Will Mortgage Interest Rates Go Down In 2021

Mortgage rates move up and down from day to day and week to week. And even though rates have dipped in the past few months, that doesnt appear to be a long-term sustainable trend.

The economy and employment rates look like they will continue to improve for the rest of 2021. And those numbers should put upward pressure on mortgage rates. So even if rates dont skyrocket, its unlikely that well see a continued drop in rates, barring an unexpected surprise.

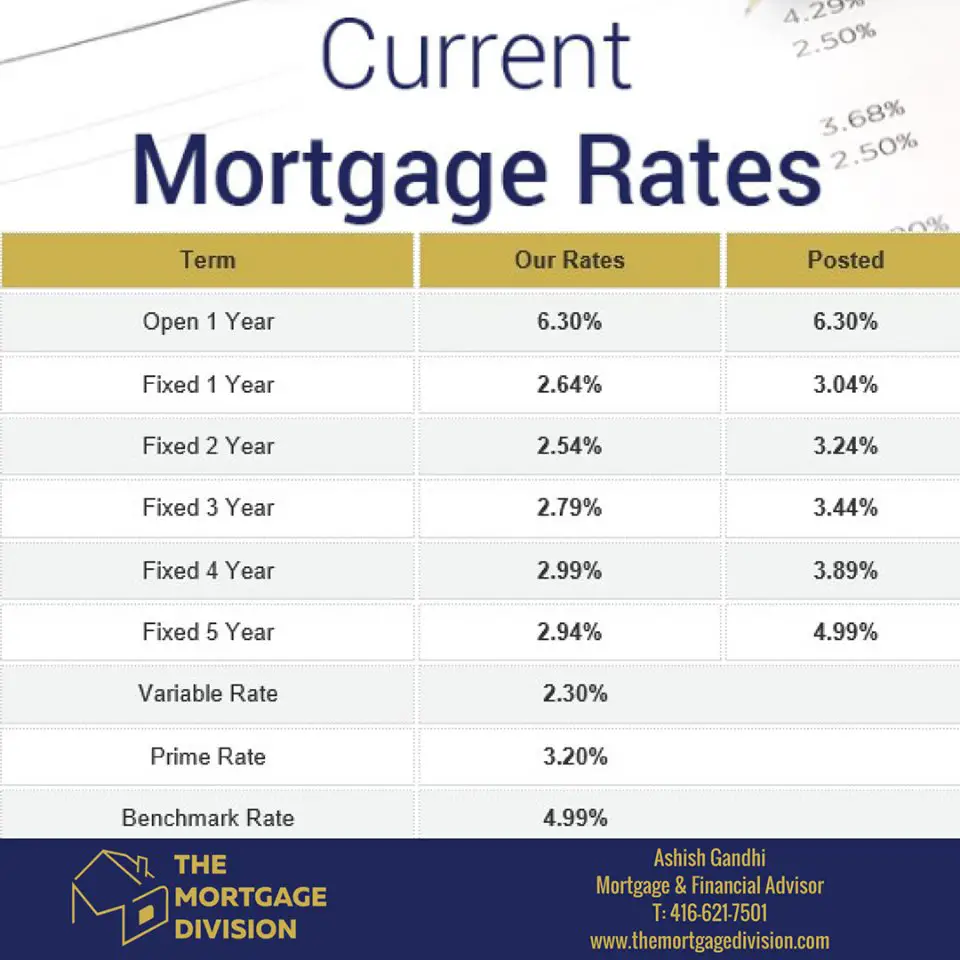

Posted Rates Vs Best Rates

When comparing bank mortgage rates, itâs important to know that these rates represent the banks’ posted mortgage rates. The posted rate is simply the rate that the bank is advertising in public. However, banks are often able to offer even lower rates, in order to secure a borrower’s business. You may be able to access these discounted rates through negotiation, or by reaching out to a representative mortgage broker. Some banks offer rates several percentage points below what is posted, so it’s worth taking the time to see if you can get a better offer.

