B How Much Government Benefit Do You Expect To Receive

If you have lived and worked in Canada before retirement, you can expect to receive Old Age Security and Canada Pension Plan benefits. The amount you receive will generally depend on how long you have lived in Canada , how much you have contributed to the plan, and for how long .

The maximum monthly OAS payable in 2021 is $615.37 for a total of $7,384.44 per year, while the maximum CPP was $1,203.75 for a total of $14,445 per year .

Most people will get less than the maximum amount. For example, the average monthly CPP benefit paid as of October 2020 was $689.17 .

For individuals who immigrated to Canada in their adult years , the total government pension they will be eligible for will be significantly reduced.

Using the 2021 maximum government pension amounts as an example, total payouts from this source to a single senior was:

$7,384.44 + $14,445 = $21,829.44 per year

Occupying More Than Half Of The Property

A small business is required to occupy 51 percent of the property or more than half of the premises. If you are unable to meet this criteria, you cannot qualify for a commercial mortgage. You should consider applying for an investment property loan instead.

Investment Property Loans

Investment property loans are appropriate for rental properties. Borrowers use them to buy commercial property and rent them out for extra profit. Investment property loans are also used by house flippers who renovate and sell houses in the market.

How Much Does A 3 Million Mortgage Cost

Trinity Financial has access to a selection of private and mainstream banks and building societies offering £3 million+ mortgages. Click on the link to view our large mortgage loan best buy table and use our borrowing calculator.

How much does a £3 million mortgage cost?

There is a lot of competition between the lenders to attract high-net-worth clients and the providers are using the cheap funding to issue some incredibly well priced large loan rates.

If you are looking to raise £3 million to purchase or remortgage a property on an interest-only, part interest-only or full capital repayment basis, Trinity Financial has access to a lender offering a two-year fix at 0.89%. The overall cost for comparison is 3.2% APRC.

The monthly payments on a 0.89% interest-only mortgage would be £2,225 rising to £9,501 on full capital repayment over a 30-year term. The mortgage has a £999 arrangement fee, and you would need to put down a 40% deposit to qualify. Rates are not much more expensive if you have a smaller deposit – the rate would rise to 1.04% if you had a 30% to put down.

Aaron Strutt, product director at Trinity Financial, says: If you would prefer longer-term payment security, it is possible to access a 0.99% five-year fix. The monthly repayments on a £3 million mortgage would be £2,475 on interest-only or £9,638 on capital repayment over a 30-year term.

Call Trinity Financial on 020 7016 0790 to secure a large mortgage loan or book a consultation

Recommended Reading: Does My Husband Have To Be On The Mortgage

A How Much Income Do You Expect To Live On Per Year

You can choose to compute this amount using different strategies for example, by using the 70% pre-retirement income rule, or by simply looking at the lifestyle you envisage living in retirement and estimating what your expenses will add up to .

Note: In your calculations, if looking at your current lifestyle and expenses, remember to eliminate expenses that may no longer be relevant in retirement such as mortgage payments, cost of commuting to work, childcare expenses RRSP, CPP, and EI payments, etc. And, remember to add new expenses that may crop up such as travel expenses, hobbies, health issues, and so on.

The Ideal Mortgage Amount Differs For Everyone

If you live parts of the country which have wonderful $500,000 homes, then awesome! There is never a need to borrow $750,000. The standard deduction of $12,550 for singles and $25,100 for married couples in 2021 is probably good enough for most.

For those of you who live in expensive coastal cities, then consider $750,000 as the cap on how much you should borrow to purchase your primary residence.

Once done, consider taking advantage of investing in lower cost areas of the country through real estate crowdsourcing. You goal should be to diversify your real estate investments and take advantage of long-term trends. As a San Francisco property owner, Im actively trying to buy heartland real estate.

Some of you reading this have liquid assets north of $1 million dollars. A $750,000 mortgage is therefore nothing to be afraid of because everything is just accounting.

Your goal in this low interest rate environment is to minimize your debt interest expense by refinancing your mortgage. You should also maximize your government subsidies with the ideal mortgage amount.

Imagine refinancing your mortgage to 2.5% while making a 2.5% or greater return on your investments? Youre essentially borrowing money for free and then some!

Dont be afraid of mortgage debt. Mortgage debt is one of the best types of debt there is. So long as you can take out the ideal mortgage amount that is right for you, you should do well.

