Comparing Current Mortgage Rates

Borrowers who comparison shop tend to get lower rates than borrowers who go with the first lender they find. You can compare rates online to get started. However, to get the most accurate quote, you can either go through a mortgage broker or apply for a mortgage through various lenders.

The advantage of going with a broker is you do less of the work and youâll also get the benefit of their lender knowledge. For example, they might be able to match you with a lender whoâs suited for your borrowing needs, this could be anything from a low down payment mortgage to a jumbo mortgage. However, depending on the broker, you might have to pay a fee.

Applying for a mortgage on your own is straightforward and most lenders offer online applications, so you donât have to drive to an office or branch location. Additionally, applying for multiple mortgages in a short period of time wonât show up on your credit report as itâs usually counted as one query.

Finally, when youâre comparing rate quotes, be sure to look at the APR, not just the interest rate. The APR reflects the total cost of your loan on an annual basis.

/1 Adjustable Rate Mortgage Increases +001%

The average rate on a 5/1 ARM is 2.80 percent, climbing 1 basis point over the last week.

Adjustable-rate mortgages, or ARMs, are mortgage terms that come with a floating interest rate. To put it another way, the interest rate can change periodically throughout the life of the loan, unlike fixed-rate mortgages. These loan types are best for people who expect to refinance or sell before the first or second adjustment. Rates could be substantially higher when the loan first adjusts, and thereafter.

Monthly payments on a 5/1 ARM at 2.80 percent would cost about $409 for each $100,000 borrowed over the initial five years, but could climb hundreds of dollars higher afterward, depending on the loans terms.

Zillow Home Loans Best For First

Zillow Home Loans, the mortgage lender affiliated with Zillow Group, offers resources for first-time homebuyers related to everything from budget to documents needed. The lender is licensed in most states, but not all, so check before applying.

Strengths: Zillow Home Loans has an A+ rating from the Better Business Bureau, and if youre checking out properties through Zillow Offers or working with a Zillow Premier Agent, you could potentially save money on your 30-year mortgage through the lender.

Weaknesses: Zillow Home Loans doesnt advertise rates on its website, and doesnt offer jumbo loans or USDA loans.

You May Like: Does Rocket Mortgage Affect Your Credit Score

When Is The Right Time To Get A Mortgage

Before you apply for a mortgage, you should have a proven reliable source of income and enough saved up to cover the down payment and closing costs. If you can save at least 20% for a down payment, you can skip paying for private mortgage insurance and can qualify for better interest rates.

At the end of the day, the best time to apply is when youre ready. But there are other details to consider when timing your home purchase. Because home sales slow down during the winter, you may be able to get a better price in the spring. However, general nationwide trends wont necessarily apply to your local real estate market. To get a better sense of the nuances of your area its important to talk with local experts.

What Is The Current State Of Jumbo Refinance Rates

Current jumbo refinance rates are based on a number of factors, including prevailing rates in the market and other macroeconomic factors. The individual rate you can expect to receive also depends on your location, how much equity you have in the home and your personal credit.

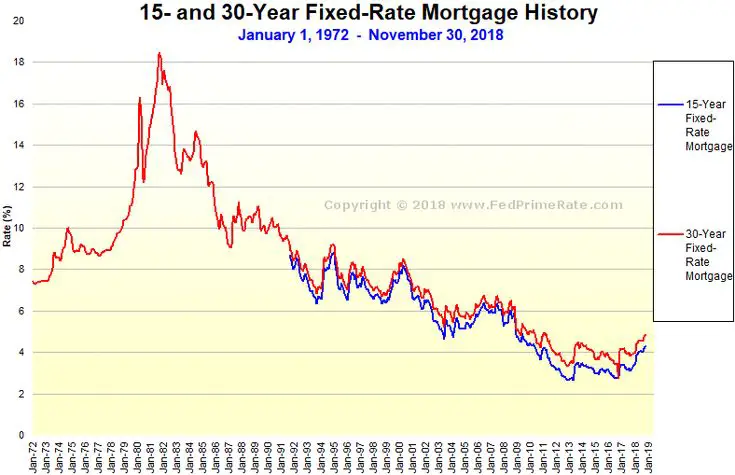

When looking at average national jumbo mortgage refinance rates, however, there are some big-picture items to keep in mind. In general, national mortgage rates are expected to remain relatively low, according to our forecast for the first quarter of 2020, and although they have been rising, theyre still expected to be low by historical standards for a while to come. Jumbo refinance rates are likely to follow the same pattern, with homeowners looking to refinance potentially able to find good deals and lower their rates.