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process the lender will look at your overall financial profile to determine how much it is willing to let you borrow. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI a lender will allow is 43%. So if you make $5,000 a month your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Recommended Reading: How Do I Apply For A Usda Mortgage

Should I Get An Open Or Closed Mortgage In Ontario

With an open mortgage, you can pay down as much of your principal as you want in a given year without restriction. However, open mortgage rates are higher. So you are essentially paying more for flexibility.

With a closed mortgage, prepayments are restricted and interest penalties are enforced on any overpayment, but your rate will be lower than an open mortgage rate.

In Ontario, closed mortgages are the more popular option as most people donât expect to pay more than their monthly mortgage payment. However, an open mortgage could be a good choice if youâre planning to move soon or expect to receive a lump sum of money during your mortgage term.

What Factors Affect The Mortgage Rate I Get

The mortgage rate that you qualify for will depend on a number of factors, some of the most important of which are:

- Your down payment – The size of your down payment will determine the amount of insurance your mortgage will require. The larger your down payment, the less insurance your mortgage will require. Though it may seem counter-intuitive, uninsured mortgages actually have higher rates. This is because lenders take on more risk for these mortgages since they cannot get insurance on them. Though you may not get the lowest rate, it is usually always better to put a larger down payment if you can afford it because you wonât have to pay for mortgage insurance.

- Your amortization period – Mortgages with amortization periods greater than 25 years are not usually insurable and therefore come at a higher rate. However, a longer amortization period allows you to have a lower monthly payment.

- What the property will be used for – Will you be living in the property? Mortgage rates for rental properties are typically higher than for those that are owner-occupied.

- Mortgage type – Mortgage rates for refinances are usually higher than rates for renewals and purchases.

- Your credit score – Your credit score may affect the type of lenders that will work with you. If you have bad credit, you may not qualify for a Big Bank mortgage.

You May Like: What Does Prequalification For A Mortgage Mean

Make The Best Offer Youre Comfortable With

When youre competing against a dozen other people for a house it can be tempting to increase your offer or to waive certain buyer contingencies to make your offer more appealing. But you shouldnt do this without understanding the consequences.

If home prices are rapidly rising in your area, consider starting your home search with properties listed below your home buying budget. That way you can comfortably raise your offer amount without paying more than you can afford.

When making an offer you should also carefully consider what contingencies you will include or waive, if any. Waiving an appraisal contingency means that if the appraised value is less than your offer price, you could have to pay the difference out of pocket or risk losing your earnest money deposit. So be sure you fully understand and accept all of the risks associated with waiving contingencies beforehand.

How Big A Mortgage Can I Afford

In general, homeowners can afford a mortgage thats two to two-and-a-half times their annual gross income. For instance, if you earn $80,000 a year, you can afford a mortgage from $160,000 to $200,000. Keep in mind that this is a general guideline and you need to look at additional factors when determining how much you can afford such as your lifestyle.

First, your lender will determine what it thinks you can afford based on your income, debts, assets, and liabilities. However, you need to determine how much youre willing to spend, your current expensesmost experts recommend not spending more than 28 percent of your gross income on housing costs. Lenders will also look at your DTI, meaning that the higher your DTI, the less likely youll be able to afford a bigger mortgage.

Dont forget to include other costs aside from your mortgage, which includes any applicable HOA fees, homeowners insurance, property taxes, and home maintenance costs. Using a mortgage calculator can be helpful in this situation to help you figure out how you can comfortably afford a mortgage payment.

Recommended Reading: How Much Mortgage Can I Afford On 200k Salary

Mortgage Rate Predictions For Late 2021

Experts are split on their mortgage rate predictions for fall and winter of 2021.

Fannie Mae and the National Association of Home Builders see average 30-year rates staying below 3% through Q4 2021, while agencies like Freddie Mac and the Mortgage Bankers Association predict 30-year rates as high as 3.3 to 3.4% by the end of the year.

In any case, mortgage interest rates should stay in the low- to mid-3% range throughout the second half of 2021. No one is expecting a dramatic spike any time soon.

| Housing Authority |

How Big Of A Mortgage Can I Afford

How much mortgage you can afford varies from person to person. If you want to figure out how big of a mortgage you can afford, you can start by looking at your budget. The rule of thumb used by many financial advisors is that you shouldnt spend more than 28% of your gross monthly income on housing costs and 36% of your gross monthly income on all debt. These are referred to as debt-to-income ratios and are also used by lenders to qualify you.

