Can I Use A Home Equity Loan To Buy Another House

See Mortgage Rate Quotes for Your Home

Yes, you can use a home equity loan to buy another house. Using a home equity loan to purchase another home can eliminate or reduce a homeowners out-of-pocket expenses. However, taking equity out of your home to buy another house comes with risks. Learn more about using a home equity loan for a second home.

Can I Get A Second Home Mortgage Overseas

It may also be possible to get a mortgage for a second home abroad these can be arranged through:

- UK-based lenders with an international reach.

- International lenders.

- Local lenders in the country where youre hoping to buy.

However, this is a niche sector of the mortgage market, so specialist advice from a whole-of-market broker is recommended.

Buy To Let Or Consumer Buy

If you’re planning to use your second home as a buy to let business, then you could just take out a buy to let mortgage. This would probably be less difficult to obtain than a standard second mortgage.

However, you would need to treat it as a business and the income you are expecting to make should cover the cost of the mortgage repayments otherwise it will be hard to get approval on your application.

If you’re using your second mortgage to simply buy a second home and you’re not sure if you will be living in it from time to time, or letting it out occasionally, then you could consider getting aconsumer buy-to-let mortgage.

Consumer buy-to-let mortgages are for ‘accidental’ landlords. These are the people who buy a home but then their circumstances change for example, they need to move out of the country for work so they would like to rent out their property.

Also Check: How Much Does A Mortgage Payment Increase For Every 100000

Take The Housing Market’s Temperature

Before putting your house on the market or committing to buying a new one, investigate the prices of houses in the areas where you’ll be both selling and buying. In order to figure out how to sell high and buy low, you’ll need a realistic idea of how much comparable houses are going for.

Also focus on whether the local real estate market is “hot” or “cold” . Since you’re both a buyer and a seller, you’ll need to protect yourself in your weaker role while making the most of your stronger role.

The Challenges Of Buying A Second Home

Second homes can be difficult to get financing for, particularly if they’re vacation properties. If designed for seasonal use, they may lack features that lenders will insist on, such as central heating. Or they may be built on leased land, or have tons of association restrictions on property transfers that can scare lenders off.

Lenders also know that when times get tough, borrowers are likely to cease making payments on a second home before they do so on their primary residence. That represents added risk, meaning a higher interest rate and tougher eligibility standards for a mortgage to buy such a property.

Don’t Miss: What Score Do Mortgage Companies Use

Homes Money Personal Credit Line

A HELOC was an unrestricted credit line linked with the money inside land.

Like a charge card, it is possible to borrow and pay resources as the range remains available. HELOCs has a preliminary draw stage determined at the outset of ones loan and a repayment stage thats usually completely amortizing.

This is basically the best solution if youre enthusiastic about property flipping as it allows you to choose the residential property, pay money for building work and pay the range if the residential property sells.

One Mortgage Two Or Three

- One remortgage – If there is enough equity in your primary property to release funds to clear any existing mortgage balance and buy a second property in full, you will be left with one remortgage tied to your first property only.

- Two remortgages This is the more usual situation, where there is enough equity in the primary property to replace the first mortgage and release funds enough to serve as a sizeable deposit on a second. You will be left with a larger mortgage on your first property and a second mortgage on your new property.

- Three remortgages In these corner cases, you would apply for a second charge remortgage on the primary property, leaving the original mortgage in place. The money released in this way would then be used as the deposit for the third mortgage used to buy the second property.

You May Like: How Much Can You Get On A Reverse Mortgage

Compare Mortgages With Uswitch

It works in the same way as a first mortgage, only with stricter affordability checks, because it could add significant financial strain to pay for a second mortgage.

So, if you want to get a mortgage for a second home you need to be sure than your finances are in good order. You can use a second home mortgage calculator to see how much you would like to borrow and what the repayments are likely to be.

Other Factors That Affect Eligibility

If youre getting a mortgage on a second home, you should expect the lender to consider the following factors when assessing your eligibility:

- Your income type borrowers in full-time employment carry the least risk to lenders, but getting a mortgage for a second property may still be possible through a specialist provider if youre self-employed or make a significant sum through things like benefits, bonuses and commission.

