Least Expensive Places To Live In Florida

1. Brooksville, FL A small county town between Orlando and Tampa known as Brooksville takes the cake for the least expensive place to live in Florida. While there may not be a lot going on in the city outside of farming, the cost of living makes up for it. The median value of an owner-occupied unit in the area is only $49,000 and the median gross rent is $806.

2. Palatka, FL If youre looking for a cheap place to live, you may want to check out Palatka. The median value of a home in the area is only $78,100. If youre looking to rent, recent data shows a median gross rent of $693.

3. Live Oak, FL You can expect to catch a lot of breaks when it comes to the cost of living in Live Oak. The median price of a home in the area is only $88,700. The monthly costs of homeownership are also quite low at $975, and the median gross rent in the area is $675, according to the most recent Census data.

4. North Fort Myers, FL While many parts of Florida have high housing costs, North Fort Myers comes in 58% below the national average. The median home price in the city is $145,823 and the median cost of rent is only $458.60. Utility costs are also 12% below the national average.

5. Orange City, FL This Florida city comes in 6% below the national average for overall cost of living. The biggest savings come via housing, which is 17% below the national average. The median home price in the city is $288,704 and the median rent is $904.38.

How To Get The Best Rates On A Florida Home Loan

Mortgage shopping in any state is a personal process. Your credit report, debt-to-income ratio, and other personal information help lenders set your mortgage or refinance rates.

This means you cant always expect to get the best rates you see quoted online. But it also means you have some control over your interest rate.

To increase your chances of getting the best rates in the market today, you can:

- Work on your credit report and score. Borrowers with FICO scores above 720 and a clean credit report can get great rates from many lenders

- Get a 15-year loan term if possible. National averages on 15-year fixed-rate loans tend to fall below averages for 30-year fixed-rate mortgages. A 15-year fixed-rate loan requires much higher monthly payments but costs less over the long term

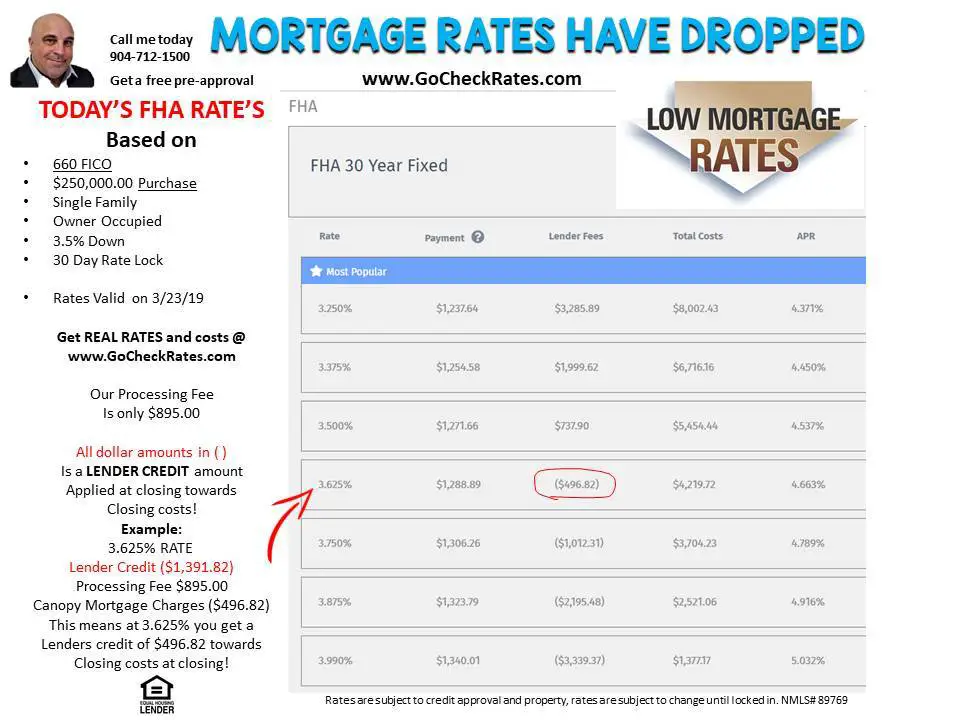

- Find the right loan type. Thanks to government backing on FHA, USDA, and VA loans, borrowers with lower credit scores and down payments can still get competitive rates on these loans

In addition, be sure to shop around for your best rate. Even though your personal credit profile guides lenders decisions, every lender is different. Shopping around will increase your chances of finding the perfect loan for your needs.

Working with a broker could also help you see multiple loan options at once so you can compare rates and fees more easily.

