Understanding Your Mortgage Payment

Monthly mortgage payment = Principal + Interest + Escrow Account Payment

Escrow account = Homeowners Insurance + Property Taxes + PMI

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment , but also property taxes, home insurance and, in some cases, private mortgage insurance.

Who Is A 15

Borrowers who dont mind a higher monthly payment might find a 15-year mortgage to be a more attractive option than a longer-term loan. Thats because 15-year mortgages come with a lower interest rate and less interest paid overall.

If youre looking to refinance, its smart to consider refinancing into a 15-year mortgage, especially if youre more than halfway through repaying your current 30-year loan. If you refinance into another 30-year loan, youd extend your repayment period, which costs more in the long run.

Another reason to consider a 15-year mortgage is if you want to retire mortgage-free. Locking in the shorter duration of a 15-year mortgage now, especially if youre in your 40s or 50s, allows you to pay it off in time for when you stop working.

Us Department Of Agriculture Loans

USDA loans are geared towards homebuyers with low to moderate incomes. It provides a zero downpayment option to borrowers with credit scores not lower than 640. The USDA home financing program was designed to aid economic development in areas with low populations in the country.

To be eligible for a USDA loan, you must purchase a house in a USDA rural area. This may seem like a limitation if you want to live in a city. However, 97 percent of land in the U.S. is actually qualified for USDA home financing. You just might find a house near a good location. Consider this option before you cross it out your list.

Qualifying for USDA Loans

To qualify for a USDA loan, borrowers should have a minimum credit score of 640. If your credit rating is lower than 640, you must provide additional documentation of your payment history to get approval. For front-end DTI ratio, you must not go beyond 29 percent. Likewise, your back-end DTI ratio must not be over 41 percent.Be sure to check the USDA income limits in your preferred home location. This will also determine if you can obtain a USDA loan. There are different income limits for households with 1 to 4 members and larger families with 5 to 8 family members. For example, under the 2008 Housing and Economic Recovery Act , high-cost areas for 1 to 4 member households are set at $212,55.

Also Check: What Is Excellent Credit Score For Mortgage

Where To Get A $300000 Mortgage

To get a $300,000 home loan, youll want to get quotes from at least a few different lenders. Though this can be done by reaching out to each mortgage company directly, you can also use an online marketplace like Credible.

Once you receive your quotes, youll want to compare them line by line. You should look at the interest rate, total costs on closing day, any origination fees, mortgage points youre being charged, and more.

After you determine the best offer, you can move forward with that lenders application and submit any required documentation.

Credible makes the process of finding the right mortgage rate easier and more efficient. You can get tailored prequalified rates from our partner lenders simultaneously all with just one form and it only takes a few minutes.

