Can You Refinance Your Mortgage Without Starting Over At 30 Years

But its possible to refinance without restarting your loan term at 30 years. With a little bit of savvy, you can take advantage of todays record-low mortgage rates and shorten the number of years remaining on your loan. Heres what to do. In this article As a homeowner, your mortgage is your choice.

Compare Rate Quotes And Loan Terms

Once youve narrowed down refinance offers, evaluate them carefully. The interest rate is of course a major consideration, but also take the time to review the closing costs and other loan terms. If one of the offers includes an early repayment fee, for example, that means paying more if you decide to refinance again sometime in the future.

Here Are Some Mortgage Refinance Options That May Suit Your Unique Needs

Tags:Mortgage,Home,Refinance,Loans

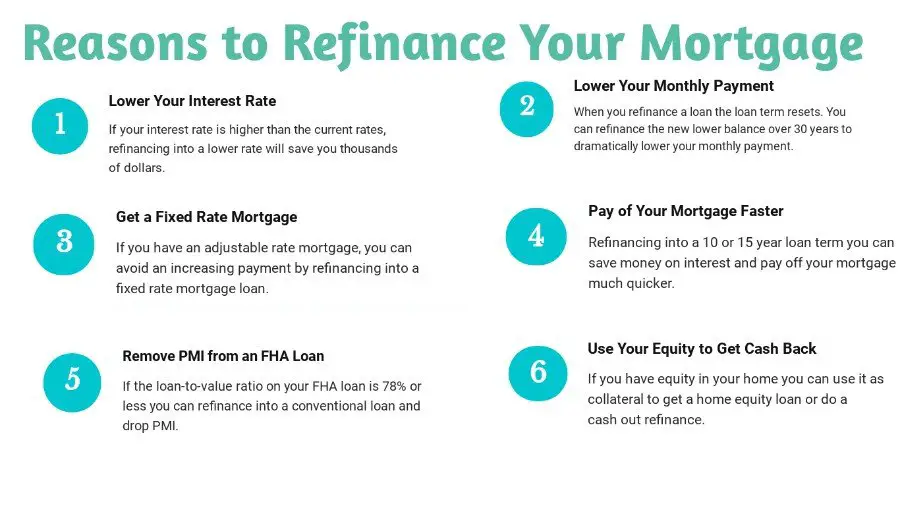

Refinancing your mortgage could save you money, help you pay off your home faster or unlock the equity in your home if the time is right. Knowing your refinancing options is key to gaining the maximum benefit from your decision. Learn whether home mortgage refinancing is right for you.

There are many mortgage refinancing options for many needs, but whatever your goals are, a mortgage loan officer can answer your questions and help you find the home mortgage refinancing thats right for you!

Mortgage and Home Equity products are offered by U.S. Bank National Association. Loan products are offered by U.S. Bank National Association and subject to normal credit approval.

Investment and Insurance products and services including annuities are:Not a Deposit Not FDIC Insured May Lose Value Not Bank Guaranteed Not Insured by any Federal Government Agency

U.S. Wealth Management U.S. Bank and U.S. Bancorp Investments is the marketing logo for U.S. Bank and its affiliate U.S. Bancorp Investments.

U.S. Bank, U.S. Bancorp Investments and their representatives do not provide tax or legal advice. Your tax and financial situation is unique. You should consult your tax and/or legal advisor for advice and information concerning your particular situation.

For U.S. Bank: Equal Housing Lender.

U.S. Bank is not responsible for and does not guarantee the products, services or performance of U.S. Bancorp Investments, Inc.

You May Like: What’s The Average Mortgage Payment

The Bottom Line: Time Your Refinance Right

When youre ready to consider refinancing your home, gather all the details about your current home budget. Factor in your familys long term financial goals, the condition of your home, and the equity you have to make an educated decision about what’s best for your familys financial future.

If you want to read more about mortgage loan refinancing, explore special considerations for a mortgage loan refinance. If youre ready to check out your options, you can apply online or give us a call at 452-0335.

You Have Concerns About Your Arm Adjusting

Adjustable rate mortgages vary over the life of the loan. The rates depend on not only market conditions, but also the type of loan you have. Some ARMs adjust once a year, while others adjust after five or seven years. In most cases, youll pay less interest with an adjustable rate mortgage and have lower monthly payments early in your loan term.

If your existing mortgage is at a fixed-rate and you anticipate that interest rates will continue falling, you might consider switching to an adjustable rate mortgage. If you plan to move within a few years, changing to an ARM may make the most sense for your situation since you wont be in your home long enough to see the loans interest rate rise.

Alternatively, the most unsettling thing about ARMs is when its time for the loan to adjust, interest rates and payments may skyrocket. Refinancing and switching over to a fixed rate mortgage may be a good option for you if youre worried you wont be able to afford your payments when your loan adjusts.

Also Check: How Do You Calculate Self Employed Income For A Mortgage

The Mortgage Refinance Process

When you get a mortgage refinance loan, youare establishing a brand-new home loan with brand-new terms. This typically means you must gothrough the full mortgage application and approval process.

Mortgage underwriters will evaluate your application in threespecific areas:

Your home will also be appraised to confirm its currentmarket value, just as it was when you got your existing loan.

Despite the similarities between buying and refinancing,borrowers can usually expect to provide less documentation during the refinancing process.

You will still be asked to provide proof of income using W-2s and pay stubs proof of assets via bank statements and proof of citizenship or U.S. residency status.

But you will not be asked to provide information related to the original transfer of the home.

Refinance mortgages are often ready to close in 30days or fewer.

But keep in mind that market conditions can affect closing times. If rates have fallen sharply and many homeowners are rushing to refinance at the same time, it may take 40-45 days or longer to close.

Does Refinancing Hurt Your Credit

One of the costs of refinancing is that it may impact your credit temporarily. When you apply for a loan, your lender will check your credit score , conducting something thats called a hard credit inquiry. Hard credit inquiries can drop your credit score by a few points, but it wont impact your score forever.

Bottom line: Refinancing can hurt your credit score temporarily. However, if the savings and benefits are worth it, a quick dip in your score probably isnt something to be too concerned about, especially if your credit is in good standing.

Don’t Miss: How Much Is Mortgage On 1 Million

Todays Mortgage Refinance Rates

There are many ways to refinance ahome and millions of U.S. homeowners are potentially eligible for lower ratesand payments.

The best way to find your low rateis to shop with three to four different lenders and compareoffers.

Popular Articles

Step by Step Guide

What Are The Biggest Obstacles To Refinancing

Loss of income due to lack of work, a credit score that has dropped or is too low, and a high debt-to-income ratio can prevent you from refinancing.

Debt-to-income ratio is your total debts each month compared to your monthly income. An optimum debt-to-income ratio is below 36 percent, says McBride. That means that your debts including your monthly mortgage payment, monthly maintenance fees or common charges, taxes, property insurance, credit cards and vehicle loans should not exceed 36 percent of your gross pay.

Certain business owners can face difficulties getting refinancing. It can be harder to qualify for a mortgage if you have 1099 tax income from a sole proprietorship, for example, rather than W-2 income as an employee.

Yet you can have good credit without traditional sources of income, says Kan. There are credit models that reflect nontraditional incomes.

You May Like: What Salary Is Required For A Mortgage

Closing On Your New Loan

Once underwriting and home appraisal are complete, its time to close your loan. A few days before closing, your lender will send you a document called a Closing Disclosure. Thats where youll see all the final numbers for your loan.

The closing for a refinance is faster than the closing for a home purchase. The closing is attended by the people on the loan and title, and a representative from the lender or title company.

At closing, youll go over the details of the loan and sign your loan documents. This is when youll pay any closing costs that arent rolled into your loan. If your lender owes you money , youll receive the funds after closing.

