What Is A Personal Loan

An unsecured personal loan is money you can borrow from a financial institution like a bank, credit union, or online lender that doesn’t require collateral . If youre approved for an unsecured loan, you’ll make monthly payments to pay it back in full, plus interest. The loan terms and interest rate can vary based on the lender and your credit.

How To Find The Best Mortgage Rate For You

Different lenders will look at your financial circumstances in different ways.

For example, a lender that specializes in FHA loans will rarely raise an eyebrow if your credit score is in the 580620 range. But one that caters to super-prime borrowers likely wont give you the time of day.

Ideally, you want a mortgage lender that is used to dealing with people who are financially similar to you. And the best way to find your ideal lender is by comparing loan offers.

Heres how to do that.

Shop Around To Find Your Best Interest Rate

Mortgage lenders personalize your interest rates based on your credit history and other details about your financial life. So you wont know for sure what your rate options look like until you apply and get pre-approved.

The first rate youre quoted may not be your best interest rate. Be sure to apply with several lenders so you can compare Loan Estimates and find your best deal.

Popular Articles

Resources

Recommended Reading: How Much Interest Do I Pay On A Mortgage

What Is A Cash Out Refinance

- Main

-

A cash out refinance is when you take a portion of your home’s equity out as cash when refinancing your current mortgage. While a traditional refinanced loan will only be for the amount that you owe on your existing mortgage, a cash-out refinance loan will increase the amount of the loan, allowing you to both pay off your existing mortgage and take a lump-sum payment in cash for the additional amount of the loan. When mortgage rates are low, a cash out refinance may be advantageous over other types of credit like credit card, personal loans, or HELOCs that have a variable rate.

Discovers cash out refinance loan has a low, fixed rates that never change for the life of the loan, as well as has no cash due at closing.

What To Use A Home Equity Loan For

A home equity loan is something to consider if you need a large sum of cash up front, like if youre paying for a large home renovation project or debt consolidation.

If someone wants to consolidate debt they may choose the home equity loan because its going to pay off all the debt that they want to consolidate in one loan in one fell swoop, says McBride.

While its important to consider the ramifications of debt consolidation that trades unsecured debt for a new secured home equity loan , it could make sense if you can get a much lower interest rate that allows you to pay it off faster.

Also Check: How 10 Year Treasury Affect Mortgage Rates

Understanding Your Interest Rates

An interest rate is a cost that a lender charges a borrower when they borrow money. The amount of interest a person is charged depends on their credit score, the loan amount and more. The lower the interest rate on a mortgage, the lower the amount the borrower will owe on the home over time.

, or annual percentage rate, is a more accurate indicator of how much a loan will cost because it includes the fees that lenders charge for originating a loan. However, it is only accurate for loans based on simple interest. For loans with compounding interest, APY is a more accurate indicator of a loan’s total cost.

APY, or annual percentage yield, is a more accurate measure of the yearly cost of a loan than APR. It is most applicable in situations where interest compounds, such as credit card debt. However, if you are considering a mortgage, APY is usually higher than your APR.

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.

You May Like: How Much Is The Mortgage On A $300 000 House

Things To Know Before Taking Home Loan

The most important thing that you have look at is the cost of the house and the way you plan to finance it. There are many banks in India that offer amazing home loan schemes at affordable rates of interest. If you are confused and unable to decide which scheme you should apply for, then you must follow the rules mentioned below:

What Are The Benefits Of Personal Loans

Personal loans offer several benefits, including:

Fixed interest rates:

Can be used to consolidate debt:

You can take out a personal loan to consolidate multiple kinds of debt, such as credit cards or other loans. Depending on your credit, you might get a lower interest rate than youve been currently paying, which could potentially help you pay off your debt faster.

Can cover large expenses:

If you need to pay for a large expense such as home improvements, medical bills, or a wedding a personal loan could be an option to get the cash you need.

Generally unsecured:

Most personal loans are unsecured, which means you dont have to worry about collateral. However, because unsecured loans present more of a risk to the lender, an unsecured personal loan could be harder to qualify for compared to a secured loan.

Recommended Reading: How To Find Mortgage Payment

Whats That In Dollars

Say youre getting a 30year, fixed-rate mortgage of $300,000 with 5% down.

Someone with the lowest of those APRs would pay around $128,000 in interest over the life of the loan.