Learn More: How to Know If You Should Buy a House

Why Comparing Rates Is Important

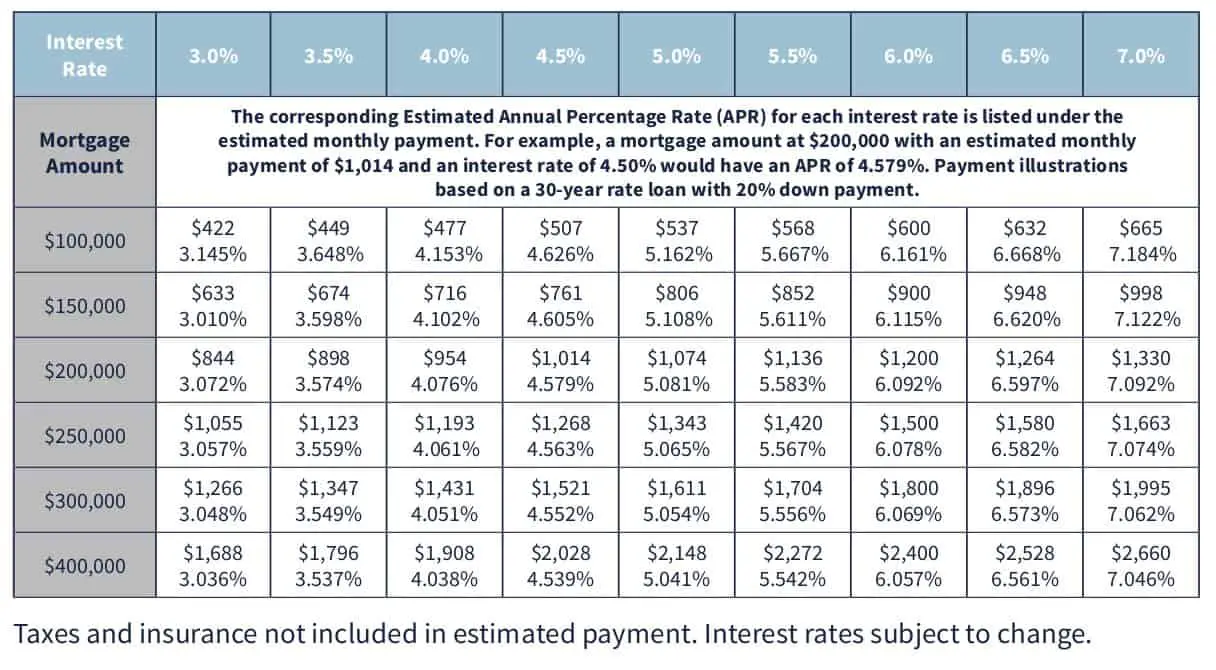

Mortgage rates and closing costs can vary widely from lender to lender, so its important that you shop around before. In a report published in 2018, mortgage giant Freddie Mac said borrowers could save an average of $1,500 over the life of the loan by getting one additional rate quote, and an average of $3,000 by seeking out five quotes.

Recommended Reading: How Much Usda Mortgage Can I Qualify For

Much More Than The Amount Of Monthly Payments

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

How To Calculate Mortgage Payments

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

You May Like: Is Citizens Bank Good For Mortgages

Considerations When Choosing A 15

When youre trying to buy a house, you think choosing which home to purchase will be the hard part. But thats just a small piece of the decision puzzle yet to come. Who will do your inspection? Who will be your mortgage lender? When should you lock your rate? Who will be your home insurance company? The list goes on and on. One of those decisions you must make is whether to choose a 15-year or 30-year mortgage.

Mortgage Bankers Association reported that 86% of people applying for mortgages in February 2015 chose 30-year loans. But does that mean its the right choice for you?The main differences between a 15-year and 30-year mortgage are fairly simple. The decision, however, may not be. A 15-year mortgage will cost you more in monthly payments. That may make this shorter loan seem like a less affordable option, but youll pay less interest. Therefore, youll pay significantly less over the life of the loan. A 30-year mortgage will have lower monthly payments, but youll pay more in interest, meaning youll pay more for the house over the life of the loan.

In short, a 15-year mortgage means higher monthly payments, but a smaller total payment. A 30-year mortgage means lower monthly payments, but a larger total payment.

Mortgages are not one-size-fits-all, and choosing a 15-year versus 30-year option should be determined based on your unique financial situation. So lets explore the options further.

What should you consider when choosing a 15 vs. 30-year loan?

Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed, which could result in a bill or a refund come tax season.

You can typically find your property tax rate on your local government’s website.

Recommended Reading: What Does A Mortgage Consist Of

Conforming Loans Vs Non

Conforming loanshave maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

What You Need To Qualify For A 15

The primary difference between qualifying for a 15-year versus a 30-year mortgage is that for the former, your lender has to make sure you can afford larger monthly payments, and usually that means having a higher income and a lower debt-to-income ratio.

