When The New Item Is An Improvement On The Old Asset

If the new item is an improvement on the old item, for example replacing a sofa with a sofa bed, you can only claim a deduction for the cost of buying an item the same as the original. For example, if a new sofa costs £400 but a sofa bed costs £550, you can only claim the £400 as a deduction and no relief is available for the £150.

A new item is an improvement when:

- its not the same or substantially the same as the old item

- the functionally has changed

- you upgrade the quality or material of the item

If the replacement item is a reasonable modern equivalent, for example a fridge with improved energy efficient rating compared to the old fridge, this is not an improvement and the full cost of the new item is eligible for relief.

How To Report Your Taxable Profits

You must contact HMRC if you have taxable profits from the property you rent.

If you have not told us about your property rental, you need to do so by 5 October following the tax year you had taxable rental profits.

If youre also employed and your rental profits are small enough, you can ask us to deal with your profits by adjusting your PAYE code.

You must report your profits on a Self Assessment tax return if we ask you to. Were likely to do this if your income is:

- more than £2,500 after allowable expenses

- £10,000 or more before allowable expenses

Whether you need to fill in a tax return will depend on:

- the total rent you get and the profit you make

- any other income youve had or may get, for example, from employment or pensions

If we ask you to send a tax return you must give details of your rental income and expenses for the tax year even if you have no tax to pay.

If you have had property income youve not told us about, use the let property campaign.

Is Rent To Buy And Vendor Finance Available

, wrap strategies and rent to buy schemes have become increasingly popular in recent years, particularly with investors that follow Steve McKnight or other popular property investment writers.

One of the biggest problems that these investors have is that as their portfolio grows, banks begin to say that these investors cannot afford their level of debt, even though in actuality most of the properties are positively geared!

This problem stems from the way lenders assess loans. For more information or to apply for a mortgage, please contact us on 1300 889 743 or complete our today!

Don’t Miss: Rocket Mortgage Vs Bank

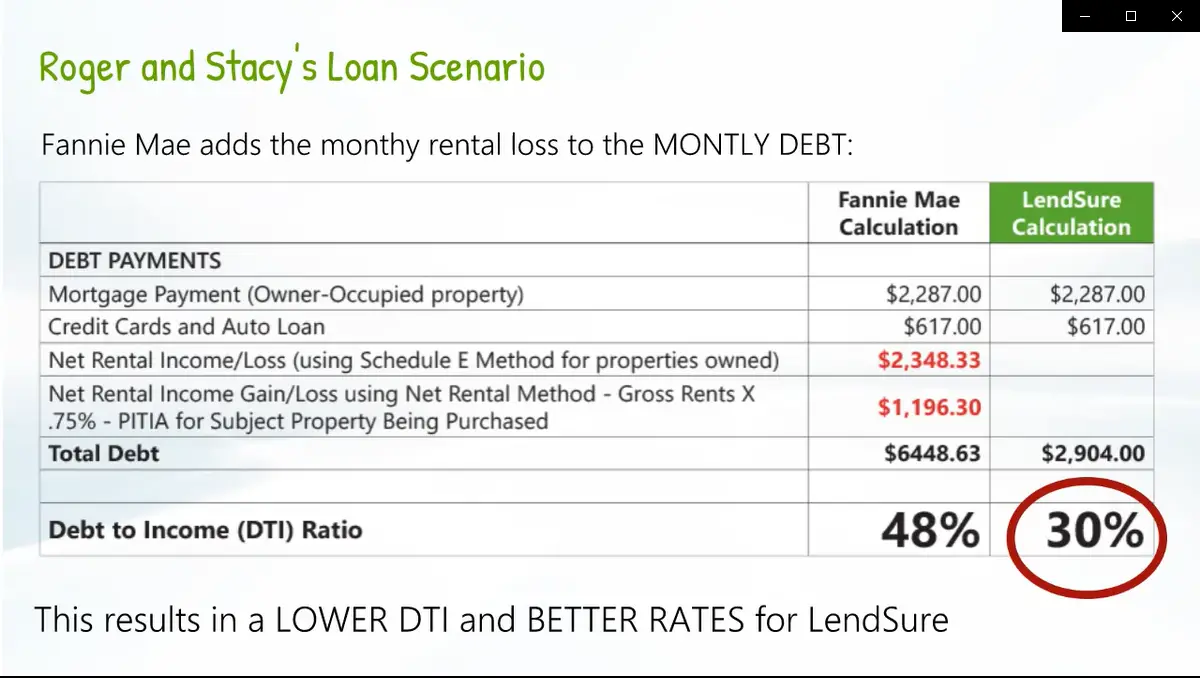

Debt To Income Ratio And Rental Income

The debt to income ratio is a ratio a lender will use to ascertain if a borrower can qualify for a mortgage and if they are likely to continue with the application for a loan.

The debt to income ratio, also written as DTI, is a significant factor in qualifying for a loan and in knowing if a to-be borrower can afford such a mortgage.

The debt to income ratio helps to compare the minimum monthly payments you owe on recurring debts. Recurring debts like auto loans and credit cards, to your gross monthly income.

How To Count Rental Income On A House Your Moving From

We frequently have clients that want to keep their current home as a rental while having the luxury of purchasing a new one. We are going to dive into some of the requirements on how to count this new rental income on your loan approval without having any prior renters on the property. You might have even spoken with a lender that denied you on this exact situation or telling you to sell the home if your debt-ratio was to high this is possible incorrect advice.

Oftentimes if there is a mortgage payment on the property clients can run into debt-to-income ratio problems. This basically means youre carrying to much debt compared to your gross income. Im going to break down some basic items to count this new income.

Departure of Current Residence

When converting a primary residence to an investment property we will use 75% of gross rental income as stated on the lease as evidence of rental income to offset the payment if the following conditions are met:

- The rental income must be documented with a copy of the fully executed lease agreement

- The receipt of a security deposit from the tenant and deposit into the borrowers account or held in escrow by the settlement agent

- Meet the minimum reserve requirement this can fluctuate depending on your loan type

For more information about our loans, their benefits and loan options and how it may apply to you, please contact us direct at 281-627-4222 or submit the quick quote form on this page.

You May Like: Chase Recast Mortgage

What Documentation Does The Va Require To Show Evidence Of My Rental Income Earnings

VA loan rental income documentation requirements depend on the rental history of the property.

If you are using income from a separate property you already own, you will need to provide income tax returns from the past two years, including Schedule E.

If you are using income from the subject property or from another property you have owned for less than two years, you will need to provide a signed lease. And if you dont have a signed lease yet, you will need a rental appraisal completed by a licensed appraiser.

While qualifying for a VA loan with rental income is possible, the process can be confusing. Make sure youre working with a lender who has experience using rental income for VA loans.

As an OVM customer, you get access to a dedicated loan officer who can help you navigate the process. Contact OVM Financial at 757-296-2148 for a free consultation. You can even start your loan application online at ovmfinancial.com/QuickStart.

Have Questions about VA Loans?

Contact our dedicated team online or via email to get personalized answers to your questions.

How To Get A Mortgage For Rental Property

Though a rental property mortgage is basically the same as a primary residence mortgage, there are some key differences. For starters, there are higher rates of default on rental property loans because borrowers facing financial troubles tend to focus on a primary home’s mortgage first. The added risk means lenders typically charge higher interest rates on rental properties.

Then there are the underwriting standards, which tend to be more strict for rental properties. In general, mortgage lenders focus on the borrower’s credit score, down payment, and debt-to-income ratio. The same factors apply to rental property mortgages, but the borrower will likely be held to more stringent credit score and DTI thresholdsand a higher minimum down payment. Additionally, the lender may take a closer look at the borrower’s employment history and income and want to see prior experience as a landlord.

In general, here’s what lenders require from borrowers to approve a rental property mortgage:

Recommended Reading: Can You Do A Reverse Mortgage On A Condo

How Is Rental Income Calculated For Mortgage Purposes

Generally speaking, if the property has a history of rental income being paid consistently, and there is no indication that the cash flow would decrease or stop, loan officers will use the income from your tax returns to calculate rental income for your mortgage qualification.

But suppose there isnt a history of rental income . In that case, loan officers will typically calculate qualifying income as 75% of the gross rent on the lease or 75% of the predicted rent reported by a licensed appraiser, whichever amount is less.

