Figuring Out Your Unpaid Principal Loan Balance

If you want to know your unpaid principal loan balance that is remaining after you make your first mortgage payment, you can use our amortization calculator. But if you’d like to understand how to figure it out on your own, read on.

First, take your principal loan balance of $100,000 and multiply it by your 6% annual interest rate. The annual interest amount is $6,000. Divide the annual interest figure by 12 months to arrive at the monthly interest due. That number is $500.

Since your December 1 amortized payment is $599.55, to figure the principal portion of that payment, you would subtract the monthly interest number from the principal and interest payment . The result is $99.55, which is the principal portion of your payment.

Now, subtract the $99.55 principal portion paid from the unpaid principal balance of $100,000. That number is $99,900.45, which is the remaining unpaid principal balance as of December 1. If you are paying off a loan, you must add daily interest to the unpaid balance until the day the lender receives the payoff amount.

You know now that your unpaid principal balance after your December payment will be $99,900.45. To figure your remaining balance after your January 1 payment, you will compute it using the new unpaid balance:

With each consecutive payment, your unpaid principal balance will drop by a slightly higher principal reduction amount over the previous month.

Calculating Interest On A Credit Card

Itâs a good idea to think of using a credit card as taking out a loan. Itâs money that is not yours, youâre paying to use it, and itâs best that you pay it back as soon as you can.

For the most part, working out how much you pay in interest on your credit card balance works much the same way as for any other loan. The main differences are:

- Your basic repayment is a minimum amount set by your credit card company. It might be a set dollar amount, similar to any other loan, or it might be a percentage of your balance. Itâs best to pay more than the minimum amount, because often, it doesnât even cover the cost of interest. Paying only the minimum is how you wind up with a massive credit card debt.

- If you make purchases on your card before paying off previous amounts, it will be added to your balance and youâll pay interest on the whole lot. This will change your minimum payment amount as well, if the minimum payment is based on a percentage of your balance.

Itâs always a good idea to pay off as much of your credit card balance as you can, as early as you can. This way, you avoid getting hit by high interest rates.

So when youâre calculating your interest, just remember to use the right amount for your repayment value and add any extra purchases onto your balance, and the above method should work to calculate your interest.

How To Account For Taxes And Recurring Expenses

Accounting for recurring charges like PMI and HOA fees requires a little more work, but even these aren’t very difficult to calculate. You can find the total cost of recurring expenses by adding them together and multiplying them by the number of monthly payments . This will give you the lifetime cost of monthly charges that exclude the cost of your loan.

The reverse is true for annual charges like taxes or insurance, which are usually charged in a lump sum, paid once per year. If you want to know how much these expenses cost per month, you can divide them by 12 and add the result to your mortgage payment. Most mortgage lenders use this method to determine your monthly mortgage escrow costs. Lenders collect these additional payments in an escrow account, typically on a monthly basis, in order to make sure you don’t fall short of your annual tax and insurance obligations.

Don’t Miss: What Percent Down Payment To Avoid Mortgage Insurance

Principal And Interest Vs Interest

Another factor that impacts your mortgage payment is whether youre making principal and interest payments or interest only payments.

- Principal and interest payments: These are the most common way to pay off a mortgage. In this case, a portion of your monthly payment goes towards the principal and the other portion goes towards the interest you owe.

- Interest only payments: These loans are designed to make interest only payments for a certain period of time. Property investors with an investment mortgage or those building a new property often use interest only mortgage structures. The reason is that the monthly payment is typically reduced.

Mortgage payments

Susie is borrowing $700,000 to buy a house and she wants to save as much money on interest as possible. She decides to calculate the impact on the total cost of the mortgage using two APRs with a 0.25% difference.

If she can find a loan with an interest rate of 4% APR on a 30-year loan term, her monthly principal and interest payments will be $3,328.63. The total interest she will end up paying over the life of the loan is $498,307.00.

If Susie finds a loan with a marginally lower interest rate of 3.75% APR, her monthly payments will be $3,230.31 and the total interest over the life of the loan will be $462,915.00. With the lower rate, Susie will save $35,392.00 in interest costs.

How Does The Cash Rate Affect Commercial Interest Rates

2016RISKSUMMIT.ORG” alt=”Monthly interest rate calculator > 2016RISKSUMMIT.ORG”>

2016RISKSUMMIT.ORG” alt=”Monthly interest rate calculator > 2016RISKSUMMIT.ORG”> The cash rate reflects the market interest rate on funds banks lend and borrow from each other overnight. It is set by the Reserve Bank of Australia , which meets on the first Tuesday of every month to discuss any potential moves.

But what does this have to do with commercial interest rates? Simply put, the cash rate serves as a benchmark rate for savings accounts and variable rate home loans. When the RBA raises or lowers the cash rate, banks and lenders tend to modify their own home loan and deposit interest rates soon after.

