How To Calculate Refinance Savings

To calculate the value of refinancing your home, compare the monthly payment of your current loan to the proposed payment on the new loan. Then use anamortization scheduleto compare the principal balance on your proposed loan after making the same number of payments youve currently made on your existing loan. Both the monthly payment and principal balance of the new loan should be lower. Enter your specific details into therefinance calculator abovefor a detailed savings breakdown.

How Do I Qualify For A Mortgage Refinance

When applying for a new mortgage or refinance loan, three main factors will impact your rates:

- Debt-to-income ratio

- Loan-to-value ratio

Although credit score requirements vary by lender and loan type, a higher score will always mean a better rate. If you feel your credit needs improvement, there are ways to gradually improve your score, such as checking your report for errors and getting them corrected.

Check out all three free copies of your annual credit reports from annualcreditreport.com.

Ultimately, the best way to improve your score is to develop good long-term credit habits, like paying your bills on time and keeping tabs on your credit utilization rate. Being patient is important because improving your credit score will take time.

How Do You Calculate Income

The formula for calculating net income is:

Read Also: Rocket Mortgage Conventional Loan

Refinancing A Va Loan

Among the benefits members of our armed forces receive for their service is access to the VA loan program, which helps finance homeownership. These loans tend to be more attractivein terms of rates, credit requirements, down payments, and refinancingthan those available to nonmilitary home buyers.

Lifelong Benefits

Many who used this program to buy their homes may not realize that they typically can continue accessing it throughout their lives as they buy and sell homes. The VA also offers its borrowers options for managing mortgages through a streamlined refinancing process.

The VA’s Interest Rate Reduction Refinancing Loan , which is also referred to as a “Streamline” or “VA to VA” loan, enables borrowers with a VA loan to refinance into a new, lower rate VA loan.

The interest rate on the new VA loan needs to be lower than the one on the current mortgage in order to qualify for this option.

Hassle-Free Refinance

How Do You Calculate Income For Mortgage

To calculate income for a self-employed borrower, mortgage lenders will typically add the adjusted gross income as shown on the two most recent years’ federal tax returns, then add certain claimed depreciation to that bottom-line figure. Next, the sum will be divided by 24 months to find your monthly household income.

Don’t Miss: Reverse Mortgage On Condo

How Does Credible Calculate Refinance Rates

Changing economic conditions, central bank policy decisions, investor sentiment and other factors influence the movement of mortgage refinance rates. Credible average mortgage refinance rates reported in this article are calculated based on information provided by partner lenders who pay compensation to Credible.

The rates assume a borrower has a 740 credit score and is borrowing a conventional loan for a single-family home that will be their primary residence. The rates also assume no discount points and a down payment of 20%.

Credible mortgage refinance rates reported here will only give you an idea of current average rates. The rate you receive can vary based on a number of factors.

Think it might be the right time to refinance? Be sure to shop around and compare rates with multiple mortgage lenders. You can do this easily with Credible and see your prequalified rates in only three minutes.

If Youre Planning To Move Soon

If youre planning to sell in the next few years, the monthly savings by refinancing may not exceed the total cost to refinance your loan.

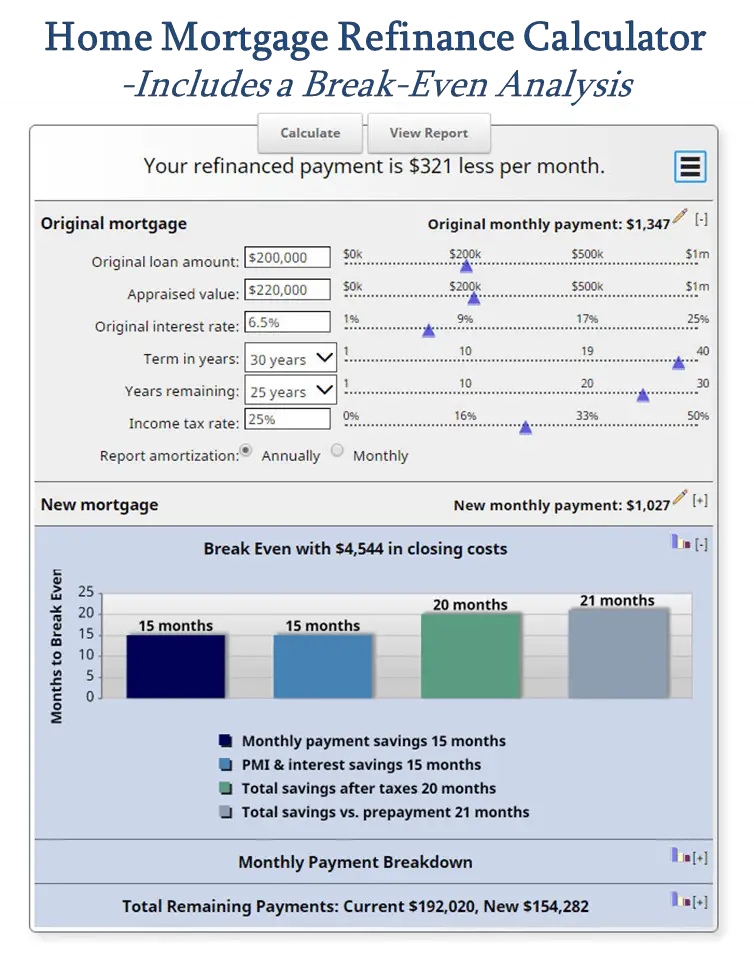

To find out your new loans break-even point, add up the closing costs, which can include appraisal fees, title and credit report fees, and origination fees around 1% of the loan amount and divide them by the amount youd be saving per month with the new payment.

According to Freddie Mac, the average closing costs on a mortgage refinance are around $5,000. If youre planning to stay in the home for less time than it would take you to get back what you would spend on closing costs, refinancing may not be a good deal.

Also Check: Recast Mortgage Chase

How To Use The Refinance Calculator

Our mortgage refinance calculator assumes that you would be investing the money youve saved . Refinance calculator for illustrative purposes only.

Calculate The Replacement Loan

Figure out what your new loan would look like if you refinance. For this example, assume the following:

- Loan amount: $152,160.64

- Loan start date: today

- Interest rate on new loan: 4.25%

- Loan term: 30 years

Notice that your monthly payment would drop to $748.54 if you refinance . Thats appealing, but its no surprise since your new loan is smaller and it comes with a lower interest rate.

Saving on the monthly payment may be important to you, but its just one of several important factors.

If can afford to pay more than the $748.54 minimum payment, consider a mortgage term of 20 years, 15 years, or 10 years. Shorter terms often have the lowest rates. The shorter the mortgage period, the faster you build equity in your home, and the sooner you pay off your mortgage.

Alternatively, you can get a 30-year loan and just pay extra each month. That approach allows you to maximize flexibility. You pay down the mortgage faster , but your required monthly payment remains low in case you fall on hard times.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

Refinance To Lower Your Mortgage Rate

To determine if you can save money with a lower mortgage rate, use our calculator to compare the monthly interest savings against the cost to refinance. As most mortgage brokers and lenders will cover your legal costs, the main cost you need to worry about is your break of mortgage penalty, or prepayment penalty. This penalty is charged by your lender for breaking your mortgage contract early and is based on your original contract date, current mortgage balance, mortgage rate, and other factors.

What Are The Benefits Of Refinancing

There are many benefits to refinancing, but they will vary based on your current situation and financial goals. Typically, the number one benefit is saving money, but there are many others as well.

For instance, with a refinance you can potentially get a better interest rate, lower your monthly payments, shorten the length of your loan, build equity faster, consolidate other existing debts by combining them all into a new mortgage, get rid of your mortgage insurance or even remove a person from the mortgage.

Related: 3 reasons its not too late to refinance your mortgage.

Also Check: Reverse Mortgage For Condominiums

Factors To Consider When Refinancing

When you buy your home, it may not always be under the perfect circumstances. Your credit may not have been good enough to qualify you for the best interest rates or you may have took out a loan using adjustable rates. You may not have had the down payment you wanted. You may taken on more than you could really afford in your enthusiasm to own your first home.

Refinancing can be the answer for many homeowners trying to balance their budget and meet their financial goals. In some cases, it can save you hundreds of dollars a month. However, it is not always the most appropriate solution. It’s important to understand the pros and cons to ensure that you make the right decision for your personal circumstances.

If you only need a small sum of money or rates have risen it might make sense to keep your current mortgage and tap your equity using either a home equity loan or a revolving home equity line of credit instead.

Calculate Step By Step

Heres how to use this calculator in a nutshell:

Depending on your selection, our calculator will adjust its recommendations accordingly to best inform your decision.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

How To Calculate The Break

The break-even point of a mortgage refinance is when the money you save is equal to what you paid in upfront closing costs. So before you pay thousands of dollars to refinance, you should do the math first.

Lets say it will cost $6,000 to refinance, but your lower mortgage payment will save you $250 a month. To figure out how many months it will be until you break even, you divide the refinance cost, $6,000, by your monthly savings, $250. In this scenario you would break even in 24 months or two years.

Total Mortgage Interest Paid

Just because you are getting a lower interest rate on your refinanced mortgage doesnt mean that you will pay less in total interest on it. For example, refinancing a 30-year mortgage with 25 years left until it is paid off into a new 30-year mortgage means that you might end up paying more total interest over the life of the new mortgage. It all depends on how much lower the new interest rate is.

Read Also: How Does Rocket Mortgage Work

How To Calculate Mortgage Payments

If you cant or dont want to pay cash, mortgage lenders and mortgages will be part of your home buying process. Its important to figure out what youll likely pay each month to see if it fits into your budget.

To estimate your monthly mortgage payment, you can use a mortgage calculator. It will provide you with an estimate of your monthly principal and interest payment based on your interest rate, down payment, purchase price and other factors.

Heres what youll need in order to calculate your monthly mortgage payment:

- Interest rate

- Insurance

- HOA fees

What you can afford depends on a number of factors, including your income, debt, debt-to-income ratio, down payment and credit score.

You also want to consider closing costs, property taxes, insurance costs and ongoing maintenance expenses.

The type of loan you choose can also affect how much house you can afford. When shopping for a loan, think about whether a conventional mortgage, FHA loan, VA loan or USDA loan is best for your particular situation.

Make Assumptions About How Long Youll Keep The Loan

Unfortunately, theres rarely a definitive answer when youre deciding whether or not to refinance. You need to project what you believe will happen and make a decision based on your assumptions. So, try to estimate how long youll keep the new loan. Will you stay in the same house for the next seven years? Will you stay there for the full 30 years? Its okay if you dont knowyou can do several what-if analyses using your amortization tables.

Also Check: Rocket Mortgage Vs Bank

How Our Mortgage Refinance Calculator Works

To use our refinance calculator, youll need to enter details about your current mortgage and the potential new loan. Once you put in the information, the refinance calculator will show you what you stand to save each month and your potential lifetime interest savings.

Our mortgage refinance calculator also factors in refinance fees. Youll even see your break-even period, which is how long youll need to remain in your home to recoup the refi costs.

When You Should Not Refinance

You always want to make sure youre refinancing for the right reasons. Refinancing can save you in the long run but it comes with some substantial up-front costs. So its important to make sure refinancing will substantially benefit your finances and that youll live in the home long enough to recover the costs. As a general rule of thumb, its not a good idea to refinance for short-term gains.

You May Like: Rocket Mortgage Requirements

What Is The Cost To Refinance A Mortgage

If you refinance your mortgage at the renewal there would be no charge but if you refinance your mortgage before your term is up, you may be charged amortgage prepayment penalty. You will be charged mortgage registration and appraisal fees. You may be charged legal fees if you require a lawyer, and switching to a new lender may result in a mortgage discharge fee.

Ok So Should I Refinance

To see if refinancing makes sense for you, try out a refinance calculator. You enter some specific information and the refinance calculator determines what makes the most sense for your particular situation. Then you can even play around a little bit to see what factors would change the recommendations.

The main number you are looking out for is the point when the monthly savings of the new mortgage become greater than the up-front costs of refinancing. In other words, how long will it take you to recoup the fees you paid to do the refinance? If that number is within the timeframe you plan on staying in the house, you may want to refinance. If you’re planning on selling in the near future, refinancing might not be worth it.

A good refinance calculator will show you the two scenarios keeping your current mortgage and getting a new one. Then you can see how your monthly payment will be affected and how much you can expect to pay in closing costs. This also shows that very important timeframe for how long you have to maintain the new mortgage to save enough money to cover the up-front costs. Basically, this is the point when you start actually saving money.

You May Like: Reverse Mortgage For Mobile Homes

How Do I Use The Refinance Calculator

Start by selecting your refinance goal from the drop-down menu. Youll then need to input your current mortgage balance and current value of your home, plus more information depending on your refinance goal. Your credit score and whether or not youre a veteran will both influence your refinance options.

When To Refinance Your Mortgage

The answer to when you should refinance your mortgage is a tricky one there is no catch-all answer. Whether you should refinance will ultimately depend on your personal situation people refinance loans for a number of reasons, including a longer or shorter term or a lower interest rate but there are a few rules you can use to help you decide.

Tip: Only consider refinancing if the new interest rate is at least 1 point lower than your current interest rate.

The first is that you should only consider refinancing if the new interest rate is at least 1 point lower than your current interest rate. Youll be paying closing costs on the new loan which can be between 2% and 6% of the homes principal, along with fees for title searches, appraisals and other miscellaneous things so anything less than 1 point lower may not be worth the extra closing costs on the new loan.

Closing costs also play into the second rule, which is that you should only consider refinancing if you have plans to stay in your home for more than 5 years. Anything less may negate the interest savings and cost you more than its worth in closing costs for the new loan. So, if theres a chance youre going to move soon, you may want to seriously consider whether the refinance costs will be worth it.

Also Check: Chase Recast Mortgage

How Much Are Prepayment Penalties

When you agree to a particular mortgage term, your are signing a contract for that amount of time, generally between 1 and 10 years. If you break your mortgage before that term is over, you’ll be charged a prepayment penalty, as a way to compensate the mortgage provider. How much this can cost varies wildly based on the type of mortgage you have, the time remaining on your term, as well as your mortgage provider – each lender has a different way to calculate prepayment penalties.

The exact prepayment penalty calculation that applies to you will be laid out in your contract, but there are two methods used, outlined below.

Find The Best Rates For Refinancing Your Mortgage

The costs of refinancing a mortgage can add up quickly, so its important to research which lenders offer the most competitive interest rates and fees. To find the best refinancing terms, start by looking at your current lender. Likewise, if you already have a relationship with another bank, it can likely streamline the application process and provide more favorable terms.

If youre getting a conventional mortgage, nationally chartered or community banks are usually the best places to start. Shop around at a variety of large banks, local banks and credit unions to ensure you get the best terms for your needs and credit history. Also keep in mind that if you want to refinance quickly, you may want to consider an alternative lender, like an online non-bank companyalthough this generally comes with a higher interest rate.

To get the best refinancing rates, pay attention to these factors before applying:

Also Check: Requirements For Mortgage Approval