Can I Get A 100000 Mortgage With No Deposit

The vast majority of UK mortgage providers no longer offer 100% mortgages, so you would usually need some kind of deposit for a £100,000 mortgage. One of the only ways to get a mortgage with no deposit whatsoever is if a family member or close friend agrees to act as a guarantor.

With a guarantor mortgage, the family member or friend who is supporting you will need to secure the loan against a property they already own or place a lump sum in a savings account held by the lender. They will be unable to withdraw from this pot until a certain amount of the mortgage has been paid off, and maybe liable to cover any payments the borrower misses.

To learn more about guarantor mortgages and the other options that might be available or make an enquiry to speak to one of the expert mortgage brokers we work with.

Are There Other Ways To Save On Interest

Yes! Consider applying any extra funds at the end of the month toward your loan balance. Even paying an extra $50 or $100 a month allows you to pay off your mortgage faster.

Another idea is to refinance to a 15-year mortgage. Though your payments will be a bit higher, your overall savings will be greater. The shorter loan term also means that youll pay off your home loan in a fraction of the time.

Structural Mortgage Market Shifts: Increasing Loan Duration & Explicit Government Backing

While the stamp duty holiday was widely discussed, the UK also pushed through other structural shifts to the mortgage market in the wake of the COVID-19 crisis.

“In the UK, usually the longest term fixed mortgage you could normally get was five years. Boris Johnson has now. Nobody can pretend that this has anything to do with Covid, and in fact when Johnson announced it, his stated aim was to give young people access onto the housing ladder. This is a good example of how the magic money tree was discovered for Purpose A, i.e. Covid, and is being used for Purpose B, furthering social justice.” – Russell Napier

When governments guarantee loans they lower the risk of making the loans, which in turn increases the flow of capital into the associated market. That typically leads to faster appreciation.

Programs created to “help” people get into the market are initially effective, but after prices adjust to reflect said capital shifts and risk-free profits the market becomes structurally dependent on such programs & the incremental help they offer declines as prices rise.

The property market has been frenzied throughout the first half of 2021 with Rightmove stating the first half of the year has been the busiest since 2000. Average home prices across England, Wales and Scotland rose to £338,447, an increase of £21,389 or 6.7% since the end of 2020.

Also Check: Who Has The Best Reverse Mortgage Rates

Your Down Payment Influences The Home Price You Can Afford

Because the minimum down payment in Canada is 5%, this benchmark is used to determine your maximum affordability. Ignoring your income and debt levels, you can infer your maximum purchase price based on the size of your down payment. Because the minimum down payment is a sliding scale, the calculation depends on whether your down payment is more or less than $25,000.

If your down payment is $25,000 or less, your maximum home price would be: down payment amount / 5%. For example, if you have saved $25,000 for your down payment, the maximum home price you could afford would be $25,000 / 5% = $500,000.

If your down payment is $25,001 or more, the calculation is a bit more complex. You can find your maximum purchase price using: down payment amount – $25,000 / 10% + $500,000. For example, if you have saved $40,000 for your down payment, the maximum home price you could afford would be $40,000 – $25,000 = $15,000 / 10% = $150,000 + $500,000 = $650,000.

Naturally, as your affordability is also a function of your income and debt levels, you should visit our mortgage affordability calculator for a more detailed analysis.

Debt Service Ratios And Mortgage Affordability

Set by the Canada Mortgage and Housing Corporation , your debt service ratios including your gross debt service ratio and your total debt service ratio are used to calculate the maximum mortgage the lender can offer. This maximum mortgage is then combined with your available down payment to determine the maximum home price you can purchase.

Your lenders uses these ratios to ensure you can consistently make your monthly payment, as they place a limit on the amount of your income that can go towards your housing expenses and monthly debt obligations. The industry standard guideline for GDS is no more than 32% and the guideline for TDS is no more than 40%. However, you may be allowed to exceed these limits if you have a stable source of income and good credit. If the mortgage you want to take on forces your GDS or TDS above 39% and 44% respectively, you will not be approved for that amount.

To use our earlier example, even if you have $15,000 for a down payment, your GDS and TDS score may only approve you for a $250,000 mortgage. Thus when combined with your $30,000 down payment, your max affordability would be $265,000 .

The maximum GDS limit used by most lenders to qualify borrowers is 39% and the maximum TDS limit is 44%.

As of July 1st, 2020, the CMHC implemented new GDS and TDS limits for mortgages that it insures. The new GDS/TDS limits for CMHC-insured mortgages is 35/42.

Recommended Reading: Would I Be Eligible For A Mortgage

Principal And Interest: Mortgage Payment Basics

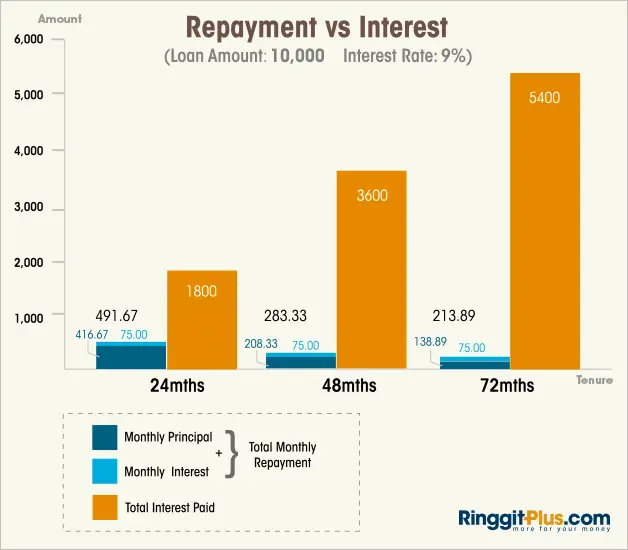

There are two basic components that make up every mortgage payment: principal and interest. The principal is the amount of funding borrowed for your home loan, and the interest is the money paid monthly for use of the loan. Understanding both principal and interest can help you choose the best mortgage option for you.

In this article, well share everything you need to know about principal and interest. Well cover the differences between the two and help you determine what you owe, or will pay, on your mortgage. Keep in mind, there may be other expenses that could find their way into your monthly payment as well.

How Much Difference Does 25% Make In A Monthly Mortgage Payment

Related Articles

The interest rate is the amount of money the bank charges you for borrowing the money to pay for your home. The principal of the loan plus the interest rate determines your monthly mortgage payment. With a fixed-interest loan, your total amount is divided by the length of the loan, and then again by 12 monthly payments. Even a .25 percent difference in your interest rate can add to your monthly payment depending on your loan amount. That number increases even more over the life of the loan.

You May Like: How To File A Complaint Against A Mortgage Lender

A Sample Maximum Affordability Calculation

Let’s look at an example where your gross annual income is $75,000. You’re buying a home with annual property taxes of $3,600, monthly heating costs are $200 and since you’re buying a house, there are no condo fees. In addition to your housing expenses, you have a monthly car loan at $300 and must make minimum monthly payments of $250 on your credit card debt. You have $20,000 saved up for a down payment.

Since both your GDS and TDS ratios must be less than or equal to the maximum, the largest mortgage payment you can afford is $1,450. Though your GDS suggests you can afford $1,500, at that monthly payment, your TDS will be over 40% and therefore $1,450 is the maximum payment that ensures both debt service ratios fall within the allowable range.

With a monthly mortgage payment of $1,450 per month, you can afford a $300,000 mortgage with a 5-year fixed interest rate of 3.28% and an amortization period of 25 years. Finally you must ensure you have the minimum down payment of 5%. Since $20,000 / $300,000 = 6.67% you can satisy the minimum down payment requirement.

After calculating your GDS ratio, TDS ratio and down payment percent, you can determine your maximum affordability at $300,000. Since your TDS ratio is limiting your affordability, you could try paying off some of your credit card or car debt to increase your maximum affordability.

