The Financing Course Of For Actual Property Transactions

A trustee’s financial quantity is often 1 to five% of the overall property gross sales value. This cash goes to the escrow account after the ultimate provide is accepted by the vendor.

The cash comparable to the land transaction will solely be launched after the title has been transferred. The funds stay within the custody of the trustee so long as the authorized actual property proceedings happen.

During this course of, neither the client nor the vendor have entry to the cash, nor can they intervene on the escrow quantity. The cash is transferred to the vendor if the acquisition is profitable or returned to the client if it fails.

How To Lower Your Escrow Payments

Generally, you can’t adjust your property tax payment amount. Though, you might be able to challenge your home’s assessed value or take advantage of an abatement, deferral, or repayment program, which could lower your escrow payments.

You could also shop around for homeowner’s insurance and pick the policy with the lowest price, which would, in turn, lower your escrow payments. However, picking a cheap insurance policy isn’t always a good idea because it could have inferior coverage. Lenders normally specify minimum policy limits and hazards that must be covered.

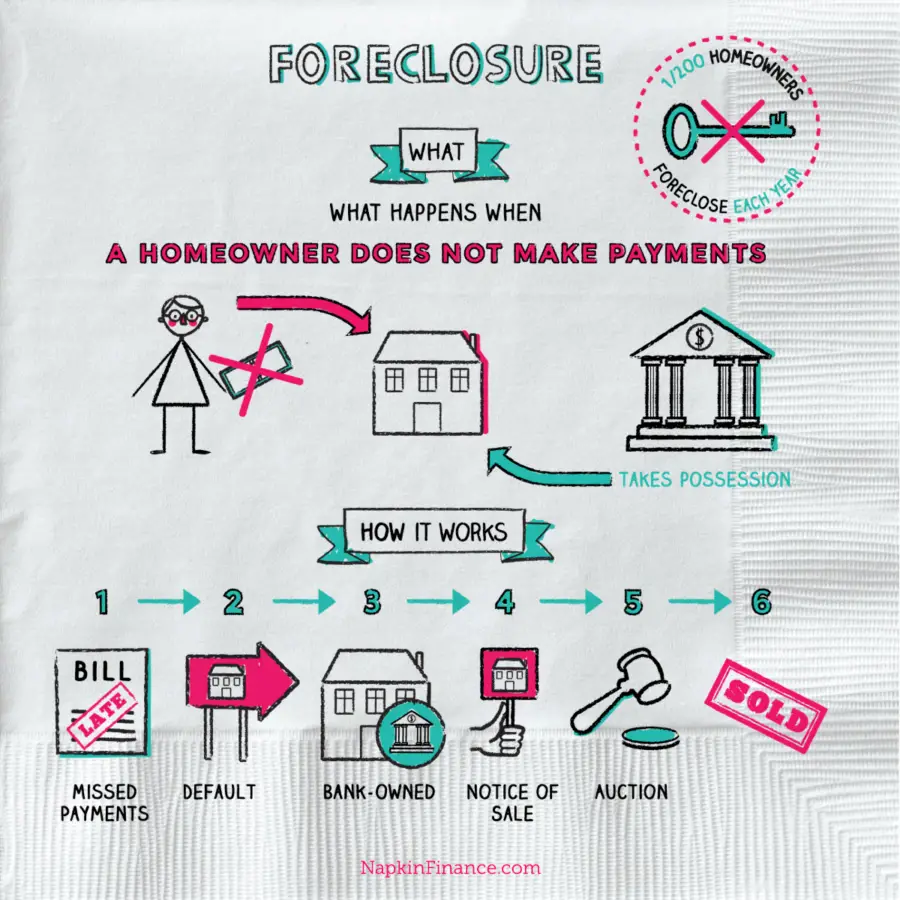

What Happens If You Don’t Pay Your Property Taxes

If you fail to pay the property taxes, the taxing authority might charge you penalties, interest, and fines. Also, when you don’t pay the property taxes, the overdue amount becomes a lien on the property. A “lien” is a claim against your property to ensure you’ll pay the debt it effectively makes the home act as collateral for the debt. So, if you don’t pay the delinquent taxes, you could lose your home to a tax sale or a foreclosure.