But someone whose score is in the 620639 range would pay closer to $218,900 in total interest payments for the same home price. So over time, what might look like a relatively small rate difference can add up to huge savings.

Interpreting What Rates Mean

When doing your homework before you take out a mortgage, it is essential to know that APR and APY might be used in different situations to alter the appearance of the amount of savings or debt that you are taking on. For this reason, you should always get both the APR and the APY on paper before you sign a mortgage document. When you understand all the figures that go into your mortgage, you will be better equipped to make your monthly mortgage payments and be financially successful.

Also Check: Can You Get A Reverse Mortgage On A Manufactured Home

Learn More About Home Loans

We think it’s important for you to understand how we make money. It’s pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform . But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That’s why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can.

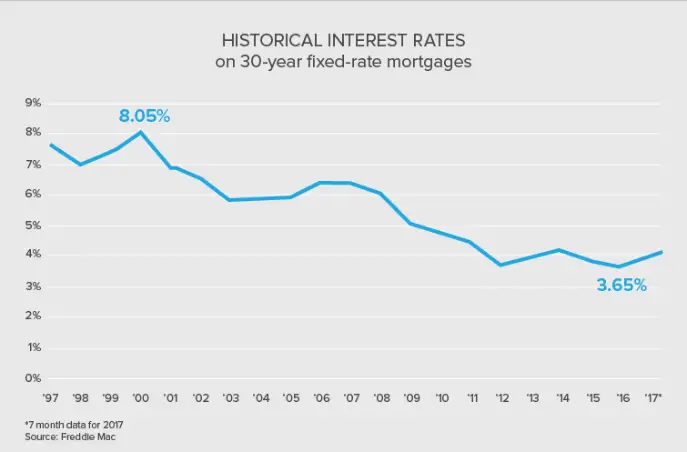

Some Interesting Takeaways From The Mortgage Rate Charts

- Monthly payment differences are larger when interest rates are higher

- Higher mortgage rates may be worse than larger loan amounts

- Small loan amounts are less affected by interest rate movement

- Those with smaller loan amounts have a higher likelihood of affording 15-year payments

The lower the interest rate, the smaller the difference in monthly payment. As rates move higher, the difference in payment becomes more substantial. Something to consider if youre looking to pay mortgage discount points.

If you look at the 30-year mortgage rate chart, the monthly payment difference on a $500,000 loan amount between a rate of 3.5% and 3.75% is $70.36, compared to a difference of $77.93 for a rate of 5.25% vs. 5.5%.

Additionally, higher mortgage rates can be more damaging than larger loan amounts. Again using the 30-year mortgage rates chart, the payment on a $400,000 loan amount at 3.50% is actually cheaper than the payment on a $300,000 loan at 6%.

So you can see where an individual who purchases a home while mortgage rates are super low can actually enjoy a lower mortgage payment than someone who buys when home prices are lower.

However, for someone purchasing a really expensive home, upward interest rate movement will hurt them more than someone purchasing a cheaper home.

Sure, its somewhat relative, but it can be a one-two punch for the individual already stretched buying the luxury home.

Don’t Miss: Is Closing Cost Part Of Mortgage

When You Apply For A Mortgage Theres One Factor That Could Save You Tens Of Thousands Of Dollars If You Play It Right: Your Interest Rate

Your interest rate impacts how much youll pay your lender over time. Fortunately, you may be able to influence the interest rate you get by taking steps to build your credit, saving for a big down payment and researching your options.

Mortgage experts predict that interest rates will jump by a half percentage point this year, which may seem trivial. But take a closer look: A 30-year, $250,000 mortgage with a 4.25 percent fixed interest rate will cost about $21,400 less over the life of the loan than the same mortgage with a 4.75 percent rate.

Whether youre planning on refinancing your current abode or purchasing a new home, heres what you can do to better your chances of scoring a great mortgage rate:

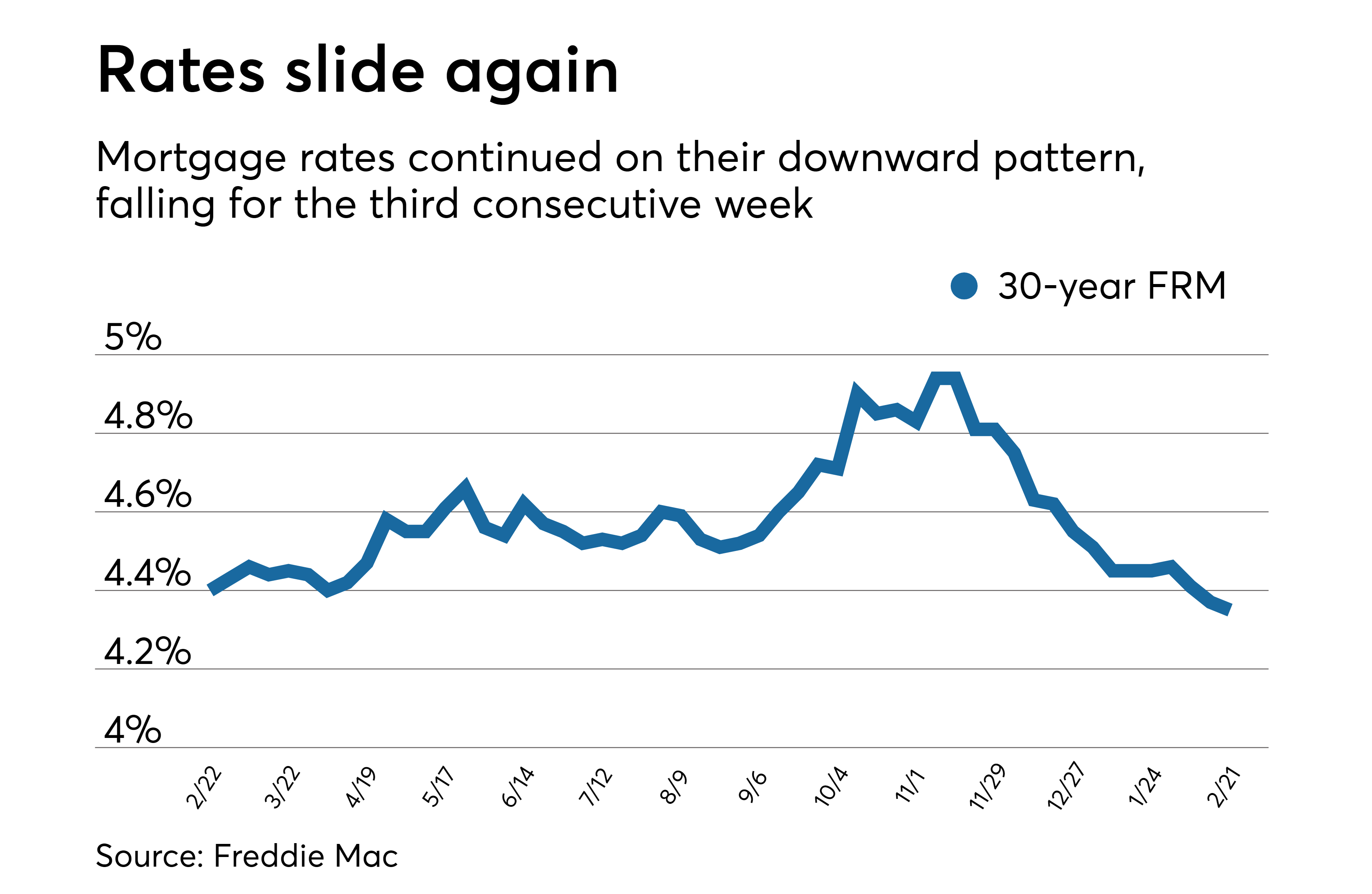

Mortgage Rates Are Back Below 4% Time To Buy Or Refinance

When it comes to fear of missing out, or FOMO, keeping an eye on Instagram, Facebook and other social media to see what your friends are doing may not cause as much anxiety as watching mortgage rates change daily and decide if you should jump in.

Rates on 30-year fixed-rate mortgages have fallen about three-quarters of a point in the past year, to below 4% as of June 6, 2019. Rates on 15-year fixed-rate mortgages have fallen about the same amount, to about half a point less than 30-year fixed. Adjustable mortgage rates are also down, though not as much.

The roller coaster ride of interest rate changes is plunging, and homeowners looking to refinance and house hunters looking for mortgage lenders for the first time want to take advantage of it and get the lowest rate they can before they start rising again whenever that climb starts.

