How Can You Lower Your Debt

To put it simply, there are two ways to lower your DTI ratio. You either need to lower your debts or increase your income. You can lower your monthly recurring debt by paying off existing debts and by not taking on any more debt than you have currently.

Another way to lower your DTI ratio is to increase your gross monthly income, perhaps by working as a freelancer in your spare time or by finding a new job that pays more than your current job.

If youre interested in learning more about mortgages, our Loan Officers are a great resource who can help you with any questions that you may have.

Contact our team today. Were here to help you every step of the way through your loan process.

How To Determine How Much House You Can Afford

Ultimately, you will need to work with a lender to figure out exactly how much house you can afford, given your current financial situation. That being said, you can do some preliminary calculations to get a better sense of your budget. Create a mortgage affordability template using these categories to crunch the numbers on what you can afford.

How Does The Home Affordability Calculator Work

Our home affordability calculator determines the value of the home and themonthly mortgage paymentyou can afford based on yourdebt-to-income ratio. It first calculates your DTI ratio using the total monthly income and debt payment information provided. The suggested DTI ratio for homeowners to maintain is 36% which means that your monthly debt and housing payments should account for no more than 36% of your monthly income. To find out your maximum mortgage payments, we subtract your monthly debt payments from 36% of your monthly income.

For example, if your monthly income is $5,000 and monthly debt expenses are $750, your current DTI ratio is 15% . Your maximum total payments with a DTI ratio of 36% is $1,800. Hence, you have $1,050 available for your monthly mortgage payment. Once the monthly mortgage payment is calculated, our home affordability calculator determines the maximum home price you could afford in your area.

You May Like: How Does Rocket Mortgage Work

What Is The Least Affordable City For Buying A House

According toYahoo Financeand Insider Monkey, the least affordable city for buying a house in the United States is San Jose, Sunnyvale, and Santa Clara, California, which had a median single-family home price of $1.265 million in 2019. Next up is San Francisco and Oakland, with a median sales price of $988,000 for single family homes.

Least Affordable Cities for Buying a House

| Rank |

|---|

Cut Back On Credit Card Purchases

Scaling back on unnecessary expenses is always a fiscally responsible move, but reducing your dependence on credit card purchases, in particular, will help you meet your DTI goals. Its way too easy to spend beyond your means by relying on credit cards and racking up more debt in the process. Credit card interest payments are another cost you simply dont want to deal with if youre trying to lower your debt-to-income ratio.

Excessive unpaid credit card balances also impact your , which is another important factor that lenders will weigh when considering your mortgage application. So, for the sake of your homebuying aspirations, put the credit card back in your wallet whenever possible.

Also Check: Reverse Mortgage On Condo

What Is Dti Ratio

Your DTI ratio is determined by adding all your monthly debt payments together and dividing that by your monthly income before taxes.

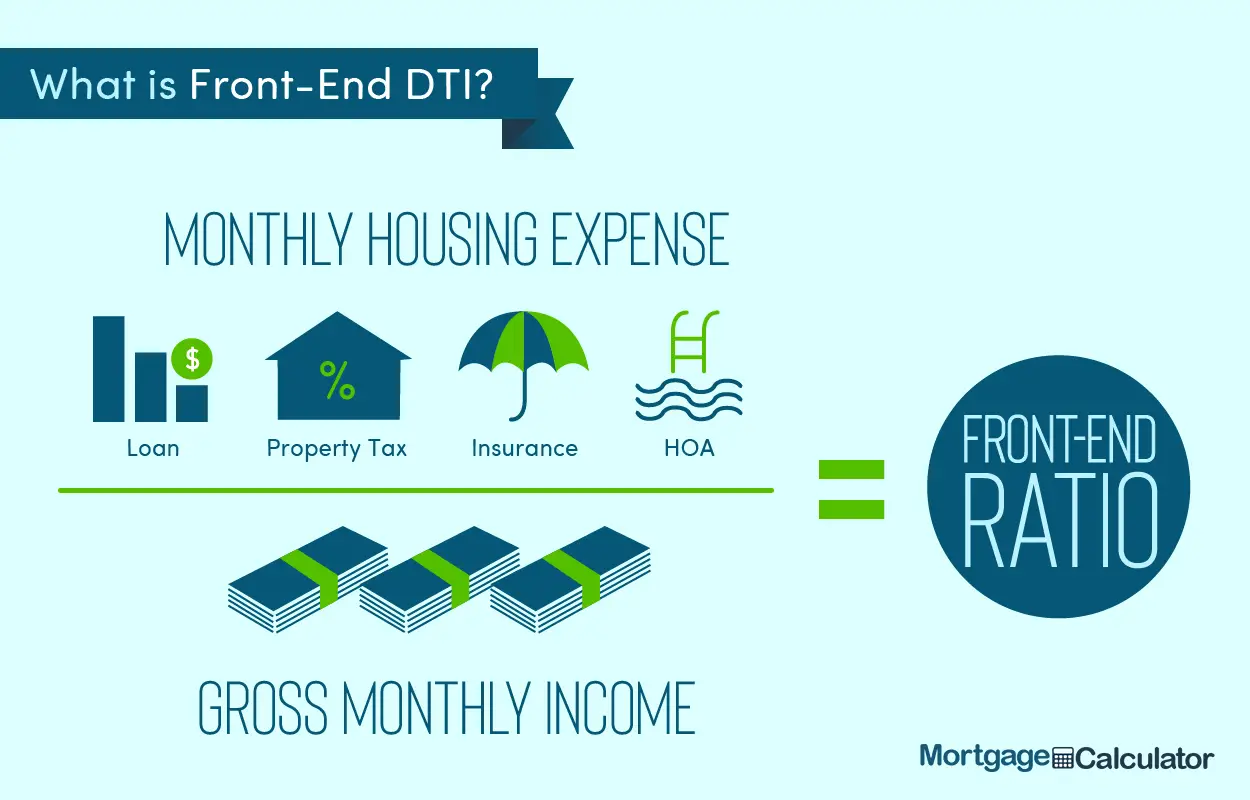

There are two types of DTI ratios that mortgage lenders use when examining your credit situation: front-end DTI and back-end DTI.

A front-end DTI ratio is a calculation related to the house youd like to buy and the mortgage youd need to buy it. Front-end DTI uses your monthly gross income to determine what percentage of that would go toward your housing costs, including your projected monthly mortgage payment, property taxes, homeowners insurance, mortgage insurance, and homeowners association fees.

A back-end DTI ratio is more of a picture of your current debt situation. Back-end DTI shows how much of your income is needed to cover all of your monthly debt liabilities combined, including any credit card debt, car payments, child support, student loans, current monthly mortgage payment, and other debt amounts that may appear on your credit report.

What Conditions Do I Have To Meet To Satisfy Lenders With A Lower Debt

Lenders who only approve of applicants with a lower debt-to-income ratio may still require certain other conditions to be met before they approve a mortgage application.

Some lenders may decline a mortgage loan, for instance, if:

- You exceed their maximum debt-to-income ratio, even if you repay in part or in whole your unsecured debts before completion

- You have loans that have more than a set amount of months to run

- You need a certain level of credit repair

- Your debts include a student loan

Make an enquiry and speak with one of the experts we work with to discuss any special circumstances you may have when applying.

Recommended Reading: Rocket Mortgage Launchpad

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

What Is Included In Debt

Your DTI ratio should include all revolving and installment debts car loans, personal loans, student loans, mortgage loans, credit card debt, and any other debt that shows up on a credit report. Certain financial obligations like child support and alimony should also be included.

Monthly expenses like health insurance premiums, transportation costs, 401k or IRA contributions, and bills for utilities and services are generally not included. However, if you have long-overdue bills for these types of accounts, they might eventually be passed on to a collection agency. The debt may be included in the calculation if that is the case.

There are two types of DTI ratios that lenders look at when considering a mortgage application: front-end and back-end.

Recommended Reading: Rocket Mortgage Conventional Loan

Figure Out Where You Spend Your Money

Track your spending for a week or two. In addition to making you more mindful of your spending, expense tracking will help you identify all the splurges that accumulate too much outflow.

Identify places where you can cut back , because youll need the extra money to reduce your existing debt payments.

Cfpb Shifting From Dti Ratio To Loan Pricing

Both Fannie Mae and Freddie Mac have allowed higher DTI ratios for buyers carrying significant student debt.

While measuring debt-to-income is useful for getting a baseline feel for what you may qualify for, the CFPB proposed shifting mortgage qualification away from DTI to using a pricing based approach.

What Change did the CFPB Propose?

“the Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach.”

Why Did They Suggest the Change?

“The Bureau is proposing a price-based approach because it preliminarily concludes that a loanâs price, as measured by comparing a loanâs annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumerâs ability to repay than DTI alone.”

How Does This Impact Loan Qualification for Low-income Buyers?

“For eligibility for QM status under the General QM definition, the Bureau is proposing a price threshold for most loans as well as higher price thresholds for smaller loans, which is particularly important for manufactured housing and for minority consumers.”

Read Also: Can You Do A Reverse Mortgage On A Mobile Home

Divide And Convert Result To A Percentage

The final step in calculating debt-to-income ratio is dividing the gross monthly income number by the sum of the fixed monthly debt. Voila! This is your debt-to-income ratio.

Lets work through an example.

- Assume you pay rent at a monthly rate of $1,000

- You also have a car payment of $400

- And a minimum credit card payment of $150

This is a total monthly debt amount of $1,550 per month.

- Lets also assume you have a gross monthly income of $5,000.

- Your debt-to-income ratio is $1,550 divided by $5,000, which equals .31. Multiply this number by 100 to get a percentage .

Lenders consider those with a lower DTI to present a lower credit risk. With a 31% DTI, not only will you more likely be preapproved, youll also likely qualify for a low interest rate.

