunch some new numbers. With a maximum budget of $250,000, that will translate to looking for homes with an asking price thats $12,500 or 5% of your actual budget lower than your max.

The bottom line is that the performance of recent sales in your market are the best indicator for how your own purchase will go. If other homes are selling for under the asking price, you should feel empowered to offer under asking on the home of your dreams.

Don’t Miss: What Is The Federal Interest Rate For Mortgage

Budgeting For Your Future

Once you have a workable budget you’ll see how useful it can be to prepare you for the future. For one thing, you’ll have an emergency fund and retirement savings. For another, you’ll be able to make room in your budget if necessary. Say you know you’re spending a hefty sum on eating out, travel or clothes. If that’s within your budget, you’ve paid your bills and you’ve paid yourself, go for it.

Now, what if something changes down the road? Say you want to take a dream job that pays less than you’re currently making or you want to move to a city with a higher cost of living. You can take a look at your budget and see what you can reasonably trim. Maybe you’re willing to cut back on some non-essential spending if it enables you to reach another goal. You won’t know how much you can afford to trim from your budget if you don’t have one at all.

How To Apply The Rule

Look at how much money you have coming in on a regular basis. This will primarily be your salary if you’re working. If your income changes from month to month, work out the average over the last 3 months.

Then, looking at your bank statements for the last 3 months, work out your average monthly spend. It can help to categorise your expenses so you can see specific areas where you may be overspending.

These categories may include your needs, which are regular outgoings like:

-

bills

Then note any money youre putting towards:

-

savings

-

repaying debt

Once you know how much youre spending in each area, you can work out the percentage:

Divide the amount youre spending on needs per month by your monthly income. For example: £750 ÷ £1,500 = 0.5

Multiply that number by 100. For example: 0.5 × 100 = 50%

Once youve worked out the percentages, look at how they compare. Again, its okay if your spending doesnt fit the 50-30-20 rule. But, if youre looking to save more, or repay debts faster, you may be able to make some changes.

Our budget planning tool can help you break down your spending into different categories to see where you could make changes.

If an unexpected expense has knocked you off track one month, dont worry. Just try to get back on track the following month. It can be helpful to have a safety net to cover unexpected costs.

Explore:How to avoid spending youll regret

Read Also: What Is The Highest Interest Rate On Mortgage

How Does Your Debt

An important metric that your bank uses to calculate the amount of money you can borrow is the DTI ratio comparing your total monthly debts to your monthly pre-tax income.

Depending on your , you may be qualified at a higher ratio, but generally, housing expenses shouldnt exceed 28% of your monthly income.

For example, if your monthly mortgage payment, with taxes and insurance, is $1,260 a month and you have a monthly income of $4,500 before taxes, your DTI is 28%.

You can also reverse the process to find what your housing budget should be by multiplying your income by 0.28. In the above example, that would allow a mortgage payment of $1,260 to achieve a 28% DTI.

How Much Are Closing Costs

Buying a home involves several costs in order to complete the purchase such as title insurance, legal fees, land transfer taxes, home inspection fees, appraisal fees, real estate agent commissions, and other expenses. These generally add up to several thousand dollars and should be accounted for from the onset.

Don’t Miss: What Does Points Mean Mortgage

Compare With Your Budget

Now that you know the full cost of homeownership and you have a rough idea of how much you can afford to spend a month, take a look at your household expenses. How does your calculated mortgage premium fit into your budget? When you factor in expenses like homeowners insurance and property taxes, how does your DTI change?

Before you commit to a mortgage, you need to be absolutely sure you can make your premium, insurance and tax payments.

If you dont already have a household budget, track your expenses for a few months and see where your money is going. Look at the amount of money you have coming in and compare it to what you currently pay for housing with the full costs of homeownership. As a general rule, your total homeownership expenses shouldnt take up more than 33% of your total monthly budget.

If your anticipated homeownership expenses take up more than 33% of your monthly budget, you’ll need to adjust your mortgage choice. Taking a longer mortgage term and buying a less-expensive home are two ways you can lower your monthly payment.

What Is A Mortgage

Amortgage is a kind of loan that is used to finance a property. Amortgage is a secured loan, which means that the person whoborrows promises some kind of collateral in the event they cannotrepay that loan in a timely manner. In the majority of cases, thecollateral for a mortgage is the property itself.

Both individuals and businesses use mortgages to finance properties.

The benefit of a mortgage is that it gives you a way to buy some property without having to shell out the entire cost upfront.

Over many years, the borrower pays back the loan plus interest in a series of installments.

In the case when the borrower cannot repay the loan, the mortgage owner has the right to foreclose the property and sell it off to make up the debt.

A mortgage is a specific type of loan, but not all loans are mortgages. The key aspect of mortgages is that they are secured loans and come with some kind of collateral.

Even when you have the funds to pay for the property upfront, it can still be a good idea to secure a mortgage. For example, securing a mortgage can free up funds that you can put into other real estate investments.

There are two major payment components to a mortgage. The monthly principal is the main amount you owe each month and is determined by the amount of the mortgage and the length of the loan terms.

Principal + interest + homeowners insurance + taxes = total monthly payment

Read More: 4 CRUCIAL Things To Look Out For When Buying A Property

You May Like: Is Quicken Loans A Mortgage Company

How Does Credit Affect Mortgage Affordability

A crucial factor in calculating your monthly mortgage payment is the loan’s interest rate. To help determine what your interest rate would be, lenders review your credit report and credit score in addition to other factors.

In general, borrowers with higher credit scores can secure lower interest rates because they’re able to show that they’ve managed their debts well in the past. In the lender’s eyes, this positive payment history lessens the risk that the borrower will default on their monthly mortgage payments.

On the flip side, a low credit score could result in a higher interest rate or even the outright denial of an application. The minimum credit score for a mortgage loan can vary based on the lender and the type of loan you’re applying for.

How Much House Can You Really Afford

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Youve shopped multiple lenders to find your best mortgage rate, and now youre expecting your preapproval letter. If youre a first-time homebuyer, its natural to hope for a large number you want to qualify for as much house as possible. But instead of looking for a big, juicy home value with your name on it, you might want to focus on a smaller, easy-to-swallow figure: the monthly payment.

Rather than committing to the largest possible mortgage, sign up for a monthly payment you can really afford. Heres how that can work.

Recommended Reading: Is A Reverse Mortgage Good Or Bad

Finding The Right Lender

One place to start is with , a site that allows you to get quotes from three lenders in only three minutes. Theres no obligation, but if you see a rate you like for your mortgage or refinancing your mortgage, you can progress to the next step of the application process. Everything is handled through the website, including uploading documents. If you want to speak to a loan officer, you can, of course, but it isnt necessary.

As you shop for a lender, remember that every dollar counts. Youre committing to a monthly mortgage payment based on the rate you choose at the very start. Even small savings on your interest rate will add up over the years youre in your house.

is another great place to get started since they allow you to shop and compare multiple rates and quotes with minimal information, all in one place. Youll input the amount of the loan, your down payment, state, mortgage product type, and your credit score to get mortgage quotes from multiple lenders at once.

In the market for a house sometime soon? Use our resources to target your searchand know well in advance what you can afford: