Best For Monthly Affordability: 30

A 30-year mortgage may be best if youre seeking stable and affordable monthly payments or wish for more flexibility in saving and spending your money over time. The longer loan term may also be the better option if you plan on purchasing property you couldnt normally afford to repay in just 15 years.

How Rates Have Changed For 30

Historically speaking, mortgage rates for 30-year fixed loans have been gradually declining. If we take a look at average rates from 2000 to 2020, it shows points were average rates have significantly decreased. The graph below is taken from the Federal Reserve Bank of St. Louis. We also compiled a table showing average rates from January 2000 to January 2020.

Based on the FRED graph, the 30-year fixed mortgage started with an average rate of 8.15 percent in January 2020. Over the next couple of years between 2001 to 2008, it fluctuates between 7.07 percent and 5.85 percent.

| 3.72% |

By January 2008, youll notice a substantial drop down to 5.01 percent. During this period, the effects of the subprime mortgage crisis gravely affected consumers and lending institutions. According to historical accounts, the mortgage crisis aggravated the U.S. recession in December 2007 to June 2009.

In January 2009, the average 30-year fixed mortgage rate dropped by 1.06 percentage points from 2008. It increased to 5.09 percent in 2010, but went down to 4.77 percent in 2011. Between January 2012 to 2017, the average rate ranged between 3.34 percent to 4.53 percent. In 2017, it reaches 4.20 percent, but continues to fluctuate downward to 3.95 percent in January 2018.

Is It Better To Get A 15 Year Mortgage Or Pay Extra On A 30 Year Mortgage

15 Year Vs 30 year mortgage: whats the difference?

In simple language, the main difference between a 15 year and 30 year mortgage is the term. On a 15 year mortgage, you will pay off what you owe within 15 years whereas with a 30 year mortgage, it will take double the time.

Why a 15 year mortgage is better

Depending on your circumstances, a 15 year mortgage can usually be more beneficial. Some of the reasons why are explained below.

Savings on interestWhile the interest rate will be the same regardless of the term of your mortgage, as interest is calculated daily and paid with each monthly payment, the shorter the period you pay your mortgage over, the less interest you will pay in total.

Build home equity fasterWith a shorter term, your monthly repayments will be higher to ensure the full amount is repaid by the end of your mortgage term. This means that with each repayment you will be building the equity you own in the property faster than if you were paying lower monthly repayments over a longer term. Please note, this is only applicable for mortgages on a capital and interest repayment basis and not interest only repayments.

Own your property in half the timeAs long as you have opted to repay your mortgage on a capital and interest only repayment basis, at the end of the 15 year term, you will own your property outright. This means you wont have to make any more mortgage repayments.

Why a 30 year mortgage is better

Getting the right mortgage

Don’t Miss: What Documents Are Needed To Get Pre Approved For Mortgage

Pay Down Your Other Debts

A crucial rule of debt repayments is: clear the most expensive debts first, suggests Martin Lewis, founder of MoneySavingExpert.com. Do so and the interest doesnt build up as quickly, saving you cash and giving you more chance of clearing debts earlier.

As a rule of thumb, Clear high-interest credit cards and loans before overpaying your mortgage, as theyre usually more expensive.

Best To Save Money Over Time: 15

The 15-year mortgage may be best for those who wish to spend less on interest, have a generous income, and also have a reliable amount in savings. With a 15-year mortgage, your income would need to be enough to cover higher monthly mortgage payments among other living expenses, and ample savings are important to serve as a buffer in case of emergency.

Recommended Reading: How Does The Interest Work On A Mortgage

How Does A Mortgage Work

A mortgage is a secured loan that uses the home as collateral for the lender to issue you financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Want To Make Irregular Payments Do You Need More Advanced Calculation Options

- Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.

- Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest.

- Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.

For your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

You May Like: How Do Rocket Mortgage Rates Compare

It’s About More Than The Loan Term

Eric is a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

Miguel Co / The Balance 2019

Fixed-rate mortgages are the simplest and most popular home loans. They prevent the surprises that can come with adjustable-rate mortgages when your interest rate is subject to increase down the road. But you still have a choice to make: Should you take out that fixed rate mortgage for 15 years or for 30 years?

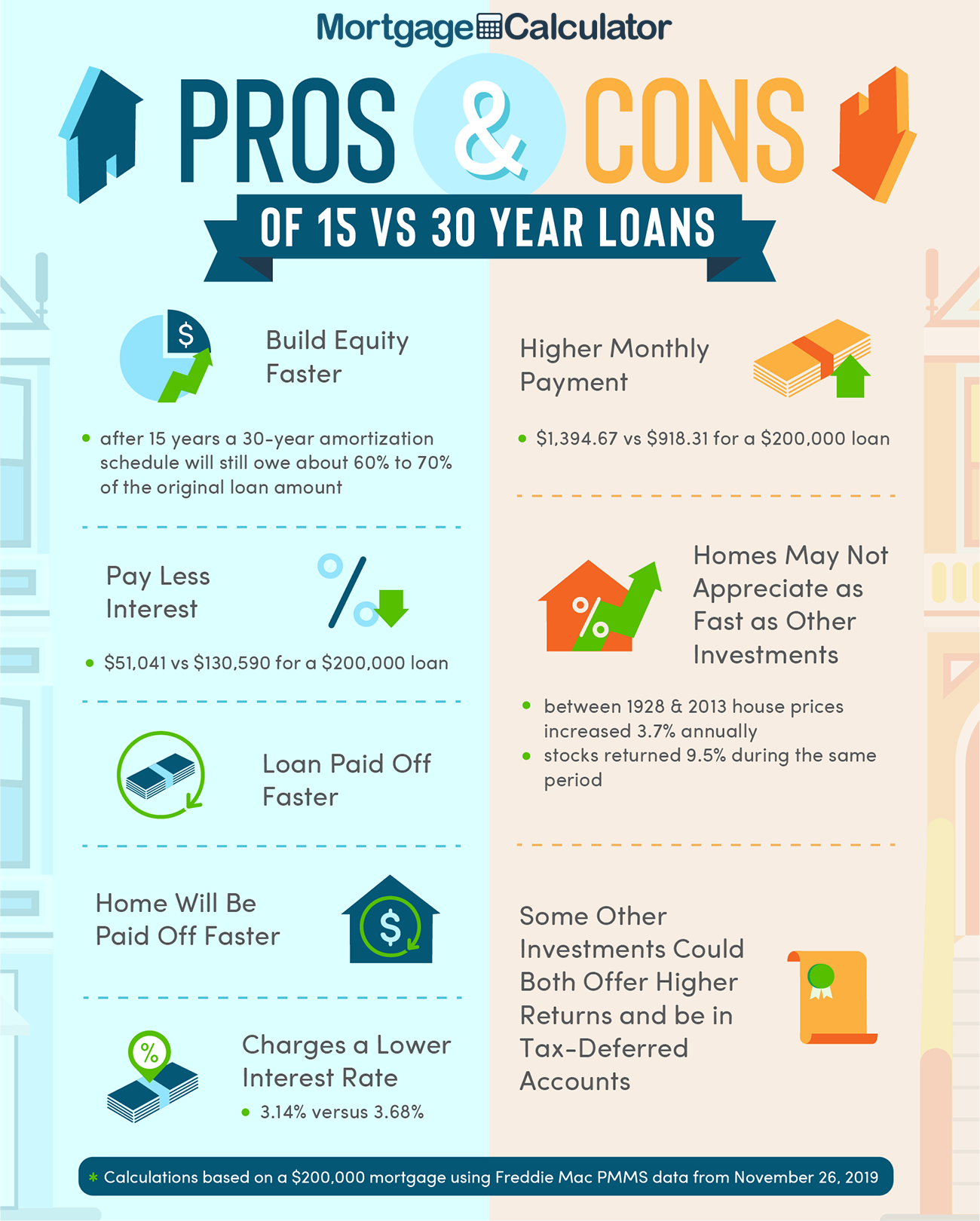

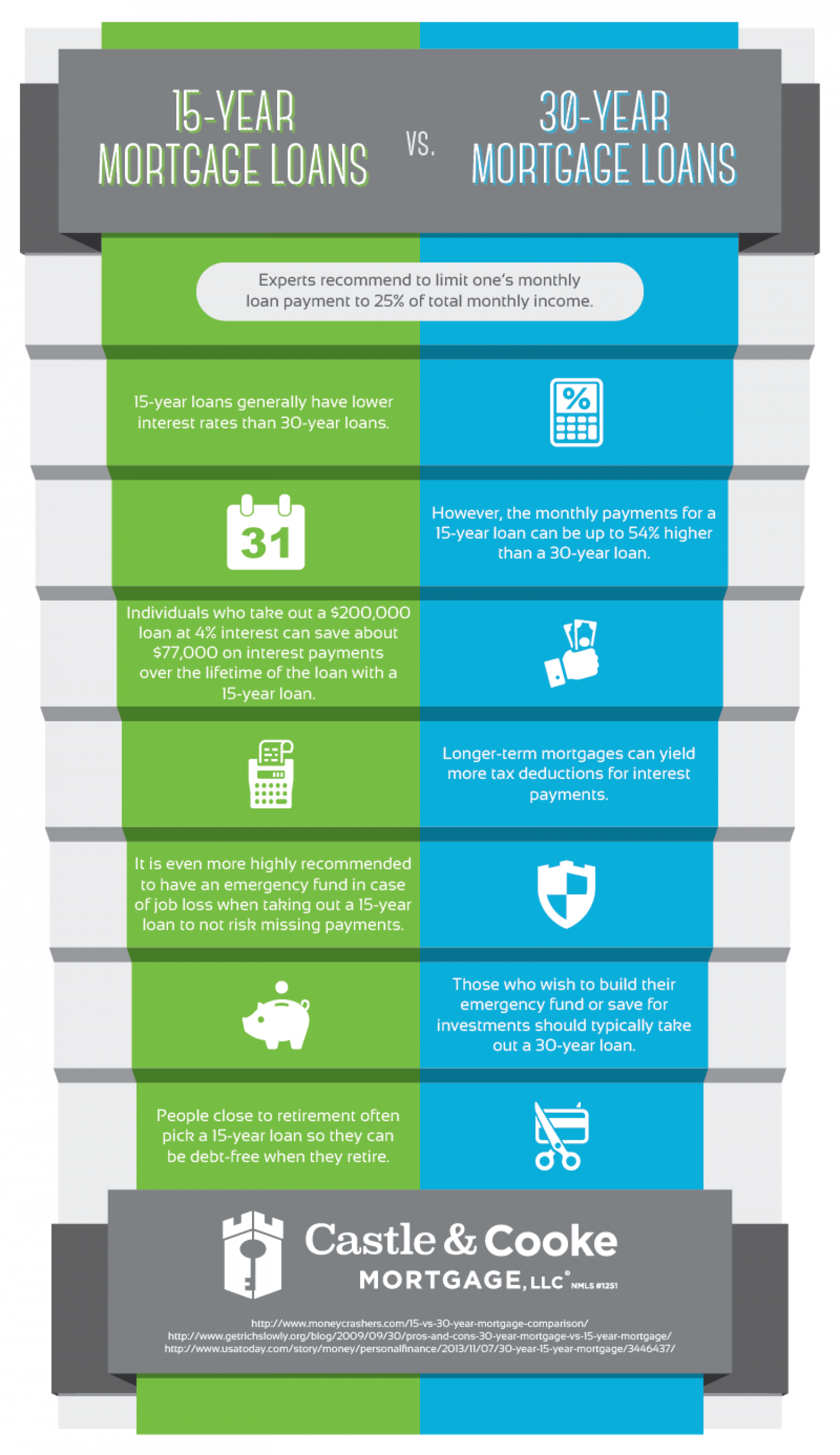

A 15-year mortgage minimizes your total borrowing costs and lets you pay off your mortgage in half the time. However, a 30-year loan has lower monthly payments, and that can free up some of your money to save for other goals or to pay for unanticipated expenses.

How To Pay Off Your Mortgage Early

8 Minute Read | September 13, 2021

So youre eager to join the nearly 40% of American homeowners who actually own their home outright.1 Can you imagine that? When the bank doesnt own your house and you step onto your lawn, the grass feels different under your feetthats freedom.

But the problem is youre currently stuck dragging around that ball and chain called a mortgagejust like most homeowners.

Dont worry. Well show you how to pay off your mortgage faster so you can finally join the ranks of debt-free homeowners. Lets get started.

