The Trusted Name In Personal Finance

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information youre reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Getting Started With Calculating Your Mortgage

People tend to focus on the monthly payment, but there are other important features that you can use to analyze your mortgage, such as:

- Comparing the monthly payment for several different home loans

- Figuring how much you pay in interest monthly, and over the life of the loan

- Tallying how much you actually pay off over the life of the loan, versus the principal borrowed, to see how much you actually paid extra

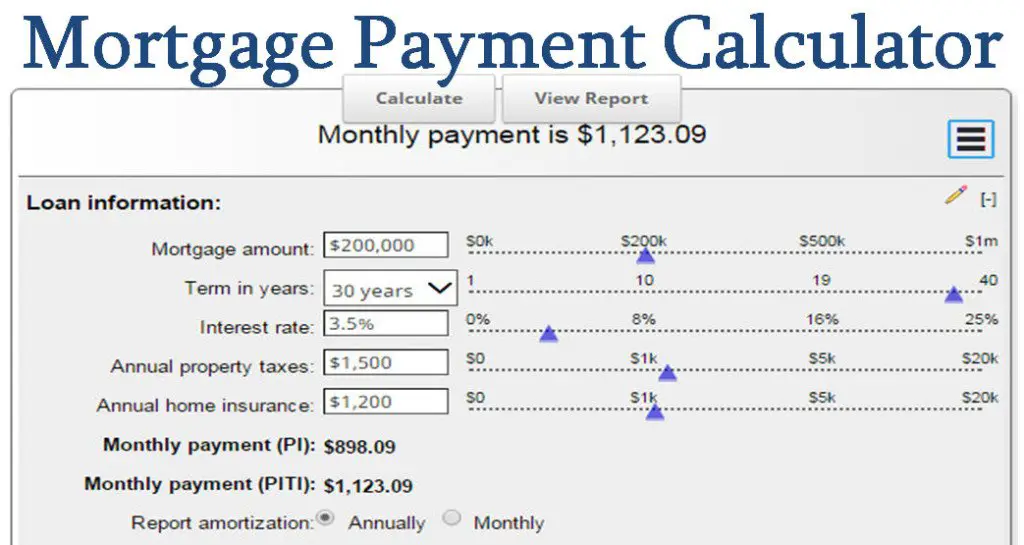

Use the mortgage calculator below to get a sense of what your monthly mortgage payment could end up being,

How To Use Our Mortgage Payment Calculator

The first step to determining what youll pay each month is providing background information about your prospective home and mortgage. There are three fields to fill in: home price, down payment and mortgage interest rate. In the dropdown box, choose your loan term. Dont worry if you dont have exact numbers to work with – use your best guess. The numbers can always be adjusted later.

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable.

Don’t Miss: Can You Refinance Mortgage Without A Job

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

How A Larger Down Payment Impacts Monthly Payments*

| Percentage | |

|---|---|

| $200,000 | $1,005 |

*The payment is principal and interest only. To get the total monthly payment for down payments below 20%, add in your property taxes, homeowners insurance and private mortgage insurance .

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate.

Recommended Reading: Can A Locked Mortgage Rate Be Changed

Mortgage Payment Calculator: Find Out How Much Youll Pay

Our goal is to give you the tools and confidence you need to improve your finances. Although we receive compensation from our partner lenders, whom we will always identify, all opinions are our own. Credible Operations, Inc. NMLS # 1681276, is referred to here as “Credible.”

A loan payment calculator like the one below can help you gauge the costs of your mortgage both monthly and over the entire life of your loan. It can also help inform your homebuying decision, guiding you toward the right price range, as well as helping you understand how much you might need to save and budget for before making your move.

Enter your loan information to calculate how much you could pay

With a$ home loan, you will pay$ monthly and a total of$ in interest over the life of your loan. You will pay a total of$ over the life of the mortgage.

Need a home loan? Credible makes getting a mortgage easy. It only takes 3 minutes to see if you qualify for an instant streamlined pre-approval letter.

Checking rates won’t affect your credit score

Calculations For Different Loans

The calculation you use depends on the type of loan you have. Most home loans are standard fixed-rate loans. For example, standard 30-year or 15-year mortgages keep the same interest rate and monthly payment for their duration.