If your DTI ratio is on the higher side, you can work to increase your income or pay down your debt. Some ways you can pay down debt include:

You May Like: How Much Is A 180k Mortgage Per Month

Early Repayment And Extra Payments

In many situations, mortgage borrowers may want to pay off mortgages earlier rather than later, either in whole or in part, for reasons including but not limited to interest savings, wanting to sell their home, or refinancing. Our calculator can factor in monthly, annual, or one-time extra payments. However, borrowers need to understand the advantages and disadvantages of paying ahead on the mortgage.

Early Repayment Strategies

Aside from paying off the mortgage loan entirely, typically, there are three main strategies that can be used to repay a mortgage loan earlier. Borrowers mainly adopt these strategies to save on interest. These methods can be used in combination or individually.

Reasons for early repayment

Making extra payments offers the following advantages:

Drawbacks of early repayment

How Mortgage Terms Impact Cost

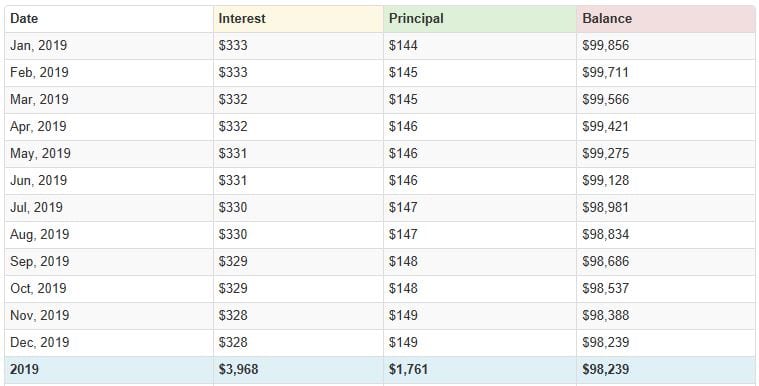

A mortgage is simply a particular type of term loanone secured by real property. For a term loan, the borrower pays interest calculated on an annual basis against the outstanding balance of the loan. Both the interest rate and monthly payment are fixed.

Because the monthly payment is fixed, the portion going to pay interest and the portion going to pay principal change over time. In the beginning, because the loan balance is so high, most of the payment is interest. But as the balance gets smaller, the interest share of the payment declines, and the share going to principal increases.

A shorter-term loan means a higher monthly payment, which makes the 15-year mortgage seem less affordable. But the shorter term makes the loan cheaper on several fronts. In fact, over the full life of a loan, a 30-year mortgage will end up costing more than double the 15-year option.

Because 15-year loans are less risky for banks than 30-year loansand because it costs banks less to make shorter-term loans than longer-term loansa 30-year mortgage typically comes with a higher interest rate.

You May Like: How Much Should Your Mortgage Be In Relation To Income

When To Consider A 30

You can likely claim a sizable tax deduction based on interest payments for your 30-year loan, especially in the early years, when most of your payments go toward interest. And because it’s a fixed-rate loan, youll pay the same amount every month.However, if you dont plan to stay put for several years, or if you want a lower rate, a 15-year fixed-rate mortgage or an adjustable-rate mortgage might be a better option.

Mortgage Payment Calculator Canada

Looking to take out a mortgage sometime soon? Know what you’ll be signing up for with our mortgage payment calculator. Understanding how much your mortgage payments will be is an important part of getting a mortgage that you can afford to service long term.

The mortgage payment calculator below estimates your monthly payment and amortization schedule for the life of your mortgage. If you’re purchasing a home, our payment calculator allows you to test down payment and amortization scenarios, and compare variable and fixed mortgage rates. It also calculates your mortgage default insurance premiums and land transfer tax. Advertising Disclosure

| Select |

Recommended Reading: How Much Is Personal Mortgage Insurance

How Do You Find Personalized 30

We’re showing today’s average mortgage rates, but you can find personalized rates based on your down payment amount, credit score, and debt-to-income ratio.

You can Google “mortgage rate calculator” to enter your information and get an idea of what rate you’d pay.