You May Like: How Much Mortgage Can I Afford On 200k Salary

Taking Out A 30 Year Mortgage Over 15 Years

Buying a house is a big step. Most consumers need to take out a mortgage in order to get the house of their dreams. That loan can be draining on your bank account, and worst of all, you will be paying it off for decades. Decades of interest adds up to a lot more than the initial cost of the home. However, taking out a 30 year mortgage and paying it off over 15 years could turn a long-term financial decision into a shorter financial responsibility that costs less in the long run.

How Do I Pay Off A 30

There are a few ways to pay down a 30-year mortgage in 15 years. First, you could consider refinancing your current mortgage into a 15-year fixed mortgage. Another way is to make extra payments towards the principal amount or make biweekly payments equally one additional mortgage payment per year. This might not get you to the 15-year mark, but the amount of principal would most certainly go down.

Also Check: How Do You Refinance Your Mortgage

Other Mortgage Loan Types To Choose From

Besides conventional 15-year and 30-year fixed-rate mortgages, there are other loan types to choose from when buying a new home or refinancing.

- Adjustable rate mortgagesAdjustable rate mortgages come in 30-year terms. The major forms of these mortgage types are 5/1, 5/6, 7/6 and 10/6. For each of these, the loan starts with a low rate for the first 5, 7 or 10 years, then adjusts every six months to a year for the remainder of the loan. These types of mortgages are great if you don’t plan on staying in the home long-term. Disclaimer: Rocket Mortgage® does not currently offer 5-year ARMs.

- Jumbo mortgages Jumbo loans are typically 30-year loans for expensive properties. Conventional loans have limits on how much you can borrow depending on the average property value where you’re buying. A jumbo loan is an option if the property you’re buying exceeds this limit. Since it’s a higher loan amount and a higher risk for the bank, jumbo loans come with higher interest rates.

- Cash-Out refinance A cash-out refinance is a type of mortgage refinance in which you can turn the home equity you have into cash. You then take on a new mortgage for the rest of what you owe.

Dont Forget About Retirement

Hows your retirement fund? Check on this and see if youre currently contributing enough. Instead of refinancing to a 15-year mortgage, you may be better off putting more money toward a 401 plan or an IRA account.

You also want to make sure youre maximizing your tax benefits in these and other types of programs, like health savings accounts and 529 college savings accounts. Compared to these plans, paying down a low-rate, potentially tax-deductible debt like a mortgage is a low financial priority.

You May Like: How Much Is The Mortgage On A $300 000 House

Make A Bigger Down Payment

The larger your down payment, the smaller your loanand the faster youll be able to get out of debt.

A 20% down payment allows you to get a home loan without also having to pay for private mortgage insurance . When you make PMI payments, that money isnt reducing your debt, and it can be expensive. PMI can cost up to 1% of your mortgage amount per year. So, on a $180,000 mortgage, thats about $1,800 just going toward PMI each year and not reducing your debt.

Consider saving up for a bigger down payment to reduce your overall loan and avoid PMI. Itll make it that much easier to pay off the mortgage within 10 years.

Related:Strategies to Pay off Your Mortgage Early

Make One Extra Mortgage Payment Per Year

Many homeowners choose to make oneextra payment per year to pay off their mortgage faster.

One of the easiest ways to make an extra payment each year isto pay half your mortgage payment every other week instead of paying the fullamount once a month. This is known as bi-weekly payments.

When you make bi-weekly instead of monthly payments, you end up adding one extra payment each year.

However, you cant simply start making a payment every two weeks. Your loan servicer could be confused about getting irregular, partial payments. Talk to your loan servicer first to arrange this plan.

You could also simply make a 13th payment at the end of theyear. But this method requires coming up with a lump sum of cash. Somehomeowners like to time their extra payment with their tax return or with ayearly bonus at work.

However you arrange it, making an extra payment each year isa great way to pay off a mortgage early.

As an example, if you took out amortgage for $200,000 on a 30-year term at 4.5%, your principal and interestpayment would be about $1,000 per month.

Paying one extra payment of $1,000per year would shave 4½ years off your 30-year term. That saves you over$28,500 in interest if you see the loan through to theend.

Paying down your mortgage balance quickly has otheradvantages, too.