How Do You Work Out Cash On Cash Return

The best way is to simply use the Cash On Cash Return Formula

Cash On Cash Return = Annual Pre-TaxCash Flow / Actual Cash Invested * 100

When using this formula, it is important to note that as a rental property owner you dont need to include the financing costs. Instead, you are simply taking the amount of money that the property generated, and dividing it by the amount of money that was spent to acquire the property, then multiplying by 100% to get the cash-on-cash return.

You May Like: Who Is Rocket Mortgage Owned By

Scenario #: Using Income From An Investment Property You Already Own

Proof of Rental Income Documentation

To document your rental income from a property you already own, youll need a Schedule E from your most recent year of tax returns.

If you dont have a Schedule E for the property because youve acquired or converted the property to a rental after the last tax year, then youll need your lease agreement and proof of the security deposit.

With this documentation, youre ready to calculate how much of your rental income will qualify for your mortgage.

Since the calculation depends on the type of documentation youre using, Ill break Scenario #1 into two sub-scenarios: Scenario 1a and Scenario 1b.

In Scenario 1a, youre using a Schedule E from the most recent tax year to calculate your rental income. In Scenario 1b, youre using your lease agreement and proof of security deposit to do the calculation.

Rental Income Calculation

In Scenario 1a, lenders take your Net Rental Income from Schedule E and add back mortgage interest, taxes, insurances, Association/HOA dues, and any listed depreciation. Then, they average that income over 12 months.

If you werent renting your property out for the whole year, the lender will average the income over the period of time during which you were renting the property out.

In Scenario 1b, lenders take 75% of the gross monthly rent and subtract PITIA, which stands for Principle, Interest, Taxes, Insurance and Association/HOA dues.

How Rental Property Loans Work

As a rule of thumb, loans for a residential rental property come with slightly higher interest rates and require larger down payments. Rental property loans are still fully amortized over 30 years so that the payment amount is the same every month, which makes putting together an accurate pro forma for cash flow easier.

Interest rates are higher and down payments are bigger because lenders view investment property loans as being more risky compared to a mortgage for an owner-occupied home. Thats because banks know from experience that if the investment doesnt go as planned, an investor-borrower is more likely to walk away and give the keys back to the bank.

However, the slightly more restrictive terms on a rental property loan can work in favor of the real estate investor. Interest payments can be completely expensed as a tax deduction by investors. A bigger down payment creates a lower loan-to-value ratio, with a lower mortgage debt service payment amount and potentially increased cash flow.

Although every lender is different, these are some of the typical requirements to expect when applying for a residential rental property loan:

Don’t Miss: Can You Refinance A Mortgage Without A Job

How Does A Loan Officer Define Rental Income

Rental income is money earned from tenants who occupy real estate you own.

Loan officers make distinctions between:

- Subject property income and income from other properties. If you want to use income generated by the property you wish to finance, this is considered subject property income. The criteria for qualifying rental income will differ from income from the subject property than from other properties you own.

- Actual rental income received and predicted rental income. If you have a history of consistent rent payments, the loan officer can use actual income received to calculate the rental income to qualify for a mortgage. But if you dont have this documented payment history, the loan officer will need to calculate your qualifying income differently.

BUY A HOME IN 4 EASY STEPS

Get your free guide and learn how to simplify the home buying process with our 4-step method.

My Bank Declined My Loan Because Im Rent Reliant

Did you know that earning too much rental income is considered to be a bad thing?

Successful property investors often hit a wall once theyre earning more income from rent than they are from their salary.

From a lenders point of view, highly exposed investors tend to be high risk borrowers as they can be affected by market downturns more severely than normal home owners.

You May Like: How Much Is Mortgage On A 1 Million Dollar House

How Lenders Calculate Debt Ratios On Rental Properties

By Romana King on April 29, 2015

Not all your rental income is used to lower your debt service ratios

In a previous post I talked about the basics of mortgage debt ratiosthe calculations lenders use to determine if you qualify for a mortgage. This prompted this reader question:

Q: If I own a rental property, which debt ratio does that get included in? GDS or TDS or both? In other words, which debt ratio do you add the rental property mortgage payment, rental income, taxes and heat to?

Bob

A: Good question. While the short answer is TDS , the mechanics of how a rental property is assessed when applying for a mortgage are important. As such, I thought it would be a good idea to provide a brief explanation of how lenders use rental property income and expenses when you apply for a mortgage.