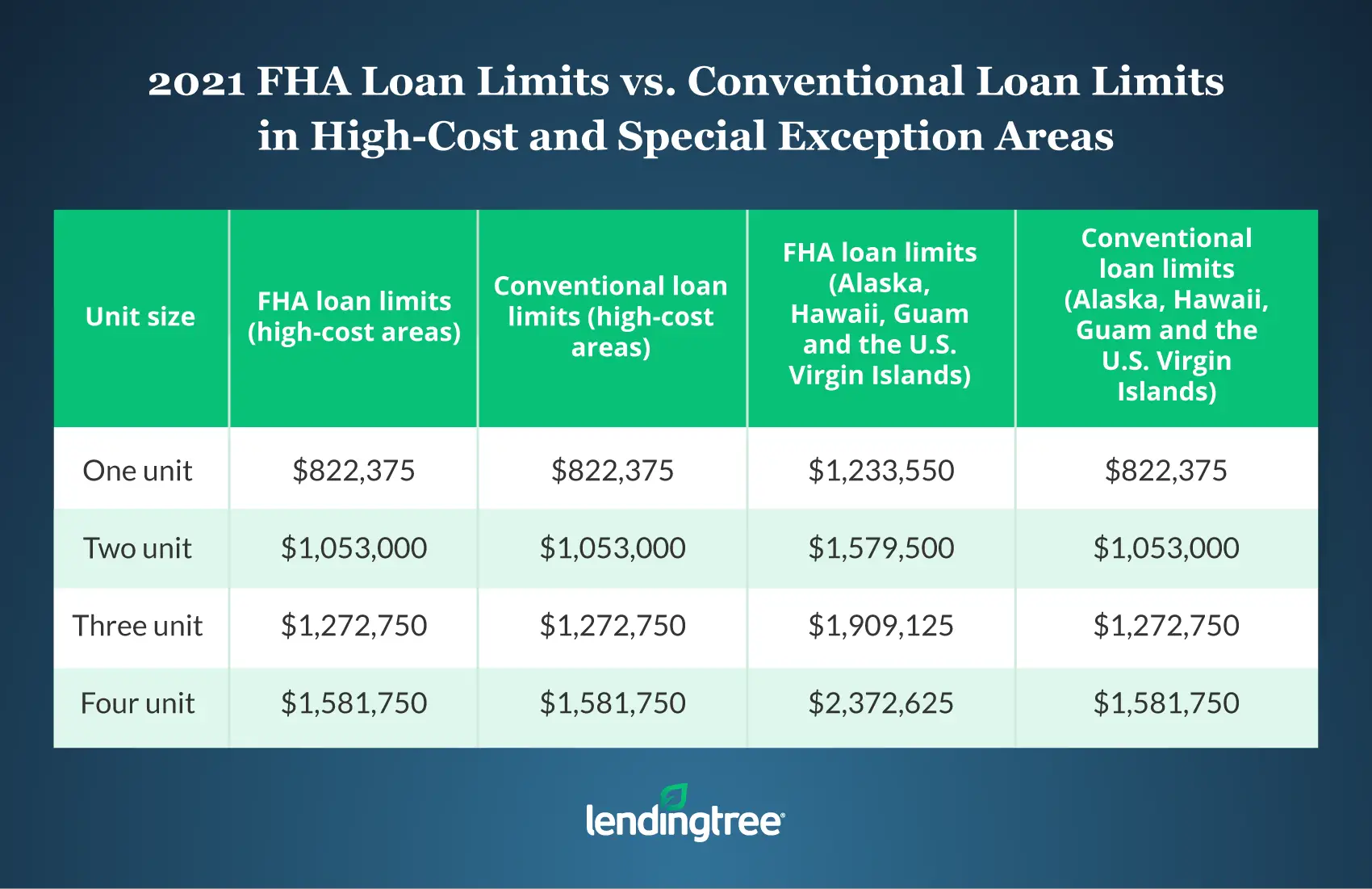

How Much House Can I Afford With A Jumbo Loan

Jumbo loansare mortgages that do not fit the conforming loan limits set by theFederal Housing Finance Association . These mortgages are too large to be insured by agencies such as Fannie Mae and Freddie Mac. Therefore, this type of home loan has a largerminimum down paymentand higher credit score requirements. If you have a high income and lowDTI ratioyou can afford a larger home with a jumbo loan as compared to a traditional mortgage.

Also Check: Will Mortgage Pre Approval Hurt Credit Score

What Is An Automated Underwriting System

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Next Steps To Finding The Right Mortgage

Whatever your DTI is, its important you shop around for your mortgage loan. Terms, rates, and eligibility requirements can vary from one lender to the next, so considering a variety of lenders is critical if you want to find the right loan for your situation.

Credible Operations, Inc. can help you compare multiple lenders at once and get a mortgage pre-approval today.

Credible makes getting a mortgage easy

- Instant streamlined pre-approval: It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter, without affecting your credit.

- We keep your data private: Compare rates from multiple lenders without your data being sold or getting spammed.

- A modern approach to mortgages: Complete your mortgage online with bank integrations and automatic updates. Talk to a loan officer only if you want to.

You May Like: Rocket Mortgage Qualifications

Avoid Adding New Debt

While youre paying down your current debt, dont take on any new debt. Even if you dont use a new credit card, the fact that youre applying for a new one will be a red flag to lenders.

There is one exception: the balance transfer offer. If you can qualify for a credit card with an extremely low introductory rate, it might be worth applying and transferring your higher-interest balances to it.

The lower interest rate will enable you to pay off debt faster because most of your payment will go toward paying off the balance rather than paying interest. Keep in mind that to make this work from a DTI standpoint, you should formally close your other credit accounts and stick to your payoff plan.

Know Your Magic Numbers: 28 And 36

On the whole, most lenders will avoid anything over 43% debt to income, as this doesnt allow a comfortable margin of error. In case of unexpected expenses, borrowers at this level are more likely to miss payments. Some lenders will accept 43% but typically levy very high interest rates.

Ideally, your housing costs should make up no more than 28% of your gross income. Meanwhile, total debts should make up a maximum of 36%. Lenders are more comfortable with figures like these since theres a larger margin of error in case things go wrong. The greater the margin of error, the better interest rates youre likely to be offered and the more mortgage you will be able to afford.

You May Like: Can You Get A Reverse Mortgage On A Manufactured Home

Calculating A 25% Dti

- Monthly Social Security Income : $6,000

- Monthly recurring debts: $500

- Monthly W2 income: $10,000

- Monthly recurring debts: $1,500

- Monthly selfemployment income: $10,000

- Monthly recurring debts: $2,000

- Monthly housing payment: $2,500

Most mortgage programs require homeowners to have a DebttoIncome of 40% or less, but loan approvals are possible with DTIs of 45 percent or higher. In general, mortgage applicants with elevated DTI must show strength on some other aspect of their application.