Housing costs include P& I plus things like private mortgage insurance , home insurance, real estate taxes, and even homeowners association fees, which can sometimes be rolled into your total mortgage payment. When figuring out how much of a mortgage you can afford, make sure to include all of these housing costs in your analysis. You may want to use a mortgage calculator to help figure out the monthly payment inclusive of these costs.

Keep in mind, although most lenders dont want total DTIs to exceed 36% to 43%, you may be able to qualify for a mortgage with a DTI as high as 50%. However, just because you can qualify for a mortgage doesnt mean you can afford it. Carefully consider the total mortgage payment in relation to your other monthly expenses before moving forward. If its not going to be easy to make the payment over the long-term, you may want to consider getting a smaller mortgage.

Read Also: Who Has The Best Mortgage Loan Rates

Compare Mortgage Rates In Newfoundland And Labrador

As noted above, its imperative for mortgage shoppers to first take the time to compare the various options available to them.

The spread between Newfoundland and Labradors best and worst mortgage rates can be over a full percentage point for the very same term. If you unknowingly accept a lenders first rate offer, which can often fall on the high side of that spread, you could end up paying thousands of dollars more than necessary, versus had you explored the alternatives.

RATESDOTCA helps you compare the best Newfoundland and Labrador mortgage rates from the most reputable mortgage providers in the province. We show rates from all prime lenders that publicly advertise their products, as well as the top brokers in the province.

Pro Tip: Generally speaking, the best mortgage rate deals are available during the busy spring homebuying season. But there are exceptions.

How Do I Compare Current Mortgage Rates

Because mortgage rates are so individual to the borrower, the best way to find the rates available to you is to get quotes from multiple lenders. If you’re early in the homebuying process, apply for prequalification and/or preapproval with several lenders to compare and contrast what they’re offering.

If you want a broader idea without yet talking to lenders directly, you can use the tool below to get a general sense of the rates that might be available to you.

Also Check: How Much Per 1000 On Mortgage

Topbritish Columbia Mortgage Brokers

Because British Columbias population density is predominantly situated in and around the Greater Vancouver and Victoria areas, and in the southern part of the provinces interior, that allows for a greater concentration of mortgage providers in those markets. British Columbia mortgage brokers are often able to offer the lowest mortgage rates on the market. The largest brokerages operating in the province include:

- Dominion Lending Centres

- M3 Mortgage Group .

Some of the top online discount brokers that are licensed in British Columbia include:

- Butler Mortgage

- Spin Mortgage.

Jamie David Business Director Of Mortgages

Jamie David is the Business Director of Mortgages at Ratehub.ca. A graduate of the Systems Design Engineering program at the University of Waterloo, she has over 15 years of business, marketing, and engineering experience in the financial technology, banking, education, energy and retail industries. She has worked in top organizations like TD Bank, Trading Pursuits, Petro-Canada, and the TTC. Her passion for personal finance, investing, education, and business strategy brought her to Ratehub.ca where she heads a very talented, cross-functional team that is dedicated to providing Canadians with the best mortgage experience all the way through from online search to funded mortgage.

Also Check: What Information Do You Need To Prequalify For A Mortgage

How Do I Know Im Getting The Lowest Rate

We have a strong selection of lenders on LowestRates.ca, including the big banks and many independent providers, and were adding more lenders all the time. This ensures were always delivering you a competitive rate. Even if youre not ready to commit to anything, you can use our site as a starting point for research .

The better informed you are, the more likely you’ll negotiate a better deal for yourself. And, really, thats what we care about the most.

