How To Get Prequalified For A Mortgage

Getting prequalified for a mortgage typically involves self-reporting basic details about your finances to a lender. Depending on the lender, you may have to visit a branch to complete the prequalification process. However, many lenders now offer online prequalification. If youre trying to get prequalified for a mortgage, youll likely have to provide information about your:

When Is The Best Time To Get A Mortgage Prequalification

Yeah, its really that simple. Since a prequalification gives you a big picture idea of how much mortgage you would be approved for, the best time to get one is in the very beginningwhen youre reviewing your budget. Think of it as the first step in the mortgage process.

Whats The Difference Between Bank Of America Prequalification And Preapproval

Aside from their distinct roles in homebuying, prequalification and preapproval can take different amounts of time. Prequalifying at Bank of America is a quick process that can be done online, and you may get results within an hour. For mortgage preapproval, youll need to supply more information so the application is likely to take more time.

Read Also: Which Is Better 30 Or 15 Year Mortgage

Does Prequalification Or Preapproval Affect Your Credit Score

Both prequalifications and preapprovals can show up as inquiries on your credit report. This may temporarily lower your credit score. If youre shopping for home loan rates from multiple lenders, TransUnion recommends limiting your mortgage loan inquiries to a 14-day window to minimize the impact.

Applying for multiple types of loans all at one time may also have a negative impact on your credit score. Try to avoid all other credit and loan applications during the time frame in which youre preparing to purchase a home.

What Does Mortgage Prequalification Mean To Me As A Borrower

By Brandon Cornett | © 2021, all rights reserved | Copyright policy

If you’ve been researching the home buying process for any length of time, you’ve probably encountered the terms pre-qualify and prequalification. These terms are often used in relation to mortgage loans. For instance, a lender’s website might invite you to “Click here to pre-qualify for a home loan.” They’ll explain how easy the process is, and that it only takes minutes. This is usually followed by a web-based form that requests information about you.

But what is mortgage prequalification exactly, and how does it help you when buying a home? What are the steps involved in the process? And is it even worth the time? These are some of the questions we will address in this mortgage tutorial.

Recommended Reading: What Is Excellent Credit Score For Mortgage

What Does Prequalified For A Home Loan Mean

Prequalification is the preliminary process in which a lender estimates the mortgage a buyer might be eligible for. This process seldom involves more than a brief conversation with the lender and a quick estimation of the potential buyer’s financial status. Because they don’t need to submit real financial documentation or go through a credit check, a prequalified buyer doesn’t have any guarantee of actually receiving a loan once you accept their offer. If their financial status changes, or if more information is revealed, the lender may choose not to make a final offer for a home loan.

Prequalified buyers know how much they might be able to spend, and they use this information to start shopping for a home in their price range. The lending company is interested in learning more about them and thinks they may be a good candidate for a mortgage. As offers start rolling in, keep in mind that those made from prequalified buyers don’t carry a lot of weight until the lender has officially agreed to a mortgage, the deal could fall through at any time.

Say This Not That At A Car Dealership Capital One

By leading with a pre-qualified financing rate, the salesperson knows a) you can get a loan, b) youve set budget parameters and c) youre a serious buyer.

Reasons Why Being Preapproved Is a Great Idea Theres a vast difference between being preapproved for an auto loan and being prequalified. To be

The rest of us have to finance. The problem with starting your car financing at the dealership is that you dont know whether the loan youre being offered is

Also Check: How To Determine What You Qualify For A Mortgage

Mortgage Fees Should Be Factored In

Many buyers focus solely on saving for a down payment and don’t stop to consider the other fees associated with mortgages. You can expect to pay for things like commissions to your real estate agent or broker, application fees, appraisal fees, title search and insurance fees, closing costs and more. Some lenders also charge fees if you pay off your loan early.

Some fees are unavoidable while others are negotiable. Speak with your lender about the fees you should expect so that you know how much youll need to pay.

Do You Need A Mortgage Preapproval To Buy A Home In Washington State

Although its not a legal requirement to have a mortgage preapproval or a letter of prequalification to buy a home in Washington state, having either document will certainly not hurt your chances. In fact, many home sellers simply will not entertain non-cash offers without one or the other.

With so many buyers competing for the available homes on the market, you need every possible competitive advantage. This includes things such as preapproval letters and solid offers that reflect the value of the home in the current, highly aggressive housing marketplace.

