Year Mortgage Pros And Cons

Picking a 30year mortgage can be a smart move for many.

A 30year mortgage is the most popular option for homebuyers in the United States. Payments are stretched out over a period twice as long, resulting in lower monthly payments, says Heck.

These lower payments make it easier to afford a home or to purchase a larger home and still stay within your budget. It also allows homebuyers to apply the money they are saving toward other household and living expenses, Heck explains.

The primary disadvantage of a 30year term is that you are committed to making payments over a longer period. That means youll pay much more in interest over the life of the loan and your home equity will build much more slowly.

As a result, if you sell your home before your loan is paid off especially within the first 5 to 10 years of owning the property youll make a smaller profit.

Another drawback is that, since your payments are lower than with a 15year mortgage, you may rationalize that you can commit to buying a bigger home and get yourself into deeper debt for a longer period, cautions Johnson.

Finally, longer terms usually come with slightly higher interest rates. This contributes to paying more in total interest over the life of your mortgage.

Much More Than The Amount Of Monthly Payments

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services. Lea has worked with hundreds of federal individual and expat tax clients.

How Do I Find Personalized 30

NerdWallets mortgage rate tool can help you find competitive 30-year mortgage rates. Specify the propertys ZIP code and indicate whether youre buying or refinancing. After clicking “Get Started”, youll be asked the homes price or value, the size of the down payment or current loan balance, and the range of your credit score. Youll be on your way to getting a personalized rate quote, without providing personal information. From there, you can start the process to get preapproved for your home loan. Its that easy.

Don’t Miss: Why Is Mortgage Cheaper Than Rent

Bettercom Best Online Lender

Better.com is an online mortgage lender, available in the majority of states in the U.S., and one of Bankrates best mortgage lenders overall.

Strengths: Better.com can preapprove you in as little as three minutes, and closings take, on average, just 21 days. The lender doesnt charge fees, and its proprietary technology automatically applies other discounts, too, if youre eligible. Since Better is completely digital, you can get the process started anytime online, and have access to support 24/7.

Weaknesses: If youre interested in a VA or USDA loan, youll need to shop elsewhere, as Better doesnt offer these types of mortgages at this time. The lender doesnt maintain branch locations, either, if youd prefer an in-person experience.

Whats The Difference Between Fixed Rate And Adjustable Rate Mortgages

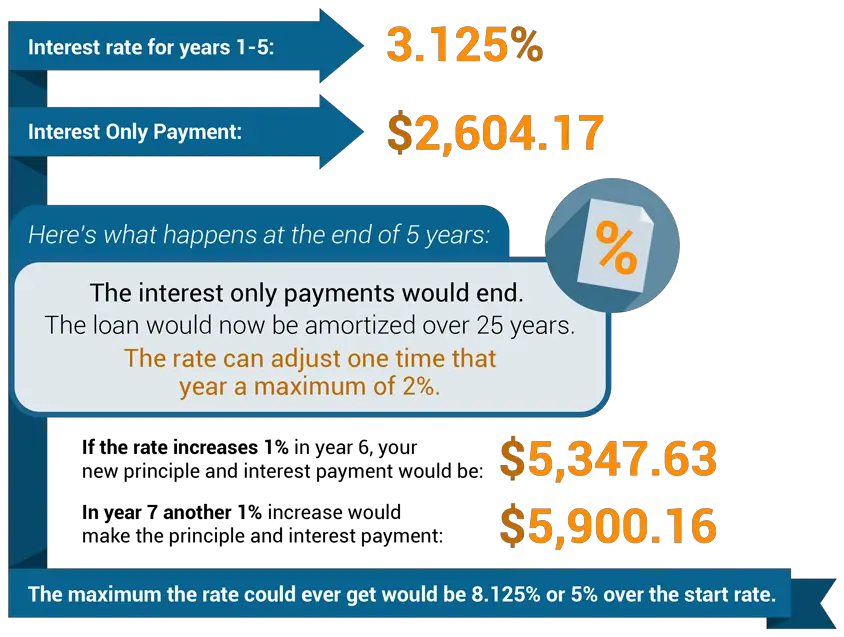

Unlike a 30-year fixed rate mortgage, adjustable rate mortgages come with a fluctuating interest rate that rises or lowers along with market conditions.

Minimum monthly payments on these loans depend on external factors, and opting for this mortgage type is usually seen as a greater risk. When mortgage interest rates go up, so do the monthly payments on an ARM.

Homeowners cant control the economy or shift the real estate market. If you apply for an ARM and these factors turn against your favor, you could end up paying thousands more in added interest after the ARM expires.

This also makes it difficult to predict how much money youll have for other expenses down the line. If the amount of interest suddenly spikes after your 5-year or 7-year ARM adjusts, youll have to adjust your finances. This makes ARMs a much more volatile lending option than 30-year fixed rate mortgages.

The major advantage of an adjustable rate mortgage is that you could end up saving money over time. The initial interest rates on these loans are typically lower than their fixed rate counterparts. If the mortgage rates continue to dip after the fixed rate period on your ARM expires and your rate adjusts, your rate could decrease even further, lowering your monthly mortgage payments.

Again, this depends entirely on the state of the economy and market trends. In addition to paying a steady rate of interest, 30-year fixed rate mortgages offer a number of financial advantages.

Read Also: Can You Sell House Before Paying Off Mortgage

Is It Cheaper To Pay Off A 30

Some people get a 30-year mortgage, thinking theyll pay it off in 15 years. If you did that, your 30-year mortgage would be cheaper because youd save yourself 15 years of interest payments.

But doing that is really no different than choosing a 15-year mortgage in the first placebesides that choosing to make those extra payments would be up to you.

Good intentions aside, this rarely happens. Why? Because life happens instead. You might decide to keep that extra payment and take a vacation. Or maybe its time to upgrade your kitchen. What about a new wardrobe? Whatever it is, theres always a reason to spend that money somewhere else.

When you have a 15-year mortgage from the beginning, you wont be tempted to use that money for something else. Youve got built-in accountability to get your house paid off fast!

How Much Can You Borrow For A Dutch Mortgage

As a rough guideline, you can borrow up to five times your gross salary, although dual-income households can typically borrow more. If you buy a home with renewable energy systems, you can borrow up to 9,000 extra when taking out a mortgage.

As of 2018 the Dutch government placed restrictions on the loan-to-value amount it is possible to borrow. Whereas before you could borrow 101% of the value, the maximum mortgage is now 100% of the property price. This means that any additional costs, like fees associated with the purchase or renovations, have to be financed with your own savings.

Good news, though: keep in mind that you will be able to borrow more if you enjoy the 30% tax ruling on your income.

Read Also: Which Is Better 30 Or 15 Year Mortgage

Mortgage Rates In The Netherlands

Although mortgage rates in the Netherlands are currently very low, rates vary depending on interest rates. Your mortgage rate will also differ depending on the time over which you plan to pay back the loan, up to a maximum of 30 years. The interest rate for your mortgage is based on the term of the fixed period and on the risk category of the loan. This risk category is based on the loan-to-value ratio: the amount of the loan compared with the value of the property. The lower your LTV, the lower your interest rate.

There are two types of interest rates in the Netherlands: fixed or floating. While floating rates are often lower, there is always the risk that they can increase. This is especially true due to the fact that current interest rates cant sink much further.

As of February 2019, Dutch mortgages rates from the major banks are as follows .

- Five-year fixed mortgage: 1.72.2%

- 10-year fixed mortgage: 2.22.57%

- 20-year fixed mortgage: 2.653.4%

If your house price increases you may be eligible for a lower interest rate. You can apply for a valuation or challenge how much the municipality deems your property is worth through WOZ valuation of immovable property.

Managing Your Mortgage Payments

Purchasing a 30-year fixed loan means making consistent payments for three decades. Thats a long time, so you must stay on top of your payments. This is why its important to secure a stable career and build savings. You must keep paying your loan even during emergencies. The same goes even when youre retired and not yet fully paid on your loan.

Before you agree to any real estate deal, you should understand how mortgage payments work. One important document you should use is the amortization schedule. This breaks down your monthly payments so you know how much goes toward your interest charges and principal loan.

- Principal This is the amount you borrowed from your lender. It also indicated the outstanding balance you still owe after making several payments.

- Interest This is the payment lenders charge to service your loan. Interest costs are higher when your principal is large. Likewise, interest increases the longer it takes to pay down a loan.

Calculate Your PITI Costs

Mortgage payments are not just comprised of interest and principal payments. You must also pay for real estate taxes and homeowners insurance. When taken together, this is called PITI costs or Principal, Interest, Taxes, and Insurance. If you check your PITI expense, you can calculate the total cost of your monthly payments. Finally, while principal and interest payments remain the same, your insurance and property taxes may change over the years.

Recommended Reading: What Does The Bank Need For A Mortgage

What’s The Difference Between A Mortgage Interest Rate And Apr

When searching for rates, you’ll probably see two percentages pop up: interest rate percentage and annual percentage rate .

The interest rate is the rate the lender charges you for taking out a mortgage.

The APR takes the rest of your house payments into consideration, such as private mortgage insurance, homeowners insurance, and property taxes.

The APR gives you a better idea of how much you’ll actually pay on your home.

Why You Should Never Pay Off Your Mortgage

If you have no emergency fund because you put your extra money toward an early mortgage payoff, a single financial disaster could force you to take out costly loans. Or, if your mortgage hasnt been paid off in full yet, an emergency could lead to foreclosure on your house if it means cant pay the mortgage later.

Also Check: What Is A Mortgage Inspection

Is 50 Too Old To Buy A House

Its not too late to buy a new house if youre in your 50s, but you must ask the appropriate questions and make the best selections possible. Above all, make sure you wont be obligated to make mortgage payments when you retire. If you or a family member is ill, you may need to put your money toward medical bills rather than a new home. This is a compelling reason to avoid overspending on real estate. If you have a large extended family, purchasing a larger home with multiple bedrooms makes sense. However, if your family only visits every few years, paying for hotel rooms is a much more cost-effective option than paying off a hefty mortgage.

Contact Mortgage Rates Today to get you the best rates with a personal touch.

Us Department Of Agriculture Loans

USDA loans are geared towards homebuyers with low to moderate incomes. It provides a zero downpayment option to borrowers with credit scores not lower than 640. The USDA home financing program was designed to aid economic development in areas with low populations in the country.

To be eligible for a USDA loan, you must purchase a house in a USDA rural area. This may seem like a limitation if you want to live in a city. However, 97 percent of land in the U.S. is actually qualified for USDA home financing. You just might find a house near a good location. Consider this option before you cross it out your list.

Qualifying for USDA Loans

To qualify for a USDA loan, borrowers should have a minimum credit score of 640. If your credit rating is lower than 640, you must provide additional documentation of your payment history to get approval. For front-end DTI ratio, you must not go beyond 29 percent. Likewise, your back-end DTI ratio must not be over 41 percent.Be sure to check the USDA income limits in your preferred home location. This will also determine if you can obtain a USDA loan. There are different income limits for households with 1 to 4 members and larger families with 5 to 8 family members. For example, under the 2008 Housing and Economic Recovery Act , high-cost areas for 1 to 4 member households are set at $212,55.

Don’t Miss: What Percent Down Payment To Avoid Mortgage Insurance

Who Can Get A Mortgage In The Netherlands

Technically, anyone with a residence permit, temporary or permanent, has the same formal rights when it comes to applying for a mortgage. That said, if you are new to a job, without a permanent contract, self-employed, on a low income, or of a non-EU nationality, it may be harder to get a loan or financing on 100% of the purchase price.

The requirements change depending on the bank, but generally you need:

- A valid passport

- A BSN

- Proof of permanent employment in the Netherlands or proof of income

- For employees, but also temporary workers or PhD students: a statement from your employer

- To have lived in the Netherlands for six months

- Three years of tax returns and accounting for self-employed residents.

Its worth noting that if you have been self-employed for less than three years it can be very hard to get a mortgage approved.

What Is A Mortgage Preapproval

When youre shopping for a mortgage, you can compare options offered by different lenders.

Mortgage lenders have a process which may allow you to:

- know the maximum amount of a mortgage you could qualify for

- estimate your mortgage payments

- lock in an interest rate for 60 to 130 days, depending on the lender

The mortgage preapproval process may be divided in various steps. It may also be called mortgage prequalification or mortgage preauthorization. Different lenders have different definitions and criteria for each step they offer.

During this process, the lender looks at your finances to find out the maximum amount they may lend you and at what interest rate. They ask for your personal information, various documents and they likely run a credit check.

This process does not guarantee your approval for a mortgage.

Recommended Reading: Is Total Mortgage A Good Company

How Do I Compare Current 30

Comparing 30-year fixed mortgage rates isnt as straightforward as looking at the mortgage interest rates you qualify for with different lenders. This is because a mortgage interest rate doesnt account for mortgage fees. To get an understanding of the overall cost of your home loan, you need to also compare annual percentage rates , which factor in other costs like loan origination fees and discount points.

After you apply for a mortgage youll get what is known as a Loan Estimate from the lender. Learning how to read a Loan Estimate is important because it shows an estimate of every fee the lender is charging you. Since every Loan Estimate form is the same, its a vital tool for comparing mortgage lenders and avoiding excessive fees.

Your Loan Term Impacts How Much Youll Pay For A Mortgage

A loan term plays a big role in the interest rate you get, your monthly payment and how much interest you pay over the life of the home loan.

When you take out a home loan, whether its a 15- or 30-year mortgage:

More of your monthly mortgage payment goes to interest in the beginning. Homeowners with a 30-year mortgage will pay more interest versus those with a 15-year mortgage.

For example:$82,970$38,931

Learn More: How to Get a Mortgage

You May Like: Who Should You Get A Mortgage From

Can You Pay A 30 Year Mortgage In 15 Years

First, well look at the monthly payments for the 30-year mortgage, the amount of interest that accumulates and what it would take to pay it off in 15 years. In order to pay off this 30-year mortgage in 15 years, you would need to pay an extra $515/month. Thats a big step up from the $1,026 monthly payments.

Monthly Mortgage Payments For 15 Vs 30year Loans

Mortgage payments on a 15year loan will likely be several hundred dollars more than for a 30year loan.

Imagine you take out a $250,000 loan over 15 years at 2.50%, says Tom Trott, branch manager with Embrace Home Loans. Your monthly principal and interest payments will be $1,667.

On the other hand, A 30year mortgage on the same loan amount at 2.99% will trigger monthly payments of $1,053 $614 less, he explains.

Of course, the exact payment amounts will depend on your credit score, down payment, interest rate, and other factors. So its worth comparing both loan types before you buy to see how your options break down.

You May Like: How To Mortgage Property In Monopoly

How Soon Can You Repay Your Loan

A 15-year mortgage helps you pay down your loan balance quickly. Youll make a bigger dent in your debt with each monthly payment you make than you would over 30 years. Youll owe less money at any given point in time, which offers several benefits.

You’ll build equity more quickly, which you can use for your next home purchase or for other needs. Its also easier to refinance when you have a lower loan-to-value ratio. And youre less likely to find yourself “underwater,” owing more on your home than its fair market value, if you find that you have to sell your property for some reason.

Most Homeowners Benefit From A ‘super

Adcock’s point of view isn’t actually unpopular. Financial experts agree that the flexibility of lower monthly mortgage payments is important for many homeowners.

“I’ve explained it to clients this way,” says Mark La Spisa, a certified financial planner and president of Vermillion Financial Advisors in South Barrington, Illinois. “If you had a 15-year mortgage and a 15-year super-duper flexible mortgage, which one do you think you would choose?”

Most them then ask what a “super-duper flexible” mortgage entails. “If you need cash, the payments can drop 20% if you want any time you want,” he says, “and the rate is only about a quarter of a point higher” than the typical 15-year loan.

The punchline, La Spisa says, is the “15-year super-duper flexible mortgage” is a 30-year mortgage that, like Adcock suggested, you pay back more quickly as your finances allow.

When your financial situation allows, you can put extra money toward your balance and pay off the loan faster as Adcock put it, turning it into a 15-year. But when money is tight, then you can take advantage of the 30-year’s lower payments and use the difference to help with other bills, says Greg McBride, chief financial analyst for Bankrate. You’re not locked into that large payment.

“Money in the bank will pay the bills home equity will not,” McBride says.

Also Check: How Much Should Your Mortgage Be In Relation To Income