LowestRates.ca Staff

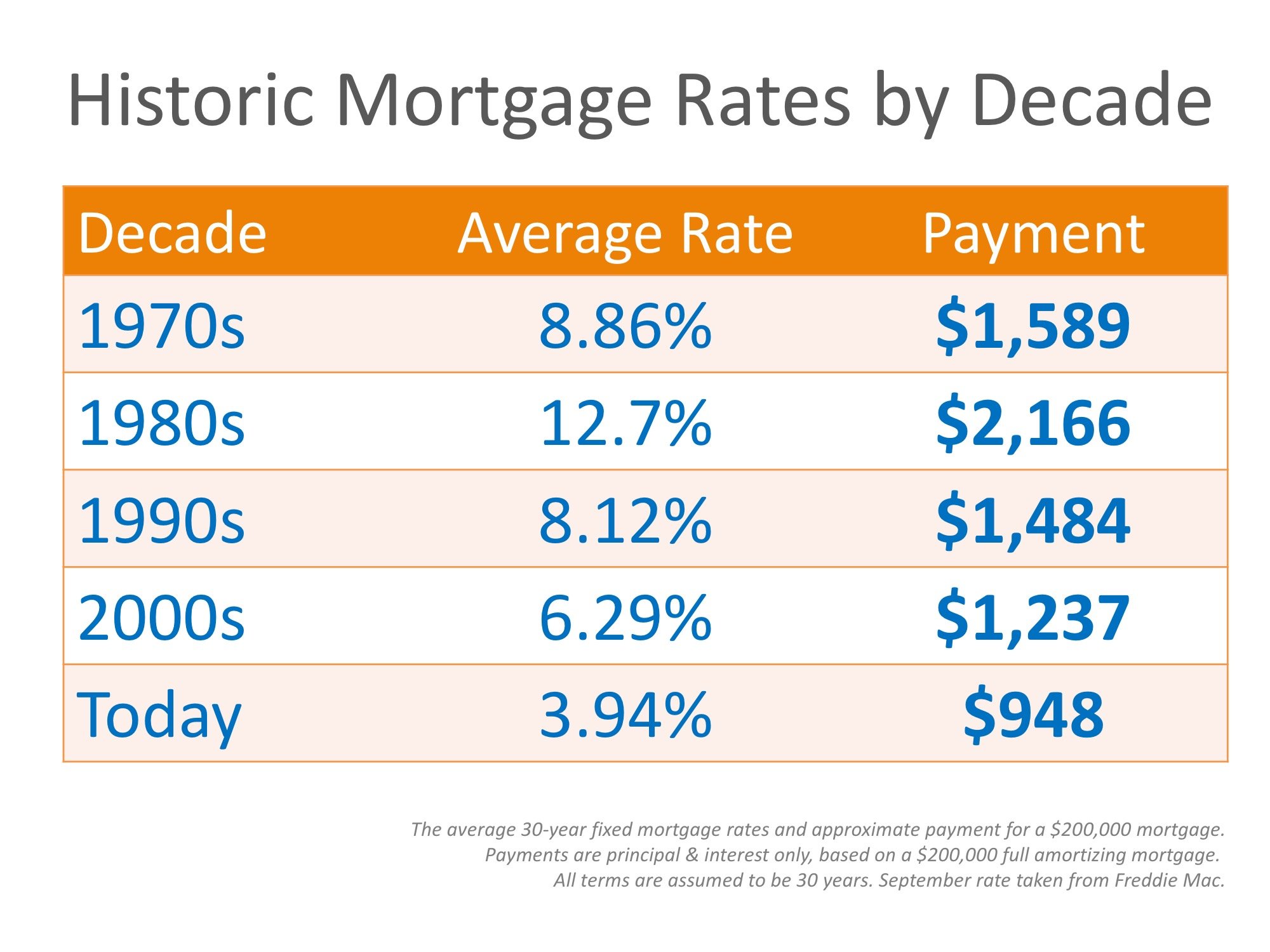

Why Does My Mortgage Interest Rate Matter

Your mortgage interest rate impacts the amount youll pay monthly as well as the total interest costs youll pay over the life of your loan. While it may not seem like a lot, a lower interest rate even by half of a percent can add up to significant savings for you.

For example, a borrower with a good credit score and a 20 percent down payment who takes out a 30-year fixed-rate loan for $200,000 with an interest rate of 4.25% instead of 4.75% translates to almost $60 per month in savings in the first five years, thats a savings of $3,500. Just as important is looking at the total interest costs too. In the same scenario, a half percent decrease in interest rate means a savings of almost $21,400 in total interest owed over the life of the loan.

Recommended Reading: What Is The Mortgage Payment On 240k

Mortgage Rate Trends By Loan Type

Many mortgage shoppers dont realize there are different types of rates in todays mortgage market.

