How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

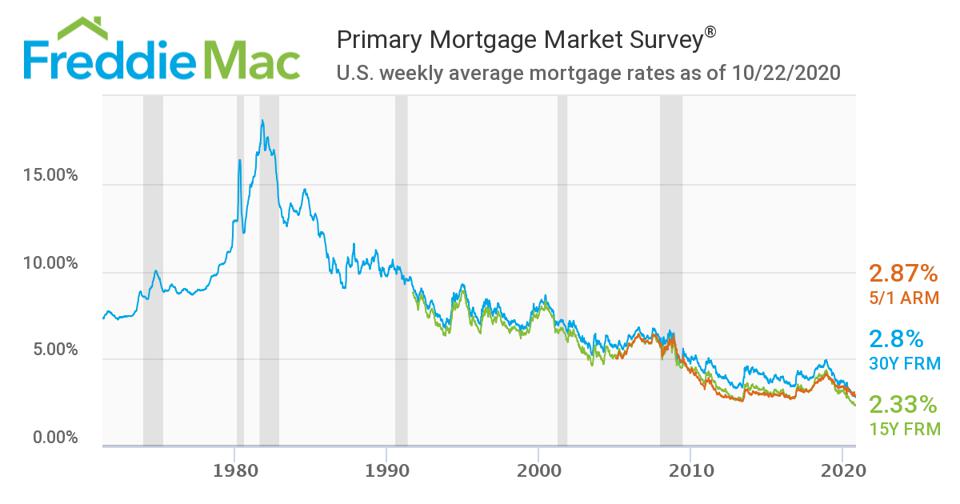

Over the past 52 weeks, the 30-year fixed has averaged 3.10 percent.

What Is A Mortgage Interest Rate

Mortgage interest rates reflect lenders cost of money, a cost that they pass on to you in the form of an interest rate. Your rate sets the amount of interest you pay over the life of your mortgage.

Even though nearly all mortgages come with fixed rates these days, small differences in interest rates can drive your monthly payments up or down. Over a 30-year term, that difference can add up. Just $50 a month equals more than $18,000 over the loans term. Knowing how interest rates factor into your loan pricing, as well as how your rate is determined, will help you evaluate your options and make the best decision for your situation.

How The Bank Of Canada Determines Its Target Overnight Rate

The Bank of Canada makes its decisions based on the growth of the Consumer Price Index from Statistics Canada. This is calculated from the price of a monthly basket of goods and services typically used by Canadians. It represents a broad picture of consumer spending across Canada.

Using its monetary policy tools, the Bank of Canada aims to maintain inflation, as calculated by changes in the CPI, within a certain range. Introduced in 1991, the inflation-control target sets a range of 1% 3% as the ideal range for annual inflation, with the midpoint of 2% being the common target rate. This range is reviewed regularly with the latest review being in October 2016.

The Bank of Canada reviews its benchmark interest rate eight times a year and considers both local and international, current and potential influences in their review. Although the Bank of Canada operates independently of the government, it is ultimately responsible to Parliament through the Minister of Finance.

Don’t Miss: Does My Husband Have To Be On The Mortgage

Is There A Higher Cost Of Living

While nothing as been confirmed about interest rates, financial experts are sure they will rise due to the higher cost of living that will come as a result of this Budget.

Scott Taylor-Barr, a financial adviser at Carl Summers Financial Services, says: Whilst nothing in the budget directly impacts on mortgages, there are plenty of things going on that indirectly effect them inflation and the rising cost of living, the potential for interest rate rises from the Bank of England and increased taxation are the main ones.

As lenders decide on how much they will lend to you based on their analysis of your affordability any increase in the cost of living will, at some point, impact on that calculation.

So, the more expensive the basics of life get, the less you can borrow as a mortgage for any given income. The potential for increases in interest rates also have a similar drag on the potential borrowing amounts for customer if the lenders feel that rates are going to rise then they will want to provision for those future higher mortgage payments in their calculations.

Again, this could reduce the amount of mortgage they are willing to offer.

One thing that consumers have going for them is competition Nathan Reilly, director of lender relationships at mortgagetech platform Twenty7Tec says: Until the Bank of England declares a new interest rate, Im not sure that we will see vast numbers of mortgage products upping their rates.

Lock Your Mortgage Based On Your Needs

Every homebuyer has their own unique circumstances, so theres no universal time to lock in a rate. It depends on you, the markets and your financial situation.

Some people are more comfortable locking in early on, while others prefer to gamble on fluctuations. One sensible rule of thumb is to lock in your rate when theres a scenario that works within your needs and budget. You need to assess how much risk youre comfortable with and go from there.

