How To Use The Mortgage Affordability Calculator

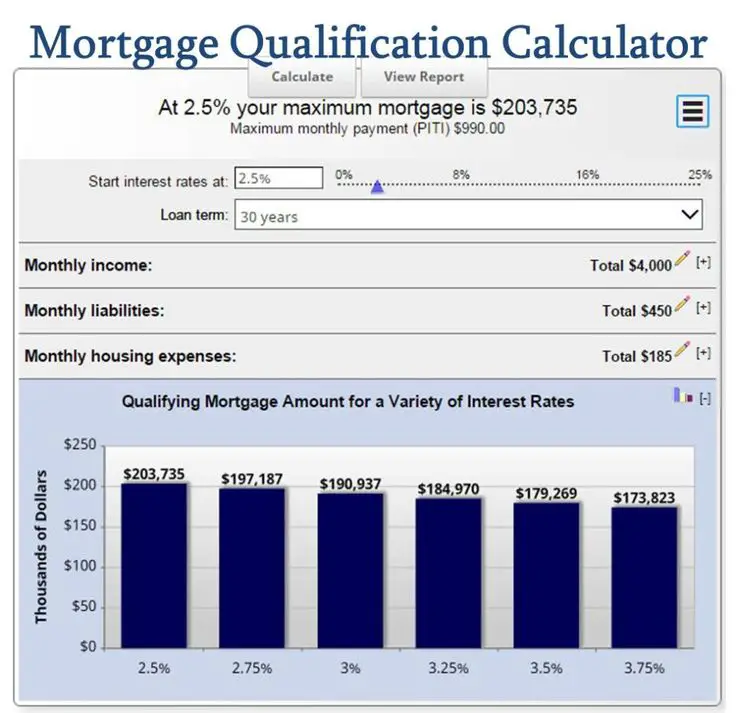

To use our mortgage affordability calculator, simply enter you and your partners income , as well as your living costs and debt payments. The calculator can estimate your living expenses if you dont know them.

With these numbers, youll be able to calculate how much you can afford to borrow. You can change your amortization period and mortgage rate, to see how that would affect your mortgage affordability and your monthly payments.

What To Do If You Want More Home Than You Can Afford

We all want more home than we can afford. The real question is, what are you willing to settle for? A good answer would be a home that you wont regret buying and one that wont have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

The National Association of Realtors found that these were the most common financial sacrifices homebuyers made to afford a home:

These are all solid choices, except for making only the minimum payments on your bills. Having less debt can improve your credit score and increase your monthly cash flow. Both of these will increase how much home you can afford. They will also decrease how much interest you pay on those debts.

Consider these additional suggestions for what to do if you want more home than you can afford:

- Pay down debt, especially high-interest credit card debt and any debt with fewer than 10 monthly payments remaining

- Work toward excellent credit

- Ask a relative for a gift toward your down payment, especially if you can demonstrate your own efforts toward becoming an excellent candidate for a mortgage

Calculator: Start By Crunching The Numbers

Begin your budget by figuring out how much you earn each month. Include all revenue streams, from alimony and investment profits to rental earnings.

Next, list your estimated housing costs and your total down payment. Include annual property tax, homeowners insurance costs, estimated mortgage interest rate and the loan terms . The popular choice is 30 years, but some people opt for shorter loan terms.

Lastly, tally up your expenses. This is all the money that goes out on a monthly basis. Be accurate about how much you spend because this is a big factor in how much you can reasonably afford to spend on a house.

Input these numbers into our Home Affordability Calculator to get a clear idea of your homebuying budget.