- Your credit rating getting approved for a second mortgage might prove more difficult than when you were taking out your first home, as some second mortgage lenders are stricter when it comes to lending to people with a history of adverse credit. However, specialist providers might take the severity of the credit issue and how long it has been on your file into account and take a more flexible approach to your application.

- Your age getting a second mortgage for a second home can be tougher if youre retired as some lenders wont cater for borrowers over 75, others go up to 85 and a minority will lend to a pensioner of any age as long as theyre confident they can meet the mortgage payments during their retirement.

- The property type if youre hoping to get a mortgage for a second home that includes any non-standard construction elements a specialist lender might be called for as some providers consider these buildings high risk.

Don’t Miss: How Much Per 1000 On Mortgage

Bear In Mind Property Purchasing Costs

What many second home buyers dont fully take into account are the .

These costs can amount to anywhere between 3-5% of the property value so you should factor this in when youre deciding on a no deposit solution.

Essentially, to purchase a second property, you actually need 7-10% of the property value to cover:

- Your minimum 5% deposit.

- Inspections including building/strata and pest.

- Home loan set up fees.

Second Mortgage Vs Refinance: Whats The Difference

A second mortgage is different from a mortgage refinance. When you take out a second mortgage, you add an entirely new mortgage payment to your list of monthly obligations.

You must pay your original mortgage as well as another payment to the second lender. On the other hand, when you refinance, you pay off your original loan and replace it with a new set of loan terms from your original lender. You only make one payment a month with a refinance.

When your lender refinances a mortgage, they know that theres already a lien on the property, which they can take as collateral if you dont pay your loan. Lenders who take a second mortgage dont have the same guarantee.

In the event of a foreclosure, your second lender only gets paid after the first lender receives their money back. This means that if you fall far behind on your original loan payments, the second lender might not get anything at all. You may have to pay a higher interest rate on a second mortgage than a refinance because the second mortgage lender is taking on increased risk.

This leads many homeowners to choose a cash-out refinance over a second mortgage. Cash-out refinances give you a single lump sum of equity from a lender in exchange for a new, higher principal.

Learn more about the difference between a second mortgage and a refinance.

Recommended Reading: Are Mortgage Rates Going To Rise

Determining If You Want A Vacation Home Or Rental Property

Before beginning to shop for a mortgage, youll need to decide whether you want to potentially earn rental income on the property. The answer to this question will determine the type of mortgage you qualify for.

However, if you need rental income in order to qualify for the additional home purchase, you may need to identify a renter and have a fully executed lease among other documents to show the lender the source of additional income. Keep in mind that the lender may only use a certain percentage of the lease amount as a credit towards your qualifying income.

To qualify for a rental property loan, lenders will likely require a higher down payment, typically at least 20% or more. Non-owner occupied loans allow you to use the home when its not rented.

The Risks And Alternatives

As a second mortgage works very much like your first mortgage, your home is at risk if you dont keep up the payments. Like any mortgage, if you get into arrears and dont pay it back, additional interest can mount up.

If you sell your home or its repossessed, the first mortgage gets cleared in full before any money goes towards paying off the second mortgage. However, be aware that the second mortgage lender can pursue you for any shortfall.

Recommended Reading: What’s A Conventional Mortgage

How To Get A Home Equity Loan To Buy Another House

If youre interested in using home equity to purchase a new home, the value of your house will need to be high enough to support the loan, and youll have to meet your lenders requirements. Heres how to get a second mortgage to buy another house.

1. Determine the amount you want to borrow. Before taking equity out of your home to buy another house, decide how much you want and need. Home equity loans limit how much you can borrow. In most cases, you can only access up to 85% of the equity in your home. For example, if your home is worth $350,000 and you owe $250,000, you have $100,000 in equity. In this example, the maximum you would be able to borrow is $85,000.

2. Prepare for the application process. Your approval for a home equity loan will depend on multiple factors. The value in your home will determine the maximum amount of equity available, and your financial information will determine how much of that equity you can borrow. In addition, your lender will look at your credit score, income, other outstanding debts and additional information.

4. Apply to the loan with the best terms. Once you’ve determined the loan with the best terms, youre ready to apply. Youll submit the application and provide the requested information. Your lender will order an appraisal of the home or determine the value using another method.