We know theres a lot to think about when buying a home. Hopefully, this article has made it easier to understand locking in mortgage rates. For help with this or any other parts of the mortgage process, speak to one of our home lending advisors.

You May Like: What Is Payment On 30 Year Mortgage

How To Calculate The Blended Interest Rate

This method of calculating a blended interest rate is simplified for illustration purposes. It does not include prepayment penalties. Your lender can combine the prepayment penalty with the new interest rate or ask you to pay it when you renegotiate your mortgage.

Example : Calculate the blended interest rate

Suppose interest rates have gone down since you signed your mortgage contract. To take advantage of these lower rates, you’re considering terminating your mortgage and renegotiating a new mortgage with your current lender.

Suppose you have:

- months until end of the term: 24

- current interest rate for a 5-year term offered by the current lender: 4.0%

- current term: 5 years or 60 months

- payment frequency: monthly

| Steps to calculate a blended interest rate | Example | Enter your information |

|---|---|---|

| Step 1: multiply your current interest rate by the number of months remaining on your current term | 5.5% x 24 months = 132 | |

| Step 2: subtract the number of months of the new term from the number of months remaining on your current term | 60 months 24 months = 36 months | |

| Step 3: multiply todays interest rate by the difference between the number of months of the new term and the number of months remaining on your current term | 4% x 36 months = 144 | |

| Step 4: add the results of Step 1 and Step 3 | 132 + 144 = 276 | |

| Step 5: divide the results of Step 4 by the number of months in the new term | 276 / 60 = 4.6 |

What Does An Interest Rate Rise Mean For Mortgages

One of the biggest concerns around a rise in interest rates is the potential impact on the cost of mortgages.

Homeowners with tracker mortgage deals should see an immediate change to their monthly payments, as their rate is directly pegged to interest rates.

In due course, a rate rise will almost certainly affect homeowners paying a standard variable rate or discounted deal linked to an SVR, as lenders will adjust this independent borrowing rate too.

Borrowers part-way through a fixed rate deal wont be affected by an interest rate rise until the offer ends, when they will revert onto their lenders respective SVR.

However, a market expectation of a rate rise will feed into the cost of funding for lenders new fixed rate mortgage deals, according to David Hollingworth at mortgage broker London and Country.

He said: We have already seen some signs of fixed rates increasing and, although competition should help to maintain some attractive deals, it looks like the reductions in fixed deals enjoyed by borrowers in recent months may be coming to an end and even begin to reverse.

The cost of fixed rate mortgage deals has been so cheap in recent months that, according to research by London and Country , borrowers could have been overpaying by up to £2,500 a year if they neglected to shop around at the end of their deal.

You can see what mortgage rates are available at our live table below, by selecting your circumstances and criteria.

Also Check: How Do You Buy Down A Mortgage Rate

Mortgage Effective Annual Rate Formula

To account for semi-annual compounding, you can calculate your mortgages effective annual rate . The number of compounding periods in a year is two. To use the effective annual rate formula below, convert your interest rate from a percent into decimals.

For example, if your mortgage lender quotes a mortgage rate of 3%, then your effective annual rate will be:

If your mortgage lender quotes a mortgage rate of 5%, then your effective annual rate will be:

This calculation assumes that interest will be compounded semi-annually, which is the law for mortgages in Canada. For a more general formula for EAR:

Where n is the number of compounding periods in a year. For example, if interest is being compounded monthly, then n will be 12. If interest is only compounded once a year, then n will be 1.

Factors That Can Affect Your Personal Interest Rate

Itâs important to understand that the best mortgage rates in Canada are not necessarily the rates that you, personally, are able to qualify for. There are a number of factors that will affect your personal mortgage rate. Below are some of the most significant ones.

Your down payment: If your down payment is less than 20% of the purchase price youâll need to pay for mortgage default insurance . While this will cost you more overall, it will result in a lower mortgage rate, as your mortgage is less risky for your lender.

Your credit score: If you have bad credit, you may only be able to borrow from a B lender, instead of a big bank or credit union. B lenders are happy to work with people with a poor credit history, but they will charge higher mortgage rates.

What the home will be used for: Your mortgage rate will probably be higher if the home will be rented out, rather than lived in as your primary residence.

Your amortization period: Insurable mortgages in Canada have a maximum amortization period of 25 years. If you take out a type of mortgage that allows a longer amortization period, it will probably have higher interest rates.

The type of mortgage: If your mortgage is for a refinance, rather than a new purchase or renewal, youâll probably be offered a higher rate.

