Disadvantages Of Mortgage Recasting

Now that weve discussed the benefits of mortgage recasting, lets look at the negatives.

- Requires A Lot Of Cash. In order to recast a mortgage, you need to come up with a large lump sum. Depending on your liquidity situation, injecting more cash into a primary residence may not be the wisest move. Not only will you reduce your liquidity, you will also forgo any potential returns your cash might generate. If you have other debt at higher interest rates, it may be better to implement FS-DAIR and pay down other debt first.

- Doesnt Reduce Mortgage Term. A loan recast will not shorten your loan term, it will just keep you on track with a lower payment. If you want to shorten your mortgage term, you will need to keep paying extra principal after the mortgage recast is complete.

- Your Interest Rate Stays The Same. A recast lowers your monthly payments, but it doesnt lower your interest rate. My latest refinance was for 2.625%. If I was able to recast my mortgage, I would be paying 4.5%, despite only having 25 years left.

Mortgage Recast Vs Mortgage Refinance

Weve loosely covered this comparison throughout this article.

But to recap, a recast is a method by which you apply additional principal to your loan balance to lower your monthly payments. It doesnt require creating a new mortgage.

Mortgage refinancing is the exact opposite.

Youre paying off your existing mortgage by creating a brand-new one. The new loan will have a new interest rate, term, and closing costs.

What Types Of Loans Can Be Recast

While most lenders and loan servicers don’t publicly advertise whether they allow mortgage recasts, certain loans simply aren’t eligible for recasts and some lenders won’t permit them.

| Loan Type | |

|---|---|

| HELOCs | Yes* |

Home equity lines of credit will automatically be recast at the end of the initial draw period on the loan based on your outstanding loan balance. Typically, when the 10-year draw period ends, the loan is recast into a 10-, 15- or 20-year fully amortizing loan, depending on the terms of your agreement.

You May Like: How To Get Approved For Mortgage With Low Income

Types Of Mortgages That May Be Recast

Before you assume you can recast your loan, review the type of loan you have and if it qualifies you for recasting. Federal Housing Administration loans, Veterans Administration home loans, and U.S. Department of Agriculture loans arent eligible for mortgage recasting. The types of loans that may allow for recasting include:

- Conventional.

- Home equity.

- Home equity lines of credit .

Your mortgage terms will outline whether your mortgage includes a recast or you can ask your lender about this option. Two types of mortgages that generally include recasting terms are negative amortization loans and option adjustable-rate mortgages .

Mortgage Recast Vs Principal Payment: Whats The Difference

Recasting a mortgage does require making a large payment toward your principal. However, you can make extra payments on your loan without recasting it. If you do this, you will have put yourself ahead of schedule, but you wont have changed the schedule. Your monthly payment requirements will remain the same. Think about it like this: paying ahead of schedule without reamortizing/recasting is like driving faster along your usual route to work. Reamortizing/recasting is like taking a different route that uses less fuel but gets there at the same time as your old route.

Recommended Reading: How To Purchase A House That Has A Reverse Mortgage

Is Recasting A Mortgage Loan A Better Option Than Refinancing

Recasting is easier than refinancing because it requires only a lump sum of money in exchange for lower monthly payments. With recasting, you’re keeping your existing loan, only adjusting the amortization. You wouldn’t be able to get a lower interest rate with recasting, like you might with refinancing.

How To Calculate If A Recast Is Right For You

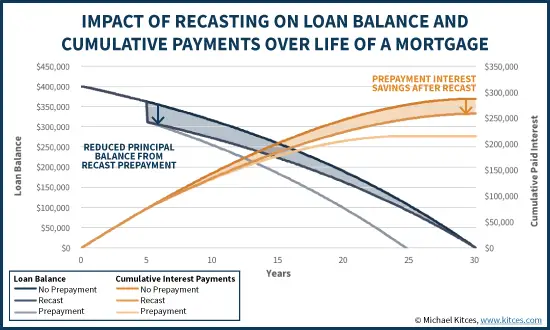

There are two ways to accomplish a major principal reduction: a recast where your monthly payment ends up lower over the same term, and an additional principal payment where your monthly payment ends up staying the same, but with a lower overall principal balance. Lets look at both of these alternatives.

For this example, lets assume a $200,000 initial loan balance on a 30-year fixed mortgage at a 4.99% interest rate. Lets say youve just freed up $40,000 you want to use toward paying off your mortgage. Different states may have slightly different lending fees that apply. Here, weve used Michigan as an example. You can check your own numbers using our amortization calculator.

Lets look at a recast scenario first.

|

With A Recast |

Recommended Reading: What Banks Look For When Applying For A Mortgage

When Youre About To Retire

Recasting can also be a popular option for people nearing retirement. If youre retiring in five years but have seven years left on your mortgage, you may not want to have to worry about it once you lose your labor income, says Green. Whereas refinancing could extend the amount of years left on your mortgage, recasting could help lower your monthly payments within the same term.