Read Also: How To Know If I Should Refinance My Mortgage

Comparing Common Loan Types

NerdWallets mortgage payment calculator makes it easy to compare common loan types to see how each type of loan affects your monthly payment. We source the latest weekly national average interest rate from Zillow, so you can accurately estimate and compare your monthly payment for a 30-year fixed, 15-year fixed, and 5/1 ARM.

To pick the right mortgage, you should consider the following:

How long do you plan to stay in your home?

How much financial risk can you accept?

How much money do you need?

15- or 30-year fixed rate loan: If youre settled in your career, have a growing family and are ready to set down some roots, this might be your best bet because the interest rate on a fixed-rate loan never changes.

In general, for a 30-year fixed loan, you will have the lowest monthly payment but the highest interest rate. However, with a 15-year fixed, youll have a higher payment, but will pay less interest and build equity and pay off the loan faster.

If other fees are rolled into your monthly mortgage payment, such as annual property taxes or homeowners association dues, there may be some fluctuation over time.

5/1 ARM and adjustable-rate mortgages: These most often appeal to younger, more mobile buyers who plan to stay in their homes for just a few years or refinance when the teaser rate is about to end.

Limits On The Mortgage Interest Tax Deduction

| Initial Mortgage Balance | |

|---|---|

| $1,000,000 | $3,923 |

| Methodology: Assumes a 30-year fixed-rate mortgage at 3.12% and a combined federal and state tax rate of 40%. |

Homeowners who itemize deductions on their federal income tax returns can deduct mortgage interest payments â but only up to a maximum of $750,000 in loan principal.

In other words, if your loan amount is $1 million, you won’t be able to deduct the interest on the $250,000 that exceeds the $750,000 limit.

Depending on your income, that could translate to $3,923 or more in “lost” tax savings during your first year owning your home.

Don’t Miss: Can I Change Mortgage Companies

Target Your Annual Salary Income

Generally speaking, if you want to buy a million dollar home. Youll need at least $225,384 in annual household income to make the payments. A persons down payment and interest rate determine how much money you need to put down on a house.

For a small down payment, youll need to earn nearly $300,000 a year to cover your housing costs, but for a large one, youll only need to earn about $207,000.

According to the 28/36 rule, you should not spend more than 28 percent of your gross monthly income on housing costs or 36 percent of your total debt payments.

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Recommended Reading: What Does It Mean Refinance Mortgage

How Much A $1000000 Mortgage Will Cost You

A 30-year, $1,000,000 mortgage with a 4% interest rate costs about $4,774 per month and you could end up paying over $700,000 in interest over the life of the loan.

Edited byChris JenningsUpdated August 17, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

A $1,000,000 mortgage could be your ticket to a Midwestern mansion or a Bay Area bungalow. Whatever type of home youre after, a substantial income and top-notch credit can help you get the jumbo mortgage you need.

In addition to your down payment, youll need money to cover the loan origination fee, home appraisal, and other closing costs. But here, well focus on the monthly payment you can expect under different scenarios as well as how much a $1,000,000 mortgage might cost in the long run.

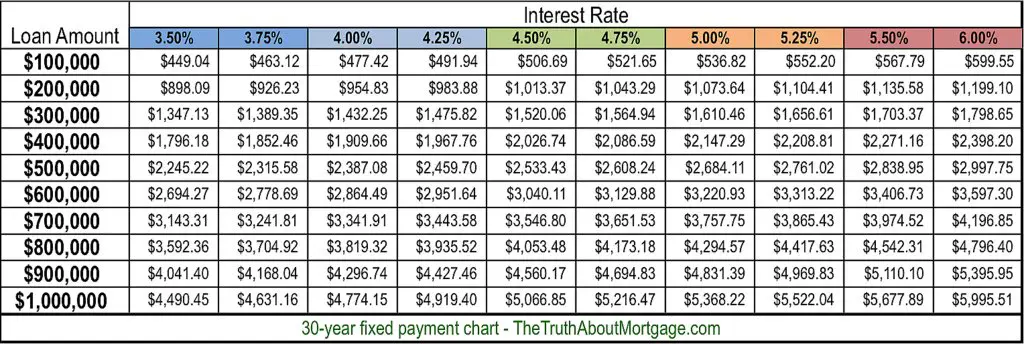

If youre applying for a $1,00,000 mortgage, heres how much that loan should cost you each month with interest:

Set A Goal To Acquire A Jumbo Loan

Your ability to gain loan approval for a loan on a million-dollar house is influenced by several requirements a down payment and closing costs of approximately $224,223 a credit score of at least 700 and savings to cover 6-12 months of mortgage payments.