Read Also: Can I Roll My Down Payment Into My Mortgage

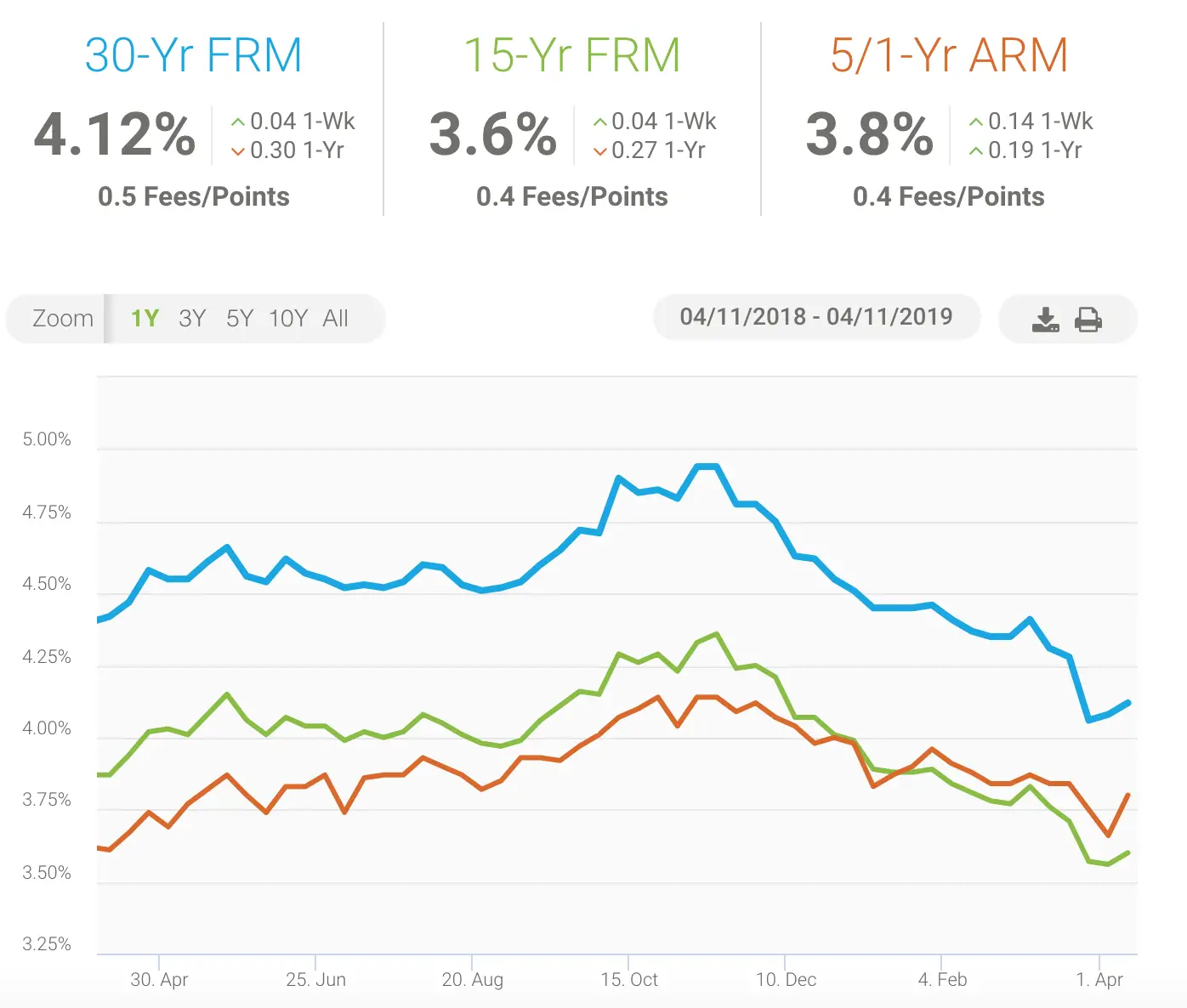

Where Mortgage Rates Are Headed

Mortgage experts offer mixed predictions about the direction of rates in the next week. In Bankrates survey this week, 55 percent of respondents predict rates will stay the same in the coming week , 36 percent say theyll rise and 9 percent predict a decline.

Rates rates will inevitably trend higher in coming months, says James Sahnger of C2 Financial Corp. in Jupiter, Florida. If you havent refinanced, time to get busy doing so.

Mortgage Rate Forecast For Next Week

Despite Thursdays report from the Labor Department, citing unemployment claims dropping to a new pandemic low, it looks like low mortgage rates should remain in place for the remainder of the summer.

Thursdays jobs report was better than expected. Showing that the surge in COVID-19 cases caused by the Delta variant has yet to lead to widespread layoffs.