The less time you have left, the bigger the payoff. If you have only a couple years left, maybe five years, and you recast your mortgage, says Zoppi, you could drive down your payments considerably.

Is Mortgage Recast A Good Idea

Recasting your mortgage means that you can reduce your monthly payments, but the interest and terms remain the same. … For those who have extra cash and want to put extra payments toward their mortgage, recasting can be a great choice. Reach out to your lender to see whether or not you can qualify.

Don’t Miss: Does Bank Of America Do Mortgage Loans

What Happens When You Recast A Mortgage

When you recast your mortgage, you pay your lender a large sum toward your principal, and your loan is then reamortized in other words, recalculated based on your new, lower balance. Your interest rate and term stay the same, but because your principal has decreased, your monthly payments will be lower.

Recasting Vs Refinancing Your Mortgage

When trying to reduce your monthly payments, the majority of borrowers will need to decide between recasting or refinancing their existing home loan. While a mortgage recast may not always be an option, a mortgage refinance is a valid alternative, depending on where interest rates are.

Should You Recast Your Mortgage

There are key differences between recasting and refinancing a mortgage, even though both options can decrease your monthly payments. Recasting your loan is an easier process than refinancing because it only requires lender approval, a lump-sum payment and a processing fee. You’ll avoid credit checks or new underwriting, and the administrative fee will be significantly lower than the closing fees incurred through a refinance. You’ll also keep the original interest rate on your mortgage. Before recasting your mortgage, remember to consult with your tax preparer or CPA to determine the tax impact.

Here’s when you should consider recasting your mortgage.

Should You Refinance Your Mortgage Instead?

Refinancing will require you to apply for a new loan with a different structure, amortization schedule and interest rate. This requires a formal application and underwriting, and the lender will perform a new credit check. You’ll also need to pay the fees and closing costs associated with creating a new loan.

Here’s when you should consider refinancing your mortgage.

Also Check: Can You Refinance Mortgage Without A Job

How Do I Recast A Mortgage

If you’re thinking about a mortgage recast, first make sure that you have the right kind of loan. Only certain kinds of mortgages can be recast. Government-backed loans like FHA and VA mortgages cannot be recast, while conventional loans and nonconforming loans, like a jumbo mortgage, can only be recast on a case-by-case basis.

Here are your steps to recasting a mortgage:

Recasting Is Another Way Besides Refinancing To Save Money On Your Mortgage

Low mortgage rates in the past year have led to a surge of refinancing activity, but a refinance isnt the only option for reducing your mortgage payment.

Recasting your loan, while less common than a refinance, allows you to keep your mortgage terms, including your interest rate and length of the loan. Typically homeowners pay a lump sum to reduce their loan balance when they ask their lender to recast the loan. The monthly payments are recalculated based on the new lower balance, which shrinks the payments.

Recasting is far different from a refinance, says Matt Weaver, vice president of Cross Country Mortgage in Boca Raton, Fla. Theres typically little to no cost to recast your loan. Your interest rate doesnt change, and your note due date doesnt change. If your loan is a 30-year fixed-rate loan, its still a 30-year fixed-rate loan. The only things that change are your balance and your monthly payment.

For example, if you have a $400,000 loan balance and pay $75,000 to reduce the principal, youre recasting your loan to one with a $325,000 balance. The monthly payments with a 3.0 percent interest rate on a 30-year fixed-rate loan would drop from $1,686 to $1,370.

Weaver says that recasting is popular now because of the competitive housing market.

For example, Weaver says, many of his borrowers are moving to Florida from New York.

Also Check: How 10 Year Treasury Affect Mortgage Rates

Which Is Better: Recast Mortgage Vs Refinance

If youâre trying to decide between recasting of refinancing your mortgage, you need to decide what your financial goals are. Both of these mortgage products can result in lower monthly payments, but everything else about them is different. Recasting is straightforward, while refinancing gives borrowers a couple different options about what happens to their mortgage.

Refinancing a mortgage happens when you get a new mortgage to buy out your old one. Itâs a common option primarily for borrowers seeking to lower interest rates, shorten term lengths, or change other loan features, like going from an adjustable-rate mortgage to a fixed-rate one.

A refinance requires you to go through the hoops of applying for a mortgage all over again by getting a credit check and appraisal, since youâre getting an entirely new loan. If your financial standing has changed â for example, if your plunged or your loan-to-value-ratio has gone up â since you first took out the current mortgage, then you may have trouble getting a good deal when refinancing. A mortgage recast, on the other hand, doesnât require any financial assessment.

You can get a lower interest rate with a mortgage refinance, but you might pay more interest in the long run, since youâre restarting a loan term from scratch with a brand new mortgage. However, when mortgage rates are low, like they are now, refinancing can be worth it. Check out our weekly analysis of mortgage rates for more information.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Also Check: Can A Locked Mortgage Rate Be Changed

The Ascent’s Best Mortgage Refinance Lenders

Refinancing your mortgage could save you hundreds of dollars for your monthly mortgage payment and secure you tens of thousands of dollars in long-term savings. Our experts have reviewed the most popular mortgage refinance companies to find the best options. Some of our experts have even used these lenders themselves to cut their costs.

Who Is The Ideal Candidate For Recasting A Mortgage

Here are some conditions I think that if met, would make you an ideal candidate for recasting a mortgage.

- Needs to reduce monthly expenses.

- Does not have any better investment ideas for his or her cash.

- Does not want to go through the pain of refinancing a mortgage.

- Does not have a high enough credit score to refinance to a better rate.

- Does not want to pay expensive refinance fees.

- Does not qualify for a no-cost refinance.

- Has a mortgage on the smaller side , which makes refinancing cost-ineffective due to the fees.

- Is a more conservative investor who prefers to simplify life.

- Really likes his or her existing mortgage rate or cant qualify for a better one.

If I could rewind time, I still wouldnt recast any of my mortgages because Im all about trying to lower my mortgage rate to save money.

It would make no sense for me to recast my previous mortgage at 4.5% given I could refinance at 2.625%. To ensure that I dont spend 30 years paying off the mortgage, I plan on paying down about $80,000 in principal each year so that I have a zero balance by October 1, 2026.

Recommended Reading: How Do You Calculate Self Employed Income For A Mortgage

How To Modify Your Loan

Every lender has their own standards for loan modification. Most require you to apply with financial documentation that proves you need the modification. Some of these documents include:

- Proof of income: Your lender needs to know that you dont have enough income to cover your current mortgage. Proof of income can include a salary agreement or contract from your employer that states your hourly rate or annual income. Your lender might ask for a profit and loss balance if youre self-employed.

- Your most recent tax return: Your lender will likely need your entire tax return when you request a modification.

- Bank statements: Your lender might ask for bank statements to confirm your assets.

- A hardship statement: Your lender needs to know why you want a modification. Your hardship letter tells your lender why you can no longer make your monthly payments or pay for your entire loan balance. You may also want to include supplementary documentation along with your letter to further illustrate your situation. Things like medical bills or a termination letter from your previous employer can increase your chances of approval.

Contact your lender and ask how to apply if you think you qualify for a modification. Keep in mind that your lender may refuse your request. You may still qualify for a refinance if that happens to you.

Costs Much Less Than A Refinance

When you refinance a mortgage, youll incur closing costs. Those costs are very similar to what you paid when you took your original mortgage.

They typically run between 2% and 3% of the loan amount. If you have a $200,000 mortgage, that can result in between $4,000 and $6,000 in closing costs.

But with a mortgage recast, youll pay a fee of a few hundred dollars to complete the process.

That will not only avoid the need to pay the closing costs out-of-pocket, but also the common practice of adding those costs to the new mortgage.

Recommended Reading: Are Mortgage Discount Points Worth It

Cons Of Mortgage Recasting

Despite its perks, mortgage recasting isnt right for everyone. In some cases, an alternative such as refinancing might be a better fit.

- Mortgage recasting fee. When you recast your mortgage, youll have to pay a small fee, often around $250. While this is significantly less than the amount youd pay in closing costs to refinance a mortgage, its still something to consider.

- No reduced interest rate. When you refinance your mortgage, you often get the benefit of a lower mortgage interest rate, which can save you 10s or even hundreds of thousands over the life of the loan. Recasting doesnt lower your interest rate it only reduces the principal balance that accrues interest.

- No shortened loan term. Mortgage recasting doesnt shorten your loan term. If you had 20 years left on your loan, you still have 20 years left after recasting. However, your new lower monthly payment leaves more money available in your budget, so it may be easier to pay your mortgage off early.

- Not available for all mortgages. Not everyone is eligible to recast their mortgage. Government-backed loans such as FHA loans and VA loans generally arent eligible. However, those mortgages are eligible for refinancing, so homeowners with those types of home loans may consider that instead.

Personal Loans 101

Alternatives To Mortgage Loan Recasting

If your goal is to use a lump sum of money in the wisest possible way, mortgage loan recasting is only one option. Here are others worth consideration:

- Pay a little extra toward your mortgage principal each month. It won’t lower your monthly obligations immediately but will help you retire the debt earlier and can save thousands in interest payments.

- Refinance your mortgage by taking out a new loan to pay off the old one. Refinancing may be your best option if the current interest rate you qualify for is lower than your original rate. While mortgage loan recasting simply recalculates your payment based on the new, lower principal amount, refinancing is a lot like taking out a new mortgage. You may be required to pay application, credit, origination, flood certification, title search, and recording fees. You will also be required to have a new home appraisal, and possibly another home inspection. Again, if you have a good relationship with your current lender, check their interest rate as you rate shop. Use our mortgage interest calculator to see how a change in interest rates may impact your monthly payment.

- Use the money to invest in the stock market. This could provide a higher rate of return in the long run.

- Build an emergency fund with enough money to pay three to six months’ worth of bills. That way you know you have cash in reserve to get you over any future bumps in the road and can focus on other, more important things.

Also Check: Is 720 A Good Credit Score For Mortgage