How Do You Qualify For A $100000 Personal Loan

To qualify for a $100,000 personal loan, make sure you have a strong credit profile and present a low level of risk to the lender. In general, a qualified applicant for a large loan has a FICO credit score of at least 720. However, prospective borrowers with a score of 750 or higher are more likely to qualify for the best rates.

Qualified applicants should also demonstrate stable employment and an income large enough to comfortably cover loan payments and other debt services. Lenders will look at your income when determining whether you qualify.

Where To Get A $100000 Mortgage

To get a $100,000 mortgage loan or any mortgage for that matter youll need to shop around with various lenders.

Because rates and terms can vary from one lender to the next, this will allow you to get the lowest rate and most affordable loan possible.

You can reach out to various mortgage lenders individually and request quotes, though this may take some time. Credible offers a more efficient option. With Credible, you can compare all of our partner lenders at once and receive prequalified rates in a matter of minutes.

Gather The Required Documentation

Before you apply for a loan, compile the required documents youll need to complete your application. This will cut back on the amount of time it takes to prepare your application and make it easier for the lender to evaluate your creditworthiness. Some of the most common documents required for a personal loan application include:

- Proof of identity, such as a drivers license, passport or birth certificate

- Employer and income verification, including paystubs, tax returns and W-2s

- Proof of address as evidenced by a utility bill, proof of insurance, a lease or rental agreement or a voter registration card

Also Check: What Is Current Interest Rate On Reverse Mortgage

Your Down Payment Determines The Amount Of Cmhc Insurance You Pay

Your CMHC insurance premium, calculated as a percent of your mortgage amount, gets smaller as you increase your down payment. To learn more about CMHC insurance and how it is calculated, please visit our CMHC insurance page.

| Down Payment |

|---|

| 5% – 9.99% |

| Total Payments over 25 Years | $402,726 | $377,991 |

|---|

Under Scenario B, the additional $15,000 put towards the mortgage down payment lowers CMHC insurance by $2,423 and saves the homebuyer around $25,000 in interest over the life of the mortgage. However, it is also important to consider the opportunity cost, or alternative uses for the additional outlay under Scenario B. You must look at your expected returns associated with RRSP contributions, stock investments, and/or debt repayments, for example, to make an informed decision.

Brief History Of Mortgages In The Us

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term.

Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes.

To remedy this situation, the government created the Federal Housing Administration and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards.

These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s.

Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012.

The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

Read Also: When You Sign A Mortgage You Are

What Are My Monthly Payments

Use the Mortgage Calculator to get an idea of what your monthly payments could be. This calculator can help you estimate monthly payments with different loan types and terms. You may be able to afford more depending on factors including your down payment and/or the purchase price. The calculator will estimate your monthly principal and interest payment, which represents only a part of your total monthly home expenses. Additional monthly costs may include: real estate taxes, insurance, condo or homeowners association fees and dues, plus home maintenance services and utility bills.

Recommended Savings

Add All Fixed Costs and Variables to Get Your Monthly Amount

Calculator Disclaimer

Home Buying Examples: See You Much You Can Afford On $100k Per Year

The amount you can borrow for a mortgage depends on many variables and income is just one of them.

That means two people who each make $100,000 per year, but have different credit scores, debt levels, and savings, could have vastly different home buying budgets.

Here are a few examples of how much home someone might afford on a $100K salary when those other requirements are factored in.

Buying a house with a $100K salary and low credit

First, lets look at an example of a homebuyer who makes $100,000 per year, but has a lower credit score and relatively high debts.

This could be someone who recently graduated with student loans and hasnt had a chance to build up their credit yet. Or, someone who has existing debt from a few different lines of credit like credit cards and an auto loan.

Whatever the case, a lower credit score and higher debts mean your home buying budget will be on the lower end of the spectrum.

$100K salary and low credit buys a home below $300K

- Income: $100,000/year

*Interest rates shown are for sample purposes only. Your own rate will be different

This borrower makes a $100k salary and has a 650 credit score.

They are looking for an FHA mortgage with a low down payment. And, they owe about $1,000 in nonmortgage debts each month.

Assuming that the lender offers a 4.5% interest rate which is higher than current averages because of their credit score and debts this borrower may be able to buy a $288,500 home.

- Income: $100,000/year

Read Also: What Are Current 20 Year Mortgage Rates

What Are My Monthly Costs For Owning A Home

There are five key components in play when you calculate mortgage payments

- Principal: The amount of money you borrowed for a loan. If you borrow $200,000 for a loan, your principal is $200,000.