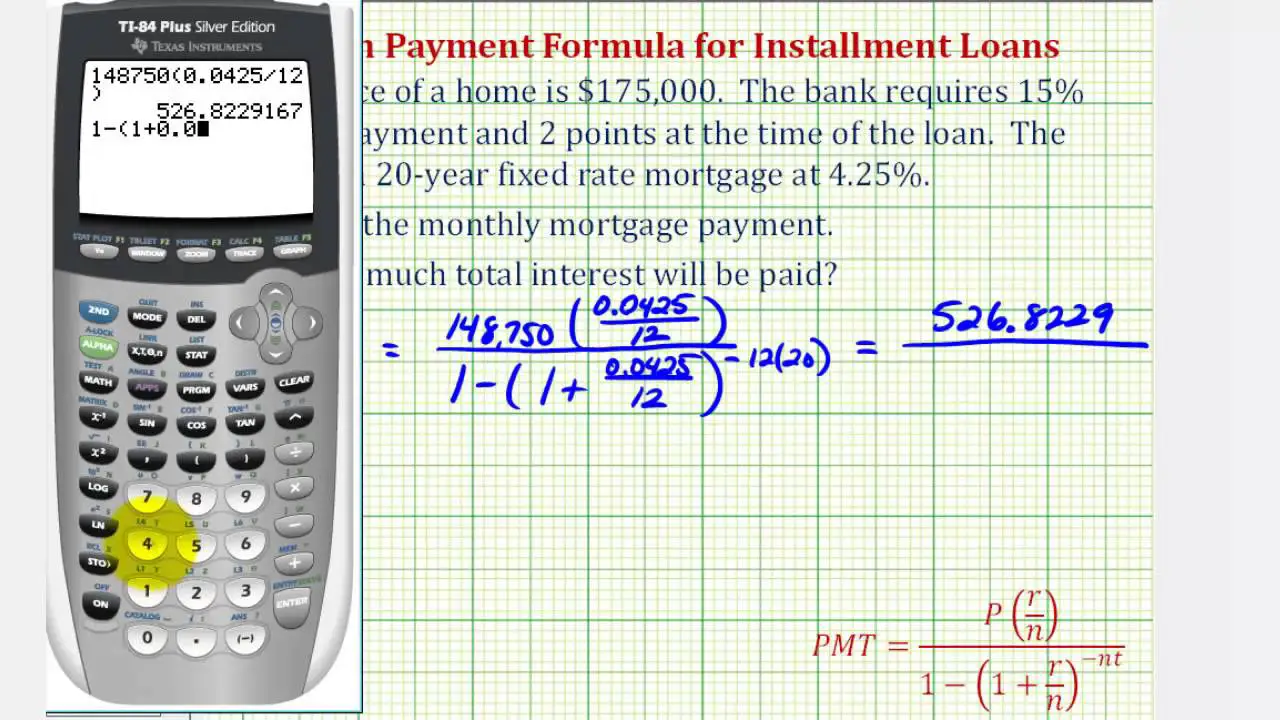

For these fixed loans, use the formula below to calculate the payment. Note that the carat indicates that youre raising a number to the power indicated after the carat.

Payment = P x x ^n] / ^n – 1

Recommended Reading: Are Mortgage Discount Points Worth It

Fixed & Variable Rates

The standard variable rate is the basic interest rate lenders use for mortgages. Each lender sets their default SVR. Its the default rate mortgages revert to after the introductory period of a loan, which is usually 2 to 5 years. SVR mortgages usually have higher interest rates than other mortgage options.

Standard variable rates move based on fluctuations in the Bank of England base rate. When rates reset higher, borrowers must be prepared to make higher monthly payments. To avoid reverting to the SVR, borrowers would remortgage to a new deal with a favourable rate.

In recent years, standard variable rates have been on the rise. Because of this, many consumers find fixed-rate mortgage options more attractive. According to the Bank of England, since 2016, fixed-rate options are more preferred by borrowers, especially first-time homebuyers.

In the third quarter of 2020, 91.2% of all mortgages used fixed-rate loans. The average fixed-rate mortgage was priced at 1.91%. In contrast, the average variable rate mortgage was priced at 1.85%, bringing the overall market average to 1.91%.

What is a Fixed Rate?

The UK government provides subsidy programs in Help to Buy and Help to Buy London. These government schemes offer mortgage deposit assistance. However, few lenders in the UK provide loans which have fixed rates extending beyond 5 years.

Which Loans Structures Do Most Buyers Prefer?

Only 1 in 50 mortgages come with a fixed rate longer than 5 years.

How Does A Mortgage Work

A mortgage is a secured loan that is collateralized by the home it is financing. This means that the lender will have a lien on your home until the mortgage is paid in full. After closing, youll make monthly paymentswhich covers principal, interest, taxes and insurance. If you default on the mortgage, the bank will have the ability to foreclose on the property.

Also Check: How 10 Year Treasury Affect Mortgage Rates

Monthly Principal & Interest

The principal is the amount of money borrowed on a loan. The interest is the charge paid for borrowing money. Principal and interest account for the majority of your mortgage payment, which may also include escrow payments for property taxes, homeowners insurance, mortgage insurance and any other costs that are paid monthly, or fees that may come due.