This can include making a large down payment showing an exceptionallyhigh credit score or having large amounts of reserves in the bank accounts and investments.

Also, note that once a loan is approved and funded, lenders not longer track DebttoIncome ratio. Its a metric used strictly for loan approval purposes. However, as a homeowner, you should be mindful of your income versus your debts. When debts increase relative to income, longterm saving can be affected.

What Is A Good Dti Ratio

As a general guideline, 43% is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Ideally, lenders prefer a debt-to-income ratio lower than 36%, with no more than 28% of that debt going towards servicing a mortgage or rent payment. The maximum DTI ratio varies from lender to lender. However, the lower the debt-to-income ratio, the better the chances that the borrower will be approved, or at least considered, for the credit application.

Don’t Miss: Rocket Mortgage Loan Requirements

High Debt Doesnt Always Mean A High Dti Ratio

Owing a large amount of money doesnt necessarily mean youll have a high DTI ratio it depends on what you earn and how much of your income goes toward debt repayment.

As an example, if you owe $1,000 in monthly debt payments and have a gross monthly income of $2,000, your DTI ratio will be high at 50%. However, if your gross monthly income is $10,000, your DTI ratio is only 10%.

In other words, your debt payments need to remain in proportion to your monthly income to remain affordable. But if your income is on the low side, its easier for your DTI ratio to creep up quickly.

Dont Forget The Upfront Costs

Its important to remember the upfront costs of buying a home, as well as the monthly mortgage payments. Take into consideration the following:

- Down payment: for a conventional loan, 3% is the minimum youll need to put down. However, down payments over 20% arent subject to mortgage insurance. This can reduce monthly payments considerably and enable you to gain more equity quicker.

- Closing costs: you can typically expect to spend between 3 to 6% of the purchase price on closing costs, sometimes adding up to more than $10,000.

- Moving costs

- Maintenance and renovations

While this short list covers the basics, you could have more or fewer fees to pay when buying your home. The most important is the down payment. Putting down a larger sum can reduce your monthly fees, allowing for a larger mortgage. In many cases, it can pay to wait until youve saved up more for your down payment.

Don’t Miss: How Much Is Mortgage On 1 Million

What Is Dti And How Does It Affect Your Mortgage

Have you ever wondered why its so important to keep your debt under control while applying for a mortgage, or how debt affects your approval? This article will assist you in answering these basic questions, putting you in a strong position to get approved for a house loan.

What is Debt-To-Income Ratio ?

Because it directly effects the monthly payment you may qualify for, your debt-to-income ratio is one of the most important indicators lenders examine to decide how much home you can buy.

The debt-to-income ratio compares your current monthly payments to your total monthly income before taxes. Two types of calculations are employed in mortgage qualification, depending on the mortgage program and your qualification metrics:

Front-end DTI examines how much you spend on housing in relation to your entire income.

Back-End DTI examines installment and revolving debts

If youre a bit more of a risk, the front-end DTI is applied on specified government loans. To qualify for an FHA loan with a credit score below 620, youll need a front-end DTI of no more than 38 percent. However, a back-end DTI is always calculated.

What Is a Good Debt-To-Income Ratio?

Its advisable to keep your DTI at or below 43% as a general guideline. However, the actual maximum is determined by your other requirements as well as the type of loan youre seeking.

What Debts Are Included in DTI?

- Mortgage payments

- Home equity loans or home equity lines of credit

- Car loans

- Child support or alimony payments

The Fha Streamline Refinance

The FHA offers a refinance program called the which specifically ignores the DebttoIncome requirements present for an FHA purchase loan.

The official guidelines for the agencys streamline refinance program waive income verification and credit scoring as part of the mortgage approval process. Instead, the FHA looks to see that the homeowner has been making his existing mortgage payments on time and without issue.

If the homeowner can show a perfect payment history dating back 3 months, the FHA assumes that the homeowner is earning enough to pay the bills. DebttoIncome is not considered as part of the FHA Streamline Refinance.

Recommended Reading: Mortgage Recast Calculator Chase