Benefits Of Breaking It All Down

Breaking down your interest payments in this way isn’t just an exercise in math. Getting this kind of analysis helps you to better understand how just the cost of your home can significantly impact how much you pay over the life of your loan. Of course, getting the best interest rate possible will help you to save money. However, if you aren’t able to lower your interest rate any further either because you haven’t been able to put together a larger down payment or because you haven’t been able to improve your credit score then focusing on finding the best price for the home of your dreams can help you save.

Use our easy calculator to get the information you need to put you in a stronger position to negotiate with the seller and to create the right budget for you while also buying the home of your dreams. Just plug in the amount of the loan, the interest rate, the length of the loan, and any loan points, origination fees and closing costs. We’ll mail you an easy-to-understand analysis of your interest charges by month and year in plain English. You don’t need to enter any personal information. Just put in your e-mail and get the results in moments!

Recommended Reading: What Day Of The Week Are Mortgage Rates Lowest

Retiring A Mortgage With Extra Payments

Many homeowners invest in home security systems to protect their property and personal assets. However, a security system will not protect the homeowner against financial disaster or bankruptcy. Making additional mortgage payments will shrink the total amount of interest paid over the life of the loan, and the borrower will pay off the debt more quickly. In addition, the home equity will grow at a faster pace when extra payments are applied to the loan. This provides for a margin of protection by lowering the interest costs. This method gives the property owner a home free and clear of debt. More payments on the principal of the loan equate to assets earning interest at the same rate as the interest rate on the loan.

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

You May Like: How To Become A Mortgage Broker In Massachusetts

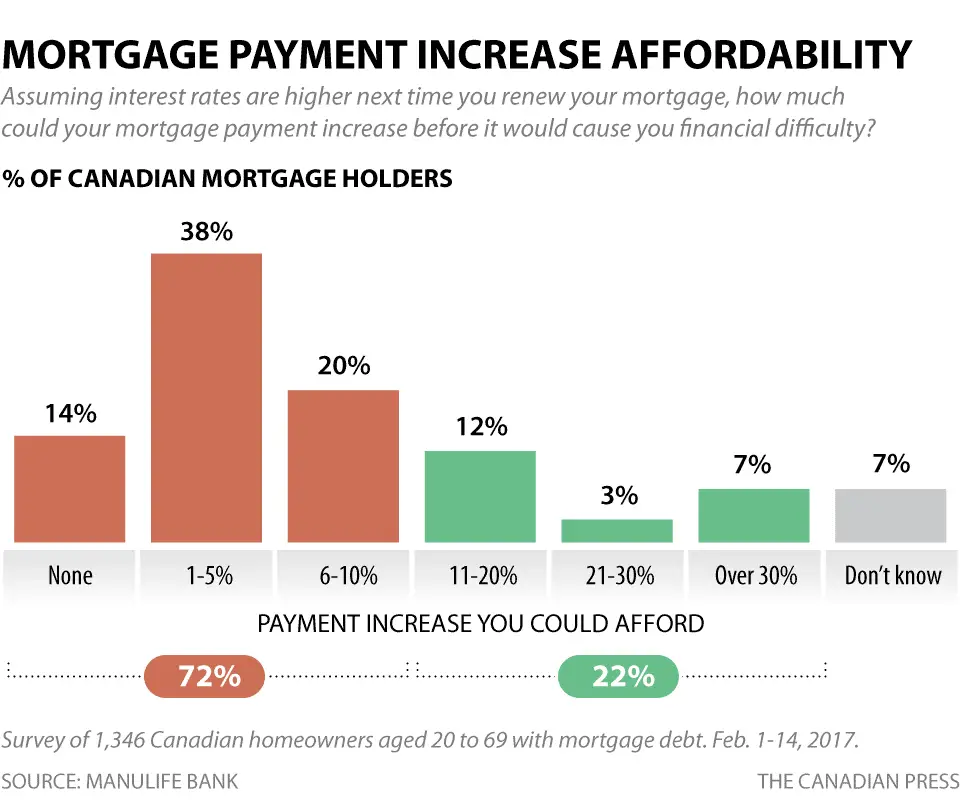

Keep Your Payments The Same When Changing Your Mortgage

When you renew your mortgage, you may be able to get a lower interest rate.

