Con : Your Payment Isnt Applied As You Pay

Even though the payment is withdrawn from your bank account twice a month, it isnt applied to your mortgage that way. Your mortgage servicer holds the payment and applies it once a full monthly payment is received. The biweekly payment just forces an extra payment at the end of each year. If youd rather save and contribute that extra payment yourself, you dont have to change to a biweekly plan. Youll just have to check your mortgage agreements to ensure you wont be penalized for paying the loan off early.

Compare Mortgage Agreements Closely Before You Sign The Dotted Line

Buying a home is one of the most expensive long term purchases you will make in your lifetime. So it’s most important to know your options and choose the loan that best fits your situation.

While there are many places to get your loan, there are basically two main types of loans to consider: Fixed Rate and Adjustable Rate Mortgages . Fixed rate mortgages are loans where the interest rate remains the same throughout the life of the loan. Your principal and interest payments are the same each month so you know what to expect. You will not have to worry about the market and fluctuations in interest rates. Your rate would be fixed. This is a good option especially if you intend to remain in your house more than just a few years.

Adjustable Rate Mortgages are the opposite of fixed rate mortgages. The interest rate adjusts just as the name implies. The rate will change annually according to the market after the initial period. One year ARMs used to be the standard, but the market has now produced ARMs called hybrids which combine a longer fixed period with an adjustable period. The initial period can be three years , five years , seven years or ten years . So a 5/1 ARM means that during the initial period of 5 years, the interest rate is fixed and thereafter will adjust once a year.

Things To Keep In Mind

Remember to check with your mortgage servicer to see whether it offers the option to pay more than once per month and whether it charges any fees to set up additional payments or issues a prepayment fee.

If you cant set up biweekly or twice-monthly payments, but you can afford to pay a little more each month, consider dividing the amount of your monthly payment by 12 and add that 1/12 amount as an extra payment marked apply to principal if your lender offers this option. This means it can be put toward the principal of the loan and not the compounding interest. At the end of the year, youll get credit for a full extra monthly payment, which can reduce your total loan repayment term.

You May Like: How To Calculate Rental Income For Mortgage Loan

How To Make Biweekly Mortgage Payments

To start biweekly payments, you can choose a day between the 1st and 14th of the month. This way, you can guarantee that every 14 days following, half of a mortgage payment will be withdrawn from your bank account. You also dont have to worry about sending a check each month, as biweekly payments can be automatically withdrawn from your account.

If youre a current Rocket Mortgage client, you can start making biweekly payments by signing into your account and adjusting your payment program. In fact, signing up for biweekly payments through Rocket Mortgage is completely free no extra fees involved.

Other Ways To Save Money On Your Loan

If you have built up sizeable savings then applying a portion of your savings to your mortgage will permanently lower your interest cost by lowering the principal balance you are charged interest on. If your loan was made during a period of higher mortgage rates, it might also make sense to refinance your loan at a lower rate & perhaps over a shorter duration of time. The following table highlights local rate information.

Also Check: Can You Sell A House With A Mortgage On It

Today’s Best Mortgage Rates

Our rate table lists the best current local mortgage rates available from our lender network. Set your search criteria by entering your loan data and selecting the relevant products from the dropdown, click search and we’ll help you compare the market by showing you the most relevant offers for homeowners.

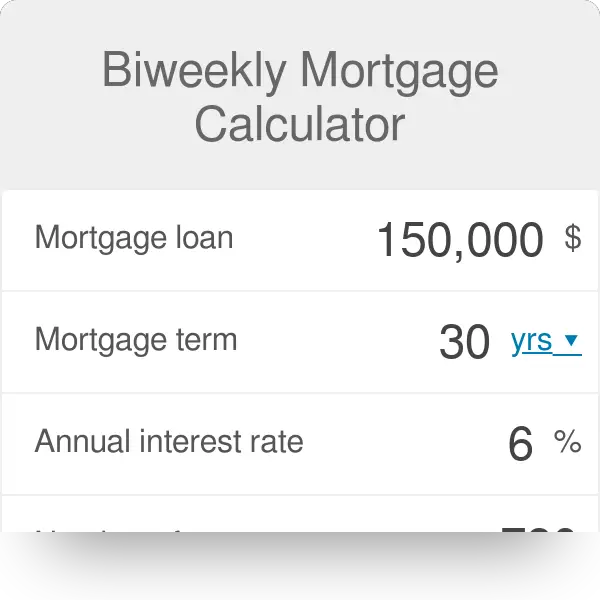

Biweekly Mortgage Payment Example

Let’s say you got a $400,000 mortgage with a 7% interest rate and 30-year repayment terms. That means your mortgage payments would be $2,661 per month.

If you continue making your payments at this pace, you’ll pay $558,216 in interest by the time the loan is paid off.

Instead, you can make biweekly payments of $1,330.50 every other week. You’ll pay $418,285 in interest and will pay off the loan six years earlier. By making one additional payment per year, you’ll save yourself $139,931 in interest payments.

Don’t Miss: What Documents Are Needed For Mortgage Pre Approval

How To Set Up Your Own Biweekly Payments Schedule

If youre facing fees for getting on a biweekly payments schedule, you can do it yourself without involving the lender or a third party at all. Heres how:

Step 1 Divide your monthly payment by 12.

Step 2 Put that much money in a savings account each month and continue making your monthly payments normally.

Step 3 At the end of the year, make one extra principal-only payment in full with the money you saved.

Then you will have made the equivalent of 13 monthly payments all without needing to get on a special payment plan.

How Do Mortgage Payments Work

When you take out a mortgage, youre borrowing money to buy or refinance a home. You make regular payments to repay this loan, usually monthly. The amount you borrow is the loan principal.

With each payment you make, you’ll be paying off part of the principal amount and part of the interest. The interest is what the lender charges for loaning you money to buy a house.

Depending on the type of mortgage you have, your payments are usually consistent in amount and made monthly. In the beginning, the majority of your payments will be used to pay off the interest on your loan. As this amount reduces, more and more of your payments will start applying to the principal the actual amount you borrowed. This means that for the first few years of your loan, your payments are focused on paying off interest rather than principal.

If you apply additional payments to your principal to bring the amount down, the interest paid on the balance goes down as well because interest is calculated based on the principal balance. The goal for anyone looking to make additional payments on their mortgage should be paying down as much of the principal as possible.

Recommended Reading: Is Quicken Loans Same As Rocket Mortgage

How Do You Make Bi

When you close your mortgage each mortgage company will have a different payment option for you to use. Some banks will offer the bi-weekly payments and others wont. So make sure to check with your lender. Sometimes there are third party companies that will offer to set it up for you outside of your mortgage lender, so you can also look into that as well. Typically they will charge a fee, but it helps put it on autopilot so that you dont have to manually make them. Lastly check with your bank. Some banks offer the ability to setup automatic payments to third parties, like your mortgage lender. The key though in any scenario is that you have to check and make sure, and this is the most important factor, that your additional payments get added directly toward principal.

A Glance At Your Loan Options

After choosing either a fixed rate mortgage or an ARM, you will also need decide which loan product is right for you. Each has different requirements, so click on the links to get full details.

Conventional Fixed-rate & ARM Mortgages

Conventional loans are those that are not backed directly by any government agency . Qualifying typically requires a significant down payments and good credit scores. Rates can be fixed or adjustable. Most homebuyers choose the 30-year fixed loan structure. We offer a calculator which makes it easy to compare fixed vs ARM loans side-by-side. Conforming loans have a price limit set annually with high-cost areas capped at 150% of the base cap. The limit for single family homes in 2022 is $647,200. This limit goes up to $970,800 in high cost areas.

Jumbo Mortgages

Jumbo loans are those above the conforming limit and are more difficult to qualify for and usually have higher interest rates. While most conforming loans are structured as 30-year fixed loans, ARMs are quite popular for jumbo loans.

FHA Loans

FHA loans are loans insured by the federal government. They require low down payments of 3.5% and low closing costs. Many first-time homebuyers and buyers with poor credit scores choose FHA loans. Learn more at the FHA.

VA Loans

USDA Loans

USDA loans are backed by the United States Department of Agriculture. These loans are available in rural areas and allow no downpayment.

Balloon Loans

Interest Only Loans

You May Like: Can You Get Reverse Mortgage With Bad Credit

How Biweekly Mortgage Payments Work

On a standard, 30-year mortgage loan, the typical repayment arrangement is to pay once a month, every month, for 30 years. Biweekly mortgage payments mean you pay every other week instead of just once each month.

Since there are 52 weeks in a year, 26 biweekly payments mean you make 13 monthly payments each year instead of the standard 12. This one extra payment substantially shortens the lifespan of the loan and reduces the amount of total interest youll pay.

For example, say you have a $300,000 home loan with a 4% interest rate. Your mortgage payment is $1,432.25, and you decide to make one additional monthly payment each year . Thisll shorten the payoff on a 30-year mortgage by five years and save you over $35,000 in interest over the life of the loan.

How High Can The Rates Go

You are not in the dark about rate increases with an ARM. Each loan has set caps that govern how high or low the interest rate can increase or decrease for the life of the loan. Caps are also in place for each adjustment period after the initial fixed period. These terms will be clearly stated in the loan paperwork. Don’t hesitate to ask the lender questions about interest rates, caps, initial period, etc. so you will fully understand what you are undertaking.