Reasons To Buy A Second Home

Buying a second home might be a great way for you to be closer to the people you love and places you enjoy, or it might help you accomplish your financial goals. Here are some of the biggest reasons for buying a second home:

- Designated vacation spot: If you and your family love the mountains but are tied to the city for work, you might be able to spend more time getting away if you have a vacationhouse in a place that you love to be. The same goes for if you have people or other places you want to establish a home near.

- A place to retire: If you plan to move after you retire, you can get a head start on creating a community in a place you love by purchasing a second home. You can use the home as a retreat for now and retire to it later.

- Diversifying your assets: Homes tend to increase in value, so you can use your second home as a means of diversifying your investments. You can choose to keep or sell your home down the road.

- Rental income: If you decide to rent your home, you can earn rental income to help cover the expenses of owning a second home. If you want to vacation at your home, you can rent it out short-term. If you decide to have it only as an investment property, you can rent to individuals or families on annual leases.

- Potential tax breaks: Many people choose to leave their second homes unoccupied when theyre not using them. If this is the case, the interest and property taxes may be fully deductible from your gross income.

You May Like: What Lender Has The Lowest Mortgage Rates

Look For A Second Home

Just as you compared different neighborhoods and options with your first home, be open to touring a range of different properties for your second home to see what fits you and your familys needs best. Research local property tax rates, and try to get a sense of the housing market in the area. Is it trending upward, a sign that your second home could also increase in value?

What Affects My Approval For A Second Mortgage

All banks, building societies and any other mortgage providers will view your current mortgage deal as paying for your main home, or main residence.

If you buy another home, then your mortgage provider will view that as your second home should you wish to apply for a mortgage.

Even if you wish to live in the second home or rent it out to somebody else, your application will be treated as a second home mortgage because you already have a mortgage that you are currently paying.

You may want to first check with your current mortgage provider if they will be willing to offer you a second home mortgage, as not all mortgage providers offer them. Of all the mortgage providers offering second home mortgages, it’s very likely you will be faced with stricter criteria in the application.

Generally speaking, in order to get a second home mortgage, you will usually need a larger deposit than what you might have been allowed to have for your first mortgage. On top of this, the second home mortgage deals are likely to have higher interest rates than standard mortgage deals.

Read Also: How Much A Month Is A 500k Mortgage

How To Afford A Second Home

Katrina Ávila Munichiello is an experienced editor, writer, fact checker, and proofreader with more than fourteen years of experience working with print and online publications. In 2011, she became editor of World Tea News, a weekly newsletter for the U.S. tea trade. In 2013 she was hired as senior editor to assist in the transformation of Tea Magazine from a small quarterly publication to a nationally distributed monthly magazine. Katrina also served as copy editor at Cloth, Paper, Scissors and as a proofreader for Applewood Books. Since 2015 she has worked as a fact checker for America’s Test Kitchen’s Cook’s Illustrated and Cook’s Country magazines. She has published articles in The Boston Globe, Yankee Magazine, and more.

In 2011, she published her first book, “A Tea Reader: Living Life One Cup at a Time” . Before working as an editor, she earned a Master of Public Health degree in health services and worked in non-profit administration.