Also Check: What Is The Mortgage Rate In Florida

Does Prequalification Or Preapproval Hurt My Credit Scores

It depends. If the prequalification or preapproval includes a hard inquiry, it may have a minor, negative impact on your credit scores. Before proceeding with a prequalification or preapproval, check with the lender about which sort of credit pull they perform. If they do a soft credit pull, you wont impact your scores.

How Much To Settle For In A Car Accident

Category: Cars 1. Average Settlements in My Personal Injury Car Accident Case The average settlement value of a personal injury car accident case in the United States is approximately $19,000. The average car accident settlement tells Average Auto Accident Settlement Amounts · $10,000 to $25,000 for minor injuries (soft tissue

Recommended Reading: What Is Needed For Mortgage Application

Which Is Right For Me

First-time homebuyers are more likely to find that getting prequalified is helpful, especially when they are establishing their homebuying budget and want an idea of how much they might be able to borrow.

Preapproval can be extremely valuable when it comes time to make an offer on a house, especially in a competitive market where you might want to stand out among other potential buyers. Again, a seller will be more likely to consider you a serious buyer because you have had your finances and creditworthiness verified.

Ready to prequalify, get preapproved or apply? Get started with the Digital Mortgage Experience.

What Does Prequalified Approval Mean

If youre looking to buy a home, then the easiest first step to take is to get prequalified by your lender. During the prequalification stage, the lender will review your financial history, including your income and any outstanding debt, and may check your credit score.

This process is quick and can be completed over the phone or online. If the lender determines youre a good candidate for a mortgage, then youll receive a prequalification letter within 1 3 days, if not sooner.

This letter will include an estimate of how much youre able to borrow. But its important to remember that prequalification is not a guarantee that youll be approved for a mortgage.

The important thing to understand is that with a Prequalified Approval, Rocket Mortgage® and other lenders are basing the decision on estimates of your income and assets during the prequalification time frame. Your lender did not do a full credit evaluation.

Its only an educated guess of what you would be able to afford. If youre looking for something more definitive, then youll want to take the next step in the process and get preapproved.

Read Also: How To Negotiate The Best Mortgage Rate

The Benefits Of Getting Preapproved For A Car Loan Credit

Nov 24, 2020 A preapproval is conditional approval given to you from a lender with estimated terms such as the amount of money you can borrow, the interest

Mar 1, 2021 Preapproval means a lender has reviewed your credit report and other information to determine a loan amount and rate youre

Nov 5, 2019 When you get a pre-approved car loan your potential lender reviews your credit profile along with all required documentation. Youre then

Two Smart Homebuying Moves: Mortgage Prequalification And Preapproval

Find out how much house you can borrow before you start looking and how you can make the strongest offer possible on the property you choose.

If youre ready to make your dream of owning a home a reality, youve probably already heard that you should consider getting prequalified or preapproved for a mortgage. Its time to understand exactly what each of those terms means and how they might help you. And when youre working toward a goal this big, you want every advantage.

Recommended Reading: What Is A 30 Year Fixed Jumbo Mortgage Rate

Who Should Get Preapproved For A Mortgage

For most prospective home buyers, getting preapproved for a mortgage will be more advantageous than getting prequalified. This tells the seller you are ready to buy. It can also give you a leg up on a rival bidder who has only been prequalified. It can also alert you to any issues with your creedit score or financial situation ahead of time.

Preapproval takes a load off your shoulders, too. You arent guaranteed to be approved for your loan that will depend on the propertys appraisal but it starts you down the road to approval, and its one less thing to worry about during homebuying.

How Long Does The Preapproval/prequalification Process Take

Mortgage prequalification doesnt require much deep financial information about borrowers, and results may be available within an hour in some cases and within one to three days in others. Mortgage preapproval, however, requires more financial information and greater detail. The average preapproval takes between one and 10 days to go through.

It should be noted that the prequalification process relies on your honest answers to provide accurate ideas about how much home you can afford based on your income and debts. The credit and financial information you provide is not verified like it is for the preapproval process.

You May Like: How To Select A Mortgage Lender

When Should You Get Preapproved For A Mortgage

Its best to get preapproved before you even start shopping for a home. Many first-time buyers pick out an ideal home before meeting with a lender. All too often, this oversight leads to unexpected issues, such as a limited borrowing capacity, that cause the sale to fall through.

Purchasing real estate can be a complicated process, requiring realistic expectations and a thorough understanding of the many factors that go into buying a home. For this reason, it is always best to begin the mortgage process with the help of a loan officer.