Home Down Payment: When Bigger Isnt Better

While making a larger down payment offers many benefits, its not always the right decision. In general:

- Dont deplete your emergency savings to increase your down payment. Youre leaving yourself vulnerable to financial emergencies.

- Its not wise to put savings toward a larger down payment if youre carrying high-interest debt like credit cards. Youll make yourself safer and pay less interest by reducing debt before saving a down payment.

- Putting off buying a home for many years to save a large down payment can be a mistake. While youre saving your down payment, the price of that house is probably going up. While appreciation is not guaranteed, home prices in the U.S. have historically increased each year.

The size of your mortgage down payment is obviously a very personal decision. Tools like Bankrates affordability calculator or down payment calculator can help you determine the right amount for you, and so can a trusted mortgage professional. Ultimately, the decision comes down to your desire, your discipline and your resources.

Also Check: Is Closing Cost Part Of Mortgage

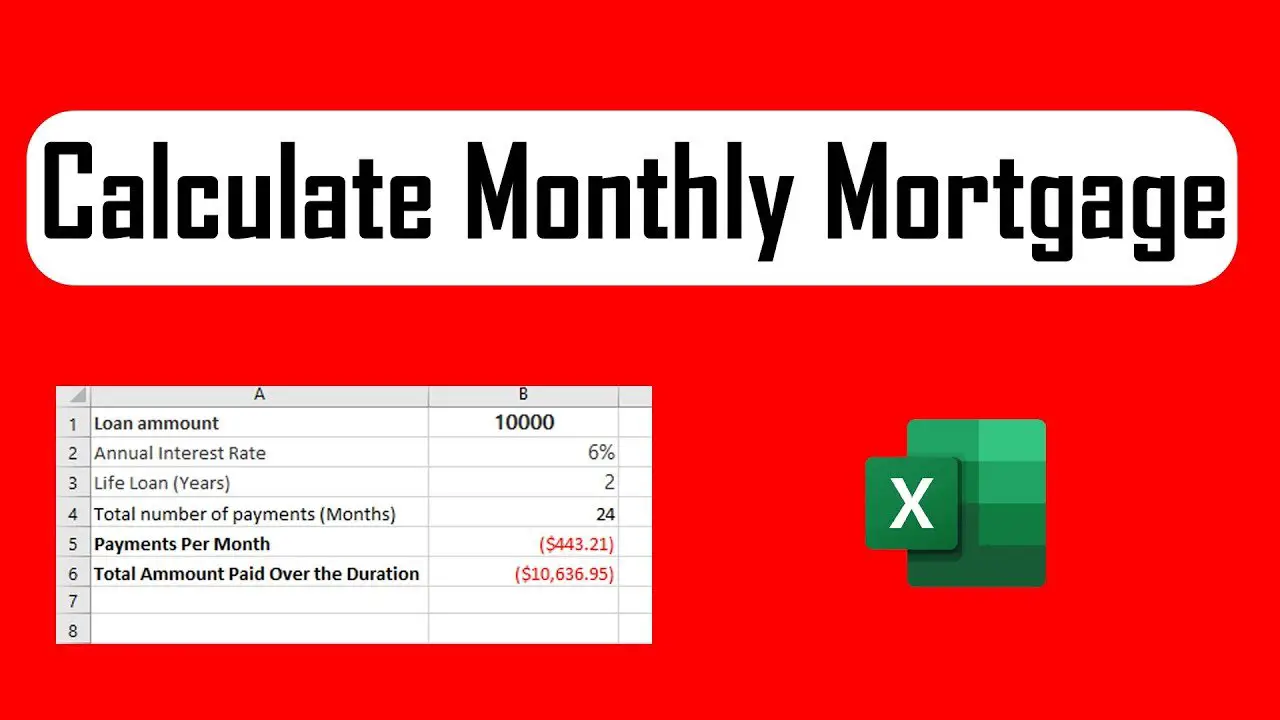

How Do I Calculate My Mortgage Payment

There are two ways to go about calculating a monthly mortgage payment. You can go old school and figure it out using a fairly complicated equation, or you can use a mortgage payment calculator. Either way, youll need to know several variables, so lets run through these.

- Loan Amount: If youre buying a home, youll want to put in the price of the homes youre looking at and subtract your down payment. If youre far enough along, you may be able to also add any costs being built into the balance. For a refi, include the expected balance after you close.

- Interest Rate: You want to look at the base rate and not the annual percentage rate . You use the lower base interest rate because your monthly payment doesnt contemplate closing costs. Knowing APR is still useful, but its more in the context of the overall cost of the loan as opposed to monthly expenses.