But this knowledge can help home buyers and refinancing households find the best value for their situation.

Following are 3-month mortgage rate trends for the most popular types of home loans: conventional, FHA, VA, and jumbo.

Which mortgage loan is best?

The best mortgage for you depends on your financial situation and your goals.

For instance, if you want to buy a high-priced home and you have great credit, a jumbo loan is your best bet. Jumbo mortgages allow loan amounts above conforming loan limits which max out at $548,250 in most parts of the U.S.

On the other hand, if youre a veteran or service member, a VA loan is almost always the right choice.

VA loans are backed by the U.S. Department of Veterans Affairs. They provide ultra-low rates and never charge private mortgage insurance . But you need an eligible service history to qualify.

Conforming loans and FHA loans are great low-down-payment options.

Conforming loans allow as little as 3% down with FICO scores starting at 620.

FHA loans are even more lenient about credit home buyers can often qualify with a score of 580 or higher, and a less-than-perfect credit history might not disqualify you.

What Is The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing the money, and it is advertised as a percentage of the loan. APR stands for annual percentage rate, and it includes the interest rate plus other fees associated with the mortgage. So the APR will provide you with a better idea of the total cost of financing the loan. You may find lenders offering the same interest rate and monthly payments, but if one is charging higher upfront fees, then the APR will be higher.

The Federal Truth in Lending Act requires lenders to disclose the APR, but which fees are included in it can vary. So when comparing APRs of different lenders, ask which fees arent included for better comparison.

Also Check: What Is A 30 Year Fixed Jumbo Mortgage Rate

Fairway Independent Mortgage Corporation Best For Home Equity Lending

Overview

Fairway Independent Mortgage has more than 400 locations nationwide and is licensed in all 50 states. As a lending institution, it focuses entirely on mortgage loans. But it also operates a mortgage wholesale division.

What to keep in mind

Even though Fairway Independent Mortgage has a smaller footprint than some of the other larger banks, it does have locations in 48 states and Washington, D.C. In addition to being able to apply in person at one of its office locations, you can also apply online.

Fairway offers a wide range of mortgages, but because its not a full-service financial institution it doesnt issue other types of accounts or credit lines, like home equity loans. So its not a good option if youre looking for a one-stop shop for all your financial services.

What Does The Future Hold For Mortgage Rates

Mortgage rates plumbed new depths in January 2021, setting all-time lows south of 3 percent. Rates have climbed a bit since then, and their trajectory for the rest of the year depends on the strength of the economic recovery. Given the robust rebound, the Federal Reserve has indicated it will ease back on its stimulus. That sets the stage for rates to rise. However, increases are likely to be gradual rather than sudden. Many mortgage experts expect rates to climb above 3.5 percent by the end of 2021.

Learn more about historical mortgage rate trends.

Also Check: How To File A Complaint Against A Mortgage Lender

Insured Insurable And Uninsurable Mortgages

Theinsurability of your mortgagewill affect your mortgage rate. Insured mortgages are those with CMHC mortgage default insurance or private default insurance from Canada Guaranty or Sagen. The borrower will pay for the mortgage insurance premiums.

Since the lender has zero risk, they will offer the lowest mortgage rates for insured mortgages. The mortgage rates that you see advertised online are often only for insured high-ratio mortgages, which are mortgages with a down payment less than 20%. Insured mortgages will need to meetCMHC mortgage requirements.

With insurable mortgages, the borrower wont pay for mortgage insurance. The mortgage wont be individually insured either. Instead, the lender can choose to bulk insure their portfolio of insurable mortgages and pay for this insurance themselves.

What this means to you is that the cost of mortgage insurance isnt directly paid by you if mortgage insurance isnt required. Insurable mortgages will have to meet the same requirements as an insured mortgage, but the only difference is that an insurable mortgage will need to have a down payment of at least 20%. Insurable mortgage rates are also slightly higher than insured mortgage rates.

An insurable mortgage can have a mortgage rate that is around 20 basis points added on top of an insured mortgage rate. Uninsurable mortgage rates will have around 25 basis points to 35 basis points added on top of insured mortgage rates.