Once you’ve closed on your loan, you have a few days before you’re locked in. If something happens and you need to get out of your refinance, you can exercise your right of rescission to cancel any time before the 3-day grace period ends.

Get approved to refinance.

A Lower Interest Rate On Your Mortgage

When interest rates go down, refinancing picks up. Depending on the length of your loan and how long you plan to stay in the home, refinancing your house for a lower rate could save you thousands over the term. But theres no need to wait for falling rates if youve improved your credit. Sometimes credit can improve enough that you can refinance at a lower rate based on having a better credit score.

You May Like: Can I Get A Mortgage With A Fair Credit Score

Check Your Credit Score

When refinancing your mortgage, youll have to qualify in much the same way as when you applied for your mortgage. To be prepared, know your credit status, Kan says.

You can order a credit report from each of the three credit reporting agencies Equifax, Experian and TransUnion to check your score and whether information about you is accurate. You can obtain a free copy of your credit score from the Annual Credit Report website. Credit reporting agencies can send you your credit scores or you can access them online.

Typically, you can only get one free credit report from one of the agencies a year. But because of the economic crisis spurred by the pandemic, the three agencies agreed to provide a weekly free credit report to any American through April 2022.

If you have score of 740 or higher you are positioned to get the best rates, McBride says. If your scores are below 660 you will typically be offered higher mortgage interest rates. If your scores are 620 or lower you may be limited to government refinance programs, he says.

The Federal Housing Administration , part of the U.S. Department of Housing and Urban Development, offers FHA refinance options. Veterans with Department of Veterans Affairs loans might qualify for a VA Interest Rate Reduction Refinance Loan .

Lock In Your Interest Rate

Once youre approved for your refinance, most mortgage lenders allow you to lock in your interest rate. With a locked rate, even if market rates rise before you close on the loan, your rate will stay the same. When you lock in your rate, you can start planning your monthly budget because youll have a good sense of how much your payments will be.

You May Like: Can You Refinance Mortgage With Poor Credit

What Are The Rules For Refinancing A Conventional Mortgage

To get a cash-out refinance on a conventional mortgage you must have owned the home for at least six months, unless you inherited the property or were awarded it in a divorce, separation or dissolution of a domestic partnership. Rules for refinancing FHA loans An FHA loan is a mortgage insured by the Federal Housing Administration.

Advantages Of Mortgage Refinancing

If the interest rate on the new loan is significantly less than the original mortgage, the homeowner can save significant money, and have a lower monthly payment.Using the second example, the original mortgage will have an approximate monthly payment of $1,317.21. When you add in the approximate monthly payment of $600.00 for the $20,000 in credit card debt, the homeowner has $1,917.21 to pay monthly.If the homeowner can borrow $220,000.00 at 5% interest to pay off both the original mortgage and the credit card, the monthly repayment will be $1,174.12. The homeowner is now combining two debts and paying less than he did on the original mortgage. If the interest rate is significantly less, the homeowner may see a great deal of savings.

You May Like: Who Has The Best Mortgage Loan Rates

Whats The Difference Between Refinancing Vs Renewing Your Mortgage

Renewing your mortgage means staying with your current lender for another term. Youll have an opportunity to renegotiate your interest rate and term, and you wont need to re-apply.

When you refinance, you are paying out your existing mortgage in order to negotiate a new mortgage loan agreement. This is usually because you want to access the equity in your home or lower other borrowing costs. There may be prepayment charges depending on when you choose to refinance.

Common Reasons To Refinance A Mortgage

There are many good reasons to pursue a refinance, the biggest of which is lowering your interest rate. If you can reduce your rate by one-half to three-quarters of a percentage point or more, refinancing is likely worth it, as long as you plan to stay in the home long enough to recoup the closing costs. Bankrates mortgage refinance calculator can help you decide.