How To Find A Mortgage Officer In Florida

Contact your U.S. Bank mortgage loan officer for more information about programs available in Florida. Find a mortgage loan officer in Florida. Our local mortgage loan officers understand the specifics of the Florida market. Let us help you navigate the home-buying process so you can focus on finding your dream home.

You May Like: What Banks Look For When Applying For A Mortgage

Factors In Your Florida Mortgage Payment

When youre calculating the costs of buying a home, youll need to think about property taxes in addition to your monthly mortgage payments. Luckily, Floridians dont have it bad, with tax rates near or below the national average. The effective property tax rate in Florida is 0.83%, which equals about $2,035 in annual tax payments for the typical homeowner.

Your property tax bill starts with an appraisal by a county official. Your actual tax rate is based on the assessed value, not just the appraised value of the home. This means that account exemptions are taken into consideration. Your assessed value can decrease if you claim the homestead exemption , or the Save Our Homes assessment increase limitation. Wondering what your property taxes pay for? In Florida, counties, municipalities, school districts and special districts can all levy taxes to pay for services, improvement projects and ongoing operating costs. Your total bill will depend on where your property is located and what taxes apply to that exact area.

Another cost youll need to consider is homeowners insurance. This is where youll be hit hardest with prices in Florida, as the state has some of the highest homeowners insurance costs in the nation. Insurance.com data shows that the average annual insurance premium in the Sunshine State is $3,643, good for the third-highest rate in the country.

Florida Arm Loan Rates

An adjustable-rate mortgage is a mortgage with an interest rate that changes over the life of the loan. ARMs generally come with introductory interest rates that are lower than the going rates for 30-year fixed-rate loans. That introductory rate will hold for a period of 1,3,5,7 or 10 years, depending on the terms of the loan. After that, the lender can adjust the interest rate of the loan once a year. Generally, the rate increases. The amount by which the interest rate on an ARM can jump is capped in the loan term, so you wont wake up to a 30% mortgage rate.

However, during the mortgage crisis many homeowners struggled to keep up with the payments on their adjustable-rate mortgages. Florida, which went through a foreclosure crisis during the last recession, was home to plenty of borrowers who came to find their monthly mortgage payments unaffordable. Anyone can fall behind on their payments, even with a fixed-rate mortgage, especially in the event of a job loss, divorce or major illness. ARMs are inherently more risky than fixed-rate mortgages if you dont plan your budget for the highest rate allowed in your mortgage term.

The average rate for a 5/1 ARM in Florida is 2.94% .

Don’t Miss: What Is Tip In Mortgage

Private Mortgage Insurance In Florida

Florida home buyers who put less than 20% down on a conforming loan typically have to pay private mortgage insurance premiums.

The rules for PMI are no different in Florida than the rest of the U.S. Although its the homeowner who pays for it, mortgage insurance protects thelender in case a borrower cant make loan payments.

Note, private mortgage insurance on a conventional loan can be canceled once the homeowners loan-to-value ratio reaches 80% or lower. This happens when youve built at least 20% equity through rising home values and paying off your mortgage.

A similar type of coverage, called mortgage insurance premium or MIP, is required for all FHA loans.

The FHA loan program requires this insurance throughout the life of the loan unless you put at least 10% down. In that case, these mortgage insurance payments go away after 11 years.

You could also refinance into a conventional mortgage loan later on to eliminate the FHA loans mortgage insurance premiums.

Details Of Florida Housing Market

Florida is known to many as a vacation destination thanks to Disney World, miles of beaches and a plethora of resort towns catering to tourists. However, a large number of residents live year-round in the Sunshine State. Its total population, according to the Census Bureau, is an estimated 21.5 million, which places it as the third-largest state in the U.S.

The state has over 8,400 miles of shoreline, and almost all of its residents live in coastal counties. Florida cities have seen some of the fastest growth in the U.S. The Cape Coral-Fort Myers area, Orlando-Kissimmee, Jacksonville and Deltona-Daytona Beach areas in Florida regularly hit the top of lists for fastest growing U.S. cities.

If you take the Florida housing market as a whole, youll see that the state is recovering from the recession, which led to many foreclosed homes. The state also ranks in the bottom half of SmartAssets Healthiest Housing Markets study, which looks at stability, affordability, fluidity and risk of loss factors.

Floridas largest urban areas by population are Jacksonville, Miami, Tampa, Orlando and St. Petersburg, according to U.S. Census Bureau estimates. Each of this large states cities is diverse and distinct in its own way and has its own housing market dynamics. Take for example, Miami-Dade County, where the median home value is $268,200, according to Census data. Compare that with Duval County, home of the largest city, Jacksonville, at only $166,900.

