How Historical Mortgage Rates Affect Buying A Home

Broadly speaking, lower mortgage rates fuel demand among homebuyers and can increase an individuals buying power. A higher rate, on the other hand, means higher monthly mortgage payments, which can be a barrier for a buyer if the cost becomes unaffordable. In general, a borrower with a higher credit score, stable income and a sizable down payment qualifies for the lowest rates.

What Is An Apr

The annual percentage rate, or APR, shows you more than just the interest rate on your loan. It also includes many of the fees you pay on any mortgage or refinance. While your mortgage interest rate is the biggest long-term cost associated with a home loan, its not the only expense to pay attention to. Anytime you take out a mortgage, there are upfront fees known as closing costs. This can include fees paid to the appraiser and home inspector, as well as loan origination fees, and discount points. All of these costs add up, and can easily be anywhere from 2% to 5% of the loan amount.

These initial costs can vary significantly by lender. So if youre comparing loan offers based only on the interest rate, you could end up paying more fees than necessary. This is why understanding APR is important. If one loan has higher broker fees, that will be reflected in the APR, but not the interest rate. So the APR gives you a better idea of the total cost of the mortgage.

Historical Home Loan Variable Rates Fixed Rates And Discount Rates

The data set includes the historical discount interest rates back to 2004. Discount rates are the special interest rates that apply to the different packages that the banks offer . In most cases the annual fees range from $350-$395 which gets you a range of loan features and entitles you to the additional discount which in most cases ranges between 0.9% and 1.65%. The variable rates above will typically be circa 1.0%-1.50% lower than above.

Recommended Reading: What Does A Cosigner Do For A Mortgage

How Much Does It Cost To Live In Ontario

The cost of living in Ontario depends on a few individual elements such as whether you rent or own a home, drive, commute via transit or bike, the cost of auto insurance, a bunch of other items that add up such as food costs, phone and internet, health and fitness, entertainment and pet ownership.

Housing will be the biggest consideration. The average resale price of a residential home in Ontario is $864,159, which is 27% higher than Canadas national average as of February 2021. But across Canadas most populous province, even smaller cities are seeing huge spikes in real estate prices that were previously confined to the Greater Toronto Area.

Not only does Ontario have more drivers than in any other province in Canada, it also has some of the highest car insurance costs. The average cost of an insurance policy for an Ontario driver is $1,505, according to the Insurance Bureau of Canada.

Factors That Affect Your Ontario Mortgage Rate

If you want to borrow money for a mortgage, lenders will review the state of your finances to help determine how much risk you pose as a borrower. This will influence whether or not the lender approves your mortgage application, and whether you qualify for their best interest rates. If youre applying for a mortgage, heres what lenders will take into account:

Down payment: One of the strongest indicators of your financial stability is if you are capable of making a down payment of 20% or more on the purchase of your new property. The more you put down, the less youll end up paying in interest over the lifetime of your mortgage. Across Canada, there are minimum down payment rules set by the federal government based on the price of the home:

- A home that costs $500,000 or less: the minimum down payment is 5% of the purchase price

- A home that costs $500,000 to $999,999: the minimum down payment is 5% of the first $500,000 of the purchase price, and 10% for the portion above the purchase price above $500,000

- A home that costs $1 million or more: the minimum down payment is 20% of the purchase price

Debt service ratios: Taking on mortgage payments adds a new financial obligation to your plate. Lenders know you have other bills to pay each month, so they want to be reassured you can handle the addition of mortgage payments. To compare your income vs. expenses, lenders use two debt ratios.

Read More

Also Check: Do Multiple Mortgage Applications Hurt Credit

How Are Mortgage Rates Set

Mortgage rates are set based on a few factors, economic forces being one of them. For instance, lenders look at the prime ratethe lowest rate banks offer for loanswhich typically follows trends set by the Federal Reserves federal funds rate. Its usually a few percentage points.

The 10-year Treasury bond yield can also reveal market trends. If the bond yield goes up, mortgage rates tend to go up, and vice versa. The 10-year Treasury yield is usually the best standard to judge mortgage rates. Thats because many mortgages are refinanced or paid off after 10 years even if the norm is a 30-year loan.

Factors that the borrower can control is their credit score and down payment amount. Since lenders determine rates based on the risk they may take, borrowers who are less creditworthy or have a lower down payment amount may be quoted higher rates. In other words, the lower the risk, the lower the rate for the borrower.

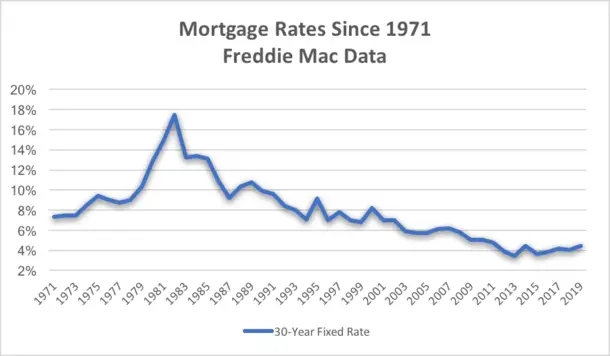

Mortgage Rate Trends In The 2000s

The 30-year rate took another tumble in the latter half of the 2000s when the housing market crashed due to the prevalence of subprime loans. According to Bankrates data, the average 30-year fixed mortgage rate dropped from about 8 percent at the start of the decade down to 5.4 percent by 2009, when the Federal Reserve implemented quantitative easing, buying mortgage bonds in bulk to drive down interest rates and usher in an economic recovery.

Read Also: How To Buy A Reverse Mortgage Property

Historical Mortgage Rates: Averages And Trends From The 1970s To 2020

See Mortgage Rate Quotes for Your Home

Since 1971, historical mortgage rates for 30-year fixed loans have hit historic highs and lows due to various factors. Using data from Freddie Macs Primary Mortgage Market Survey , well do a deep dive into whats driven historical mortgage rate movements over time, and how they affect buying or refinancing a home.

What Type Of Mortgage Do You Need

First-time homebuyers can walk into a mortgage brokerage office or visit an online lender without knowing what kind of mortgage they need. But it’s always better to have an idea of what you’re shopping for, especially since you can’t control other factors such as home prices and current rates.

Mortgage loan types include:

Also Check: How Much Money Should You Spend On Mortgage

Are Interest Rates And Apr The Same

Interest rates and APR are not the same. An annual percentage rate reflects additional charges associated with your mortgage, which includes the interest. The interest rate reflects the cost homeowners pay to borrow money. These fees include charges such as origination fees and discount points, which is why the APR is typically higher than the interest rate.

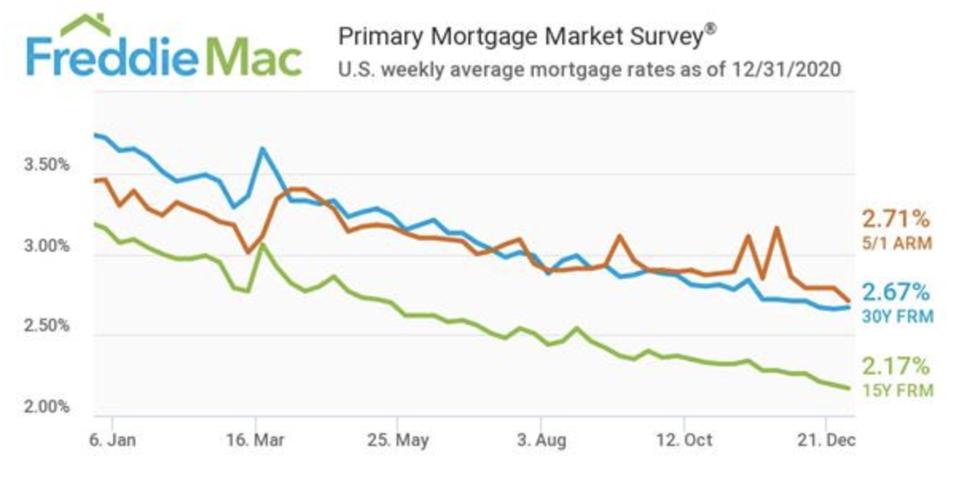

Mortgage Rates Dip Deeper Below 3% And Open Wider Window To Refinance Savings

Down. Up. Down. Up. Aaand back down again.

