How Long Do I Have To Own A Property Before I Can Remortgage

Typically you can remortgage to a new deal six months after taking out your current mortgage, meaning you will not be able to release equity for at least six months. If you wait for longer than half a year you will have a better choice of remortgage with variable or fixed rate deals and equity options.

Additional Monthly Mortgage Expenses

Note, that in addition to homeowners insurance, your lender may also require you to pay whats called mortgage insurance on conventional and FHA loans depending on your down payment amount. This insurance protects the lender if you fail to make your payments. When you put a down payment of less than 20% on a conventional loan, youll pay private mortgage insurance until you reach 20% equity. FHA loans have mortgage insurance premiums for the life of the loan. VA and USDA loans do not require mortgage insurance.

You may have other monthly costs associated with owning a home that are your own responsibility, such as homeowners association fees and home warranty premiums. Make sure to stay on top of these expenses to avoid any late fees or penalties. You can use Zillows online mortgage calculator to estimate your mortgage payment, including any PMI, property tax, homeowners insurance and HOA dues.

Things To Look For In A Mortgage

When youre approved for a mortgage, youll sign a promissory note, saying you promise to follow all the agreed-upon terms of the loan in order to keep the property. Make sure you understand the terms youre agreeing to, such as:

- The size of the loan

- Your interest rate and annual percentage rate

- The type of interest rate and whether it can change

- Your mortgage repayment schedule

- Any additional clauses or penalties

- The number of years you have to repay the loan

Don’t Miss: Can You Refinance A Mortgage With Less Than 20 Equity

How Many Mortgages Can I Have On My Home

Lenders generally issue a first or primary mortgage before they allow for a second mortgage. This additional mortgage is commonly known as a home equity loan. Most lenders dont provide for a subsequent mortgage backed by the same property. Theres technically no limit to how many junior loans you can have on your home as long as you have the equity, debt-to-income ratio, and credit score to get approved for them.

Could A Remortgage Help You

While most homebuyers have heard of remortgaging, they do not understand what it means. Well go into how it works and when you should and shouldnt remortgage in this guide.

Remortgaging will help you lower your mortgage payments, pay off current debts, or finance a home improvement project. However, it is not appropriate for all. Below, we clarify whether its a viable choice, what happens, the steps you must take, and the costs you can incur.

Don’t Miss: How Much Will My Monthly Mortgage Payment Be

Do You Need A Remortgage Valuation

It would help if you first determined the value of your home before looking at mortgage rates. Its important to be realistic since your lender will ultimately perform their own valuation to validate your estimation either by an online desktop valuation or an internal inspection.

You can arrange for your own valuation for an impartial surveyor to determine the value of your home, but this can be costly, as the lender would also need to commission their own appraisal. A simple thing to do is just look on a property selling website to see the value of similar properties in your local area to see how much they are up for sale for.