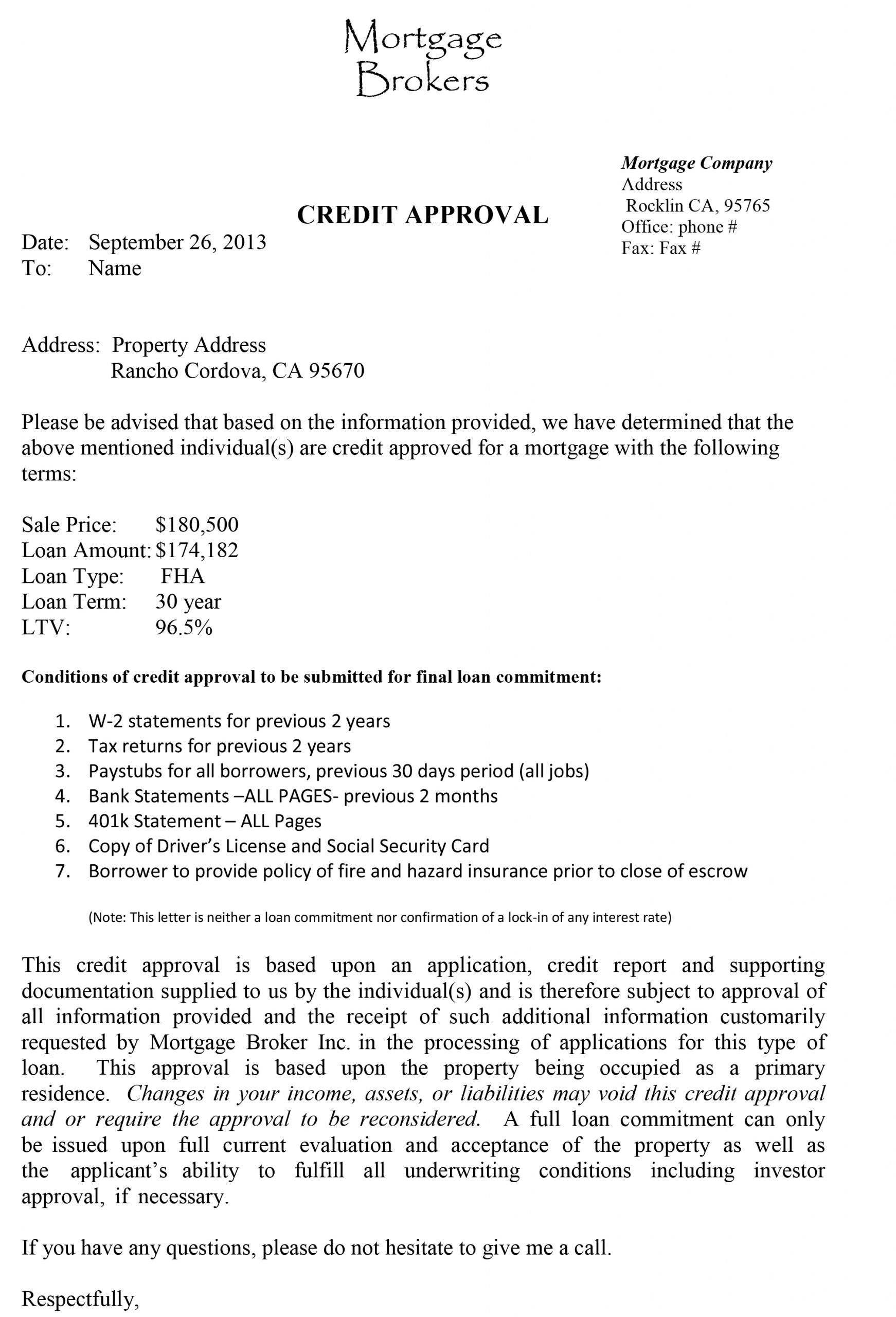

Get Your Home Loan Preapproval Letter

Once your lender has completed its review, you’ll receive the verdict. If there are no serious issues, you’ll receive a preapproval letter indicating your maximum loan amount, estimated interest rate, loan type and terms. You’ll want to give this letter to your real estate agent so they’ll have it ready to submit with any offer.

You May Like: Why Are Mortgage Rates Lower Than Prime

Do Preapproval And Prequalification Offers Impact Credit Score

With credit cards, neither prequalification nor preapproval offers will impact your credit scores because with either process, if there’s a credit check, the credit check usually results in a soft inquiry. Auto loans and mortgages are different, however, and will typically result in a hard inquiry on your credit that may hurt your credit scores. Fortunately, if it does, it’s often a small impact that only lasts for a few months.

