How Much House Can I Afford With An Fha Loan

are available to homebuyers with credit scores of 500 or more, and can help you get into a home with less money down. If your credit score is below 580, youll need to put down 10 percent of the purchase price. If your score is 580 or higher, you can put down as little as 3.5 percent.

Youll still need to crunch all the other numbers, but these lower downpayment thresholds should be a shot in the arm for your budget.

Will I Qualify For A Mortgage +

To know if you will qualify for a mortgage based on your current income, try our Mortgage Required Income Calculator. You will need to supply information about the cost of the Mortgage, down-payment, interest rates, and other liabilities, after which the calculator responds with the required minimum income to qualify for the loan.

Facts To Consider For Mortgage Loan Calculator

A Mortgage loan calculator is a specialised online tool that allows for the easy computation of monthly instalments for loans against property. Its always best to check your liabilities before applying for loan against property, which is where this tool comes of use. It helps you compute the monthly instalment by considering three factors, namely:

You May Like: Reverse Mortgage For Mobile Homes

Mortgage Balances Over Time

Mortgage balances accelerate toward zero over time. The root word is mort, or to the death, meaning until the loan dies.

The rate at which your mortgage balance falls will not remain constant. In the early years your payments will primarily be interest and in the later years the payments will be mostly principal creating a natural acceleration over the course of your loan term toward payoff.

Don’t be surprised if you check your mortgage balance early in your loan term and find it hasn’t dropped much. That is natural. This shifts midway through your loan term, with the principal taking the majority of the mortgage payments later in the term.

Remember: The longer you pay your mortgage, the faster your mortgage balance will fall.

Bond: Predetermined Lump Sum Paid At Loan Maturity

This kind of loan is rarely made except in the form of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value of a bond, is the amount paid by the issuer when the bond matures, assuming the borrower doesn’t default. Face value denotes the amount received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a percentage of the face value. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually. Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value, then pay the face value when the bond matures. Users should note that the calculator above runs calculations for zero-coupon bonds.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and many other factors. While this does not change the bond’s value at maturity, a bond’s market price can still vary during its lifetime.

Read Also: Reverse Mortgage Mobile Home

Diy Extra Payment To Prepay Mortgage

Lets say you want to budget an extra amount each month to prepay your principal. One tactic is to make one extra mortgage principal and interest payment per year. You could simply make a double payment during the month of your choosing or add one-twelfth of a principal and interest payment to each months payment. A year later, you will have made 13 payments.

Make sure you earmark any additional principal payments to go specifically toward your mortgage principal. Lenders typically have this option online or have a process for earmarking checks for principal payments only. Ask your lender for instructions. If you dont specify that the extra payments should go toward the mortgage principal, the extra money will go toward your next monthly mortgage payment, which wont help you achieve your goal of prepaying your mortgage.

Once you have built sufficient equity in your home , ask your lender to remove private mortgage insurance, or PMI. Paying down your mortgage principal at a faster rate helps eliminate PMI payments more quickly, which also saves you money in the long run. You can also refinance your mortgage to eliminate PMI altogether.

How Much Down Payment Should You Save

Before buying a house, be sure to give yourself enough time to save for a down payment. While the amount depends on your budget, the homes price, and the type of loan you have, most financial advisers recommend saving for a 20% down payment. This is a sizeable amount, which is more expensive if your homes value is higher.

In September 2020, the median sales price for new homes sold was $326,800 based on data from the U.S. Census Bureau. If this is the value of your home, you must save a down payment worth $65,360. Paying 20% down lowers risk for lenders. Its a sign that you can consistently save funds and reliably pay back your debts.

Down Payments Vary

Down payment requirements are different per type of loan. However, many conventional mortgage lenders require at least 5% down. For government-backed loans such as an FHA loan, a borrower with a credit score of 580 can make a down payment as low as 3.5% on their loan. Take note: A smaller down payment subjects you to a higher interest rate.

Nonetheless, its still worth making a larger down payment on your mortgage. Heres why paying 20% down is more beneficial for homebuyers.

Don’t Miss: How Much Is Mortgage On 1 Million

Consider The Cost Of Property Taxes

A monthly mortgage payment will often include property taxes, which are collected by the lender and then put into a specific account, commonly called an escrow or impound account. At the end of the year, the taxes are paid to the government on the homeowners’ behalf.

How much you owe in property taxes will depend on local tax rates and the value of the home. Just like income taxes, the amount the lender estimates the homeowner will need to pay could be more or less than the actual amount owed, which could result in a bill or a refund come tax season.