Low rates offer opportunities for buyers and owners, along with a few downsides that they should look out for when shopping for a mortgage. Here are some to consider:

You May Like: Does Bank Of America Do Mortgage Loans

Which Lenders Offer The Lowest Mortgage Rates

The truth is no mortgage lender has a clear edge when it comes to mortgage rates. Each has its own specific methods for calculating which rates to charge which borrowers, so the lender with the best rate for one person might not have the best offer for another. It really depends on individual circumstances.

This is why its so important to look into a variety of lenders and see what they can offer you. Using tools, such as our rate comparison tool, can help you compare mortgage rates for your specific situation and give you a good idea of what rates you may qualify for. You can also get ahead by checking your credit score before you apply for a mortgage, to better understand your financial standing.

Why Do Average Mortgage Rates Vary Per State

The basic rules of supply and demand apply to mortgage rates, and variables such as inflation, federal and state monetary policies, and economic growth all come into play.

For example, a state where unemployment and foreclosure are prevalent is likely to have higher interest rates. Foreclosures cost the lender time and money, so they are forced to charge higher rates.

On the flip side, a high number of mortgage lenders in a state can lower its average rate, according to Pennsylvania State University research. And in competitive markets, lenders tend to trim their profit margins.

Read Also: Are Mortgage Discount Points Worth It

Save For A Down Payment

When taking out a mortgage, youll pay a certain percentage of the homes value upfront. This is called a down payment.

While you may be approved for a mortgage with a down payment of less than 20 percent , a down payment of less than 20 percent is typically considered more risky to lenders.

On the other hand, a down payment of 20 percent or more could help improve your mortgage rate by an eighth of a percentage point to as much as half a percent, says Milauskas. It can also help you avoid having to pay for private mortgage insurance , which protects the lender if you stop making your mortgage payments. Borrowers are typically required to pay for PMI when they get a loan with a down payment thats less than 20 percent.

It can be hard to save for a 20 percent down payment, especially if youre trying to pay down debt at the same time. After all, a 20 percent down payment on a $250,000 house is $50,000 not an amount everyone can easily set aside. Consider starting a side hustle to help you save.

In any case, Morse cautions that you should carefully consider your overall financial situation before shelling out a large down payment. Lenders generally require that you have at least two months worth of cash reserves in your savings account.

How Much Can I Get For A Personal Loan

Personal loan amounts vary depending on the lender. With Credibles partner lenders, you can take out a $600 personal loan up to a$100,000 personal loan.

Keep in mind that your credit will also likely affect how much you can borrow. Youll typically need good to excellent credit to qualify for the highest loan amounts. If you have poor credit, you might need a cosigner to get approved for a larger loan.

You May Like: What Banks Look For When Applying For A Mortgage

Current Mortgage Refinance Rates

The average rates for 30-year loans, 15- year loans and 5/1 jumbo ARMs are:

- The refinance rate on a 30-year fixed-rate refinance is 3.49%.

- The refinance rate on a 15-year fixed-rate refinance is 2.538%.

- The refinance rate on a 5/1 jumbo ARM is 2.467.

- The refinance rate on a 7/1 conforming ARM is 3.839%.

- The refinance rate on a 10/1 conforming ARM is 4.139.

Average Total Cost Including Interest Of A Mortgage

When you think about your mortgage repayments, youll probably see it as paying for your home. But actually a lot of the money goes towards paying the interest.

This is for two reasons.

One, mortgages are for large sums of money, so the interest charges, especially when you first take out a mortgage, are large. For the same interest percentage rate, larger sums of money get higher interest charges than smaller sums.

Two, mortgages last for many years, so the interest has a long time to grow.

Thats why the interest rate is so important, and why a shorter mortgage can be better. But, no matter the deal you get, lots of your money will be spent on the interest on your mortgage.

Heres an example.

The average UK house price is ££255,535 according to HM Land Registry. If you had one of the average interest rates, say 3.53% for a Standard Variable Rate , heres how your mortgage costs would work out over a 25-year mortgage.

House price:£255,535

Total amount repaid: £327,570Total paid in interest:£72,035

In these examples, the interest totals are worked out as if the interest stays the same. In real life, the interest rates on your mortgage could go up every time you remortgage so every 2, 3 or 5 years, depending on when you change. If you dont get a new mortgage, the interest rate will reset to the Standard Variable Rate. All this means that in real life, the total amount you repay on your mortgage could be tens of thousands of pounds higher.

Also Check: Can You Refinance Mortgage Without A Job