Some online lenders, such as Ally and Better.com, provide personalized rates with their own digital calculators.

If you’re a little further along in the homebuying process, then you can speak with multiple lenders to receive personalized rates to compare and contrast rates before choosing a lender.

How Is The Interest Paid On A Balloon Mortgage Calculated

Monthly principal and interest payment . The monthly payment is calculated using a 30 year term. Total of all monthly payments over the term of the balloon mortgage. This total payment amount assumes that there are no prepayments of principal. Total of all interest paid over the term of the balloon mortgage.

Read Also: How To Market Yourself As A Mortgage Loan Officer

How To Decide Which Term Is Right For You

Theres a lot to consider around the entire home buying process, and the mortgage part of it is no different. Think about your current financial circumstances and ask yourself the following questions:

- Do you have a good amount saved for a down payment?

- Is there some wiggle room in your monthly budget to pay higher monthly payments so you can pay less over the whole loan term?

- What is the real estate market like where you live?

- Do you expect your monthly income to rise, fall or stay the same in the future?

Carefully considering all of these factors and more will give you the confidence needed to select the right mortgage for your unique circumstances. Dont let all the financial forensics turn you off from buying a home altogether, though, because any purchase regardless of loan type is better than none at all given the significant advantages from a tax perspective and a building equity perspective.

Should You Consider A Combo Option

Some home buyers choose to take a middle route that borrows advantages from both the 15-year and 30-year payment plans. Technically, this is a strategy rather than a third loan type. It involves choosing a 30-year mortgage and then making the monthly payments you would on a 15-year mortgage. Just like with conventional payment methods, there are pros and cons to this best-of-both-words approach.

On the plus side, making higher payments on a 30-year mortgage allows you to get out of debt faster. But it also gives you a safety net. On a true 15-year mortgage, you must pay the higher monthly payments. With this alternative method, you have the option of reverting back to the standard, lower monthly payment if your income changes.

The benefit of flexibility comes at a price, however. For one, your 30-year interest rate will remain higher, so if you choose to pay the equivalent of 15-year monthly payments and never need to adjust, you end up paying more than you would have if you had just used the 15-year mortgage to begin with. Additionally, many borrowers find it difficult to stick to the higher monthly payment, since they are the only ones holding themselves accountable for it.

