How Long Do I Need To Show Income For A Mortgage

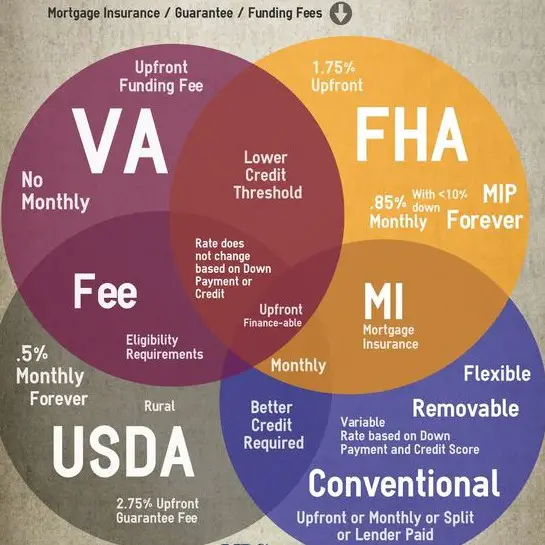

The standard qualification rules for a conventional mortgage, the more popular mortgage type, generally require at least two years of employment history. There are, however, circumstances where a lender would work with a borrower outside of this standard. Other loan types, such as FHA or VA loans, the requirements will differ by lender.

What Should I Get Preapproved

In todays housing market, it will be almost impossible to get a seller to consider your offer unless you have a mortgage preapproval . There are simply too many buyers for sellers to be willing to take a chance on one who hasnt at least talked to a lender about getting a mortgage.

Another important reason to get preapproved: It gives you an idea of how much home you can afford based on how much money a lender is prepared to let you borrow. This can save you time during house hunting by eliminating properties out of your price range.

Dont Miss: Can You Add Money To Mortgage For Improvements

How To Increase Your Pre

Pre-qualification can help you form a realistic budget and get ready to start looking at homes. You could pre-qualify for a larger loan and expand your options if you:

-

Grow your credit score: Three ways to do this quickly include correcting errors on your credit report, using less of your credit limit and paying bills on time and in full each month.

-

Consolidate or pay off debts: If you have high-interest debt spread out over several credit cards, consolidating it will reduce your monthly debt payments. Eliminating debt completely, through larger or more frequent payments, is even better. Reducing expenses and following a budget will help.

-

Consider an adjustable-rate mortgage: These loans often begin by offering a lower rate than a fixed-rate loan, but after an introductory period, that rate can increase or decrease based on market conditions. You can often afford more home if you choose an adjustable rate mortgage just be sure you have a plan for when the introductory period ends.

-

Increase your income: A higher gross income will improve your DTI ratio and may qualify you for a larger loan amount. You may be able to achieve this by asking for a raise or starting a side hustle.

Recommended Reading: How Long Does Mortgage Refinance Underwriting Take

Conditions For Mortgage Approval

During the conditional approval mortgage time period, you will have to meet certain conditions and provide documentation to the mortgage lender. Examples of conditions are:

- Several years of financial statements and proof of income if you are self-employed

- Appraisals of high-value assets such as art or jewelry

- Verification of income and assets through bank statements, check stubs and other means.

- Letters concerning any gift that will go toward your down payment

What People Are Saying About New American Funding

As of January 9, 2023, New American Funding rating from the Better Business Bureau is 3.96 out of 5.00 stars. The BBB has closed 61 complaints in the last 12 months and 162 over the last three years.

The BBB has given New American Funding an A+ rating, but that rating doesnât take customer reviews into account. Instead, itâs based on how the company responds to complaints, its time in business, size and other factors.

The CFPBâs Consumer Complaint Database shows 194 mortgage complaints for New American Funding from for three years ending January 9, 2023. Most of these were about applying for a mortgage, refinancing a mortgage, having trouble during the payment process or closing on a mortgage. The company provided a timely response to 178 complaints. Note that the CFPB doesnât verify the accuracy of consumer complaints.

Additionally, while these numbers might seem high, theyâre insignificant compared to the number of borrowers who have used New American Funding.