You could lose your home to a tax sale. All states have laws that allow the local government to sell a home through a tax sale process to collect delinquent taxes. For example, in a tax lien certificate sale, the taxing authority sells the tax lien, and the purchaser gets the right to collect the debt along with penalties and interest. If the delinquent amounts aren’t paid, the purchaser can typically foreclose or follow other procedures to convert the certificate to a deed. In some jurisdictions, though, a sale isn’t held. Instead, the taxing authority executes its lien by taking title to the home. State law then generally provides a procedure for the taxing authority to dispose of the property, usually by selling it. In other jurisdictions, the taxing authority uses a foreclosure process before holding a sale.

Also Check: Does Getting Pre Approved For Mortgage Hurt Credit

How Much Do Escrow Services Cost

DiBugnara says fees for escrowservices can vary.

Thankfully, the borrower is notcharged when their deposit is held and paid out by the escrow officer, hesays.

Other services come with a price.These include duties like ordering surveys, handling title matters, andassisting in closing.

The escrow company determinesthese costs. But the charges must be customary and reasonable for the area, Betancourt-Molinasays.

In my state of Georgia, theattorney fee could be $500 to $1,000. Title search can cost $250 if the titleis clean. A tax search costs about $50. And title insurance fees vary based onthe price of the property, says Ailion.

Per the National Association of Realtors, escrow costs add 1 to 2% of the cost of the home. Often, the buyer and seller split the charges, depending on local custom. Of course, everything is negotiable, and when you refinance, those costs are all yours.

What You Need To Know About Mortgage Escrow Accounts

By Amy Loftsgordon, Attorney

People who own real property have to pay property taxes. If you have a mortgage loan on your home, the servicer might collect money as part of the monthly payments to later pay the property taxes, as well as certain other costs, like:

- homeowners’ insurance

- homeowners’ association dues.

The loan servicer pays the costs for these items on the homeowner’s behalf through an escrow account. Lenders often require borrowers to have an escrow account as a condition of getting a loan. The idea is to protect the lender from the possibility that you won’t regularly pay these expenses on your own.

Here’s what you should know about mortgage escrow accounts if you’re planning on getting a mortgage loan.

Recommended Reading: Is Fairway Mortgage A Broker

Mortgage Escrow Account Rules Lenders Have To Follow

Every year, loan servicers have to review escrow accounts to ensure the escrow portion of borrowers’ monthly mortgage payments cover the escrow item costs while also maintaining the minimum escrow account balance. This process is called an “escrow analysis.” ).

If your mortgage loan has an escrow account, you can and should review the escrow analysis whenever the servicer completes one. Servicers usually provide this information through the mail, as well as online. Check your lender or servicer’s website and log in to your account to see what escrow payments are being made out of your account. Look for potential errors, like missed payments to the taxing authority or your homeowners’ insurance company. If you notice something is amiss, or if your insurance company or tax collector informs you that your payment is delinquent, contact your loan servicer immediately.

However, if you’re over 30 days behind in your payments when the analysis is completed, or you’re in foreclosure or bankruptcy, the servicer doesn’t have to send you the statement. But if you reinstate the loan later on or otherwise bring it current, like by completing a loan modification, the servicer must provide an account history since the last annual statement within 90 days of when the account became current. .

What Does That Mean For Escrow Reconciliation

Your mortgage company takes a portion of your payments to pay these monthly bills. Your mortgage loan company will keep an accurate count on what youve paid to them, what theyve been charged, and how much theyve paid out.

Once a year, normally in the first half, your mortgage company will dip into their books to reconcile how much theyve paid out vs. what you have paid them. Any money leftover is paid back to the homeowner in the form of an escrow reconciliation payment.

The mortgage company will then use the data from previous and current years to adjust what they charge you and what they pay out. The next year they do it all again. Youre likely to receive many reconciliation checks over the life of your mortgage.

Why Escrow Reconciliation Happens

Escrow reconciliation happens due to changes in charges on your mortgage, but it also happens based on how mortgages work. Lets imagine your property taxes go up by $48 a year. Youd expect your mortgage to reflect that with a monthly $4 increase, after all $48/12 =$4 but when you get your first statement there is an extra $8.