In general, lenders will apply two calculations when examining a rental property:

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Don’t Miss: What Does Gmfs Mortgage Stand For

Claiming Rental Income To Qualify For A Mortgage: How Do Lenders View It

See Mortgage Rate Quotes for Your Home

As a landlord or aspiring real estate investor, its possible that a lender will let you use rental income to qualify for a mortgage. Whether they actually do so will depend on your ability to provide proof of income, or if it’s for a new rental, proof of the earnings potential of the property. Lenders have to adhere to specialized guidelines when making their decision. Read on to learn more about these stipulations, as well as how they may impact your eligibility.

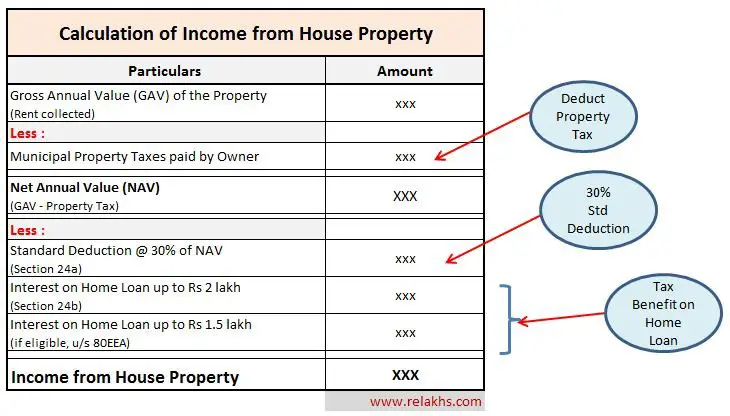

Chapter 2 Calculating Your Rental Income Or Loss

If you received income from renting real estate or other real property, you have to file a statement of income and expenses.

Even though we accept other types of financial statements, we encourage you to use Form T776.

Form T776 includes areas for you to enter your gross rents, your rental expenses, and any capital cost allowance . To calculate your rental income or loss, fill in the areas of the form that apply to you.

This chapter explains how to calculate your rental income or loss, as well as how to fill in the “Income” and “Expenses” parts of the form.

Rental losses are not allowed if your rental operation is a cost-sharing arrangement rather than an operation to make a profit.

Also Check: Chase Recast

Apply For An Investment Loan Now

We are mortgage brokers that specialise in finding solutions for people who are in situations that are outside of the box, and for investors that earn rental income thats difficult to prove or doesnt meet .

If youd like to know how we can help with your home loan then please call us on 1300 889 743 or fill in our . Our mortgage brokers are experts in helping people get the most out of their income sources and will help you get the best rates available!

Find The Right Location

The last thing you want is to be stuck with a rental property in an area that is declining rather than stable or picking up steam. A city or locale where the population is growing and a revitalization plan is underway represents a potential investment opportunity.

When choosing a profitable rental property, look for a location with low property taxes, a decent school district, and plenty of amenities, such as restaurants, coffee shops, shopping, trails, and parks. In addition, a neighborhood with a low crime rate, easy access to public transportation, and a growing job market may mean a larger pool of potential renters.

You May Like: 10 Year Treasury Vs 30 Year Mortgage

I Own An Investment Property That I Purchased In The Middle Of Last Year My Tax Returns Dont Show An Accurate Reflection Of The Income I Wouldve Made If Id Owned The Full Year Is That Going To Impact How Much Rental Income Can Be Used Toward Qualifying For A Home Loan

If your rental property was acquired during or after the most recent tax filing year or was out of service for an extended period of time, it is possible to use more income than what is reported on your tax returns.

Work directly with your mortgage advisor to explain your specific scenario. We can help you determine how much income can be used toward qualifying. You should prepare to provide documentation, such as a settlement statement to prove when the home was acquired, a current lease agreement to show what its being rented for, and/or documentation to explain why the rental property was out of service for a specific amount of time.

These are just a few of the questions you might have about rental income and qualifying for a home loan. Our experienced mortgage advisors are ready to answer any additional questions you may have.

Fill out the form below to learn more!

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our mortgage reporters and editors focus on the points consumers care about most the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more so you can feel confident when you make decisions as a homebuyer and a homeowner.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home