Read Also: Where To Prequalify For A Mortgage

How To Calculate Affordability

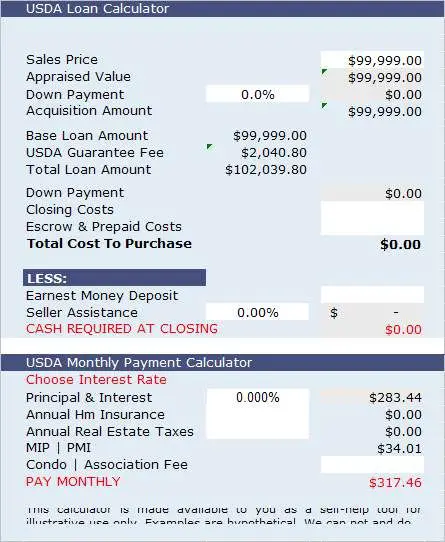

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

How Far In Advance Should I Get Pre

The best time to get pre-approved for a mortgage is at least one year before you decide to purchase.

As a home buyer, pre-approvals are for your benefit, so its never too early to get one.

Getting pre-approved early is an advantage because one-third of mortgage applications contain an error. These errors can negatively affect your interest rate and ability to buy a home. Pre-approvals uncover those mistakes and give you time to fix them.

Getting pre-approved also sets your price range. Pre-approved buyers are less likely to overspend or underspend! on their residence as compared to buyers who use online mortgage calculators.

Read Also: How To Figure Mortgage Payments With Taxes And Insurance

Income Can You Pay For The Loan

Your income determines your debt service ratio. That is, how much of your income goes into servicing all your debt payments. The government has set maximum allowable debt servicing ratios, so ultimately you wont be able to get a mortgage that you wont be able to pay for.

Income requirements are very strict, and normally only very specific documents are allowed in calculating your total income towards your application. Lenders are very specific as to what they will consider usable income versus unusable income. For example, lenders will not consider income from cash jobs, nor will they consider income from contract only positions. Also, if you just got your job you may have to wait for your probationary period to finish prior to being approved for a mortgage.

Mortgage Preapproval: Everything You Need To Know

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, commissioned or otherwise endorsed by any of our network partners.

If youre thinking about owning a home, youll likely need a mortgage preapproval. A home loan preapproval gives you a snapshot of what you can afford based on the program you apply for.

A preapproval letter shows sellers youre solid financially, and if theres a lot of competition for homes in your area sellers wont consider your offer without one. Knowing the ins and outs of a mortgage preapproval will give you the edge you need to compete against other less prepared homebuyers.

Things to know first

Knowing how to get preapproved for a mortgage gives you an edge before you start house hunting

Many sellers wont consider an offer without a mortgage preapproval letter

Theres a big difference between a prequalification and a preapproval

Make sure you pick the right loan type for your mortgage preapproval

Have your financial paperwork ready before you apply for a preapproval

Learn what steps to take if youre denied for a preapproval

Don’t Miss: Why Is My Mortgage Loan Being Transferred

How Does The Mortgage Pre

The calculator determines what amount you can qualify for by analyzing yourdebt-to-income ratio. The DTI ratio is a financial metric used by lenders to assess the ability of the borrower to manage their debt. It is calculated by dividing your monthly debt expenses by your gross monthly income. For example, if your monthly debt is $1,500 and your gross monthly income is $4,500, then your DTI ratio is 33% .

The Bottom Line: Theres A Lot To Learn When You Decide You Want To Own A Home

Becoming a homeowner isnt easy and its certainly not cheap but its worth the effort. Its important to take the time to familiarize yourself with what a mortgage is before you plunge into the market. Ready to take the first step in your home buying journey? Get started on your mortgage approval today! You can also give us a call at 326-6018.

Get approved to buy a home.

Rocket Mortgage® lets you get to house hunting sooner.

Don’t Miss: How To Process A Mortgage Loan

Will Getting Preapproved By Multiple Lenders Hurt My Credit Score

If youre shopping around for a mortgage with different lenders, the multiple credit inquiries they conduct as part of the process are viewed as one inquiryif they all occur within a given period of time, typically within 45 days. This means your will not be negatively impacted, and allows you to get preapproved with multiple lenders in that window.