You May Like: What Is Current Interest Rate On 15 Year Mortgage

How The Regular Mortgage Repayment Costs You Money

The typical mortgage asks for one payment per month, which equals 12 payments per year. So youd pay 360 payments over a 30-year period to zero out your mortgage balance.

Each mortgage payment has an interest portion and a principal portion. The interest part goes to your lender to cover the monthly interest on your remaining balance. The principal part goes toward actually reducing that balance.

As you pay down your balance, the interest cost diminishes. That leaves more of your payment for reducing your balance. Its like a snowball your balance is lower, so your interest is lower, and every month, your balance goes down faster.

This repayment schedule is the reason why during the first five years or so, your loans balance goes down only a little. But later, it drops dramatically. The technical term for this repayment schedule is amortization .

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Is Mortgage Insurance The Same As Pmi

The Benefits Of Paying Your Mortgage Biweekly

On top of paying your mortgage in half payments, biweekly mortgages offer a number of additional benefits that make this repayment strategy worth considering. Below are some of the biggest pros that you can enjoy if you start paying your mortgage every other week.

Pay Off Your Home Quicker

That extra payment every year goes a long way in the life of your loan. It can actually cut years off of your repayment timeline if youre making an extra payment every year by switching to a biweekly payment program, youre building equity in your home quicker than when you were making monthly payments, effectively paying your home off faster.

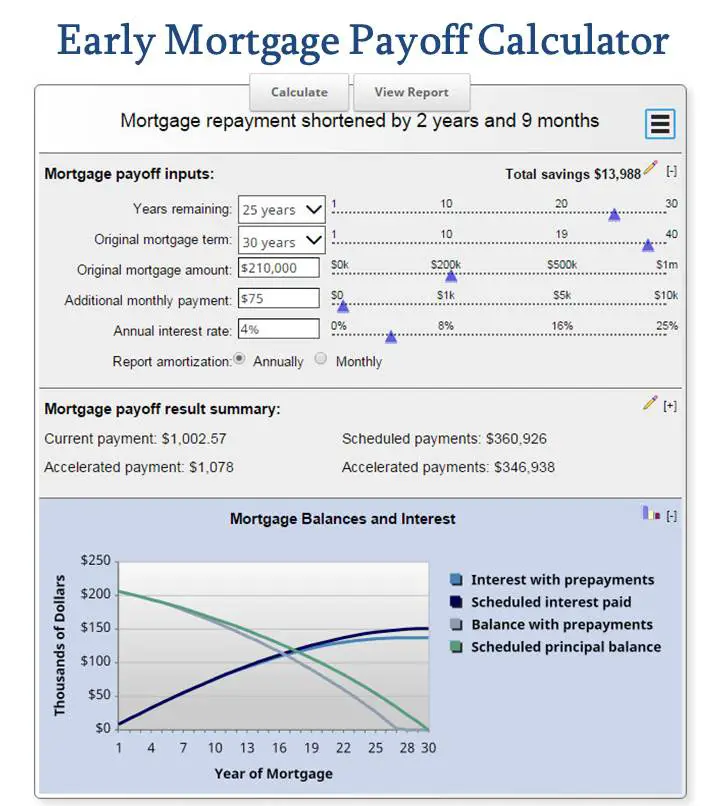

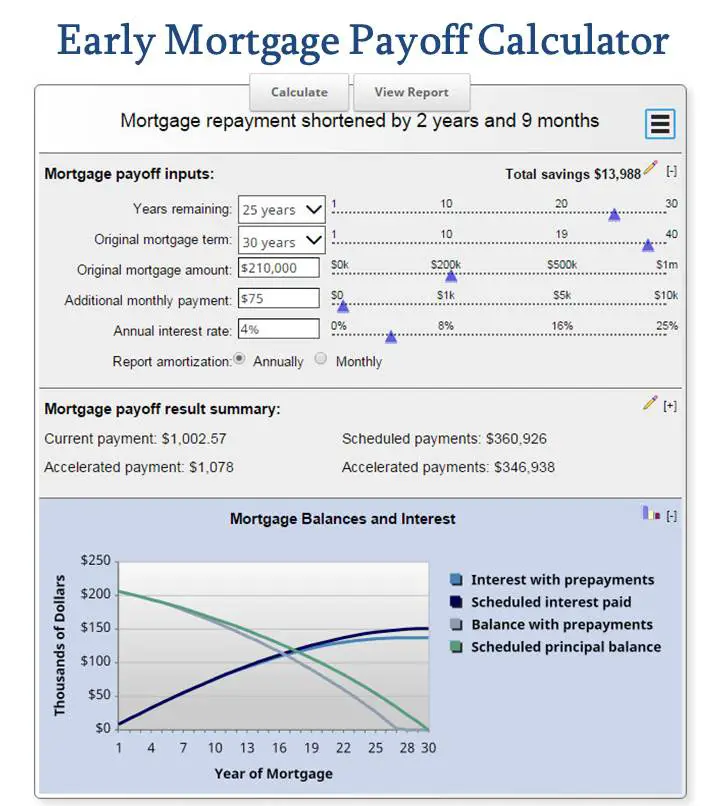

Lets put some numbers to this scenario. Say your loan is $200,000 on a 30-year fixed-rate mortgage with a 4.125% interest rate. Well take a look at it from both a monthly and biweekly payment perspective.