What Does Your Monthly Payment Actually Cover

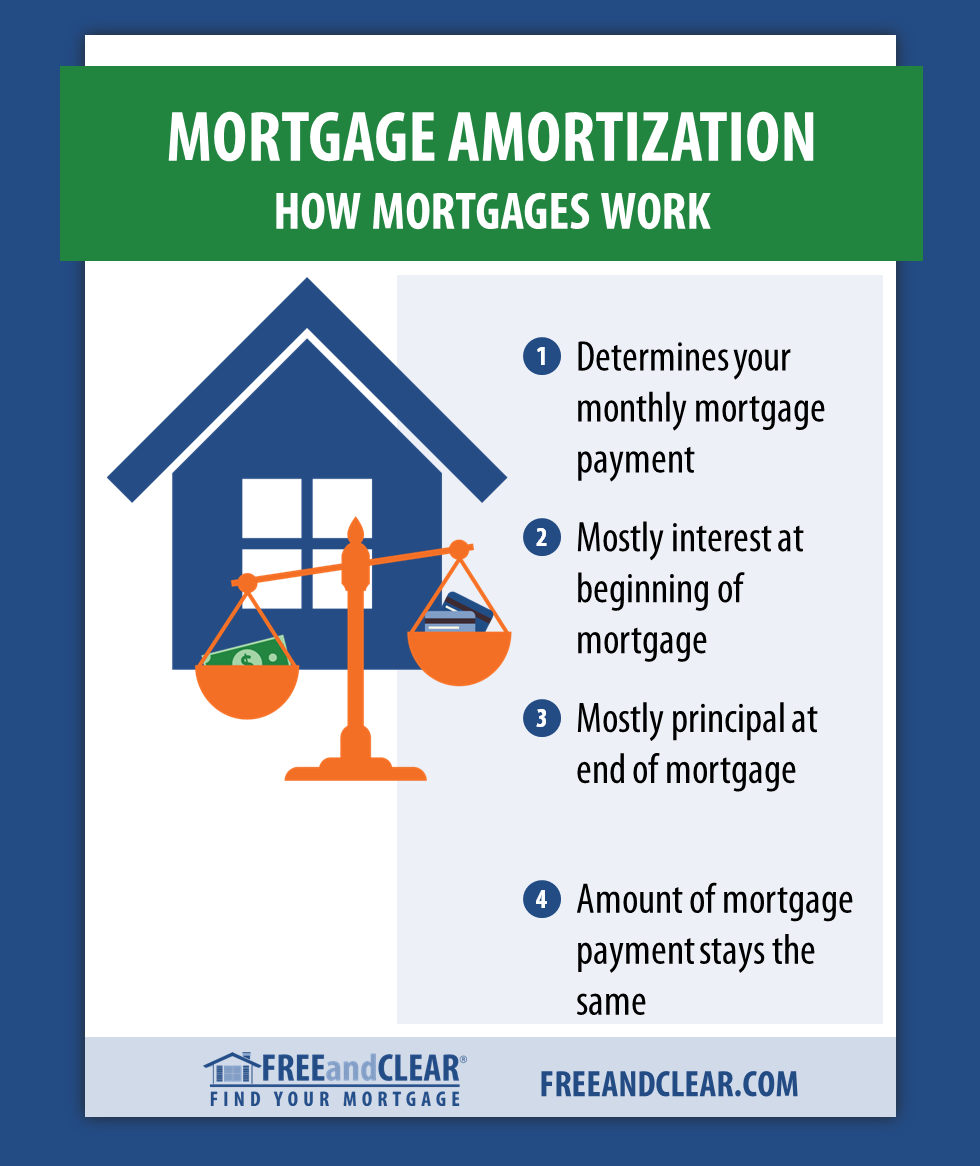

Your monthly mortgage payments allow you to build equity, or ownership, in the home over time. Think of it this way: If you were to pay a 10% down payment, you’d own 10% of the home.

A mortgage is made up of four parts: The principal amount, interest, taxes and insurance. Remember that any time you borrow a loan of any kind, you’re expected to make monthly payments toward the balance you borrowed in addition to the interest. The same holds true for a mortgage the principal amount is broken down into fixed, equal monthly payments over the span of your loan’s term.

Property taxes are yet another component of the home buying process. Whether you’re buying your home outright in cash or opting to take on a mortgage, you’re still responsible for paying these.

If you opt to pay cash for the home , it will be your responsibility to pay your property taxes directly to the government. If you have a mortgage, you can opt to have your property taxes included in your monthly payment and put into an escrow account. Then, when your taxes are due, the lender will take the money out of that account and use it to pay your property taxes.

Finally, your escrow account will cover the homeowner’s insurance payments so you’ll be covered in the event of a claim such as hurricane damage, for example. However, each policy covers different events at different amounts, so be sure to read your insurance disclosures to understand what you’re home is protected against.

Read Also: How To Create A Rocket Mortgage Account

Select Breaks Down The Mortgage Process And Digs Into What Your Monthly Payments Actually Cover

A mortgage is a type of loan consumers use to purchase a house and agree to repay in small, equal, fixed monthly amounts over a certain time span, or term. For many homebuyers, the mortgage process is an essential part of the homeownership experience, though it can be a lot to wrap your head around if you’re going through it for the first time. Here’s a look at everything you need to know about mortgages, how they work and what your monthly payment actually covers.

What Does It Mean To Mortgage A House You Own

Asked by: Marc Kuhic

The term mortgage refers to a loan used to purchase or maintain a home, land, or other types of real estate. The borrower agrees to pay the lender over time, typically in a series of regular payments that are divided into principal and interest. The property serves as collateral to secure the loan.