This is because mortgage companies normally bill the first and next years payments in one statement. Once those payments are adjusted the next year, youll receive the difference during escrow reconciliation.

Two vs Three Way Reconciliation

Using a Professional for Other Questions

Reconciling Reconciliation

You May Like: What’s The Mortgage Rate

Benefits Of Depositing Tax And Insurance Money Into An Escrow Account

If your mortgage servicer requires an escrow account, you don’t have to worry about making property tax or insurance payments on your own. Instead, you can rely on your mortgage servicer to handle these.

In addition, you don’t have to budget for tax and insurance payments since they’re already included in your monthly mortgage payment. You’ll pay a little every month, so you won’t have to make a big tax or insurance payment once or twice a year.

Most mortgage servicers require at least two months of tax and insurance payments in escrow, so you’ll automatically have some funds set aside.

Advantages And Disadvantages Of Escrow

Escrow can provide security for high-ticket transactions, but that service generally comes with a fee. Escrow for mortgages can help protect the borrower and lender from potentially underpaid property taxes or homeowners insurance.

On the downside, these numbers are generally estimated, so you may end up overpaying into your escrow account, which may lead to an adjustment when it comes time to make the annual payments. For the ease that monthly escrow payments offer, this requires a higher mortgage payment than if the payment only included principal and interest.

-

Provides protection during a transaction, notably a real estate transaction

-

Can allow for the monthly payment of insurance and taxes .

-

Escrow is beneficial for both the buyer and seller when high-ticket items are involved.

-

Higher mortgage payments

-

Estimates might be incorrect for the amount of taxes.

-

For online transactions, escrow fees might be higher than other platforms, such as PayPal.

Also Check: Should I Refinance My Mortgage To Pay Off Debt

How To See Your Freedom Mortgage Escrow Accounts Details

View escrow details by logging into your online Freedom Mortgage account. Your monthly statement also contains information about your escrow account.

If you have questions about your escrow account, please see our Escrow Account FAQs. You can also call our Customer Care Department at . Representatives are available to help you Monday through Friday from 8:00 am to 10:00 pm and Saturday from 9:00 am to 6:00 pm Eastern Time.

Other Insights

Initial Escrow Payment At Closing

Lenders usually require at least two months worth of insurance and property tax funds in the impound account at closing. The amount you have to prepay into an impound account for these costs is based on your location. Keep in mind that these funds arent additional closing costs. Instead, youre prepaying extra months of home insurance and property tax bills that you would be required to pay when due. Your mortgage servicer will list the initial escrow payment amount due at closing on your loan estimate.

Also Check: Can You File Bankruptcy On A Second Mortgage

Final Thoughts On Escrow

Escrow is an important part of purchasing a home. It protects buyers and sellers during home sales and offers a convenient way for you to pay for your taxes and insurance.

An escrow account is sometimes required, and sometimes its not. It depends on the type of loan you get, as well as your financial profile. It may be tempting to go without an escrow account because it could mean a lower monthly mortgage payment but escrow can actually provide peace of mind by removing your responsibility to make sure those important bills get paid.

Can Seller Back Out After Closing

Sellers can back out of a home sale without ramifications in the following instances: The contract hasnt been signed. Before a contract is officially signed, a seller can kibosh a deal at anytime . The contract is in the five-day attorney review period.

Don’t Miss: How Can I Mortgage My House

Do You Have To Keep Tax And Insurance Money In An Escrow Account

A monthly escrow account may be optional for some homebuyers, but many mortgage servicers require them. For example, if you take out a loan backed by the Federal Housing Administration , you’re required to have an escrow account for taxes and insurance. If you take out a loan backed by the U.S. Department of Veterans Affairs , you may not be required to keep money in escrow. Lenders may also waive the requirement depending on the amount of your down payment or any discount points or charge a higher interest rate.

Escrow Accounts For Taxes And Insurance

After you purchase a home, your lender may establish an escrow account to pay for your taxes and insurance. After closing, your lender takes a portion of your monthly mortgage payment and holds it in the escrow account until your tax and insurance payments are due.

The amount required for escrow is a moving target. Your tax bill and insurance premiums can change from year to year. Your servicer will determine your escrow payments for the next year based on what bills they paid the previous year. To ensure theres enough cash in escrow, most lenders require around 2 months worth of extra payments to be held in your account.