- Interest: The cost of borrowing money from a lender. Interest rates are expressed as a yearly percentage. Your loan payment is primarily interest in the early years of your mortgage.

- Property taxes: The yearly tax assessed by the city or municipality on a home that is paid by the owner. Property taxes are considered part of the cost of owning a home and should be factored in when calculating monthly mortgage payments. However, lenders dont control this cost and so it shouldnt be a major factor when choosing a lender.

- Mortgage insurance: An additional cost of taking out a mortgage, if your down payment is less than 20% of the home purchase price. This protects the lender in case a borrower defaults on a mortgage. Once the equity in your property increases to 20%, you can stop paying mortgage insurance, unless you have an FHA loan.

- Homeowners association fee: This cost is common for condo owners and some single-family neighborhoods. Its money that must be paid by owners to an organization that assists with upkeep, property improvements and shared amenities.

Calculate The Cost Of Borrowing

When you buy a home, you already know that you’re going to pay a lot of interest over the life of the loan. However, you may not be prepared for just how much you are going to have to pay. In many cases you could buy your house two or three times over with the amount you end up paying back to your loan.

A good mortgage calculator like the ones we offer at MortgageCalculator.org can help you determine your monthly payment and your total interest payments. However, looking at the total interest you pay may seem too abstract. For instance, if you pay 5 percent on a $250,000 30-year fixed loan, you will end up paying $233,139.46 in interest alone. Since this amount is spread out over 30 years, it may be harder to contextualize the impact of.

Understanding exactly how much you pay in interest each month and each year rather than cumulatively over several decades can help make the amount seem more concrete and immediate. Breaking it down further by every thousand dollars of your mortgage can help you how it all adds up.

On that same $250,000 loan with 5 percent interest, you would pay $5.41 in interest each month for every $1,000 of the loan. You would pay $64.91 each year for every $1,000 of the loan.

Is there something else you could or should have invested in which would have offered better returns?

Higher Returning & More Diversified Opportunities

Also Check: How Much Mortgage Can I Get With 50k Salary

Monthly Payment: Whats Behind The Numbers Used In Our Mortgage Payment Calculator

The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. Youll just need to plug in the numbers. The more info youre able to provide, the more accurate your total monthly payment estimate will be.

For example, you may have homeowners association dues built into your monthly payment. Or mortgage insurance, if you put down less than 20%. And then theres property taxes and homeowners insurance. It helps to gather all of these additional expenses that are included in your monthly payment, because they can really add up. If you dont consider them all, you may budget for one payment, only to find out that its much larger than you expected.

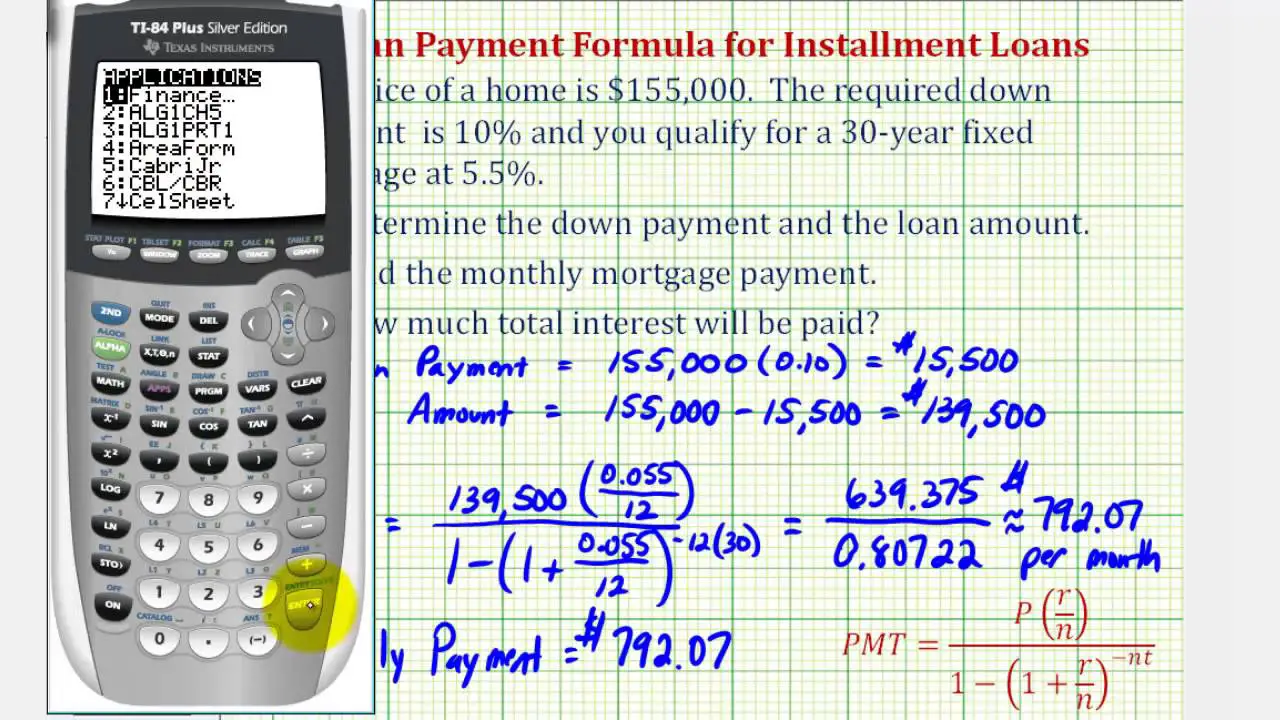

For you home gamers, heres how we calculate your monthly mortgage payments on a fixed-rate loan:

M = P /

The variables are:

-

M = monthly mortgage payment

-

P = the principal, or the initial amount you borrowed.

-

i = your monthly interest rate. Your lender likely lists interest rates as an annual figure, so youll need to divide by 12, for each month of the year. So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.

-

n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments.

Can My Monthly Payment Go Up

Your monthly payment can rise in a few cases:

Don’t Miss: Are There Different Types Of Reverse Mortgages

Mortgage Preapproval Confirms Your Home Buying Budget

Its a good idea to figure out how much home you can afford before you start shopping so that you avoid falling in love with a property you wont be able to buy.

In addition to getting an estimate through an online mortgage calculator, you can apply for preapproval with a lender to get a better idea of what they might offer you.

That allows you to search for homes in your price range, and it reassures your real estate agent and sellers that youre in the right ballpark when youre touring homes.

You can get started by requesting todays rates from top lenders.

Simple Loan Payment Calculator

Before you get a loan, its important to know just how much debt you can afford. Our simplified loan payment calculator does all the heavy lifting to help you discover what your monthly payment could be. Just input the principal balance of your loan, the interest rate, and the number of years.Having an idea of your monthly payment can help when youre putting together a budget. You might find that you have enough money left over to make extra payments. In the end, you might even be able to develop a plan to get ahead of your debt.

Having an idea of your monthly payment can help when youre putting together a budget. You might find that you have enough money left over to make extra payments. In the end, you might even be able to develop a plan to get ahead of your debt.

Don’t Miss: What Is The Payoff On My Mortgage

Factors That Determine How Much House You Can Afford

Income is an important factor when you apply for a mortgage.

If you make a $100k salary annually, lenders will weigh that heavily in your mortgage application.

It indicates that you likely have the income needed to cover a decentlysized mortgage payment.

However, lenders dont just look at income when they qualify you for a home loan. They also look at:

- The property youre buying

Heres what each of these factors mean to a lender.

Lenders want to see that you have a history of good credit management and ontime payments, and that youre not paying too many other debts on top of a mortgage.

To get the best mortgage rate, aim for a credit score of 720 or higher and a DTI ratio below 36%.

These indicators show that youre a responsible borrower whos not likely to default on their mortgage loan.

Down payment and LTV

In addition, lenders consider your down payment and LTV when deciding which mortgage programs you qualify for and how low of a rate youll get.

To get the best mortgage rate, aim for a down payment of 20%. Although its not required, a bigger down payment lowers your rate and increases your home buying power.

The higher your down payment is, the less risk the lender takes on since youll be asking for less money. This means a lower rate and bigger home buying budget.

LTV is a similar metric, which measures how much youre borrowing vs. how much the home is actually worth.

Low down payments are always an option

However, these things are by no means required.