Don’t Miss: How Much Is The Current Mortgage Interest Rate

Average Mortgage Rates In 2022

One of the most important factors in determining the cost of a mortgage is the interest rate. Given the size of the typical mortgage, even a small difference in rate has a big impact.

For example, on a $250,000, 30-year loan, youd pay $1,375 a month with a 5.57 percent interest rate and $1,194 with a 4 percent rate. Thats a difference of $181 a month or more than $65,000 over the life of the loan.

In August 2022, the average interest rate on a 30-year fixed mortgage was 5.57 percent. 15-year loans were less expensive at 4.82 percent. ARMs were even cheaper, with rates as low as 4.284 percent available.

Our rate tables are updated daily and will show you the latest rates for your area.

How Can I Get Out Of My Mortgage

7 Ways To Get Out Of Your Mortgage

Don’t Miss: Should I Take Out A Mortgage At Age 60

A Remortgage Will Help You Save Money On Things Like:

Legal fees Since the legal process for a remortgage is less complicated than buying a home, solicitors fees should be smaller if not free in some cases.

Stamp Duty Land Tax You only pay SDLT when you purchase a property, so you wont have to pay it because you already own it.

Homebuyers report or survey youre unlikely to replicate this exercise because you already own the home and are familiar with its condition.

Get Preapproved Or Be Ready To Show Proof Of Funds

Youll need a preapproval to be taken seriously by real estate agents and sellers in todays real estate market.

Preapproval

Its a good idea to get an initial approval from your mortgage lender before you start looking for homes. Getting preapproved upfront can tell you exactly how much youll qualify for so you dont waste time shopping for homes outside your budget. In some very hot sellers markets around the U.S., you may not be able to get a real estate agent to meet with you before you have a preapproval letter in hand.

Theres a difference between prequalification and preapproval. Prequalification involves sharing verbal or written estimates of your income and assets with your lender, who may or may not check your credit.

You can use our home affordability calculator to get a sense of what you can afford as you begin thinking about buying a home, but the numbers you use arent verified, so it wont carry much weight with sellers or real estate agents.

Mortgage preapproval, on the other hand, means that the lender has verified your financial information and issued a preapproval letter to show sellers and agents that you have essentially been approved, pending only a determination of the houses value and condition.

Rocket Mortgage® offers Verified Approval1, which verifies your income, assets and credit upfront, giving you the strength and confidence of a cash buyer. .

All-Cash Purchases

Read Also: How Late Can You Be On Your Mortgage

Craig: What Does A 50

Many of us remember from high school civics that the legislative branch of the United States consists of the U.S. Senate and U.S House of Representatives. There are 100 U.S. Senators and 435 U.S. Representatives. Note, the U.S. Senate has an even number of senators and the U.S. House has an odd number of Representatives.

Both the Senate and the House do most of their work for our countrys citizens through appointed Committees. Committees make recommendations about laws, budgets, policies and other important issues to their larger elected bodies. The majority party represented in the Senate generally appoints the chairpersons and members to those committees. The U.S. House of Representatives follows a similar procedure.

The policies of the majority party, democrat or republican, are usually advocated through the committees by the selection of the chairperson of the committee and committee members. The majority party typically appoints the chairperson and more of their party members than the minority party. The committee chairperson controls the agenda and the majority party committee members usually determines the results of the committee.

Georgia voters will soon determine if the Senate is controlled by one party. A majority senate means little compromise in committee work and other decisions. A 50-50 senate likely will result in the two political parties forced to work together for joint decisions.

Your Senate vote has more significance than you might think!

Va Loans For Veterans

The U.S. Department of Veterans Affairs guarantees the home mortgage loans taken out by military veterans. VA loans are similar to FHA loans, in that the government is not lending money itself, but rather insuring or guaranteeing a loan supplied by another lender. In the event that a veteran defaults on his or her loan, the government repays the lender at least 25% of the loan.

A VA loan comes with some specific benefits, namely that veterans are not required to make a down payment or to carry private mortgage insurance . Due to tours of duty having sometimes affected their civilian work experience and income, some veterans would be high-risk borrowers who would be rejected for conventional mortgage loans.

You May Like: Can You Refinance Into A 15 Year Mortgage

How Does Remortgaging Work

Typically, our procedure is as follows:

1 You request a redemption letter from your new lender. The statement indicates how much of your existing mortgage is still owed on a given day, as well as any costs associated with paying it off.