You can typically find your property tax rate on your local government’s website.

Get A More Accurate Estimate

Get pre-qualified by a lender to see an even more accurate estimate of your monthly mortgage payment.

-

How much house can you afford? Use our affordability calculator to estimate what you can comfortably spend on your new home.

- Pig

Interested in refinancing your existing mortgage? Use our refinance calculator to see if refinancing makes sense for you.

- Dollar Sign

Your debt-to-income ratio helps determine if you would qualify for a mortgage. Use our DTI calculator to see if you’re in the right range.

- Award Ribbon VA mortgage calculator

Use our VA home loan calculator to estimate payments for a VA loan for qualifying veterans, active military, and military families.

Participating lenders may pay Zillow Group Marketplace, Inc. a fee to receive consumer contact information, like yours. ZGMI does not recommend or endorse any lender. We display lenders based on their location, customer reviews, and other data supplied by users. For more information on our advertising practices, see ourTerms of Use & Privacy. ZGMI is a licensed mortgage broker,NMLS #1303160. A list of state licenses and disclosures is availablehere.

Recommended Reading: 10 Year Treasury Vs 30 Year Mortgage

Why Its Smart To Follow The 28/36% Rule

Most financial advisors agree that people should spend no more than 28 percent of their gross monthly income on housing expenses and no more than 36 percent on total debt that includes housing as well as things like student loans, car expenses and credit card payments. The 28/36 percent rule is the tried-and-true home affordability rule that establishes a baseline for what you can afford to pay every month.

Example: To calculate how much 28 percent of your income is, simply multiply your monthly income by 28. If your monthly income is $6,000, for example, your equation should look like this: 6,000 x 28 = 168,000. Now, divide that total by 100. 168,000 ÷ 100 = 1,680.

Depending on where you live and how much you earn, your annual income could be more than enough to cover a mortgage or it could fall short. Knowing what you can afford can help you take financially sound next steps. The last thing you want to do is jump into a 30-year home loan thats too expensive for your budget, even if you can find a lender willing to underwrite the mortgage.

What Are My Options If The Result Is Less Than I Need

In this case, you may find that adjusting the loan term enables you to meet your requirements. Although it will mean repaying more in total over the course of your loan, the lower monthly repayments could help you to afford more than your initial result suggests.

Alternatively, you can experiment with different interest rates to get the best options delivered directly to you, click the Get the FREE Quote button to get in touch with lenders who will be able to assist you.

Recommended Reading: 10 Year Treasury Yield Mortgage Rates

How Much House Can I Afford

Your house will likely be your biggest purchase, so figuring out how much you can afford is a key step in the home-buying process. The good news is that coming up with a smart budget is pretty straightforward and not too time-consuming especially with the Bankrate Home Affordability Calculator.