Biweekly payments mean you pay off your loan 4 years and 3 months early by making the equivalent of one extra payment per year.

Save Thousands

Not only will switching to biweekly payments save you time on the life of your loan, but it can also save thousands in payments and interest.

Lets continue with that same scenario of a $200,000 loan amount. By switching to a biweekly payment program, you can see in the table above that you save more than $24,000 in interest over the life of your loan.

Want to see your savings for yourself? Check out our amortization calculator and see how much you can save.

Things To Watch Out For

Making biweekly payments is a handy tool, but be careful of scams or special programs that claim they can do this for you. Some companies offer to convert your monthly mortgage payment into biweekly payments for a one-time fee. Avoid those offers. It shouldnt cost you anything to make extra payments on your loan.

Make sure that making biweekly payments fits your budget. If youre typically paid once per month, you might be used to paying all of your bills at once instead of spreading them out. If youre paid weekly, make sure that youre holding enough cash in reserve each week to make your next biweekly payment once it comes due.

Finally, make sure there isnt a penalty for prepaying your mortgage. Most mortgages these days do not have a prepayment penalty, but there are still some out there that will penalize you for trying to pay off your mortgage early. Just be sure that you wont be doing more harm than good by making extra biweekly payments.

You May Like: What Is The Interest Rate To Refinance A Mortgage

Read Also: How Are Mortgage Rates Trending

Consider Your Other Debts

Lets say your mortgage interest rate is 4% and your other debts include an auto loan at 2%, a student loan at 6% and a at 16%. Putting extra money toward your mortgage wont save you as much as putting extra money toward your student loan or credit card which have higher interest rates. Retiring those debts faster will likely have a greater financial benefit in the near term.

Saving Money On Homeownership

In addition to saving money on your mortgage, there are a large number of ways to save money as a homeowner. Whether these methods are used to put more money in your pocket each month or to free up additional funds to pay off your mortgage faster, they are worth looking into.

Have a licensed inspector inspect your home before you move in. By having your home inspected before you buy it, you can save yourself the trouble and hassle of buying a home with a number of problems you may not know to look for. Home inspectors can let you know if home wiring is out of date, if the roof desperately needs replacing, if the home foundation is cracking or if there are carpenter ants in the walls.

Keep up on home maintenance.Homes required a lot of upkeep. Gutters need cleared out, furnace filters need changed and drier vents need cleaned. Procrastinating on routine home maintenance tasks can end up causing you many expensive problems later on. It is much easier and cheaper to simply keep up with home maintenance from the time you move in.

Recommended Reading: When Will Home Mortgage Rates Go Up

How Smart Are Biweekly Payment Plans

Biweekly plans will save you a lot of interest over the life of your loan, but its only a smart move if the extra payments work for you. Youre essentially paying the equivalent of one additional mortgage payment each year, so you should be sure you can budget for that. Its also smart to compare your interest savings to what you could potentially earn by investing that extra payment instead.

Types Of Mortgage Payments

Your mortgage payment consists of two parts: the principal and the interest. The payment frequency you choose will impact the amount of time itll take for you to fully pay off your principal, as well as the amount of interest youll end up paying. You can select from five different payment frequencies:

- Accelerated Weekly

Monthly

The most common way of paying a mortgage is with monthly payments. Under this method, youll make a single payment every month, usually on the 1st, for a total of 12 payments per year. For example, if your mortgage payment is $1,200 per month, youll pay $14,400 in total over a year.

Though paying once a month is convenient for many homebuyers, a major drawback is the large amount of interest that accrues between payments. Following a monthly payment schedule is also the slowest way to pay off your mortgage.

Bi-Weekly

Bi-weekly payment schedules are quite prevalent. Many homeowners receive a paycheque twice a month, so using this payment plan allows them to time their incoming cash flow with their mortgage payment. Bi-weekly payment schedules are determined by multiplying your monthly mortgage payment by 12 and then dividing by 26. Youll make a total of 26 payments per year under this payment method. Using the previous example, this means youll pay $553.85 every two weeks. At the end of the year, your total payments still add up to $14,400.

Weekly

Recommended Reading: What Mortgage Could I Get