Also keep in mind that if you’re rate-shopping for an auto or home loan, credit scoring models will treat all hard inquiries as one if made in a 14-day period . So assuming you shop your loans in a short period of time, your credit will suffer little, if any, damage.

What Do I Need To Provide For Pre

With pre-qualification, all of your information is consumer-submitted, meaning youre providing the lender with the data, including:

- Information about your debt, income, and assets

- Basic information about your bank accounts

- A soft credit check

- How much money you plan to use as a down payment

- Desired mortgage loan amount

Also Check: How 10 Year Treasury Affect Mortgage Rates

How To Get A Preapproval For A Home Loan

If you have a preferred mortgage lender or financial institution, you may try for preapproval through it. The internet also offers numerous opportunities for prospective homebuyers to apply for loan preapproval and prequalification online.

Before applying for either, pay attention to information about estimated response times and how the lender will use the information you provide. You want to be sure youre working with a legitimate financial institution that treats your privacy with the respect it deserves especially since youre providing pertinent personal and financial information.

For the most part, you provide the necessary information via online forms for whichever mortgage lender youre considering and wait for the results to come to you. During that time, you might want to start sifting through housing listings in your area to get an idea of prices, as well as the types of homes available that appeal to your tastes and budget.

What Is Mortgage Prequalification

Prequalification is an early step in your homebuying journey. When you prequalify for a home loan, youre getting an estimate of what you might be able to borrow, based on information you provide about your finances, as well as a credit check.

Prequalification is also an opportunity to learn about different mortgage options and work with your lender to identify the right fit for your needs and goals.

You May Like: What Is Loan To Value Mortgage

So What Do These Letters Of Pre

Lets say you find the perfect house. Your real estate agent puts together an offer to buy packet your offer price and contract, and financial information to show youre capable of buying including your letter of pre-qualification or pre-approval for a loan.

And, lets say the seller has some things he or she is looking for in addition to the right price a quick sale and a quick move. When the seller reviews the offers, a buyer pre-approved for a loan equals someone who can close on the purchase in as little as 14 days, according to Blonder. All thats left for the lending institution to do is conduct a home appraisal and make sure theres a cleantitle of ownership.

On the other hand, a buyer pre-qualified for a mortgage is going to close in the typical 30-60 days, if he can actually get a mortgage for the price hes offered, because he still has to go through the loan process that the pre-approved guy went through!

Things To Know Before Getting A Mortgage

The United States’ mortgage debt totaled more than 15.5 trillion in the first quarter of 2019, making it the most substantial debt for American households. Conventional wisdom tells us mortgages are good debt because homes typically appreciate in value, but that doesn’t mean you should get a mortgage without careful research. Make sure you understand the following points before buying a home.

Recommended Reading: How To Get Assistance With Mortgage Payments

How Does Getting Prequalified Affect Your Credit Score

Prequalification usually involves a soft credit check, meaning it will not negatively affect your credit score. That said, getting prequalified is only the first step toward getting approved for a mortgage. To get preapprovedor approvedfor a loan, your lender will ultimately run a hard credit inquiry to get a more comprehensive picture of your creditworthiness.

Whats The Difference Between Being Prequalified And Preapproved For A Mortgage

If youre starting the process of buying a home, you may have been told you should get prequalified for a loan, which could lead you to believe that youre all set after you do so. But when the time comes to actually secure the financing for your home, youll quickly find that being prequalified for a mortgage and being preapproved are two very different things.

What does each term mean, and should you seek prequalification or preapproval before putting in a bid on a home? Heres a look at what you need to know about prequalification vs. preapproval.

Don’t Miss: How Much Mortgage Do You Pay A Month

Difference Between Preapproval And Prequalification

Mortgage preapproval status is determined after the borrower has prequalified for a loan. Prequalification describes the lenders ability to grant a loan based on the documentation submitted by the borrower. This documentation typically details the borrowers financial status and is used to gauge the terms of the mortgage and what options the borrower can afford.

Prequalification provides all parties with an assurance that if a loan process moves forward, the borrower is creditworthy and can pay back the loan. While prequalification indicates that the loan process can continue, it does not provide definitive assurance that a loan will be preapproved. Preapproval can only be granted once the documentation submitted during prequalification is verified.

Loan officers will then confirm the details provided during prequalification, such as employment verification, credit history and proof of assets, to determine preapproval status.