2 Our mortgage consultants search the whole market for the right deal for you.

3 If you want to move on, your adviser will present your current situation to the new lender for a Decision in Principle

4 If your DIP is approved, your adviser will walk you through the proposed mortgage illustration and the full mortgage application, which they will then apply for on your behalf. You provide passports, payslips, tax calculations, bank statements, proof of address, and other necessary documents.

5 Your new lender requests a valuation report for your property.

6 If your mortgage and valuation is affordable and satisfactory the lender will formally make you a mortgage offer and send a copy to you, your solicitor, and your mortgage adviser.

7 Your solicitor will look at the title deeds, as well as any leases that may be present, and any additional questions that may need to be answered.

8 You and your solicitor set a completion date. This is the date on which the solicitor will get the money from your new lender sent to them and then they will pay off your existing lender. Any money that is left over is given to you.

Your Credit Score Income And Assets

As weve noted, you cant control current market rates, but you can have some control over how the lender views you as a borrower. Be attentive to your credit score and your DTI, and understand that having fewer red flags on your credit report makes you look like a responsible borrower.

To qualify for the loan, you must meet certain eligibility requirements. Therefore, a person who gets a mortgage will most likely be someone with a stable and reliable income, a debt-to-income ratio of less than 50% and a decent .

Recommended Reading: How To Get A Renovation Mortgage

Qualifying For A Loan

In order to qualify for a mortgage, most lenders require that you have a debt-to-income ratio of 28/36 . This means that no more than 28 percent of your total monthly income can go toward housing, and no more than 36 percent of your monthly income can go toward your totalmonthly debt . The debt they look at includes any longer-term loans like car loans, student loans, or any other debts that will take a while to pay off.

Here’s an example of how the debt-to-income ratio works: Suppose you earn $35,000 per year and are looking at a house that would require a mortgage of $800 per month. According to the 28 percent limit for your housing, you could afford a payment of $816 per month, so the $800 per month this house will cost is fine . Suppose, however, you also have a $200 monthly car payment and a $115 monthly student loan payment. You have to add those to the $800 mortgage to find out your total debt. These total $1,115, which is roughly 38 percent of your gross income. That makes your housing-to-debt ratio 27/38. Lenders typically use the lesser of the two numbers, in this case the 28 percent $816 limit, but you may have to come up with a bigger down payment or negotiate with the lender.

How To Get A Home Mortgage

To obtain a mortgage, the person seeking the loan must submit an application and information about their financial history to a lender, which is done to demonstrate that the borrower is capable of repaying the loan. Sometimes, borrowers look to a mortgage broker for help in choosing a lender.

The process has several steps. First, borrowers might seek to get pre-qualified. Getting pre-qualified involves supplying a bank or lender with your overall financial picture, including your debt, income, and assets. The lender reviews everything and gives you an estimate of how much you can expect to borrow. Pre-qualification can be done over the phone or online, and theres usually no cost involved.

Getting pre-approved is the next step. You must complete an official mortgage application to be pre-approved, and you must supply the lender with all the necessary documentation to perform an extensive check on your financial background and current credit rating. Youll receive a conditional commitment in writing for an exact loan amount, allowing you to look for a home at or below that price level.

After youve found a residence that you want, the final step in the process is a loan commitment, which is only issued by a bank when it has approved you as the borrower, as well as the home in questionmeaning that the property is appraised at or above the sales price.

Don’t Miss: What Percentage Of Your Income Should Your Mortgage Payment Be

Who Owns The House If You Have A Mortgage

In a home mortgage, the owner of the property transfers the title to the lender on the condition that the title will be transferred back to the owner once the final loan payment has been made and other terms of the mortgage have been met.

Is it wise to pay off mortgage early?

Paying off your mortgage early can be a wise financial move. Youll have more cash to play with each month once youre no longer making payments, and youll save money in interest. You may be better off focusing on other debt or investing the money instead.

How can I prove I paid off my house?

Documents that may be released after paying off your home:

What happens to your mortgage when you buy a new house?

However, if youre buying a house at the same time as selling your old home, you may be able to port your mortgage to your new home instead. When you port a mortgage you take the rates and terms of your loan with you when you move house. Technically, porting does not actually mean transferring the loan from your home to another property.

What happens when you port a mortgage to a new home?

What happens to your money when you sell your house?