For example, lowering your balance means you can stop payingprivate mortgage insurance premiums sooner. Conventional loans let youcancel PMI when youve paid off 20% of the loans original balance.

Read Also: How To Know How Much Mortgage I Can Afford

Hit The Principal Early

Over the first few years of your mortgage, it may seem that you are only paying interest and the principal isnt reducing at all, says Nila Sweeney, managing editor or Property Market Insider. Unfortunately, youre probably right, as this is one of the unfortunate effects of compound interest. So you need to try everything you can to get some of the principal repaid early and youll notice the difference.

Every dollar you put into your mortgage above your repayment amount attacks the capital, which means down the track youll be paying interest on a smaller amount. Extra lump sums or regular additional repayments will help you cut many years off the term of your loan.

What’s The Difference Between A 15

A 15-year mortgage is designed to be paid off over 15 years. A 30-year mortgage is structured to be paid in full in 30 years. The interest rate is lower on a 15-year mortgage, and because the term is half as long, you’ll pay a lot less interest over the life of the loan. Of course, that means your payment will be higher, too, than with a 30-year mortgage.

Also Check: Is Closing Cost Part Of Mortgage

How To Refinance From An Interest

Thirty years is a long commitment, especially in a relationship that will cost you thousands of dollars in interest. A mortgage is usually necessary to purchase a house and, unfortunately, many young homeowners can’t afford to pay it in less than 30 years. However, if your financial situation improves, it is to your benefit to pay off the mortgage in less time. If you don’t want to be stuck with a mortgage for 30 years and can afford the higher payments and closing costs, you can refinance to make your mortgage a 15-year term.

Why Pay Off Your Mortgage Early

Few people keep a 30-year loan for its full term. In fact, homeowners stay put just 13 years on average and their loans might have an even shorter lifespan if they refinance at some point.

Homeowners who plan to sell their home orrefinance soon usually arent concerned about paying off their mortgage early.

But what about homeowners who stayput for the long haul? Those 30 years of interest payments can start to feellike a burden, especially compared to the payments on todays lower-interest-rateloans.

You may find yourself wonderinghow to pay your mortgage off faster so you can live debt-free and have fullownership of your home.

Here are five strategies you canuse to meet those goals.

Don’t Miss: Can You Get A Mortgage While In Chapter 13

Your Loan Term Impacts How Much Youll Pay For A Mortgage

A loan term plays a big role in the interest rate you get, your monthly payment and how much interest you pay over the life of the home loan.

When you take out a home loan, whether its a 15- or 30-year mortgage:

More of your monthly mortgage payment goes to interest in the beginning. Homeowners with a 30-year mortgage will pay more interest versus those with a 15-year mortgage.

For example:$82,970$38,931

Learn More: How to Get a Mortgage

How Often Do 15

Mortgage rates fluctuate daily during the 5-day workweek. They can steadily hold from month to month or can shift due to market changes and economic concerns. In the past 20 years, the moments we’ve seen with the largest shifts in mortgage rates have to do with recessions. Historically, greater economic uncertainty means lower mortgage rates

Read Also: What Percentage Of Mortgage Is Interest

How Does Your Mortgage Term Impact Cost

When you pay back a mortgage, your monthly loan payment is split between paying down the principal balance and paying interest. As you pay off your loan, your interest payments are recalculated based on the remaining balance, and over time, less of your monthly payment will go toward interest and more toward principal. This concept is called amortization. Depending on your mortgage term, the amount of each monthly payment that goes toward either the interest or the principal balance can be altered.

The length of your mortgage term can affect costs in several ways, but one of the biggest factors is how it can influence your interest rates. The current national average rates stand at around 2.64% for a 15-year mortgage and 3.34% for the 30-year option. The rates for your specific mortgage will vary based on factors like your home’s price, your and income.

As a result, a 15-year mortgage costs less in the long term, but a 30-year term requires lower monthly payments. The 15-year mortgage’s principal will be paid down faster with the shorter timeline and higher monthly payments.

Suppose you’re approved for a $500,000 mortgage with a 10% down payment. For simplicity’s sake, let’s say the interest rate is 3.5% for the 15-year loan and 4% for the 30-year term .

In this example:

Check out our mortgage calculator to crunch the numbers for your own situation: