Current Mortgage Rates: 30

- The 30-year rate is 3.541%.

- That’s a one-day increase of 0.038 percentage points.

- That’s a one-month increase of 0.218 percentage points.

Most borrowers will opt for the stability of a fixed-rate mortgage. Neither the interest rate nor the monthly payment will change throughout the term of the loan. The most popular term length is the 30-year loan. Its long payback time means your monthly payments will be relatively low. Compared to a shorter-term loan, however, the interest rate will be higher, so you’ll pay more interest over time.

Average Mortgage Rates

Data based on US mortgage loans closed on Oct 21, 2021

Loan TypeLast WeekChange

15 Year Fixed Conventional2.57%2.53%0.04%

30 Year Fixed Conventional3.54%3.47%0.07%

7/1 ARM Rate3.44%3.35%0.09%

10/1 ARM Rate4.01%3.82%0.19%

Your actual rate may vary

Find your actual rate at Quicken Loans.

The Disadvantages Of Va Home Loans

You’d be hard pressed to find a whole lot of drawbacks to a VA home loan. Assuming you qualify – i.e., that you are an active member of the United States military, or a veteran – then you will quickly see that the pros of such a loan far outweigh the few cons. Still, in order to make the best and most educated decision possible, you should learn about the drawbacks and disadvantages of VA loans. Knowing exactly what you’re getting yourself into is always a good idea. In general, the main drawbacks of a VA loan are:

Loan Limits

Although they vary depending on where you live in the country, there are limits on how large of a VA home loan you can take out. Those who are looking to purchase a very expensive home, for instance, may be discouraged by the loan limits that are imposed by the VA home loan program. If the home that you want to buy exceeds the loan limits set by the VA home loan program, you will have to finance the balance through another mortgage program. This can seriously negate the benefits of using the VA home loan program. Still, the limit in most areas is currently $729,000 for the vast majority of people, that amount is more than enough for what they are looking at.

Hidden Fees

VA home loans are interesting because they don’t include a ton of different hidden fees. Still, there are a few that you need to be aware of in order to get the best idea possible about what you can really afford. These fees include:

| Borrower | |

|---|---|

| 0.5% | 0.5% |

Jfq Lending Best Broker

JFQ Lending is a mortgage broker that offers a suite of refinancing options ranging from cash-out to VA streamline refinances. The broker is based in Scottsdale, Arizona, and is licensed in 39 states and Washington, D.C.

Strengths: If youre interested in refinancing a VA loan and find a competitor with a lower rate, JFQ Lending can match or beat that rate. The broker can connect you to both VA and FHA streamline refinancing, which allows you to take advantage of low rates with fewer hassles.

Weaknesses: Youll have to contact JFQ Lending to get a quote for a VA or other type of loan it doesnt advertise rates on its website. In addition, the broker is licensed in many states, but not all.

Read Bankrate’s JFQ Lending user reviews

You May Like: Can Low Credit Score Get Mortgage

When Is The Best Time To Get A Va Home Loan

When shopping around for a mortgage, many people wonder if there is a “good time” to apply. For some mortgage products, there is no doubt that key market conditions affect how much they’re going to pay. However, there is no tried and true advice for when you should – or shouldn’t – apply for a VA home loan. The things that affect the interest rates that are attached to the typical VA home loan are so varied and complex that there is no hard and fast rule to refer to.

If you are considering a VA home loan, contact a number of qualified lenders and ask them what the current rate is. Try to get a feel for whether rates have recently crept up or gone down, and act accordingly. Either way, you’re going to be paying a lot less than those who don’t qualify for VA loans are going to. Also, without the worry of private mortgage insurance and without having to make a down payment, you’re going to be ahead of the game financially anyway. In fact, the relaxed conditions for VA home loans makes any time a good time to get one. The VA loan benefit is flexible and widely used across the country. Here are usage stats for fiscal year 2018.

| Loan Type |

|---|

| $264,197 |

Whats The Difference Between A Va Interest Rate And Apr

The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate, is supposed to reflect a more accurate cost of borrowing. The APR calculation includes fees and discount points, along with the interest rate.

A major component of APR is mortgage insurance a policy that protects the lender from losing money if you default on the mortgage. You, the borrower, pay for it.

Lenders usually require mortgage insurance on loans with less than 20% down payment or less than 20% equity .

You May Like: Who Is Rocket Mortgage Owned By

Benefits Of A Va Streamline Refinance

The VA IRRRL lets veterans and service members refinance their current mortgage loan to a lower rate and monthly payment.

The biggest benefits of the VA Streamline program compared to other refinance options are:

- Limited paperwork

- May be able to refinance with little or no equity

- You might have low or no closing costs

- A low credit score wont disqualify you

- Available to most veterans and active-duty members of the armed forces from all branches, including many Reserves and National Guard members

The VA Streamline loan program is extremely popular because its easy to use.

If you already have a VA mortgage on your home, the IRRRL program makes refinancing to a lower rate relatively quick and painless.

However, lenders can set their own requirements for credit checks and appraisals. So if you want to skip these steps, be sure to shop around and ask about lenders policies before you apply.

Our Mortgage Rate Methodology

Moneys daily mortgage rates show the average rate offered by over 8,000 lenders across the United States the most recent business day rates are available for. Today, we are showing rates for Thursday, October 21, 2021. Our rates reflect what a typical borrower with a 700 credit score might expect to pay for a home loan right now. These rates were offered to people putting 20% down and include discount points.

Recommended Reading: Can Non Permanent Resident Get Mortgage

Who Has The Lowest Va Rates

Most mortgage lenders are VA-approved. So youll have a wide variety to choose from.

Since VA mortgage rates are set by individual lenders, rather than the VA itself, there can be a wide range across the market.

For instance, one lender might offer 30-year fixed VA rates starting at 3.0% on the same day another lender is offering 2.5%.

To find the lowest VA rate for your new loan, youll have to apply with multiple lenders and compare their offers. That might sound like a lot of work, but its possible to rate shop in under a day if you set your mind to it.

The best VA lender will be different for each borrower. But as a starting point, here are the five most popular VA lenders by volume, according to the Department of Veterans Affairs:

For more information on how to choose the best VA lender for you, check out our review of the Best VA Loan Lenders in 2021.

Va Streamline Refinance And The Va Funding Fee

The VA funding fee is an upfront fee applied to every purchase and refinances loan. Proceeds from this fee are paid directly to the Department of Veterans Affairs and are used to cover losses on any loans that may go into default.

The good news is the VA funding fee is lower on IRRRLs than for typical VA purchase and cash-out loans. Borrowers who are not exempt pay a 0.5 percent funding fee on their IRRRL. Borrowers can roll the VA funding fee into the loan balance. Estimate the cost of the VA funding fee with this calculator here.

Homeowners who receive compensation for a service-connected disability and qualified surviving spouses are exempt from the funding fee.

Keep in mind, refinancing may result in higher finance charges over the life of the loan.

Don’t Miss: How Much Should Your Mortgage Be In Relation To Income

How Are Mortgage Rates Set

At a high level, mortgage rates are determined by economic forces that influence the bond market. You can’t do anything about that, but it’s worth knowing: Bad economic or global political worries can move mortgage rates lower. Good news can push rates higher.

What you can control are the amount of your down payment and your credit score. Lenders fine-tune their base interest rate on the risk they perceive to be taking with an individual loan.

So their base mortgage rate, computed with a profit margin aligned with the bond market, is adjusted higher or lower for each loan they offer. Higher mortgage rates for higher risk lower rates for less perceived risk.

So the bigger your down payment and the higher your credit score, generally the lower your mortgage rate.

» MORE:Get your credit score for free

When Should You Refinance

In general, if you can save money over the life of your loan, then you should consider refinancing. Everyones financial situation is different, however, and refinancing can help you achieve a couple of different financial goals. Below are some of the most common reasons homeowners refinance:

You May Like: What Banks Look For When Applying For A Mortgage

Tips For Getting The Lowest Mortgage Rate Possible

There is no universal mortgage rate that all borrowers receive. Qualifying for the lowest mortgage rates takes a little bit of work and will depend on both personal financial factors and market conditions.

Check your credit score and credit report. Errors or other red flags may be dragging your credit score down. Borrowers with the highest credit scores are the ones who will get the best rates, so checking your credit report before you start the house-hunting process is key. Taking steps to fix errors will help you raise your score. If you have high credit card balances, paying them down can also provide a quick boost.

Save up money for a sizeable down payment. This will lower your loan-to-value ratio, which means how much of the homes price the lender has to finance. A lower LTV usually translates to a lower mortgage rate. Lenders also like to see money that has been saved in an account for at least 60 days. It tells the lender you have the money to finance the home purchase.

Shop around for the best rate. Dont settle for the first interest rate that a lender offers you. Check with at least three different lenders to see who offers the lowest interest. Also consider different types of lenders, such as credit unions and online lenders in addition to traditional banks.

Finally, lock in your rate. Locking your rate once youve found the right rate, loan product and lender will help guarantee your mortgage rate wont increase before you close on the loan.

Va Home Loan Benefits

The goal of the VA loan program is to make homeownership more accessible for veterans and service members.

As such, VA loans offer unique benefits not available to most other borrowers.

These loans are especially attractive for first-time home buyers, since you dont need to worry about saving for a down payment.

Although theyre backed by the federal government, VA loans are offered by private lenders. That means youre free to shop around and compare mortgage companies to find the lowest rate.

Recommended Reading: Does Chase Allow Mortgage Recast

Is The Va Irrrl Program Worth It

As with any refinance, using the VA IRRRL results in a brand new loan. So your mortgage will start over at 30 or 15 years, depending on which loan term you choose.

But using the VA IRRRL is worth it for many homeowners.

Thats because todays ultra-low VA rates can result in a much lower monthly payment and potentially save you thousands in interest payments in the long run.

Another big benefit? VA loan closing costs can be rolled into the loan. This allows veterans to refinance with few or no out-of-pocket expenses.

Sometimes it is also possible for the lender to absorb your loan costs in exchange for a higher interest rate on your loan.

Tips For Strengthening Your Va Mortgage Application

Work to improve your personal finances before you start shopping for a loan can make a big difference to the interest rate youre offered. Thats because mortgage lenders offer the best rates to the borrowers deemed least risky.

Here are some of the variables a mortgage lender will consider when evaluating your application and determining your interest rate:

Below, well explore the steps you can take to make your application as attractive as possible and potentially help you save thousands of dollars with the lowest interest rate.

1. Improve your credit score

Although the VA doesnt set a minimum credit score, most lenders impose their own credit thresholds. These minimum credit score requirements vary by lender but typically range from 580 to as high as 660.

Still, theres good reason to get your credit score as high as you can, not just over the credit score minimum. The higher your credit score is, the lower interest rate youre likely to receive. Raising your credit scores is one of the best ways to bring your interest rate down.

To improve your score, start by requesting free copies of your credit report from the Big 3 credit bureaus. You can get these all at once at AnnualCreditReport.com. Youre entitled to one free report every year so be wary of sites that try to charge you.

Review your report carefully and have any mistakes corrected. Errors are commonplace on these and adverse ones can seriously lower your score.

Also Check: Does My Husband Have To Be On The Mortgage

When Should I Use A Va Loan

If youre looking to buy a home but dont want to make a down payment or pay for private mortgage insurance, it may be the right time to use a VA loan.

Additionally, a VA loan must be used on your primary residence and may carry additional fees if its not the first time youve used it. VA loans also carry a maximum loan amount that changes each year, which may limit the options available if youre planning to buy a more expensive home.

For most U.S. counties, the 2020 limit is $510,400 an increase from $484,350 in 2019. However, in more expensive housing markets, the limit can be as high as $756,600 an increase from $726,525 in 2019.

If youre looking to secure the best loan rate in 2020 without making a large down payment, it may be the right time to consider a VA loan. If you want to see how a VA loan can benefit you and your family, be sure to check out our helpful mortgage calculator.

Current Va Refinance Rates

Mortgage interest rates remain at historic lows this week. As reported from a weekly survey of 100+ lenders by Freddie Mac, the average mortgage interest decreased for all three main loan types 30-year fixed , 15-year fixed , and 5/1 ARM increased .

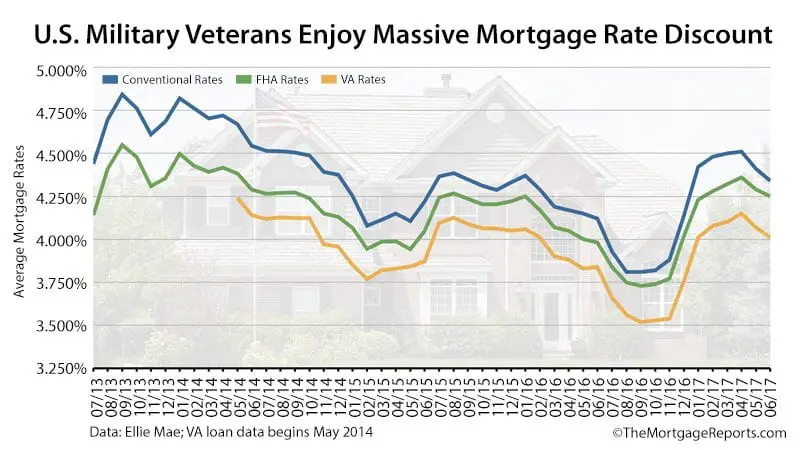

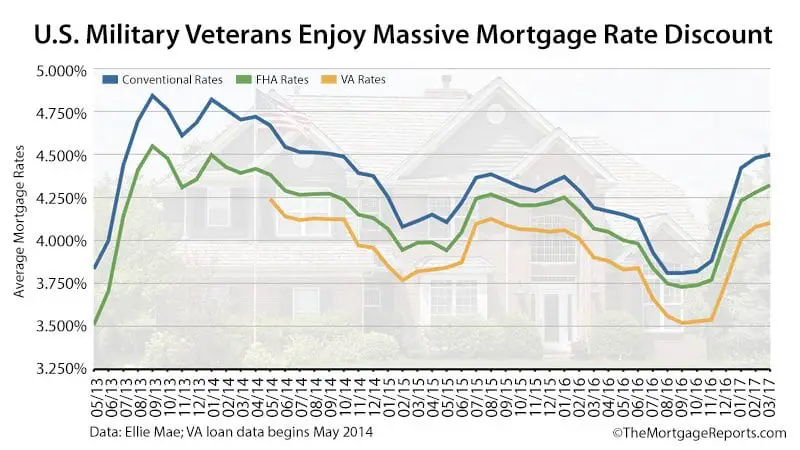

VA refinance rates are no different. In fact, when compared to other loan types conventional and FHA, for example VA home loans offer consistently lower rates than for the average consumer.

Shop and compare your personalized rates with multiple lenders.

You May Like: What Is The Mortgage Rate In Florida

Are You In Need Of A Va Loan

Assess your needs to determine if you currently require and qualify for a VA loan. If youre a veteran, active service member, or the spouse of a veteran who died in service or from a service-related injury, you may qualify for a VA loan which can often offer more competitive rates and lower down payments than other loans.

VA loans can be used to purchase a home, a multi-family property, as long as you live in one unit, or build a home. They can also be used to repair or improve a home or refinance your current mortgage.

Is It A Good Idea To Refinance A Va Loan

To refinance using the IRRRL program, the new loan must have a lower interest rate. The exception is when you refinance from an adjustable-rate mortgage into a fixed-rate loan. Either way, the VA assumes that the refinance is a good idea, because you’re getting a lower rate or the predictability of a fixed rate.

A VA cash-out refinance requires you to pass what’s called the Net Tangible Benefit test. To pass the NTB test, the refinanced loan has to save you money in one way or another, or pay off a construction loan, orswitch from an ARM to a fixed rate.

Don’t Miss: What Is The Mortgage Payment On 240k