Also Check: Will Mortgage Pre Approval Hurt Credit Score

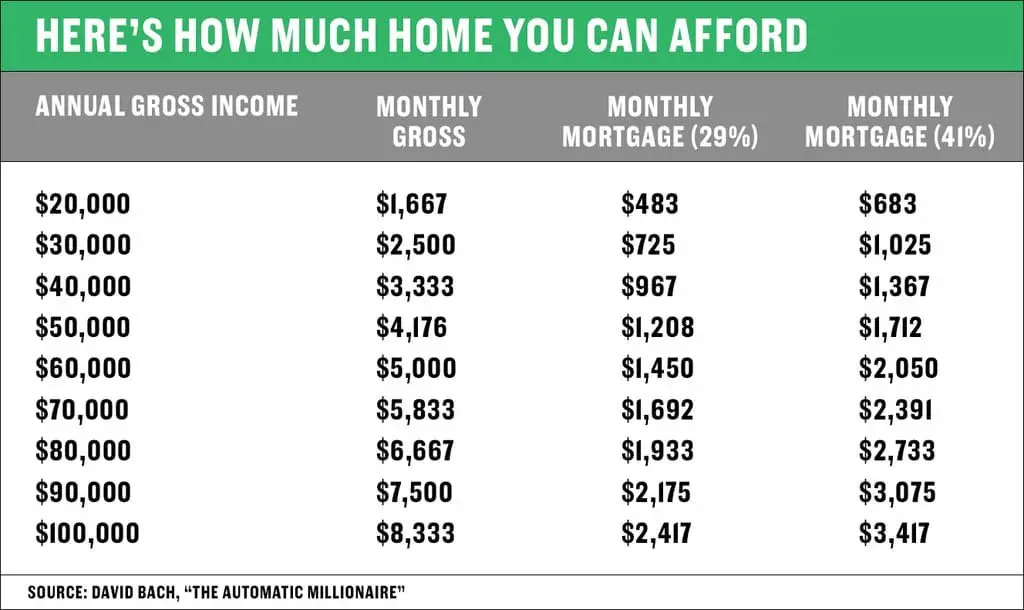

What Percentage Of Your Income Can You Afford For Mortgage Payments

Modified date: May. 31, 2021

These questions often come up among first-time home buyers:

- What percentage of my monthly income can I afford to spend on my mortgage payment?

- Does that percentage include property taxes, private mortgage insurance , or homeowners insurance?

Today we tackle these questions to help make your home buying experience a little easier.

Whats Ahead:

Three Homebuyers’ Financial Situations

| $0 | $185,000 |

House #1 is a 1930s-era three-bedroom ranch in Ann Arbor, Michigan. This 831 square-foot home has a wonderful backyard and includes a two-car garage. The house is a deal at a listing price of just $135,000. So who can afford this house?

Analysis: All three of our homebuyers can afford this one. For Teresa and Martin, who can both afford a 20% down payment , the monthly payment will be around $800, well within their respective budgets. Paul and Grace can afford to make a down payment of $7,000, just over 5% of the home value, which means theyâll need a mortgage of about $128,000. In Ann Arbor, their mortgage, tax and insurance payments will be around $950 dollars a month. Combined with their debt payments, that adds up to $1,200 â or around 34% of their income.

House #2 is a 2,100-square-foot home in San Jose, California. Built in 1941, it sits on a 10,000-square-foot lot, and has three bedrooms and two bathrooms. Itâs listed for $820,000, but could probably be bought for $815,000. So who can afford this house?

House #3 is a two-story brick cottage in Houston, Texas. With four bedrooms and three baths, this 3,000-square-foot home costs $300,000. So who can afford this house?

Also Check: What Is Current Interest Rate On Reverse Mortgage

How To Increase Your Mortgage Affordability

If you want to increase how much you can borrow, thus increasing how much you can afford to spend on a home, there are few steps you can take.

1. Save a larger down payment: The larger your down payment, the less interest youll be charged over the life of your loan. A larger down payment also saves you money on the cost of CMHC insurance.

2. Get a better mortgage rate: Shop around for the best mortgage rate you can find, and consider using a mortgage broker to negotiate on your behalf. A lower mortgage rate will result in lower monthly payments, increasing how much you can afford. It will also save you thousands of dollars over the life of your mortgage.

3. Increase your amortization period: The longer you take to pay off your loan, the lower your monthly payments will be, making your mortgage more affordable. However, this will result in you paying more interest over time.

These are just a few ways you can increase the amount you can afford to spend on a home, by increasing your mortgage affordability. However, the best advice will be personal to you. Find a licensed mortgage broker near you to have a free, no-obligation conversation thats tailored to your needs.

What Is A Down Payment

A down payment is the cash you pay upfront to make a large purchase, such as a car or a home, and is expressed as a percentage of the price. A 10% down payment on a $350,000 home would be $35,000.

When applying for a mortgage to buy a house, the down payment is your contribution toward the purchase and represents your initial ownership stake in the home. The lender provides the rest of the money to buy the property.