U.S. mortgage rates have been bouncing around from week to week, but here’s the important part: Despite all the gyrating, the average for America’s standard mortgage has avoided jumping back above 3% for nearly two months.

A popular survey shows rates just fell a little deeper into the 2s, which helps not only homebuyers but also homeowners, who can refinance and save hundreds on their monthly payments.

Also Check: Does Bank Of America Do Mortgage Loans

How Do You Qualify For The Best Mortgage Rates

Getting the best mortgage rates requires five main things:

Mortgage Rate Trends In The 1990s

The 1990s saw a dramatic shift in the 30-year rates movement, as it plunged to an average of 6.91 percent in 1998, according to Bankrate data. This was spurred by the dot-com bubble, an era when investors rushed to buy stocks from technology companies that were overvalued. When these stocks plummeted, investors turned their focus to fixed-income investments, such as bonds. As bond prices rose and yields fell, mortgage rates, which follow the 10-year Treasury yield, also declined.

Read Also: How To Pay Off A 200 000 Mortgage

What Is The Current Interest Rate For A Uk Mortgage

The current Bank of England base rate is 0.1%, a record low.

Source: Bank of England

At time of writing, the base rate sits at 0.1% and has done since March 2020 when we first went into lockdown early on in the Coronavirus pandemic.

The cuts, which have been introduced in response to the upheaval of the Coronavirus crisis, are bad news for savers who will be earning less from their nest eggs. However, the rates also represent a possible saving for borrowers. So, if you are considering buying a property, remortgaging or looking into development finance, now could be the right time.

Protect Your Investment For Your Family

It isnt pleasant to think about, but the possibility that something unexpected might happen to you is important to consider as a homeowner.

Once youve refinanced, you want to make sure your family wont have to worry about how theyd make the mortgage payments if you were to die.

The best way to ensure that your family will be financially secure after youre gone is to take out a life insurance policy. And while the idea of shopping for life insurance might seem a bit uncomfortable, using a service like Quotacy can make the process painless.

In just minutes, Quotacy will find you the three best rates for your and your familys specific needs. Depending on how old you are and where you live, you could find a policy that offers your loved ones $1 million in financial protection for less than $7 a week.

It never hurts to be prepared, and even though you cant put a price on peace of mind, with Quotacy youll know that youre getting the best coverage available.

Read Also: How 10 Year Treasury Affect Mortgage Rates

Can I Still Get A Sub

The cheapest mortgages are available at up to 60% loan-to-value, meaning theyre available to home buyers with big deposits and people remortgaging with significant equity in their home.

Concerns about a base rate rise have now pushed even the cheapest two-year fixed-rate deals above 1%. A handful of sub-1% mortgages remain, but these are either tracker deals or come with geographical restrictions, for example only being available in Northern Ireland.

The table below shows the cheapest rates currently available on two-year and five-year fixes.

| Loan-to-value |

Best rate without an upfront fee: 1.34% from Nationwide

How Much Does Getting A Lower Mortgage Interest Rate Matter In Ontario

Ensuring that the mortgage you get for your new Ontario house has a low interest rate will save you thousands of dollars in interest over the lifetime of your mortgage. But getting the lowest interest rate possible isnt the only important aspect you should keep in mind when shopping for the best mortgage. Talk to an Ontario mortgage agent about negotiating these features into your contract.

Prepayments: You can save money on your mortgage by making sure your contract includes prepayment privileges. This allows you to pay extra money toward your mortgage. For example, say you were to inherit money from a relative. You could use the inheritance money to make a mortgage prepayment, which would reduce your mortgage principal and amortization period and lead to savings on the cost of interest.