Also Check: What Banks Look For When Applying For A Mortgage

Renting Vs Buying A Home

However, over the long term, buying a home can be a good way to increase your net worth. And when you buy, you can lock in a fixed interest rate, which means your monthly payments are less likely to increase compared to renting. Owning a home also has the added benefit of providing a stronger sense of stability for you and your family. And when you own, you have the freedom to customize your living space however you like.

Whats The Difference Between Apr And Interest Rate

The interest rate is the cost of borrowing money whereas the APR is the yearly cost of borrowing as well as the lender fees and other expenses associated with getting a mortgage.

The APR is the total cost of your loan, which is the best number to look at when youâre comparing rate quotes. Some lenders might offer a lower interest rate but their fees are higher than other lenders , so youâll want to compare APR, not just the interest rate. In some cases, the fees can be high enough to cancel out the savings of a low rate.

You May Like: What Salary Do I Need For A 200k Mortgage

Shopping Around For The Best Jumbo Mortgage Rates

When getting a jumbo loan , its a good idea to shop around. Bankrate is a good starting point. Because a non-conforming loan is usually for such a large amount, getting the best rate can make a big difference in the amount of interest that you pay.

Be sure to check with local financial institutions as well, since sometimes community banks or credit unions can have good rates. Its also a good idea to work with a mortgage broker who specializes in jumbo loans.

As you solicit quotes from lenders and brokers, make sure you provide information thats as accurate as possible. Because your is going to be a big determinant of your rate, review your credit report before you start shopping around. If you see errors, have them fixed as soon as possible.

Be prepared to answer questions about your liquid and non-liquid assets, as well as how much you can afford for your down payment. You should also have an accurate idea of your income and your debt levels so you can let potential lenders know your debt-to-income ratio. The more accurate your information, the more accurate your preliminary mortgage rate quote will be.

Are Interest Rate And Apr The Same

Borrowers may notice some lenders offer interest rates and annual percentage rates that are similar, but they are in fact two different things. The interest rate, expressed as a percentage, is the amount a lender intends to charge borrowers for the amount lent . The APR, also expressed as a percentage, includes the interest rate plus all lender charges rolled into the loan, such as application fees, broker fees, origination fees, and any mortgage points.

Also Check: How Do Mortgage Companies Decide How Much To Lend

Where Is The Market Headed

Expert economists predicted the economy would rebound in 2010. However, the economy was sluggish with slow growth rates for many years beyond that. The economy contracted in the first quarter of 2014, but in the second half of 2014 economic growth picked up. The Federal Reserve tapered their quantitative easing asset purchase program & the price of oil fell sharply. Consumer perception of inflation and inflation expectations are set largely by the price they pay at the pump when they refill their gas.

Two year Treasury yield keeps marching higher. Today cleared pivot dating back years. Coast seems clear for rise to continue significantly.

â Jeffrey Gundlach

With growth picking up the consensus view is interest rates will continue to head higher for the next couple years into 2020, or until a recession happens. The following table highlights 2018 rate predictions from influential organizations in the real estate & mortgage markets.

How Do I Find Personalized 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. Specify the propertys ZIP code and indicate whether youre buying or refinancing. After clicking “Get Started”, youll be asked the homes price or value, the size of the down payment or current loan balance, and the range of your credit score. Youll be on your way to getting a personalized rate quote, without providing personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

Don’t Miss: Are Mortgage Discount Points Worth It

Compare Today’s Current Mortgage And Refinance 30 Year Fixed Interest Rates

When shopping for a mortgage, most prospective homeowners look to the popular 30-year mortgage term. This product provides a steady interest rate for the life of the loan, enabling homebuyers to budget for the long term, knowing clearly what their payments will be. By financing a mortgage for this length of time, monthly payments are kept relatively low, allowing buyers to save money for other expenses which can arise, both unexpectedly and due to life changes.