You may be able to reduce your interest rate and monthly mortgage payments, notes Alan Rosenbaum, CEO and founder of New York City-based GuardHill Financial Corp. Also, if youve built up equity in your home, you can take out cash at closing to pay for home improvements, consolidate debt, invest or pay for a large transaction.

You can also refinance to shorten your loan term and pay it off faster, resulting in less interest paid over the life of your loan. One option is refinancing a 30-year mortgage into a 15-year one.

If you have an adjustable-rate mortgage, refinancing to a fixed-rate loan can be a smart move, too. Youll have peace of mind knowing that your principal and interest payments will stay the same throughout the loan term.

In addition, if youve been paying for private mortgage insurance, refinancing can eliminate those payments if youve reached at least 20 percent equity in your home.

Also Check: Can You Get A 30 Year Mortgage On Land

When Is It A Good Time To Refinance My Mortgage

Homeowners refinanced $2.6 trillion in mortgage debt last year thanks to record-low mortgage rates, according to Freddie Mac, a quasi-government agency that helps support the mortgage market. Rates remain exceptionally low, so its worth running the numbers and seeing how much you could save by refinancing now. Here are some signs the time might be right.

- You can lower your rate by at least 0.5%. Theres no hard-and-fast rule that determines what interest rate drop makes refinancing worthwhile. You have to calculate how much youd save based on each lenders offer. But if the current rates are lower than your existing rate, its a good time to do the math and seek options. The typical homeowner who refinanced in 2020 lowered their rate by 1.2 percentage points, according to Freddie Mac. Borrowers with very good to excellent credit to get the best rates.

- You can pay off your mortgage faster. Refinancing into a shorter mortgage term can potentially save you more by combining a lower interest rate with fewer years of payments.

For example, if youve borrowed $300,000 and your rate on a 30-year mortgage is 3.5%, your monthly payment is $1,350 and youll pay $185,000 in interest over 30 years.

If you refinance that amount into a 15-year loan at 2.1%, your new monthly payment will be $1,900, and youll pay $49,000 in interest over the next 15 years . Youll save $126,000 in the long run, minus closing costs of around $3,000.

Consider The Cost To Refinance

Before you decide on refinancing your TD Mortgage or a TD Home Equity FlexLine, be sure to look at all potential costs. Prepayment charges may apply if the agreement is ended before the term is done. There may also be associated fees for mortgage registration and property valuation.

But if youre able to take advantage of lower interest rates, your overall savings may make it worthwhile.

You May Like: How To Understand Mortgage Payments

Too Busy To Visit A Branch

Meet with a Mortgage Specialist at your home, workplace, coffee shop, or other convenient location.

Need to talk to us directly?Contact us

Follow TD

Super: TD presents Asking for a FriendWhy Would You Refinance?

Welcome to Asking for a Friend. Lets see who could use some financial advice today.

Dear Asking for a Friend,My neighbour was talking about refinancing her home so she can borrow more money to build an extension, and it got me wondering…what exactly IS refinancing and why do people refinance?Sincerely,Next Door Nancy

I hear you, Nancy. First, what is refinancing?

Refinancing means renegotiating your existing mortgage loan agreement, usually to use any available equity in your home.

So what does that mean in real terms? Let’s say the value of your home is $500,000.

Super: $500,000

80% of home value 0.8 x $500,000 $400,000Outstanding balance of your mortgage $300,000How much you can borrow $100,000

Subject to the bank’s approval, you could borrow up to 80% of the value of your home less the outstanding balance of your mortgage.

That means if your home is worth $500,000 and you have an outstanding balance of $300,000 on your mortgage, you may be able to borrow an additional $100,000 .

So WHY do people refinance?

Super: To consolidate debts.

Super: Provide flexibility to pay for big ticket items.

Book an appointment and get financial advice for what you feel is most essential, through TD Ready Advice

Endslate: Visit td.com/readyadvice