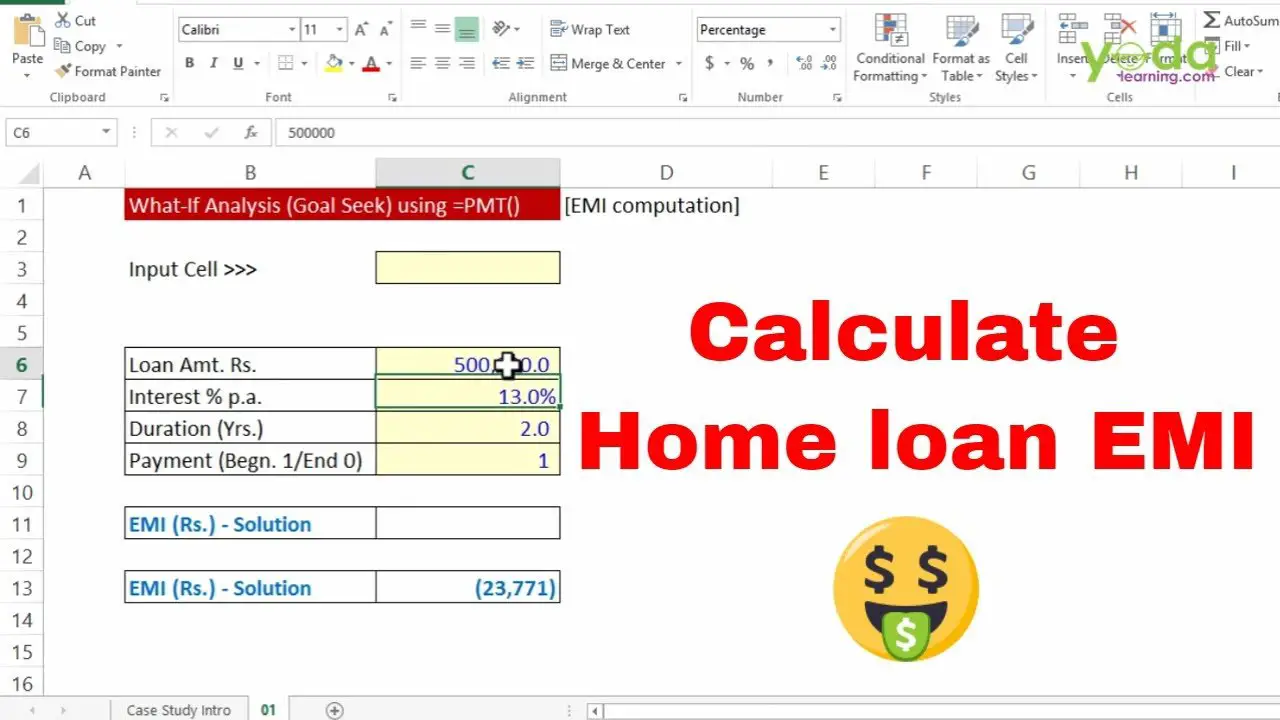

How To Use The Cleartax Loan Against Property Calculator

- Use the slider and select the loan amount.

- You then select the tenure of the loan in months.

- Move the slider and select the rate of interest.

- The calculator will show you the EMI payable, total interest, and the total payable amount.

- You can recalculate the EMI anytime by changing the input sliders.

- The EMI is calculated instantly when you move the sliders.

Read Also: Chase Mortgage Recast Fee

Want To Pay Your Loan Off Quicker

With strong property prices, its not uncommon for people to take out loans extending beyond 25 years. However, with the rise of technology and automation, who knows what the world would look like in a quarter century? Paying extra on your home means your balance is lower today AND your balance is lower tomorrow. The earlier you make mortgage overpayments, the more interest expense you will save.

Making early overpayments reduces your balance for the duration of the loan. Just take note of early repayment charges . Some lenders allow you to overpay up to a certain amount before prompting early repayment penalty fees. These fees can range between 1% to 5% of your loan amount. Be sure to make qualified overpayments to avoid this extra cost.

Suppose you want to pay off your loan in 15 years. Your original mortgage has with a 25-year term. To estimate the overpayment amount you need to make, adjust the above calculator to 15 years. For example, a £180,000 loan structured over 25 years will see you pay £56,581.78 in interest over the life of the mortgage. However, if you pay off the loan within 15 years, your monthly payment would jump from £788.61 to £1,182.51. See the example in the table below.

Loan Amount: £180,000

| £56,581.78 | £32,851.43 |

What Factors Impact The Amount You Can Borrow

Lenders consider several factors in determining the amount you qualify for, including:

-

Your debt-to-income ratio. Our How much can I borrow calculator? depends on an accurate input of your income and recurring debt. Youll want to really hone those figures down to a fine point, because lenders will be using them too.

-

Your loan-to-value ratio. This ratio is a function of the amount of money you put down. If you want to drill down on this calculation, use NerdWallets loan-to-value calculator.

-

Your credit score. This number impacts the pricing of your loan, more than how much youll qualify for. But thats really important. If you dont know your score, get it here.

Don’t Miss: Rocket Mortgage Conventional Loan

Determine Your Mortgage Principal

The initial loan amount is referred to as the mortgage principal.

For example, someone with $100,000 cash can make a 20% down payment on a $500,000 home, but will need to borrow $400,000 from the bank to complete the purchase. The mortgage principal is $400,000.

If you have a fixed-rate mortgage, you’ll pay the same amount each month. With each monthly mortgage payment, more money will go toward your principal, and less will go toward your interest.

The High Cost Of Quick Decisions

Between 2015 and 2016, nearly one in three UK consumers chose mortgage products which cost them more than £550 per year. They got more expensive options over cheaper alternatives that were readily available and which they also qualified for. This fee difference amounts to 12.7% of what consumers spend annually on their mortgage.

The remortgage market is more competitive amongst lenders than the first-time buyer market. So only around 12% in that category opted for strongly dominated product choices. About 18% of first-time buyers fall into the strongly dominated product choice category, and well over 20% of mover mortgages fall in this category. Movers who are in a rush often make emotionally driven or time-sensitive decisions. This compromises their ability to obtain the best deal the way a person who is remortgaging can.