Fixed Or Adjustable Rates

Across the broader real estate market, at the end of 2018 roughly 10% of new refis & 6% of new home purchase loans were structured as traditional or hybrid ARM loans, with the remainer of the market using fixed rates. Fixed rate home loans simply dominate the market.

Compared to the typical homeowner, high-wealth families are more likely to use adjustable-rate loans to lower their short term interest expenses. CoreLogic highlighted how prevalent ARMs are for wealthy families:

ARMs remained the most popular option for those financing luxury homes. Roughly 76 percent of borrowers refinancing ARM loans opted to go with another ARM, and 31 percent of the fixed-rate borrowers switched to an ARM.

Also Check: Does Bank Of America Do Mortgage Loans

How To Use Our Mortgage Rate Table

This table will show you estimated mortgage rates from different lenders, tailored to you. Fill out the fields above as accurately as possible so we can get a sense of where you live, what youre looking to do and your financial situation. Based on the information provided, you will get custom quotes and be on your way to getting a new mortgage. This is an estimate your actual rate will depend on a number of factors.

Cardinal Financial Company Best For Low

Cardinal Financial Company, also doing business as Sebonic Financial, is licensed in all 50 states, with both in-person and online service.

Strengths: Cardinal Financial can accept credit scores as low as 620 for a conventional loan, 580 for an FHA or USDA loan, 550 for a VA loan and 660 for a jumbo loan. The lender has closed in as little as one week, although the average timeframe is 30 days.

Weaknesses: If youre looking for interest rate and fee information, youll have to inquire directly with the lender this information isnt showcased on Cardinal Financials website.

Don’t Miss: What Score Do Mortgage Companies Use

What Is A Good Loan Term

When picking a mortgage, you should consider the loan term, or payment schedule. The mortgage terms most commonly offered are 15 years and 30 years, although you can also find 10-, 20- and 40-year mortgages. Mortgages are further divided into fixed-rate and adjustable-rate mortgages. For fixed-rate mortgages, interest rates are the same for the life of the loan. Unlike a fixed-rate mortgage, the interest rates for an adjustable-rate mortgage are only fixed for a certain amount of time . After that, the rate fluctuates annually based on the market interest rate.

One factor to take into consideration when deciding between a fixed-rate and adjustable-rate mortgage is how long you plan on living in your house. For people who plan on staying long-term in a new house, fixed-rate mortgages may be the better option. While adjustable-rate mortgages might have lower interest rates upfront, fixed-rate mortgages are more stable over time. If you aren’t planning to keep your new house for more than three to 10 years, though, an adjustable-rate mortgage could give you a better deal. There is no best loan term as an overarching rule it all depends on your goals and current financial situation. Make sure to research and understand what’s most important to you when choosing a mortgage.

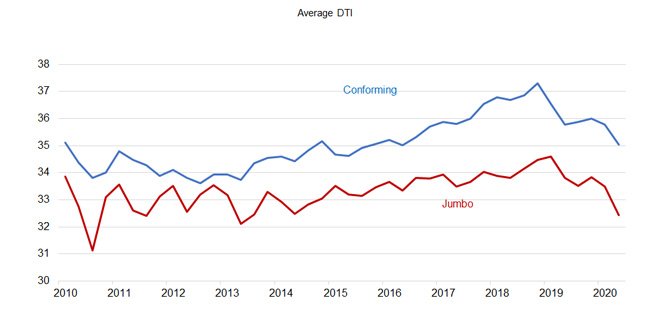

Jumbo Rates Vs Conforming Mortgage Rates

Jumbo mortgages have higher risk to the lender and lower liquidity in the marketplace. Historically lenders have typically charged higher rates than on conforming mortgages, though as the recovery has continued that gap has shrunk and there have been brief periods where yields on jumbo mortgages were lower than conforming mortgages. Prior to the 2008 recession jumbo loans had a spread of about 0.2% against conforming loans. During the crisis this spread blew out to a peak of about 1.7%, but has since come down to where jumbo mortgages are similarly priced to conforming mortgages.