That said, on Thursday, September 9, Sam Khater, Freddie Macs Chief Economist stated, While the economy continues to grow, it has lost momentum over the last two months due to the current wave of new COVID cases that has led to weaker employment, lower spending and declining consumer confidence.

Therefore, we expect rates to stay in the sub-3% range for next week.

Recommended Reading: How To Build A Mortgage Business

Should You Fix Your Mortgage Rate Now

As interest rates are so low, it may be a good idea for you to consider remortgaging now. Here are some tips:

- Move quickly: the best fixed-rate mortgage deals tend to disappear fast if there is a hint rates will rise so get in there quick.

- Charges and fees: watch out for any early-repayment charges or exit fees to switch. Other costs include: arrangement fee, valuation fee and the cost of a solicitor. It may work out cheaper in the long run for you to pay the fees and charges, so get out the calculator.

- Use a mortgage calculator: remortgaging to a lower interest rate can save you a lot of money. Use a mortgage calculator and remember to factor in any fees and charges.

- Shop around: find the best deal on the market by shopping around. Try out our free mortgage comparison tool.

- Get help: get advice from a mortgage adviser or broker if you arent sure. An independent financial advisor can also help with your future financial planning.

- Read Times Money Mentor: we have lots of articles, independent best buy tables, Q& As and real life stories on our website.

Find out more: Seven tips on how to get a mortgage

Have A Financial Plan In Place

Its a good idea to have a financial plan in place to deal with any potential interest rate changes. Current forecasts indicate that changes are likely to be small, but steady, so while a 0.25% rate rise might not set alarm bells ringing, several consecutive raises could have a significant impact.

The table shows how much more youd have to pay on a £200,000 mortgage if interest rates increase.

Read Also: Can You Do A 40 Year Mortgage

How The Overnight Rate Works

Think of the banks as a group of friends. The banks don’t like to hold cash and like to lend out their money whenever they can. Sometimes, Bank A might have a lot of cash on its hands while Bank B might have less. Since they’re friends, Bank A is more than happy to lend money to Bank B. But they’re banks, so they don’t want to lend their money out for free. So they charge an interest rate.

Everyday, the banks come together and make offers to borrow and lend money. The rate that they settle on is called the “overnight rate” because it’s the interest rate for borrowing cash “overnight”. The Bank of Canada is the “mom” of the group. The Bank of Canada has a “target overnight rate” and tries to keep the overnight rate close to the target. If the rate gets too low because there’s too much money, the banks can lend their money to the Bank of Canada instead. If the rate gets too high because there’s a shortage of money, the Bank of Canada acts as a “lender of last resort” and will lend out money.

If The Debt Limits Not Raised In Time All Bets Are Off

Rates could fall if a new, deadlier COVID variant rakes the globe, or if the United States or an ally gets involved in a military conflict, or if the financial markets are struck by some other shock.

If Congress didn’t increase the debt limit and the country went into default, the effect on mortgage rates would be unpredictable. The United States has never defaulted on its debts.

If U.S. government IOUs lost value and became untradeable, the effect on financial markets could be catastrophic, but we don’t know exactly what that calamity would look like. In a government default, borrowers might find it hard or impossible to get mortgages, and rates might skyrocket temporarily.

It’s also possible that the executive branch would find a workaround that would spare the financial markets from turmoil.

You May Like: How Do Rocket Mortgage Rates Compare

What You Should Know

- Variable mortgage rateshave historically performed better than fixed mortgage rates, although interest rates have generally fallen over the past few decades

- 5-year fixed mortgages are the most popular in Canada

- Insured high-ratio mortgageswill have the lowest possible mortgage rate, but youll need to pay formortgage default insurance

- Typically, longer mortgage term lengths will have a higher mortgage rate compared to shorter mortgage terms.

- Closed mortgage rates are lower than open mortgage rates, but open mortgages allow you to make principal prepayments of any amount withoutmortgage penalties

How To Find The Best Mortgage Lender

The best mortgage lender for you will be the one the can give you the lowest rate and the terms you want. Your local bank or credit union probably writes mortgage loans with rates close to the current national average. A loan officer in your local branch could guide you through the process.

Online lenders have expanded their market share over the past decade. You could get pre-approved within minutes. Your loan amount combined with current mortgage rates could define your price range for home prices in your area. Many online lenders also assign a dedicated loan officer to offer continuity as you shop.

Shop around to compare rates and terms, and make sure your lender has the loan option you need. Not all lenders write USDA-backed mortgages or VA loans, for example. If you’re not sure about a lender’s veracity, ask for its NMLS number and search for online reviews.

Also Check: When To Refinance Your Mortgage Dave Ramsey