Read Also: Can I Get A 30 Year Mortgage

Calculate The Daily Interest

Multiply your principal balance by your daily rate in decimal form. Assuming a principal balance of $234,000, the daily interest on our sample loan is $234,000 times 0.00022, which equals $51.48. This is the amount of money you’ll pay in interest each day while your principal is at its current balance. It’ll change to a lower number the next time you make a principal payment.

Calculate The Monthly Interest Rate

The interest rate is essentially the fee a bank charges you to borrow money, expressed as a percentage. Typically, a buyer with a high , high down payment, and low debt-to-income ratio will secure a lower interest rate the risk of loaning that person money is lower than it would be for someone with a less stable financial situation.

Lenders provide an annual interest rate for mortgages. If you want to do the monthly mortgage payment calculation by hand, you’ll need the monthly interest rate just divide the annual interest rate by 12 . For example, if the annual interest rate is 4%, the monthly interest rate would be 0.33% .

Also Check: How To File A Complaint Against A Mortgage Lender

What Is An Interest

An interest-only mortgage is a home loan that allows you to only pay the interest for the first several years you have the mortgage. After that period, you’ll need to pay principal and interest, which means your payments will be significantly higher. You can make principal payments during the interest-only period, but you’re not required to.

How To Calculate Mortgage Interest

To calculate interest paid on a mortgage, you will first need to know your mortgage balance, the amount of your monthly mortgage payment, and your mortgage interest rate. For example, you might want to calculate mortgage interest for a mortgage of $500,000 with monthly payments of $2,500 at a 3%mortgage rate .

To find how much interest is paid on your initial monthly mortgage payment, you just need to apply the interest rate against your mortgage balance as a monthly rate. Applying the 3% mortgage rate to the mortgage balance, you will get an annual interest amount of $15,000. You then divide this by 12 to get your monthly interest amount, which would be $1,250. As your monthly payment is $2,500, the remaining amount of $1,250 will go towards your principal.

To calculate mortgage interest paid for the second month, you first need to recalculate your mortgage balance. Since you paid $1,250 towards your principal in the first month, your new mortgage balance is $498,750. The interest paid will be 3% of $498,750 divided by 12 to get a monthly rate. You will get $1,246.87, which is the interest paid in the second month. Your principal payment will be the remaining out of the $2,500 payment, which would be $1,253.13.

Also Check: What Is Loss Mitigation Mortgage

Calculate The Monthly Interest

Multiply the daily interest by the number of days in your payment period to calculate the interest that will be charged for the month. If it’s February, then the interest cost of the sample loan is 28 times $51.48, which equals $1,441. You may get a more accurate result by using an online calculator, as decimals won’t be dropped or rounded as they usually are when calculating manually.

Although it may seem like these small numerical details won’t make much of a difference, it is important to remember that even the smallest of numerical adjustments can result in significant changes over a lengthy span of time, such as a year.

What Does Breaking My Mortgage Mean

If you decide to end your mortgage before the prescribed term is up, then you are “breaking” your mortgage contract. For example, if you are 3 years into your 5-year fixed rate mortgage, and you find out that a lender is offering a significantly lower interest rate, then it is possible to break your mortgage early to sign a new mortgage with the discounted lender. But be aware, deciding to break your mortgage before the mortgage term ends is usually associated with penalties.

Recommended Reading: What To Watch For When Refinancing Mortgage

Refinance To Access Home Equity As Cash

As you pay off your mortgage, you’ll gradually build up equity in your home. Your home equity is calculated by taking the current value of your home, then subtracting from that your outstanding mortgage amount. Many lenders will allow you to borrow from them, using your home equity as security for the loan – this is what accessing your equity is all about.

If youâre considering a refinance to access your home equity, youâre not alone. According to the Canadian Association of Mortgage Professionals, last year 10% of Canadian mortgage holders accessed an average $49,000 of equity from their homes. The large majority of this equity was used for debt consolidation or home renovation.

If refinancing for equity, the first thing you want to determine is the maximum amount of equity you can access. In Canada, mortgage holders can access a maximum of 80% of their home’s value, less any outstanding mortgage balance. Unfortunately, accessing this equity comes at a cost â your lender will change you a penalty for breaking your mortgage early. Use Ratehub.caâs refinance calculator to determine your maximum equity and the corresponding penalty. If youâre refinancing in a falling interest rate environment, you may be able to take advantage of interest savings as a bonus.