Lenders require a down payment for most mortgages. However, there are exceptions, such as with VA loans and USDA loans, which are backed by the federal government, and usually do not require down payments.

Also Check: How To Qualify For A Higher Mortgage

Tips To Improve Your Dti Ratio

If you want to buy a home but you are carrying too much debt to qualify for a mortgage, you may first want to focus on improving your debt-to-income ratio. There arenât any tricks to decreasing your DTI. You have three main avenues to improve your DTI:

- Consolidate debt

- Pay off debt

- Increase income

If is holding you back from getting to 36%, you might want to consider a balance transfer. You can transfer your credit card balance to a and pay down your debt before the offer expires.

This means your money is going toward your actual debt and not interest on that debt. Itâs important to remember that if you donât manage to pay down the debt before the 0% APR offer ends, you might end up with a higher interest rate on your debt than you had before.

But if you can swing a balance transfer it might be able to help you fast-track your debt payment and get you to the debt-to-income ratio you need to qualify for a home purchase.

Your other two options, pay off debt and increase income, take time. Perhaps you need to make a budget and a plan to knock out some of your large student or car loans before you apply for a mortgage. Or you wait until you get a raise at work or change jobs to apply for a mortgage.

Borrow Up To 6 Times Your Salary With A Low Mortgage Rate

In the example above, were assuming you are offered a mortgage rate of 3.125%, which, nationwide, is a reasonable expectation for a highly creditworthy borrower at the time of writing.

But check out how the borrowers budget changes as mortgage rates rise and fall:

| Salary | |

| $2,700 | $2,700 |

*Home buying budgets estimated using The Mortgage Reportsmortgage calculator. Calculation assumes the borrower has $300 in existing monthly debts

Assuming relatively low debts $300 per month and a 3.0% mortgage rate, this person might be able to borrow up to $564,000 for a mortgage. .

Thats nearly six times their salary.

But suppose the borrower has credit issues, and only qualifies with a higher mortgage rate of 4.5%.

Suddenly, the maximum amount they can borrow on their salary drops to $471,000, or 4.7 times their salary. The higher mortgage rate has reduced their home buying budget by about $100K.

Luckily, rates are at historic lows right now, so buyers at every level are able to maximize their budgets.

You May Like: How Much Is Mortgage On 1 Million

Things That Determine How Much Mortgage You Can Afford

The amount you can borrow for a mortgage depends on how much a lender thinks you can pay back. And that equation isnt just based on your salary theres a whole host of factors lenders consider.

These are the three main pillars mortgage lenders use when deciding how much to lend you:

Each of these factors is roughly as important as the others. And each one will have a big impact on how much mortgage you can afford.

Use A Piggyback Loan To Put 20% Down

Another strategy that could help increase your budget is to finance your home with two different home loans simultaneously. This strategy is known as an 801010 loan or piggyback loan.

An 801010 mortgage means youd get:

- A first mortgage for 80% of the homes cost

- A second mortgage for 10%

- A cash down payment of 10%

This gives you the benefit of having a bigger home buying budget . It also eliminates the need for private mortgage insurance , which is usually required on conventional loans with less than 20% down.

Also Check: How To Know How Much Mortgage I Can Afford

How Much Home Can I Afford

Your home may be the single biggest investment you make in your lifetime. Many people start the process by asking the question How much do I qualify for? This is not the right question to ask. You need to be asking yourself How much can I afford?

You should not let a real estate agent or lender determine your price range. Only you can determine a monthly payment that is compatible with your budget and lifestyle. If you have significant out-of-pocket prescription drug costs, enjoy dining out regularly, or pay for a child to attend private school, you may prefer to buy a less expensive home.

Dont even think about buying a home until you have made a budget that tracks your monthly income and expenses. Live on this budget for several months to truly understand what you can afford in terms of a monthly mortgage payment. If you have trouble making ends meet while paying rent, you should create a game plan to free up money in your budget by changing your lifestyle, paying down debt or looking for a home that will cost you less in mortgage payments than your current rent.