However, if you try to get multiple preapprovals but the applications dont all fall within that grace period, your credit score will be slightly impacted with each check.

The Buyers Employer Or Job Title Changed

Changing jobs even for higher pay can ruin your pre-approved mortgage.

If you plan to make any of the following changes in your job or career, ask your mortgage lender before making the change:

- Becoming a partner in a company

- Starting a new business

- Switching from a salaried position to a salary + bonus position

- Changing industries

- Accepting payment in cryptocurrency

Its okay to make changes in your career. Be sure to speak with your lender to avoid unintended consequences.

Read Also: What Are Jumbo Mortgage Rates

How Much House Can I Afford

The old formula that was used to determine how much a borrower could afford was about three times the gross annual income. However, this formula has proven to not always be reliable. It is safer and more realistic to look at the individual budget and figure out how much money there is to spare and what the monthly payments on a new house will be. When figuring out what kind of mortgage payment one can afford, other factors such as taxes maintenance, insurance, and other expenses should be factored. Usually, lenders do not want borrowers having monthly payments exceeding more than 28% to 44% of the borrowers monthly income. For those who have excellent credit, the lender may allow the payments to exceed 44%. To aid in this determination, banks and websites like this one offer mortgage calculators to assist in determining the mortgage payment that one can afford. For your convenience, here is a rate table displaying current mortgage rates in your area & the associated monthly payment amounts. If you adjust the loan amounts and hit the search button, the monthly payment numbers will automatically update.

Determine Your Mortgage Budget

Before ever speaking with a mortgage officer, youll want to determine how much house you can afford and are comfortable paying .

A good rule is that your total housing payment should be no more than 35% of your gross income.

For example, if together you and a co-buyer earn $80,000 a year, your combined maximum housing payment would be $2,333 a month. Thats an absolute, max, however. I recommend sticking with a total housing payment of 25% of gross income. Youll find other readers here who are even more conservative.

It can be difficult to equate this monthly payment to a fixed home price, as your monthly housing payment is subject to variables like mortgage interest rate, property taxes, the cost of home insurance and private mortgage insurance , and any condo or association fees.

You May Like: What Is The Typical Closing Costs For A Mortgage

Our Favorite Mortgage Lender

There are a lot of companies offering competitive mortgage rates, but theyre difficult to find one by one. Thats why we like Fiona, an online marketplace to compare mortgage quotes. Youll simply enter the homes purchase price, your down payment amount, your state, choose your mortgage product type, and your credit score to get mortgage rates and offers from multiple mortgage lenders.

Another service we like is Credible, which also moves the approval process completely online. In just three minutes, Credible offers loans from multiple lenders without revealing your personal data to them. You can even quickly generate a preapproval letter that you can use to start your home-shopping process.

Make Yourself A Competitive Buyer

Don’t spend all your time daydreaming about listings you find on Zillow. Do research to learn what kinds of mortgage loans are out there, including FHA, conventional, VA and USDA loan programs. Get pre-approved by a lender before you start shopping, so you know your price range, and you’ll be ready to make an offer on the spot if need be.