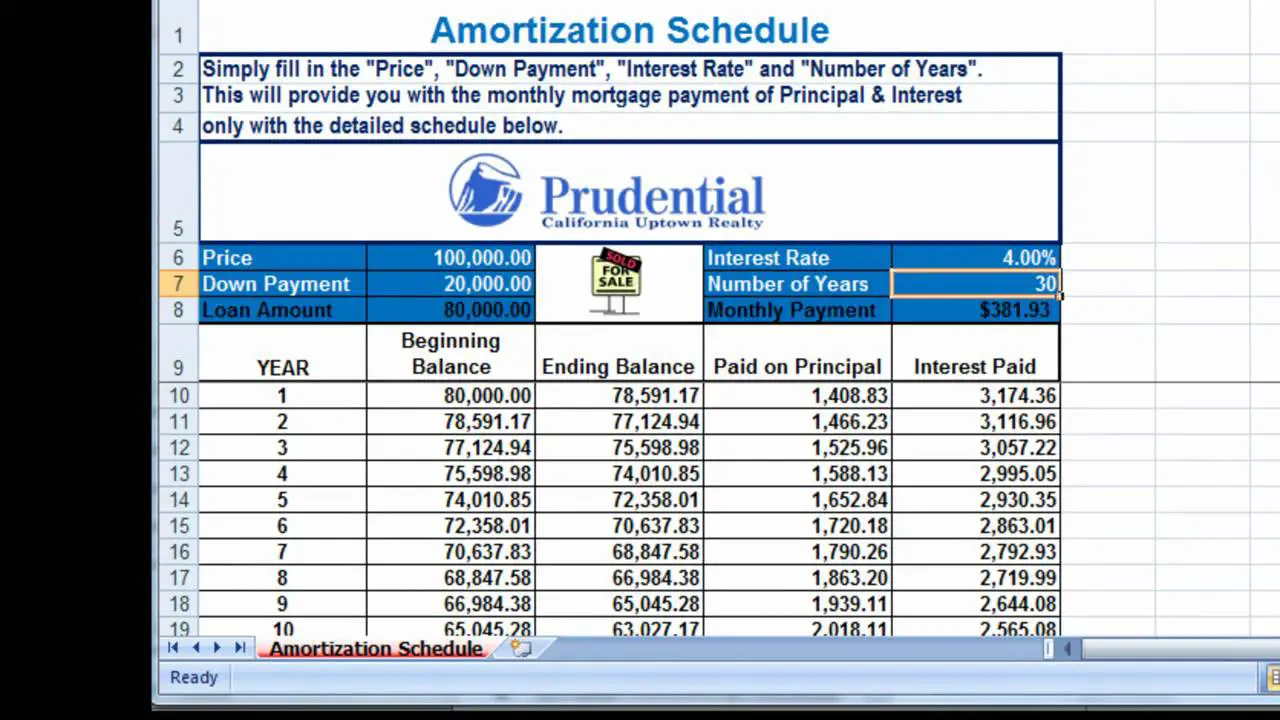

How Much A $100000 Mortgage Will Cost You

A $100,000 mortgage comes with both upfront and long-term costs. Your total costs will depend on your lender, APR, and loan term.

Edited byChris JenningsUpdated October 11, 2021

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

Every mortgage comes at a cost several of them, actually. Upfront, there are your closing costs, and over the course of the loans life, theres your monthly payments, escrow costs, and finally, interest. Understanding these costs is critical before you take out a loan.

Learn more about how much a $100,000 mortgage will cost you throughout the life of the loan:

You May Like: What Portion Of Your Income Should Be Mortgage

Is Making 50k A Year Good

Income is, of course, another very important consideration for most people. Is $50k a year considered a good salary? As such, a $50,000 salary would be above the national median and a pretty good salary, of course, dependent on where one lives. Thats good news for people making an annual salary of $50,000 or higher.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Is Citizens Bank Good For Mortgages

How To Increase Your Maximum Mortgage Affordability

If youve used our mortgage affordability calculator, and youre unhappy with your results, there are several steps you can take to increase your mortgage affordability:

- Increase your down payment: This will give you the ability to increase your affordability and purchase a more expensive home.

- Pay off your debts: This will lower your TDS ratio and free up more of your income for your mortgage payment, ultimately giving you the ability to carry a larger mortgage and therefore more expensive home.

- Increase your income: This is the tougher option, but it will allow you to afford a larger monthly mortgage payment, which will increase the overall size of the mortgage you can afford to borrow and repay. Alternatively, you can apply for your mortgage with your partner, or get a co-signer, such as your parents, to guarantee your mortgage.