About 14% of borrowers in the top credit score quartile secured strongly dominated products, while more than 20% of consumers in the bottom quartile did not. In general, people who are young, including borrowers with low incomes, low credit scores, and limited funds for deposit are more likely to get an unfavourable mortgage deal. If there are factors that make your transaction more complex, you might find it more challenging to obtain a good loan.

Don’t Miss: Rocket Mortgage Launchpad

Mortgage Loan Emi Calculator

Are you planning to take a loan against your property to help with your expenses? Use the Money View Mortgage Loan EMI calculator to quickly find out your EMI and plan out your finances….

All you need to enter is the loan amount that you wish to avail, the interest rate, and the repayment term. Within a minute youll be able to find out the EMI amount that you need to pay.

| 0.00 |

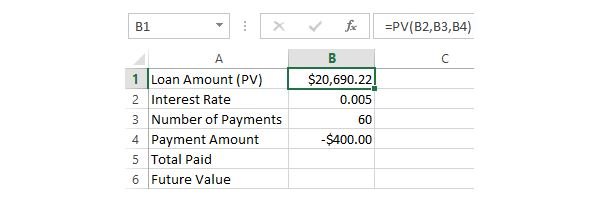

What Loan Amount Can You Afford Based On Monthly Payments

When you are looking into getting a loan, it is easier to estimate the amount you can pay monthly, based on your current financial situation, as opposed to the total loan amount you can borrow, depending of course on its interest rate and its term. It is a common situation when you shop for a car or a home. In fact, knowing the total amount of the monthly payment is vital when applying for a loan.

This important number, the monthly payment, will inform you from the start if a cash down on the loan would be required on the transaction. For example, if you want to buy a house at $300,000.00 and you calculate that you can afford a mortgage of $240,000.00, you know that you require a cash down of $60,000.00 in order to be accepted by the lender, or at least, to avoid .

This approach can protect your credit score from decreasing since you would avoid making potential .

With the following calculator, you can predict the possible total loan amount, based on your monthly payments, the interest rate and the term.

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

Get A Handle On What A Loan Costs You Each Month

If you own a home, you probably know that a portion of what you pay the lender each month goes toward the original loan amount while some gets applied to the interest. But figuring out how banks actually divvy those up can seem confusing.

You may also wonder why your payment stays remarkably consistent, even though your outstanding balance keeps going down. If you understand the basic concept of how lenders calculate your payment, however, the process is simpler than you might think.

Know How Much You Own

Its crucial to understand how much of your home you actually own. Of course, you own the homebut until its paid off, your lender has a lien on the property, so its not yours free-and-clear. The value that you own, known as your “home equity,” is the homes market value minus any outstanding loan balance.

You might want to calculate your equity for several reasons.

- Your loan-to-value ratio is critical, because lenders look for a minimum ratio before approving loans. If you want to refinance or figure out how much your down payment needs to be on your next home, you need to know the LTV ratio.

- Your net worth is based on how much of your home you actually own. Having a million-dollar home doesnt do you much good if you owe $999,000 on the property.

- You can borrow against your home using second mortgages and home equity lines of credit . Lenders often prefer an LTV below 80% to approve a loan, but some lenders go higher.

Read Also: 70000 Mortgage Over 30 Years

What Other Expenses Does Homeownership Entail

It’s important to recognize that the estimated total cost of your home purchase is only an estimate and not necessarily representative of future conditions. There are many factors that are not taken into account in the calculations we illustrated above we include a few below for your consideration.

Taxes

While these fixed fees are charged regularly, they have a tendency to change over time, especially in large metropolitan areas like New York and Boston. New-home purchases often have their values reassessed within a year or two, which impacts the actual taxes paid. For that reason, your originally forecasted tax liability may increase or decrease as a result of new assessments.

HOA Dues

For buyers considering condos, homeowners associations can increase their monthly dues or charge special HOA assessments without warning. This can make up a large portion of your housing expenses, especially in large cities with high maintenance fees. You might also be subject to increased volatility in HOA fees if the community you live in has issues keeping tenants or a troubled track record.

Maintenance Costs

Finally, typical mortgage expenses don’t account for other costs of ownership, like monthly utility bills, unexpected repairs, maintenance costs and the general upkeep that comes with being a homeowner. While these go beyond the realm of mortgage shopping, they are real expenses that add up over time and are factors that should be considered by anyone thinking of buying a home.