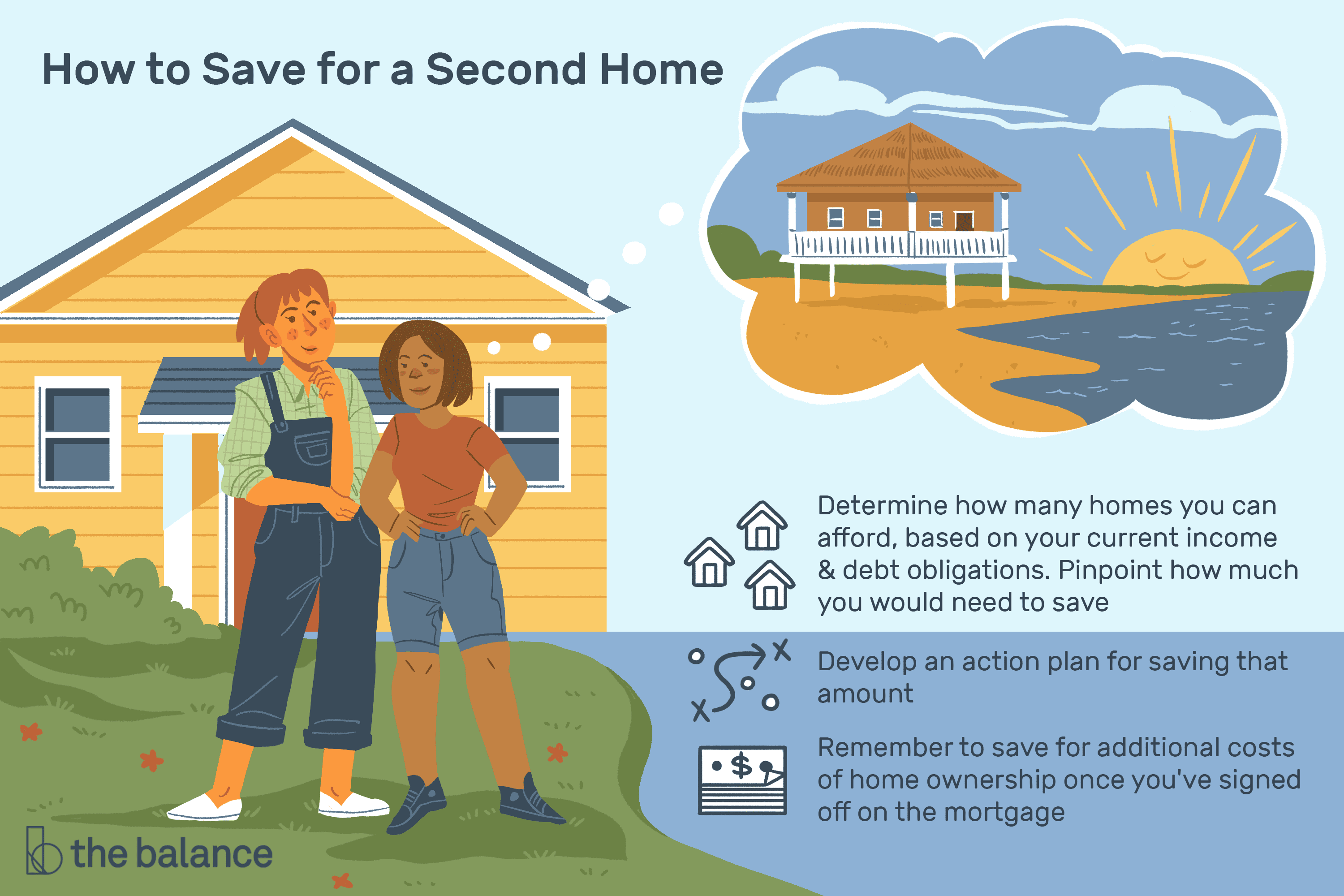

The summer vacation season brings joy to many people, but for some, the longing for a year-round second home brings a touch of melancholy. If you are one of those people who would love to own a place for weekend getaways and long lazy vacations in every season, the first consideration should be how to pay for that luxury.

How To Afford A Second Home

Choose The Right Loan

There are several loans you can and cant use to buy a second home. For example, you can take out a jumbo loan but usually cant take out an FHA loan or a VA loan.

Additionally, there are different financial factors that lenders take into consideration when evaluating someone for a loan on a second home. For example, theyre stricter on a persons debt-to-income ratio and credit score.

Also Check: How To Select A Mortgage Lender

Joint Mortgages For Second Homes

Most mortgage products are available to more than one person. Maybe you want a mortgage for both you and the person you plan to share a holiday home with, or maybe a business partner wants to invest in a property with you. Whatever the case, the type of mortgage you need wont change just because theres more people involved. Instead, you take out a joint version of whichever mortgage youre after, e.g. a joint residential mortgage, a joint buy-to-let mortgage, a joint bridging loan, a joint development loan etc.

Most lenders will only offer joint mortgages for second properties to 2 people, but some lenders will allow up to 4, especially if youre taking out a mortgage for an investment property. John Charcol can recommend lenders who offer mortgages to multiple people.