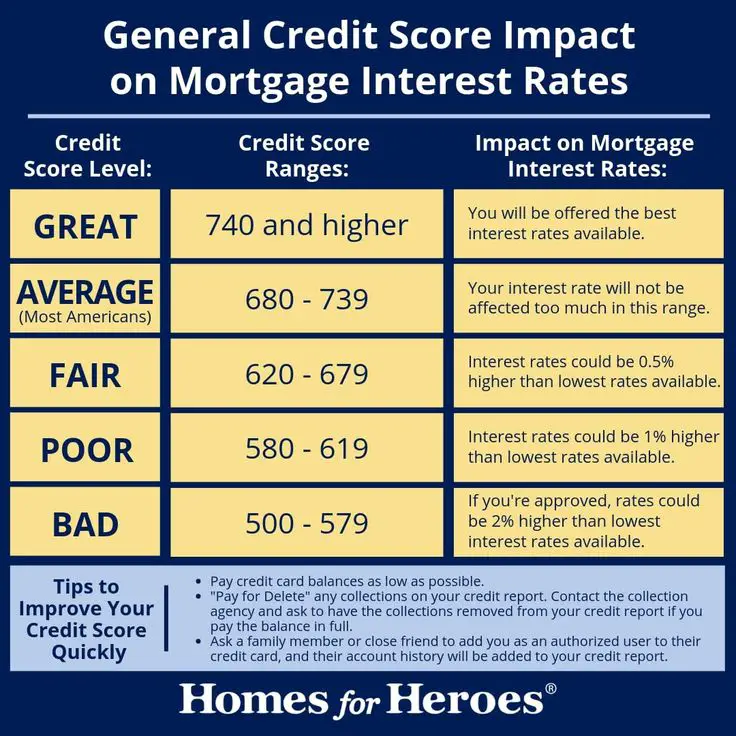

It’s also important to know your credit score. Having a score of 760 or higher will qualify you for the best mortgage rates, so take a few months and build your credit if you can. And then do everything you can to keep it in good standing.

If you’re not sure where your credit score currently stands, sign up for a free or paid to check your score.

is a free credit monitoring service that anyone regardless of whether they are Capital One cardholder can use. Receive an updated VantageScore credit score from TransUnion every week and credit report updates from TransUnion and Experian in real time. Use the credit score simulator to check the potential effect that certain actions, such as paying off debt or closing a credit card, may have on your credit score. In the months leading up to applying for your mortgage, you’ll want to be extra careful about closing accounts and racking up debt, as it can decrease your score and make your mortgage more expensive.

Don’t Miss: How Much Is A Million Dollar Mortgage Per Month

Go Through Underwriting Process

The next stage is for your application to be assessed by underwriters.

Though you are unlikely to deal with them directly, mortgage underwriters are actually the key decision-makers in the mortgage approval process and are the people who will give final approval for your mortgage.

Underwriters will check every aspect of your mortgage application and carry out a number of other steps. For instance, borrowers are required to have an appraisal conducted on any property they take out a mortgage against. The underwriter orders this appraisal and uses it to determine if the funds from the sale of the property are enough to cover the amount you will be lent in your mortgage.

Once underwriters have assessed your application, they will give you their decision. This will either be to accept the loan as it is proposed, reject it, or approve it with conditions. Your mortgage might be approved, for instance, on the condition that you supply more information about your credit history.

If your application is approved, you will then lock in your interest rate with your lender. This is the final interest rate you will pay for the remainder of your mortgage term.

Why Would You Want A Mortgage Pre

While a pre-approval doesnt guarantee youll get a mortgage, being pre-approved does have some advantages. Here are three reasons you might want a mortgage pre-approval:

You May Like: Who Do I Pay My Mortgage To

Whats The Difference Between Pre

Unlike pre-qualification, preapproval requires proof of your debt, income, assets, and credit score and history.

Sellers often prefer to see a preapproval letter with your offer over a pre-qualification letter. Being preapproved can give you a distinct advantage if you’re competing for a home with buyers who aren’t.

To get preapproved, youll supply documentation such as pay stubs, tax records and proof of assets. Once the lender verifies your financial information, which may take a few days, it should supply a preapproval letter you can show a real estate agent or seller to prove youre ready and able to purchase a home.

Keep in mind, pre-qualification doesnt guarantee preapproval. You can still be turned down if your financial documents dont support the numbers you reported.

» MORE: Learn more about the difference between pre-qualification and preapproval

How Long Does It Take To Get Preapproved

Depending on the mortgage lender you work with and whether you qualify, you could get a preapproval in as little as one business day, but it usually takes a few days or even a week to receive and, if you have to undergo an income audit or other verifications, it can take longer than that.

In general, if you have your paperwork in order and your credit and finances look good, its possible to get a preapproval quickly.

You May Like: What Is The Current Mortgage Rate Right Now

What Changes Your Credit Score

These 5 factors provide a glimpse into your financial habits and history, and help lenders assess your financial health. Home buyers with lower credit scores are typically assigned a higher interest rate.