Jumbo loans can be structured as either fixed or adjustable rate offerings, and yields tend to be similar to the associated conforming options. The most common adjustable rate option is the 5/1 ARM but other options exist including 5/5, 7/1 & 10/1.

For the first two loan types it means the interest rate would remain the same for the first 5 years of the loan. Then on the first loan the interest rate could reset annually after that, whereas on the second loan interest rates would reset every 5 years. The third and fourth examples would have a set rate for 7 and 10 years respectively and then reset annually. Adjustable-rate mortgages adjust based upon a spread off a reference rate such as LIBOR, up to a pre-determined rate cap in the loan contract.

Also Check: How To Apply For A House Mortgage

How We Chose The Best Jumbo Mortgage Rates

In order to assess the best jumbo mortgage rates, we first needed to create a credit profile. This profile included a credit score ranging from 700 to 760 with a property loan-to-value ratio of 80%. With this profile, we averaged the lowest rates offered by more than 200 of the nations top lenders. As such, these rates are representative of what real consumers will see when shopping for a mortgage.

Keep in mind that mortgage rates may change daily and this data is intended to be for informational purposes only. A persons personal credit and income profile will be the deciding factors in what loan rates and terms they are able to get. Loan rates do not include amounts for taxes or insurance premiums and individual lender terms will apply.

What Is A Jumbo Mortgage

A jumbo mortgage, or jumbo loan, is a type of loan that exceeds value limits set by the Federal Housing Finance Agency . These types of mortgages arent guaranteed, purchased, or sold by Fannie Mae or Freddie Mac, both government-sponsored entities.

These limits vary based on where you livein general, areas with a higher cost of living will have higher limits. As of 2021, FHFA set the conforming loan limit at $548,250 for most of the U.S. counties. There is an exception where there are higher home values and the limit is increased to $822,375. Anything above these numbers is a jumbo mortgage.

Also Check: How To Determine Ltv Mortgage

What Is A 30 Year Fixed Jumbo Mortgage Rate

| Product |

|---|

National 30–year fixed mortgage rates go up to 4.04%Additionally, the current national average 15-year fixed mortgage rate increased 4 basis points from 3.40% to 3.44%. The current national average 5/1 ARM rate is down 1 basis point from 3.59% to 3.58%.

Furthermore, is 4.25 A good mortgage rate? The new normal is 4.25 percent on the popular 30-year fixed loan. Some lenders are slightly lower, but not by much. Mortgage rates had been moving in a tight range throughout the first half of this year, generally around 3.75 percenta little higher, a little lower.

Correspondingly, what is the current interest rate for jumbo home loans?

Current Mortgage and Refinance Rates

| Product |

|---|

| Jumbo Loans Amounts that exceed conforming loan limits |

| 30-Year Fixed-Rate Jumbo |

| 3.186% |

Is 3.75 A good mortgage rate?

Mortgage giant Freddie Mac said Thursday the average rate for a 30-year fixed-rate mortgage jumped to 3.75% from 3.69% last week. By contrast, the benchmark rate stood at 4.94% a year ago. The average rate on a 15-year mortgage increased to 3.2% this week from 3.13% last week.

How Much Can I Borrow For A Mortgage

The amount of money you can borrow is affected by the property, type of loan, and your personal financial situation.

During the mortgage preapproval process the lender will look at your overall financial profile to determine how much it is willing to let you borrow. A big factor in this process is your debt-to-income ratio . Your DTI is calculated by dividing your total monthly debt payments by your monthly income. In most cases, the maximum DTI a lender will allow is 43%. So if you make $5,000 a month your mortgage payment and other monthly debt payments cant exceed $2,150.

To protect its investment, a lender will typically only let you borrow a certain percentage of a propertys value. So the value of the property can also limit how much you can borrow. Most mortgage loans require a down payment of anywhere from 3% to 20%. You may be able to borrow 100% of the propertys value with certain government-backed loans, like Department of Veterans Affairs Loans or U.S. Department of Agriculture Rural Development loans.

Read Also: What Are Mortgage Underwriters Looking For