You May Like: How To Get A 15 Year Fixed Mortgage

Interfirst Mortgage Company Best For Refinancing

If youre looking to refinance your mortgage in The Sunshine State, Chicago-based Interfirst Mortgage Company could be a worthwhile candidate to consider. Since it doesnt charge any lender fees, your transaction will be cheaper overall. Youll also be able to take advantage of the convenience of e-signing your documents a key point of differentiation during the pandemic.

Strengths: Doesnt charge lender fees A+ rating from the Better Business Bureau

Weaknesses: Doesnt advertise rates online requires a minimum down payment of 15 percent

Read Bankrate’s Interfirst Mortgage Company review

How To Find Florida Mortgage Brokers

Looking for a Florida mortgage broker? You can start with this search tool from the National Association of Mortgage Brokers. Type broker in the search bar, select Florida, and find listings for your area.

Or, if youre already working with a real estate agent, your agent should be able to give you mortgage broker recommendations.

To verify that a mortgage broker in Florida is currently licensed, look them up using the Florida Office of Financial Regulation search tool.

Another option is to compare rates from 3-4 direct lenders on your own to find the best deal. Most mortgage companies will give you a free quote online, which makes comparison shopping relatively easy.

Also Check: What Is A Good Dti For A Mortgage

Overview Of Florida Housing Market

While some areas of Florida boast affordable housing markets, homeownership in Florida comes with some risk. The state has some of the highest foreclosure rates and homeowners insurance costs in the country. However, Florida’s 0.83% average effective property tax rate is less than the national mark.

How Does Your Property Value Affect Mortgage Loan Rates

Risk plays a big factor on mortgage rates. The more equity you have in your property the less risk for the lender when it comes to conventional mortgage loans. For instance, if you are trying to get a loan for cash-out refinance, your interest rate is much better when the loan-to-value is under 60% of the property value.

Read Also: Can A Locked Mortgage Rate Be Changed

Florida State Current Mortgage Rates

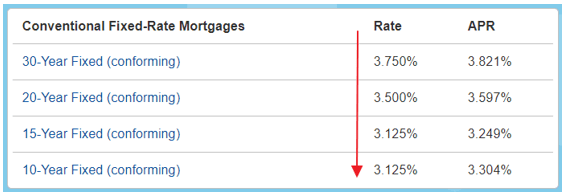

You can currently get a 30-year fixed-rate loan in Florida with an interest rate of about 3.55%. This could offer some savings when compared to the average national interest rate of 3.72%. Your exact savings will depend on your creditworthiness and loan terms, though, as these rates assume a 20% down payment and a 740 or higher credit score.

Shorter-term fixed-rate loan interest rates in Florida are somewhat lower, with 20-year rates at about 3.45% and 15-year rates just under 3%. The interest rates for 10-year loans are typically close to the 15-year interest rates, but have been a little higher as of late. While 7/1 and 5/1 ARM loan interest rates have been volatile over the years, the two types of loans currently have average interest rates of 3.15% in Florida.

What Is The Minimum Down Payment Required To Buy A Home

Each loan program requires a certain percentage. A typical conventional loan will require 5% down payment on owner occupied properties. FHA loans require a minimum of 3.5% down payment. Finally, VA loans may require zero down payment depending on the eligibility of the veteran. Lastly, Investment properties require a minimum of 20% down payment but if you are trying to get the lowest mortgage rate then you should put 25% down on an investment property loan.

You May Like: Can You Get A Mortgage While In Chapter 13

Does The Amount Of Down Payment Affect Your Mortgage Rate

It depends on the type of loan you are applying for. For instance, if you are getting an FHA loan, it doesnt change your note rate whether your put the minimum 3.5% down or 20% down payment. On the other hand, if you are getting a conventional mortgage, there is a slight difference in the cost associates with the mortgage rate for a borrower putting 5% down payment versus another borrower that puts 20% down. Finally, on a conventional mortgage putting 20% down helps you avoid the PMI which results in a lower annual percentage rate .

The Rates Listed Above Are Community Credit Union Of Florida’s Starting Base Interest Rates

Loan rates are based on credit history, loan terms, and borrower qualifications. Contact CCU to determine your rate. The interest rate to be charged on a specific loan will be based on the loan program, the transaction type, the credit scores of all borrowers, the loan to value or combined loan to value ratios, the type of property financed, the number of units within the property and if secondary financing will apply.

The rate to be offered will be determined once a complete application has been submitted, including property address and all supporting documents. Complete application package must be submitted for rate and point to be locked. Rate adjustments will be made when escrows are waived and with no closing cost programs. Contact CCU to ask about rate buy-downs.