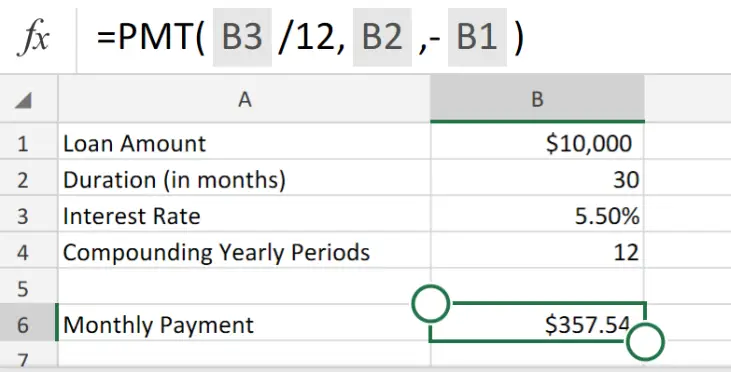

How To Calculate Monthly Interest Mortgage Payment In Excel

- Open Excel on your computer. In cell A1, enter the amount of the mortgage, in cell A2 – the term in years, in cell A3 – the interest rate, in cell A3 – the monthly payment.

- Enter the amount you want to borrow in cell B1, the term of the mortgage in cell B2, and the interest rate in cell B3.

- Enter =PMT in cell B4.

Don’t Miss: Should I Take Out A Mortgage

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

Don’t Forget Taxes Insurance And Other Costs

If you’re buying a home, you’ll also need to consider some other items that can significantly add to your monthly mortgage payment, even if you manage to get a great interest rate on the loan itself. For example, your lender may require that you pay for your real-estate taxes and insurance as part of your mortgage payment. The money will go into an escrow account, and your lender will pay the bills as they come due. These costs are not fixed and can rise over time. Your lender will itemize any additional costs as part of your mortgage agreement and recalculate them periodically.

You May Like: How Much Money Should You Spend On Mortgage

How Long Youll Stay In Your Current Home

When you refinance, there are origination and other closing costs associated with taking out the new loan. Because of this, its important to have a decent idea of the number of years you might stay in the home.

Your time in the home will help you calculate the breakeven point and determine whether its worth it for you to do the refinance. For instance, if it takes you 2 years to breakeven in payment and interest savings after paying closing costs, you know you have to stay in the home longer than that for the refi to make sense.

The key here is to have an idea of your situation. If you have some sense of what your future plans might be, then you can sit down and do the math.

Why Do Interest Rates Change

There are a number of things the RBA will take into account when deciding whether to change the cash rate. Chief among them are domestic conditions, such as employment and inflation, though global financial conditions are also important.

If the economy is booming and high demand is pushing up prices, the RBA might increase the cash rate to make sure inflation doesnât spiral out of control. And if the economy is weak and demand is low, the RBA might decrease the cash rate to encourage spending, borrowing and investment.

Recommended Reading: Can Low Credit Score Get Mortgage

Is There Anything Else That Lenders See As Risk

There is one more risk that the lenders end up facing. The risk of you prepaying the loan.

What? Why is that a risk? As a lender, wouldnt I be happy if the money is paid back in full and before time? In full, yes. All lenders love that. But before time, not really.

Banks and other lenders are in the business of making loans. The original principal is what they owe to depositors. Their revenue solely comes from the interest you pay them. If you pay back early, they will not be earning interest from you any more.

One would ask, well they can make a new loan and start earning interest again. A very fair point.

Unfortunately, people prepay and refinance their loan only when interest rates go down. For a bank to be paid the loan amount in full is bad because the new loan the bank will make will be at a lower rate than what you were paying him so far.

This type of risk is called reinvestment risk. Because most mortgages in the US dont have a prepayment penalty associated with them, people can refinance whenever rates fall. So lenders face that risk. Unfortunately, no one refinances when rates go up to make it even for the lenders.

That risk is not with specific borrowers only. Its a risk they face with all borrowers in general. If borrowers were prohibited from early payment, all of us would have had slightly lower mortgage rates. But most borrowers are fine to have the option to prepay for a small cost in the form of a slightly higher mortgage rate.

What Is Mortgage Interest

Interest is charged by lenders in exchange for allowing you to borrow money. For borrowers, mortgage interest is charged based on your mortgage principal balance. The mortgage interest charged is included in your regular mortgage payments. This means that with every mortgage payment, you will be paying both your mortgage principal and your mortgage interest.

Your regular mortgage payment amount is set by your lender so that youll be able to pay off your mortgage on time based on your selected amortization period. This is why your mortgage payment amount can change when yourenew your mortgageorrefinance your mortgage. This can change your mortgage rate, which will impact the amount of mortgage interest due. If you now have a higher mortgage rate, your mortgage payment will be higher to account for the higher interest charges. If youre borrowing a larger amount of money, your mortgage payment may also be higher due to interest being charged on a larger principal balance.

However, mortgage interest isnt the only cost that youll need to pay. Your mortgage might have other costs and fees, such as set-up fees or appraisal fees, that are necessary to get your mortgage. Since youll need to pay these extra costs in order to borrow money, they can increase the actual cost of your mortgage. Thats why it can be a better idea to compare lenders based on theirannual percentage rate . A mortgages APR reflects the true cost of borrowing for your mortgage.

Read Also: What Were Mortgage Interest Rates In 2006