- Term: This is how long you have to pay the loan off. Longer terms mean smaller payments, but more interest paid. Shorter terms have the opposite properties.

- Property Taxes: Since property taxes are often built into your mortgage payment, having a fairly accurate estimate will help you get a better picture of cost. Regardless of whether you have an escrow account, these need to be accounted for as a cost of ownership.

What You Can Learn From A Mortgage Loan Payment Calculator

With a mortgage loan payment calculator, you can determine:

- Your monthly payment

- The total cost of your loan over time

- The total amount of interest youll pay to borrow the money

This can help you make a smarter, more informed decision for your finances.

Mortgage loan payment calculators arent just for homebuyers, either. You can use one when considering a home equity loan, HELOC, or refinance to help gauge your options and calculate your costs.

Tip:

Learn More: Mortgage Points: What Are They and Are They Worth It?

Don’t Miss: How To Purchase A House That Has A Reverse Mortgage

How To Calculate Your Monthly Mortgage Payment

You can calculate your monthly mortgage payments using the following formula:

M = P /

In order to find your monthly payment amount “M,” you need to plug in the following three numbers from your loan:

- P = Principal amount

- I = Interest rate on the mortgage

- N = Number of periods

A good way to remember the inputs for this formula is the acronym PIN, which you need to “unlock” your monthly payment amount. If you know your principal, interest rate and number of periods, you can calculate both the monthly mortgage payment and the total cost of the loan. Note that the formula only gives you the monthly costs of principal and interest, so you’ll need to add other expenses like taxes and insurance afterward.

Also keep in mind that most lender quotes provide rates and term information in annual terms. Since the goal of this formula is to calculate the monthly payment amount, the interest rate “I” and the number of periods “N” must be converted into a monthly format. This means that you must convert your variables through the following steps:

Example

N = 30 years X 12 months = 360

What If The Math Still Doesn’t Add Up

If these two steps made you break out in stress sweats, allow us to introduce to you our third and final step: use an online loanpayment calculator. You just need to make sure you’re plugging the right numbers into the right spots. The Balance offers for calculating amortized loans. This loan calculator from Calculator.net can do the heavy lifting for you or your calculator, but knowing how the math breaks down throughout your loan term makes you a more informed consumer.

Recommended Reading: Can You Get A Reverse Mortgage On A Manufactured Home

Calculate Your Monthly Payment By Hand

You can calculate your monthly mortgage payment, not including taxes and insurance, using the following equation:

M = P /

P = principal loan amount

i = monthly interest rate

n = number of months required to repay the loan

Once you calculate M , you can add in the monthly property tax and homeowners insurance premium, if you have them. These are fixed costs that aren’t determined by how much you borrow from the bank, so they can easily be added to the monthly cost.

How To Calculate Your Mortgage

You may be thinking about purchasing a house or refinancing the one youre already in. This decision brings with it a number of questions. What kind of interest rate can I get? What kind of payment should I expect? How much money can I save by paying off the loan before the end of the term?

In this post, well show you how to calculate your mortgage payment and break down the formula for you. Well also show you how the variables that go into the equation work so that you can figure out how different moves you make might save you money and help you better plan for the future.

There are also several different types of mortgage calculators that can be used to help you game out various scenarios. Well walk you through different calculators and their uses.

Don’t Miss: How Do You Calculate Self Employed Income For A Mortgage

What You Need To Qualify For A 15

The primary difference between qualifying for a 15-year versus a 30-year mortgage is that for the former, your lender has to make sure you can afford larger monthly payments, and usually that means having a higher income and a lower debt-to-income ratio.

If your DTI ratio is on the higher side, you can work to increase your income or pay down your debt. Some ways you can pay down debt include:

Have A Down Payment Of 20% Or More Ready

The most clear-cut and straightforward way to avoid paying PMI is to have a 20% down payment for your home ready to go from day 1. Remember to take the market conditions into account before bidding on a home. If it’s a seller’s market, you’ll likely need to come in over the asking price, and that 20% number can rise quickly. Be sure to leave yourself some wiggle room and don’t overreach.

Is Your Mortgage Payment Calculator Free

Yes, our mortgage payment calculator is free. In fact, all of our calculators, articles, and rate comparison tables are free. Ratehub.ca earns revenue through advertising and commission, rather than by charging users. We promote the lowest rates in each province offered by brokers, and allow them to reach customers online.

What Is Your Dti Or Debt

Your debt-to-income ratio indicates how much of your income is accounted for by debt like credit cards and student loans.

Mortgage lenders use your DTI to determine what sort of monthly payment you can comfortably afford. In general, they want to see a DTI of 43% or less, though it can be higher or lower depending on the lender and loan product.

For example:

$600 + $400 = $1,000

$1,000 is 20% of $5,000

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.