Some mortgage lenders may allow you to extend the length of your mortgage before the end of your term. Lenders call this early renewal option the blend-and-extend option. They do so because your old interest rate and the new terms interest rate are blended.

When your interest rate is lower, you have the option to reduce the amount of your regular payments. If you decide to keep your regular payments the same, you can pay off your mortgage faster.

How To Use The Mortgage Loan Calculator

We have done our best to make this calculator as simple and user-friendly as possible, but if you arent sure where to start, try following these steps:

Also Check: What Is A Mortgage Rate Lock

What Is The Monthly Repayment On A 100000 Mortgage

Customers often ask us what are the average repayments on a £100K mortgage? and the answer comes down to a number of factors.

For instance, interest rates need to be considered and they can vary from one lender to the next, since they are based on your credit rating, affordability and general eligibility. Then theres term length to take into account the longer the term, the less youre likely to pay each month.

Play with our calculator here for an accurate measure of what a mortgage will cost, and you can also check how much you can borrow as well as get approved by the best lender, with our partners Mojo, for FREE!

The table below illustrates how the typical repayments on a £100,000 mortgage loan can vary based on these two factors.

| Interest Rate | |

|---|---|

| £438.50 | £497.63 |

The above data is for illustration purposes only. Consult your mortgage lender or broker for the most up-to-date information and rates.

The interest rate you end up on if you borrow a £100k mortgage will depend on the level of risk the lender is taking on, which theyll determine based on factors such as how much deposit youre able to put down and your profile as a borrower.

If youre still unsure about how much the repayments are on a £100k mortgage, get in touch and the advisors we work with will work with you to give you an idea of the kind of rates you might be able to get, based on your specific circumstances, affordability and eligibility.

Why Use The Mortgage Loan Calculator

There are so many different mortgage and loan options to choose from, it can sometimes be a little overwhelming. Whether you are setting up a new mortgage to purchase a home or to refinance a mortgage on a home that you already own, there are always a great many aspects to consider.

To name just a few of the more common choices, there are fixed rate mortgages, adjustable rate mortgages, and fixed to adjustable rate mortgages for those who want something in between. Fixed rate mortgages with terms lasting between 15 and 30 years are currently the most common.

Whichever kind of mortgage you end up using, the information you get from the Mortgage Loan Calculator will remain relevant.

Also Check: What Is Mortgage Rate Vs Apr

How To Use The Mortgage Required Income Calculator

The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be.

As a general rule of thumb, lenders limit a mortgage payment at 28 percent of your gross that is after-tax monthly income.

So, if you simply multiply your annual income by 0.28, then divide by 12, youll find your maximum monthly mortgage payment.

Can You Afford A 10000000 Mortgage

Is the big question, can your finances cover the cost of a £100,000.00 Mortgage? Are you sure you have considered all the costs? If you are increasingly answering ‘yes’ then it’s worth doing the final financial checks, review your monthly household budget (so you are ready to answer all the questions the mortgage advisor will ask and check that you have the deposit covered. See how much it will cost you to move home when buying a property worth £100,000.00

Do you need to calculate how much deposit you will need for a £100,000.00 Mortgage? Try our new Mortgage Deposit Calculator or quick on a deposit percentage below to see an illustration that you can tweak to suit your circumstances

Did you know that we review the UK’s leading mortgage providers each month and produce a comparative guide to the best mortgage deals? By collating the latest mortgage deals from each provider, we save you the time and effort of looking for and finding the best mortgage deals. We also provide regular mortgage updates, guides and mortgage news so you can make the right financial decision when choosing a mortgage.

Using an Independent Mortgage Advisor will saves you time and stress and affordability calculations and mortgage comparison can be completed centrally on your behalf. Use a mortgage broker which doesn’t charge you fees, so you get the best mortgage deals without the hassle.

Recommended Reading: How Much Mortgage Can I Get With 50k Salary

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment