How To Choose Between Points Or Credits

As with a lot of decisions during the mortgage process, the right choice depends on your personal situation. In this case, it largely depends on one of the first questions your Mortgage Expert will ask you:

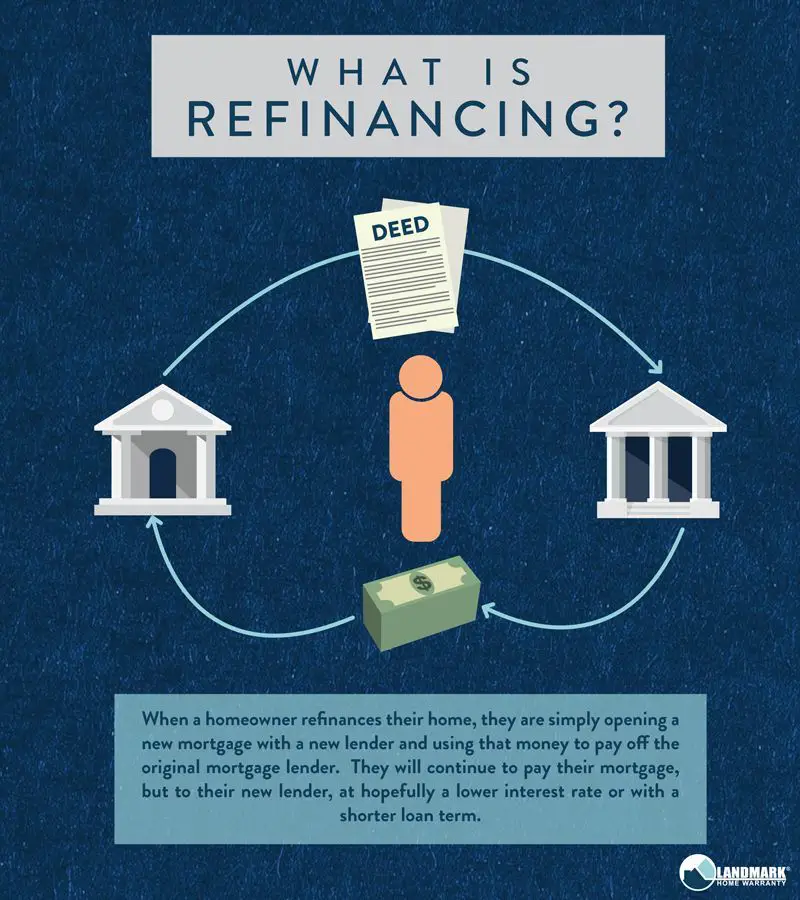

How long do you intend on keeping the property that youre purchasing or refinancing?

Like a lot of financial choices, theres a break-even point at the heart of this issue. Most Americans will sell, refinance, or otherwise close within 6 years.

This can change on a case-to-case basis and choosing credits versus points depend on how long you plan on keeping the loan. If youre like most Americans and dont plan on keeping the loan for a long time, credits might make more sense. The upfront savings will outweigh any potential savings down the road. If you know that you will keep the loan for a longer period of time, points might make more sense. Your monthly payment will be higher but the long-term savings will outweigh the cost of points upfront.

Keep in mind that you can also choose the par rate, which is the lowest rate option that comes with no points. If youre unsure about your future plans this might make the most sense.

In addition to time, another factor to think about is how much cash youre comfortable paying upfront. Remember, points mean more money at closing, credits mean less.

Below are three different situations with the same loan amount, and why you might opt for points, credits, or neither with your rate.

Final Thoughts On Refinancing Points

As with all things mortgage, its best to arm yourself with as much knowledge as possible. Determining the best strategy for your home savings requires personal assessment. You know your current and future finance goals better than anyone. If you need help laying out your options, and determining which are the right questions to ask, speak with a mortgage broker or a lender.

As professionals in the field, they will be able to provide you with more information and help steer you in the right financial decision.

Comparing Monthly Mortgage Principal & Interest Payments With Discount Points

A home-buyer can pay an upfront fee on their loan to obtain a lower rate. The following chart compares the point costs and monthly payments for a loan without points with loans using points on a $200,000 mortgage.

| Points | |

|---|---|

| $9,072.22 | $17,997.21 |

Some lenders advertise low rates without emphasizing the low rate comes with the associated fee of paying for multiple points.

A good rule of thumb when shopping for a mortgage is to compare like with like. Shop based on

- annual percentage rate of the loan, or

- a set number of points

Then compare what other lenders offer at that level.

For example you can compare the best rate offered by each lender at 1 point.

Find the most competitive offer at that rate or point level & then see what other lenders offer at the same rate or point level.

Recommended Reading: Why Are Mortgage Rates Lower Than Prime

Why Do We Use Basis Points

Basis points are used to remove any uncertainty when talking about percentage change. To say my commission is usually 10%, but it increased by 10% last quarter is needlessly ambiguous is your commission now 20%, or 11%? This is why we use basic points, so that we know when someone says a 100 basis point increase they mean an increase of 1%.

Consider Making A Larger Down Payment Instead

Rather than purchasing points, some borrowers make a larger down payment to reduce their monthly payment amount. Also, if you make a down payment large enough, you can usually avoid paying for private mortgage insurance . The extra money you put towards the down payment might be money better spent than using your money on points.

In addition, putting more money down helps you build equity in the property faster. You could also decide to use the money to make extra payments on your loan and gain equity in your home quicker that way.

Don’t Miss: How To Negotiate The Best Mortgage Rate

What Aretodays Mortgage Rates

Todays mortgage rates are at historic lows. Mortgage points allowborrowers to buy down their interest rate even further, which can generate hugesavings.

However, mortgage points arent always worth it. And if you opt notto pay for them, youre still likely to get a great deal in todays ultra-lowrate environment.

Popular Articles

Step by Step Guide

Points Are Tax Deductible

The cost of mortgage points does not differ by type. If one lender has a one-point origination fee and one-point discount fee for a certain rate and a second lender has no origination fee and a two-point discount fee, the cost is the same. The one difference for the borrower is that origination-fee points are not tax-deductible and discount points may be tax-deductible. Buying down a mortgage using points will result in interest savings several times greater than the cost in points if the mortgage is paid in full.

You May Like: How Do You Refinance Your Mortgage

How Do You Calculate Basis Points For Commission

How Much Money Do You Have To Put Down At Closing

If your down payment on a conventional loan is under 20%, you may be required to pay private mortgage insurance , which can cost about 1% of the loan amount annually. In the case of a conventional loan for $150,000, the PMI will cost $1,500 a year or $125 a month.

This is important for clients who are on the fence between paying for mortgage discount points or a larger down payment. If its between discount points and boosting your down payment to 20% or over, youll want to choose the down payment most of the time. Always do the math and consider if your discount points are costing you more or less than your monthly PMI fees.

PMI rates do vary from lender to lender, so this is a question worth asking if youre shopping for a conventional loan. Its also important to know that mortgage insurance guidelines will depend on the type of loan you have .

You May Like: How To Become A Certified Mortgage Underwriter

How Soon You’ll Break Even After Buying Mortgage Discount Points

To figure out when you’ll break even if you buy mortgage discount points, take the cost of the points and compare it to how much you’ll save each month if you have a lower interest rate. After you break even, you’ll start saving money.

Example: Mortgage Points Break-Even

Using the example above, let’s say you get a 30-year loan of $200,000 with a 5% fixed interest rate. Your monthly payment will be $1,073.64. But if you buy two points by paying $4,000, and your rate goes down to 4.5%, the monthly payment falls to $1,013.37. Divide the cost of the point by the difference between the monthly payments. So, $4,000 divided by $60.27 is about 66, which means the break-even point is about 66 monthsâmeaning you’d have to stay in the home for 66 months to make it worth buying the points.

The break-even point varies, depending on the size of the loan, the interest rate, and the term . Once you do the calculation, assuming you can afford the upfront cost of the points, think about whether you’ll remain in the house and not refinance beyond the time when you break even. The longer you live in the property and make payments on the mortgage, the better off you’ll be paying for points upfront to get a lower interest rate. But if you plan to sell or refinance your home within a couple of years , you should probably opt for a loan with few or no points.

Who Should Buy Points

People who are likely to keep their current mortgage for a long time. They would have the following attributes:

- Likes the local area and plans to live in the area for at least a half-decade or more.

- Stable family needs, or a home which can accommodate additional family members if the family grows.

- Homebuyer has good credit & believes interest rates on mortgages are not likely to head lower.

- Stable employment where the employer is unlikely to fire them or request the employee relocate.

Read Also: How To Get Pre Approved For A Mortgage Chase

Considerations For Negative Points

When you obtain negative points the bank is betting you are likely to pay the higher rate of interest for an extended period of time. If you pay the higher rate of interest for the duration of the loan then the bank gets the winning end of the deal. Many people still take the deal though because we tend to discount the future & over-value a lump sum in the present. It is the same reason credit cards are so profitable for banks.

Buyers who are charged negative points should ensure that any extra above & beyond the closing cost is applied against the loan’s principal.

If you are likely to pay off the home soon before the bank reaches their break even then you could get the winning end of the deal. There are many reasons a buyer might repay the loan soon including stock options which are coming due soon, an inheritance in the near future, or a professional flipper who only needs financing in the short term while they rehab the home.

Upsides And Downsides To Paying Discount Points

Again, by lowering your interest rate, your monthly mortgage payments also go down. So, you’ll have extra money available each month to spend on other things. Also, if you pay for discount points and itemize your taxes, you can deduct the amount at tax time .

But the money you pay for points, like the $3,000 paid in the above example, might be better used or invested somewhere else. So, be sure to consider whether your expected savings will exceed what you might get by investing elsewhere.

What You Need to Knowand DoBefore Taking Out a Mortgage

Getting a mortgage isn’t too difficult, but it will involve some effort on your part. If you’re planning on taking out a loan to buy a home, you can take certain steps to ensure the process goes smoothly and that you fully understand the transaction.

Instead of buying points, some borrowers choose to make a larger down payment to lower the monthly payment amount. In some cases, making a down payment large enough so that you can avoid paying for private mortgage insurance might be money better spent than using your money on points.

Also, a larger down payment helps you build equity faster. However, buying mortgage rate pointsboth discount points and origination pointswon’t increase your equity in the home. Or, you could choose to make extra payments on your mortgage to build equity in your home quicker and pay off the mortgage early.

Don’t Miss: What Is The Mortgage Rate In Florida

What Is A Cema Mortgage

A Consolidation, Extension and Modification Agreement, or CEMA, loan is an option available to New Yorkers that can drastically reduce the cost to refinance a mortgage. CEMA loans allow borrowers to pay mortgage recording taxes on only the difference between their current principal balance and their new loan amount.Feb 9, 2021

Are Points Tax Deductible

Home mortgage points are tax-deductible in full in the year you pay them, or throughout the duration of your loan.

The IRS guidelines list the following requirements:

- Your main home secures your loan .

- Paying points is an established business practice in the area where the loan was made.

- The points paid weren’t more than the amount generally charged in that area.

- You use the cash method of accounting. This means you report income in the year you receive it and deduct expenses in the year you pay them.

- The points paid weren’t for items that are usually listed separately on the settlement sheet such as appraisal fees, inspection fees, title fees, attorney fees, and property taxes.

- The funds you provided at or before closing, including any points the seller paid, were at least as much as the points charged. You can’t have borrowed the funds from your lender or mortgage broker in order to pay the points.

- You use your loan to buy or build your main home.

- The points were computed as a percentage of the principal amount of the mortgage, and

- The amount shows clearly as points on your settlement statement.

Also Check: How To Recruit Mortgage Loan Officers

Mortgage Calculator: Should I Buy Points

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

What Do Points Mean On A Mortgage

You have to pay for discount mortgage points at the loan’s closing you can’t buy them afterward. Again, one point is typically equal to 1% of the loan principal and generally reduces the rate by .25%. However, one point might lower the rate by more or less than 0.25%, depending on the loan and lender. The more discount points you buy, the lower your interest rate will be, but you usually can’t purchase more than four. Most lenders offer two or three points on a loan.

Also Check: Why Do You Need Mortgage Insurance

When To Buy Mortgage Points

Buying mortgage points might make sense if any of the following situations apply to you:

- You want to stay in your home for a long time. The longer you stay in your home, the more it makes sense to invest in points and a lower mortgage rate. If youre sure youll have the same mortgage for the long haul, mortgage points can lessen the overall cost of the loan. The longer you stick with the same loan, the more money youll save with discount points.

- Youve determined when the breakeven point is. Do some math to figure out when the upfront cost of the points will be eclipsed by the lower mortgage payments. If the timing is right and you know you wont move or refinance before you hit the breakeven point, you should consider buying points.

How do you calculate that breakeven point, you ask? Lets run through a quick example using the numbers referenced earlier.

If you have a $200,000 loan amount, going from a 4.125% interest rate to a 3.75% interest rate saves you $43.07 per month. As mentioned earlier, the cost of 1.75 points on a $200,000 loan amount is $3,500. If you divide the upfront cost of the points by your monthly savings, youll find that your breakeven point is about 82 months , which is equal to roughly 6 years and 10 months. So, if you plan to stay in your house for longer than that amount of time and pay off your loan according to the original schedule, it makes sense to buy the points because youll save money in the long run.

The Seller Pays The Points

This practice is more common in slower housing markets, and with lower-priced properties.

The sellers may offer to pay some, or all, of your closing costs, including points, to entice you to purchase their home.

But what the seller can pay differs based on the type of loan you have.

- For FHA loans, the seller can pay up to 6% of the sales price, regardless of the down payment made.

You should be aware, however, that while sellers may willingly pay a 1% origination point, they may be highly reluctant to pay discount points. Thats because discount points are more about providing you with a lower interest rate and payment than they are about directly facilitating the sale of the property.

Also, sometimes the property seller is a builder. As the seller, the builder can cover the buyers closing costs within the same limits listed above.

You May Like: Can You Get A Mortgage With A Fair Credit Score