How Much Should You Be Spending On A Mortgage

According to Brown, you should spend between 28% to 36% of your take-home income on your housing payment. If you make $70,000 a year, your monthly take-home pay, including tax deductions, will be approximately $4,328. So, ideally, if we round that 28%-to-36% rule to one-third of your take-home income, you wouldnt be spending more than $1,442 on your housing payment dont forget, that should include your principal and interest payment, taxes and insurance, any HOA fees, plus PMI or mortgage insurance if you have it.

But if you have no debt, you can stretch up to 40% of your take-home income, which will be devoting about $1,731.20 to your mortgage payment.

Also Check: How Much Does A Mortgage Payment Increase For Every 100000

How Will My Debt

When you apply for a mortgage, lenders usually look at your debt-to-income ratio your total monthly debt payments divided by your gross monthly income written as a percentage.

Lenders often use the 28/36 rule as a sign of a healthy DTImeaning you wont spend more than 28% of your gross monthly income on mortgage payments and no more than 36% on total debt payments .

If your DTI ratio is higher than the 28/36 rule, some lenders will still be willing to approve you for financing. But theyll charge you higher interest rates and add extra fees like mortgage insurance to protect themselves in case you get in over your head and cant make mortgage payments.

How Much Mortgage Payment Can I Afford

To calculate how much house you can afford, we take into account a few primary items, such as your household income, monthly debts and the amount of available savings for a down payment. As a home buyer, youll want to have a certain level of comfort in understanding your monthly mortgage payments.

While your household income and regular monthly debts may be relatively stable, unexpected expenses and unplanned spending can impact your savings.

A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of some unexpected event.

You May Like: A& m Mortgage Merrillville Indiana

Save A Bigger Down Payment To Make Your Home More Affordable

Remember, your down payment amount makes a big impact on how much home you can afford. The more cash you put down, the less money youll need to finance. That means lower mortgage payments each month and a faster timeline to pay off your home loan! Just imagine a home with zero payments!

Now, were always going to tell you that the best way to buy a home is with 100% cash. But if saving up to pay in cash isnt reasonable for your timeline, youll probably wind up getting a mortgage.

If thats you, at the very least, save up a down payment thats 10% of the home price. But a better idea is to put down 20% or more. That way you wont have to pay private mortgage insurance .

PMI protects the mortgage company in case you dont make your payments and they have to take back the house . PMI is a yearly fee that usually costs 1% of the total loan value and isyou guessed ityet another expense thats added to your monthly payment.

Lets backtrack for a second: PMI may change how much house you thought you could afford, so be sure to include it in your calculations if your down payment will be less than 20%. Or you can adjust your home price range so you can put down at least 20% in cash.

Trust us. Its worth taking the extra time to save for a big down payment. Otherwise, youll be suffocating under a budget-crushing mortgage and paying thousands more in interest and fees.

How Much House Can I Afford Based On My Salary

To calculate how much house you can afford, use the 25% rulenever spend more than 25% of your monthly take-home pay on monthly mortgage payments.

That 25% limit includes principal, interest, property taxes, home insurance, private mortgage insurance and dont forget to consider homeowners association fees. Whoathose are a lot of variables!

But dont worry, our full-version mortgage calculator makes it super easy to calculate those numbers so you can preview what your monthly mortgage payment might be.

You May Like: Why Do I Pay Escrow On My Mortgage

What Is Monthly Debt

Monthly debts are recurring monthly payments, such as credit card payments, loan payments , alimony or child support. Our DTI formula uses your minimum monthly debt amount meaning the lowest amount you are required to pay each month on recurring payments. Whencalculating your monthly debts, you can exclude:

- Monthly utilities like water, garbage, electricity or gas bills

- Car insurance expenses

- Health insurance costs

- Groceries, food or entertainment expenses

To calculate your total minimum monthly debts, add up each minimum payment. If you pay more than the minimum amount on your credit cards, this does not count against your DTI, since only the minimum amount you’re required to pay is included in the total. For example, if you owe $5,000 on a high-interest credit card and your minimum monthly payment on that card is $100, then $100 is the minimum monthly debt amount used for your DTI.

What Is Mortgage Required Income

Lenders consider two main points when reviewing loan applications: the likelihood of repaying the loan and the ability to do so .

Nerdwallet.com explains that mortgage income verification, even if they have impeccable credit, borrowers still must prove their income is enough to cover monthly mortgage paymen

Recommended Reading: How Much A Month Is A 500k Mortgage