Because its more than the maximum loan amount allowed in your area, your mortgage will likely be considered a jumbo loan. Normally, the cap is $510,400, but in some expensive markets, it rises to $765,600. Jumbo loans have more stringent requirements than conventional or government-backed mortgages, as you might expect.

You might also consider these factors:

-

Downpayment Size

Keep in mind that the total amount you can borrow with most conventional home loans is capped. According to Bankrate, the maximum home loan amount in 2019 was capped at $484,850. The traditional down payment for a house in the United States is 20%. Although mortgages require 10% or 15% down, it is possible to buy a house with only 3.5% down, thanks to programs like the Federal Housing Administration .

Private mortgage insurance may require that the buyer pay the minimum down payment to qualify for coverage. Otherwise, the monthly payment could increase by 0.5% to 1% percent.

-

The Debt-to-Income Ratio

The debt-to-income ratio is metric lenders use to measure how financially secure a buyer is. It measures how much their household liabilities are compared to the total annual income. The majority of lenders prefer a debt-to-income ratio of at least 32%.

You May Like: How Much Mortgage Can I Get With 50k Salary

Your Down Payment Determines The Amount Of Cmhc Insurance You Pay

Your CMHC insurance premium, calculated as a percent of your mortgage amount, gets smaller as you increase your down payment. To learn more about CMHC insurance and how it is calculated, please visit our CMHC insurance page.

| Down Payment |

|---|

| 5% – 9.99% |

| Total Payments over 25 Years | $402,726 | $377,991 |

|---|

Under Scenario B, the additional $15,000 put towards the mortgage down payment lowers CMHC insurance by $2,423 and saves the homebuyer around $25,000 in interest over the life of the mortgage. However, it is also important to consider the opportunity cost, or alternative uses for the additional outlay under Scenario B. You must look at your expected returns associated with RRSP contributions, stock investments, and/or debt repayments, for example, to make an informed decision.

You Make Closer To The Ideal Income

In the past, how much mortgage interest you can fully deduct is based on how much money you make. Make too much, and your mortgage interest deductions get phased out. Make too little, and you will feel the strain of the mortgage payments.

If you or your household make between $250,000-$300,000, you are in the sweet spot to take on a $750,000 dollar mortgage. This is because you shouldnt spend much more than 3X your annual income on a home after putting 20% down. This is my 30/30/3 rule for home-buying.

In expensive big cities like San Francisco, New York City and elsewhere, you may have to stretch to 5X your annual income. However, if you do, just make sure you have rock-steady employment and a good financial cushion. Buying a home thats 5X your annual income is a function of low mortgage rates and future income growth.

Read Also: Is Quicken Loans A Mortgage Company

Refinance Your Mortgage Now

Everybody should refinance their mortgage if they havent done so in a while. My favorite way to get free mortgage quotes from qualified lenders is Credible. Low mortgage rates is spurring on housing demand in the new decade.

You just need to come up with the 20% downpayment, which is one of the main struggles for first time home buyers today. Note, banks still only lend out 3-4X your income despite a drop in rates.

It is aggressive to think that someone who only makes $60,000 $90,000 a year in gross salary can afford a $750,000 mortgage. However, its also absurd that one can borrow $750,000 nowadays for only 2% 3%. Depending on your credit score and type of mortgage you get, getting a low-2% mortgage rate is possible.

I got a 7/1 jumbo ARM with minimal fees for 2.125% recently. However, I have an 810 credit score and have relationship pricing.

Future Cost To Sell Your $1 Million House

| Cost to Sell a $1 Million House | |

|---|---|

| Pre-listing expenses, closing costs, and other fees | Up to $90,000 |

| Total cost to sell: | Up to $150,000 |

Many people justify purchasing homes they can’t really afford by assuming property values will continue rising and they’ll rake in a huge profit when they decide to sell.

There are three big problems with this logic:

- There’s no guarantee property values will go up.

- Even if they do, they may not outpace inflation and the costs of homeownership.

- Selling a house is expensive!

The average cost to sell a house is around 10-15% of the final sale price, plus whatever it costs to pay off the remaining mortgage balance.

To sell a $1 million home, you should expect to pay roughly $100,000-150,000 in pre-listing expenses, closing costs, realtor commission, and other fees.

If you haven’t built a substantial amount of equity by the time you sell your house, you could actually lose money on the transaction.

Hopefully, your home value will have increased, but there’s no guarantee it will have climbed high enough to offset your home-selling expenses.

» MORE: How Much Commission Does a Realtor Make on a Million-Dollar House?

Also Check: How Do I Become An Underwriter For Mortgage

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.