Community Credit Union of Florida reserves the right to limit the maximum Loan to Value or Combined Loan To Value ratio that we will finance.

Purchase/Refinance Loan Amounts OVER $50,000**

You May Like: How To Sell A Mobile Home With A Mortgage

Mortgage Facts In Floridas Biggest Cities And Towns From Alafaya To West Palm Beach

LendingTrees research provided in-depth comparisons of various mortgage facts among the states largest cities and towns with a population of at least 50,000 residents.

We have data on:

- Median housing costs for renters and homeowners

- Median incomes for renters and homeowners

- Median property taxes

Floridas three largest cities by population Jacksonville, Miami and Tampa have very different housing markets.

For example, the percentage of homes with an active mortgage is low in Miami at just 29.6%, compared with:

- 48.6% in Tampa

- 56% in Jacksonville

The difference may be because the median rent and median homeowner costs gap is widest in Miami.

- In Miami, renters pay a median of $1,183 a month, versus $1,973 for homeowners

- In Tampa, renters pay a median of $1,131 a month, versus $1,622 for homeowners

- In Jacksonville, renters pay a median of $1,065 a month, versus $1,366 for homeowners

Home values vary widely between the three cities, too. In Jacksonville, the median home value is $183,700, compared with $258,200 in Tampa and $334,100 in Miami.

Ways To Get The Best Refinance Rates In Florida

If youre considering refinancing in Florida, it can be a good idea to get your home refinance-ready before you apply for a loan. Here are some ways to help you get the best refinance rates in Florida.

Invest in Your Home Equity

The more equity you have in your home, the more competitive loan offers that you receive may be. In the months or years leading up to a refinance, it may be helpful to put extra money toward your principal to increase your equity or to make any home improvements that may heighten your homes value.

Keep on Top of Repairs

Making sure repairs are completed in a timely manner, appliance upgrades are completed when necessary, and curbside appeal is considered are all ways to keep the valuation of your home competitive, which can help you get the most competitive loan possible.

Regularly Check Mortgage Rates

Understanding whether mortgage rates are rising or falling and seeing how those rates may affect your mortgage can be a habit that may help you understand how interest affects your monthly payments and can help you predict when the best time to consider refinancing.

Have Your Home Equity Be Part of Your Overall Financial Plan

Compare Lenders

Interest rates are just one factor in a mortgage payment. Comparing loans from different lenders can help you find the most competitive mortgage refinancing in Florida for you.

You May Like: Can You Apply For A Mortgage Before Finding A House

How Do Refinance Mortgage Rates Vary In Florida

Several factors affect refinance mortgage rates. For instance, rate/term refinance rates are much lower than cash out refinance transactions. Also, shorter term mortgages such as 15 year fixed have almost .5% lower mortgage rates than a 30 year fixed mortgage. Also, borrowers that have a lot of equity in their home get a much lower mortgage rate than borrowers with little or low equity.

How Does A Southstate Mortgage Officer Help You

Our loan officers work closely with you to make sure you are comfortable with your mortgage loan and it will help you meet your long-term goals. Talk to us about whats important to you and well find the mortgage that will fit you best. By refinancing, you may be able to reduce your interest rate and monthly payment.

Don’t Miss: How Much Do You Pay Back On A Mortgage

See Current Mortgage Rates In Florida From Top Lenders

What is the mortgage interest rate today in florida. Compare mortgage rates from multiple lenders in one place. Generally the rate increases. Shopping for the lowest florida mortgage and refinance rates.

Fha loans annual percentage rate apr calculation assumes a 255 290 loan 250 900 base amount plus 4 390 upfront mortgage insurance premium with a 3 5 down payment monthly mortgage insurance premium of 176 30 and borrower paid finance charges of 0 862 of the base loan amount plus origination fees if applicable. We ll show both current and. Learn more about today s mortgage rates.

That introductory rate will hold for a period of 1 3 5 7 or 10 years depending on the terms of the loan. Save money by comparing rates today. Compare fixed and adjustable rates today and lock in your rate.

Current rates in florida are 3 49 for a 30 year fixed 2 84 for a 15 year fixed and 3 36 for a 5 1 adjustable rate mortgage arm. View and compare urrent updated today mortgage rates home loan rates and other bank interest rates in florida fl. 30 year fixed 15 year fixed 10 year fixed 5 1 year arm and etc.

Use this free florida mortgage calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. After that the lender can adjust the interest rate of the loan once a year. Compare the latest rates loans payments and fees for arm and fixed rate mortgages.

View current mortgage interest rates and recent rate trends.