Your lender or servicer will analyze your escrow account annually to make sure theyre not collecting too much or too little. If their analysis of your escrow account determines that theyve collected too much money for taxes and insurance, theyll give you a refund. If their analysis shows theyve collected too little, youll need to cover the difference. You may be given options to make a one-time payment or increase the amount of your monthly mortgage payment to make up for a shortage in your escrow account.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Also Check: How Do I Apply For A Usda Mortgage

Escrow And Real Estate

Escrow accounts can apply to real estate transactions. Placing the funds in escrow allows the buyer to perform due diligence on a potential acquisition. Escrow accounts also assure the seller that the buyer can close on the purchase. For example, an escrow account can be used for the sale of a house. If there are conditions attached to the sale, such as the passing of an inspection, the buyer and seller may agree to use escrow.

In this case, the buyer of the property deposits the payment amount for the house in an escrow account held by a third party. The seller can proceed with house inspections confident that the funds are there, and the buyer is capable of making payment. The amount in escrow is then transferred to the seller once all the conditions for the sale are satisfied.

Escrow can also refer to an escrow account that is set up at the time of mortgage closing. With this, the escrow account houses future homeowners insurance and property tax payments. A portion of the monthly mortgage payment is deposited into the escrow account to cover these payments. Thus, mortgagees that set up an escrow account will have higher payments than those who do not however, they will also not have to worry about paying the yearly premiums or property tax bills as they’re already paying it monthly into their escrow account.

What Happens When You Place Tax And Insurance Money In Escrow

When you take out a loan to buy a house, your monthly mortgage payment may include more than just principal and interest. It can also include enough to cover a portion of the property tax as well as the homeowners, mortgage or flood insurance for your house. Many mortgage servicers collect money for tax and insurance and submit the payments to your insurance provider and property tax office on your behalf. Your money stays in your account until your tax and insurance payments are due. Most mortgage servicers require you to keep a certain minimum balance, such as two months of escrow payments, at all times.

In most cases, your mortgage servicer bases your escrow payments on the previous year’s tax and insurance payments. If the amount you owe for taxes and insurance goes up or down over the course of the year, your mortgage payment may change.

Mortgage servicers provide an annual escrow analysis. This analysis provides an overview of your account, including account history and projected activity for the next year. It also highlights your current and new mortgage payments and confirms whether you have a surplus or a shortage. If you have a surplus, your mortgage servicer may include a refund check. If you have a shortage, your mortgage servicer will automatically spread the shortage over the next 12 months. You may also have options to pay all or part of the shortage upfront.

Read Also: What Will Be My Mortgage

Escrow And Earnest Money

The tradition of escrow in real estate is most closely tied to the need for earnest money in a high-value sale. Also known as a good-faith deposit, earnest money is the buyers investment in the purchase. When a buyer opens negotiations., the seller takes a good-faith action and pulls the house off the market. This is an investment, in its way, because of the potential cost to put the house back on the market if a deal falls through.

A buyer puts down 1% to 3% of the homes listed price as earnest money. This money will eventually go into their purchase amount, eventually applied to your homeowners insurance and property taxes, unless the deal falls through. If the deal falls through, the seller keeps the earnest money to cover the costs of re-listing.

What Is Escrow Analysis

Since property taxes and insurance premiums can change over time, your lender will conduct a yearly review, called an escrow analysis, to ensure that there are enough funds in your escrow account. The lender will analyze the amount youll need to have in your account over the next year, breaking it down by month. From there, your lender will project if youll have a shortage or an overage. Youll be informed of any changes to your account in a statement after the analysis.

You May Like: Can You Refinance Your Mortgage

Escrow Fraud And Scams

Keeping informed about your escrow account is essential, and not just from a budget perspective. Due to the often large amount of money held in escrow, these accounts have become targets for scammers.

The types of scams vary, but one common scheme is duplicating your lenders or servicers website or email communications in an attempt to get your login credentials or have you wire funds to a fraudster. Some scams even set up official-sounding phone numbers as another way to build trust and get you to reveal your login information. Always carefully review any communications relating to your escrow account, and alert your lender or servicer if you suspect fraudulent activity.