Portability: Another feature to consider is making your mortgage portable. A few years from now, you may decide its time to move or maybe you have to sell your home and move due to a job transfer. Whatever the case may be, a portable mortgage means you can take your current mortgage contract with you and apply it to your new home. This will save you money because youll avoid charges that would occur if you had to break your mortgage early and apply for a new one.

You May Like: Can You Get A Second Mortgage With Bad Credit

Mortgage Interest Rates Fall To Their Lowest Rate Ever Recorded Again

Mortgage rates written on a model of house.

Getty

The threshold many thought could never be crossed, has been crossed.

The average interest rate for a 30-year mortgage dropped below 3%, as Freddie Mac reported yesterday, settling in at 2.98% for the week that ended July 16th. For a 15 year loan the average rate was 2.58%. Once again interest rates have reached the lowest rates ever recorded in the fifty years that Freddie Mac has been tracking the data.

As expected, the continued decline has had the corresponding increases in demand. Even leading up to last week, when rates were hovering just above the 3% mark, refinance applications saw an increase of 12%, which is 107% higher than they were a year ago, according to a report from the Mortgage Bankers Association. Purchase applications did see a small decrease, of 6%, compared to the week before. But after seeing a 33% surge the week before, it is most likely due to a post-holiday slowdown. Compared to one year ago, purchase applications were 16% higher and it is the eighth consecutive week they have been higher than the same week a year previously.

The demand from buyers was already high before the Covid pandemic slowed down activity, but with such low interest rates even those who were thinking of waiting it out for another year are coming off the sidelines to try and lock in a low rate. Of those purchase applications, only 3% were for an adjustable rate mortgage.

Compare Rates To Find The Right Loan

With mortgage rates so low, you might be tempted to jump at the first refinance offer that comes along. But shopping around and comparing rates could wind up saving you even more on your new monthly payment.

You can always do it the old-fashioned way, by researching local lenders and contacting them individually about their rates but that could eat up a lot of time.

A better option is to go online, gather quotes from at least three lenders, and compare them.

Typically, you answer just a few questions to be connected instantly with lenders in your state or area that will meet your needs.

You can easily do a side-by-side comparison of lenders interest rates, loan terms, and monthly payments, and you can check user reviews for each bank, credit union or loan company to help inform your decision.

Checking mortgage rates will never impact your credit score. If youre planning to refinance, you owe it to yourself to shop around and find the best rate available.

You May Like: How To Select A Mortgage Lender

Mortgage Rate Trends Chart: Where Are Rates Headed

The coronavirus pandemic pushed mortgage rates to rock bottom, and most experts think they cant go down much further.

If anything, mortgage rates are likely to go up in the coming months and years, as COVID recovery progresses and the economy begins to improve.

Borrowers shouldnt expect dramatic rate spikes.

But unlike 2020, when mortgage rates hit record lows over and over, were likely to see more upward movement for 30year mortgage rates and other home financing rates.

Those who are ready to buy a home or refinance now shouldnt wait on rates to fall its not likely to happen.

But if your home buying or refinancing plans are further down the road, you shouldnt worry about any huge rate increases in the near future. Affordable financing is here for the long haul.

Are Mortgage Rates Impacting Home Sales

![How to Get the Lowest Mortgage Rates in 2012 [Survey] How to Get the Lowest Mortgage Rates in 2012 [Survey]](https://www.mortgageinfoguide.com/wp-content/uploads/how-to-get-the-lowest-mortgage-rates-in-2012-survey.png)

The number of mortgage applications ticked up 0.3% for the week ending September 10, according to the Mortgage Bankers Association. The increase takes an adjustment for the Labor Day holiday into consideration.

- Purchase applications were up a seasonally adjusted 8% from the previous week and 12% lower than the same week last year. On an unadjusted basis, purchase loan volume was 5% lower week-over-week.

- Refinance applications also ticked lower, decreasing 3% from the week prior and 3% lower than the same week last year. Refinancing continued to slow as the share of refi applications dropped to 65% of all applications, the lowest total since July.

Make sure we land in your inbox, not your spam folder.

You May Like: Is Us Bank Good For Mortgages