You May Like: How Much Income To Qualify For 1 Million Mortgage

How Much A $300000 Mortgage Will Cost You

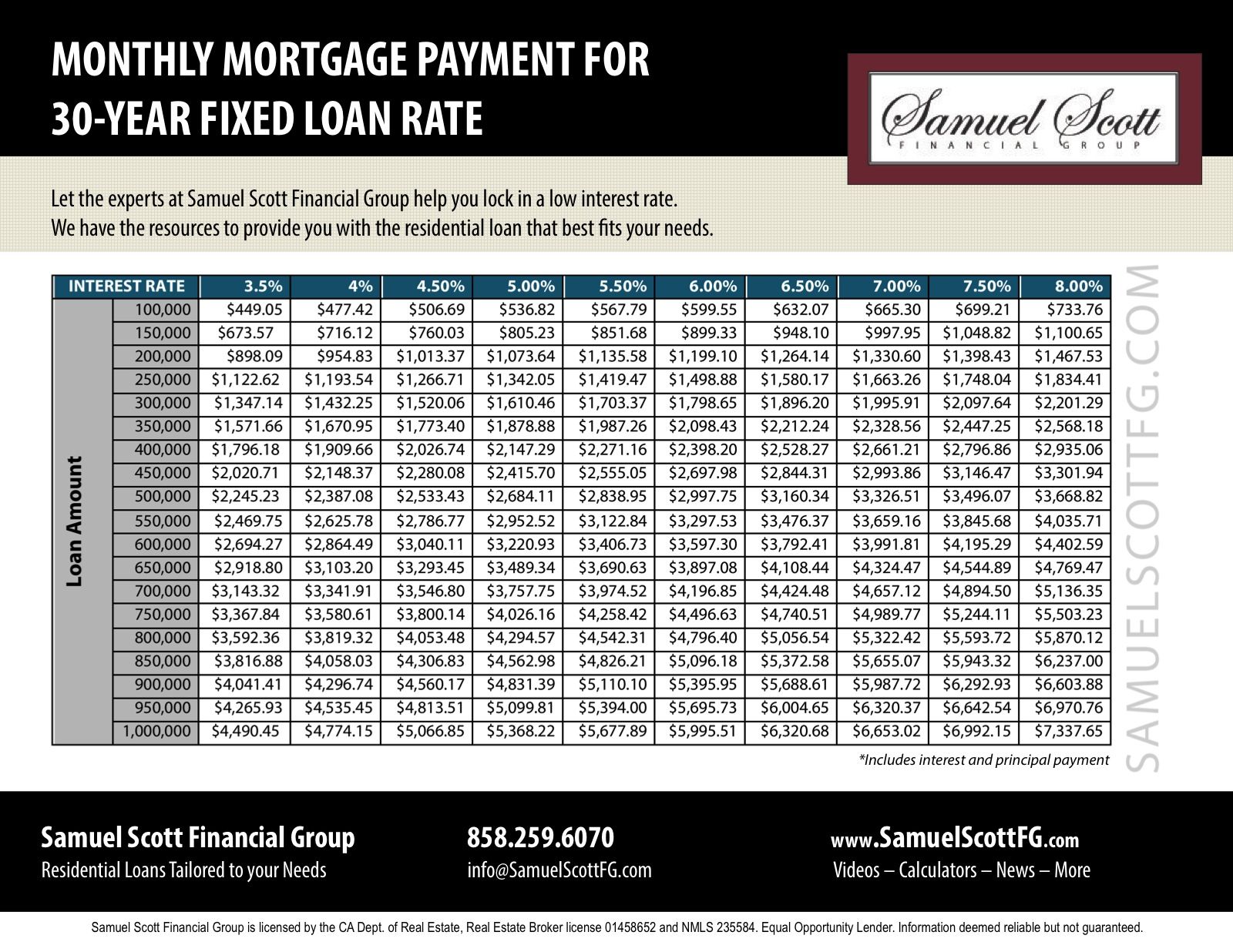

A $300,000 mortgage comes with upfront and long-term costs. The total costs of the loan will depend on your interest rate and loan term.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Taking out a mortgage comes with many costs some upfront and some paid over long lengths of time. On a $300,000 mortgage, those costs might surprise you.

In fact, on a traditional 15- or 30-year loan of this size you might pay anywhere from $72,000 to $155,000 just in interest.

Learn more about how much a $300,000 mortgage will cost you in the long run:

What To Consider Before Prepaying Your Mortgage

Prepaying your mortgage is a great goal to work toward, but before you do, make sure youve met these financial milestones first:

- Get the match. If youre not getting the full company match from a workplace retirement plan, youre passing up an instant return. The typical company match equals 50 percent to 100 percent of your contribution, up to a limit . Thats where extra money should go first until youre on track for retirement. Retirement plan contributions get a tax break and the more time your money has to grow, the better.

- Pay off your higher-rate debt. It doesnt make sense to pay off a 4 percent mortgage if you have credit cards accruing at 16 percent or more.

- Plan for emergencies. A savings account with at least three to six months worth of expenses can help you weather most setbacks.

- Protect yourself. You should be adequately insured, which for most people means having property, health and disability policies. If you have financial dependents, youll probably want life insurance, as well.

Once those bases are covered, prepaying a mortgage comes down to discipline and comfort level. Do you want to be completely debt-free, or would you prefer your money working harder for you in other ways? Ideally, you want to pay off your mortgage before retirement so you dont have those monthly payments to worry about if your income becomes more limited.

You May Like: Is Closing Cost Part Of Mortgage