Example Cost Of Mortgage Payment Protection In 2021

Like with all insurance policies, the cost of your premiums will be determined by your personal circumstances and the type of policy you opt for.

To provide you with some useful examples we have calculated the cost of a Mortgage Payment Protection policy for a 30 year old who:

- is in an office based role as a marketing manager

- has no pre-existing health conditions

- is a non-smoker

- wants the policy to pay out for up to 2 years

What Other Factors Influence Your Home Insurance Premiums

Remember those other factors we were talking about? Weve listed a few of them for you below, but this isnt the whole list. Not nearly. Our property insurance calculator will evaluate all these factors and more to figure out exactly what kind of coverage you might need. Once you know, it makes getting a home insurance quote much easier. But, for now, scroll down to see what variables you may need to consider.

Location: The location of your home can make a difference. If your neighbourhood has a higher number of claims than other neighbourhoods, the insurance company may increase your premiums.

Fire hydrant/station proximity: Living close to a fire station might mean being woken up in the middle of the night, but it could also lead to lower premiums because theres a reduced chance of substantial property damage. In urban areas, this isnt much of an issue. However, this could result in higher premiums if your home is in a rural or remote area.

The age and condition of your home: A home is more susceptible to damage as it ages. Old pipes can leak or the roof may begin to deteriorate. Renovating and repairing your home to avoid age-related repairs can lead to lower premiums.

How many claims youve made in the past: Making a number of claims can lead to higher premiums.

Your age: It may be difficult to maintain your home as you grow older. This increases the possibility of damage to your home and your premiums may also rise.

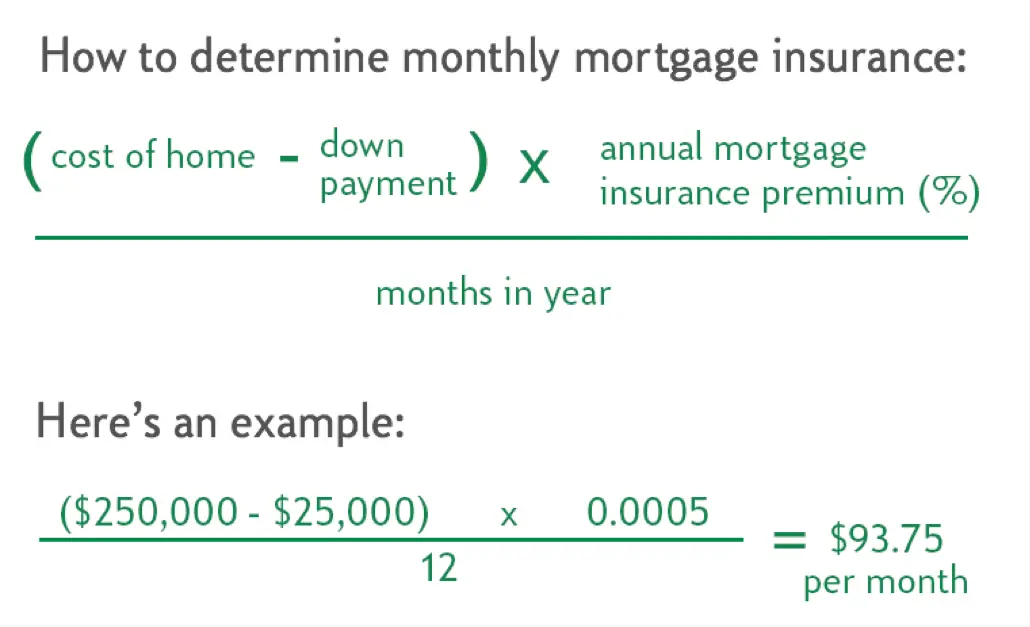

What Is Pmi And How Is It Calculated

When you take out a home loan or refinance your mortgage, your lender may require you to pay for an additional type of insurance private mortgage insurance.

When do you have to pay private mortgage insurance and how much will it cost you? It depends on your loan-to-value ratio. Find out when you have to pay PMI and learn how to calculate the cost.

Also Check: How Does The 10 Year Treasury Affect Mortgage Rates

How To Get Rid Of Fha Mortgage Insurance

One of the main ways to get rid of FHA MIP is to make at least a 10% down payment at closing. Youll still pay the premiums, but just for 11 years.

Another way to get an FHA MIP removal it is to refinance into a conventional loan however, there are several things youll need to do to prepare for a refi, including:

- Having a credit history thats free from any blemishes that could stop you from qualifying for a refinance

- Improving your credit score to 620 or higher

- Building at least 20% home equity

Still, FHA mortgage insurance may not bother you much if youre a first-time homebuyer. The benefit of making a small down payment and achieving homeownership sooner rather than saving up for a 20% down payment may outweigh the disadvantage of carrying this extra loan cost.

When Do You Need Mortgage Insurance

When you get a mortgage, insurance varies by loan product. Heres what you can expect with each type of loan:

- Conventional loans: On conventional loans, youll only need mortgage insurance if you make a down payment under 20% . Conventional loans dont require an upfront mortgage insurance payment just a monthly one youll pay along with your mortgage.

- FHA loans: If youre getting an FHA loan, mortgage insurance will always be required both upfront and annually .

- USDA loans: USDA loans also require upfront and annual premiums, though theyre referred to as guarantee fees.

VA loans do not require mortgage insurance. There is a funding fee, but this is paid at closing and can be rolled into the loan balance.

Recommended Reading: Rocket Mortgage Loan Requirements

How To Calculate Mortgage Payments

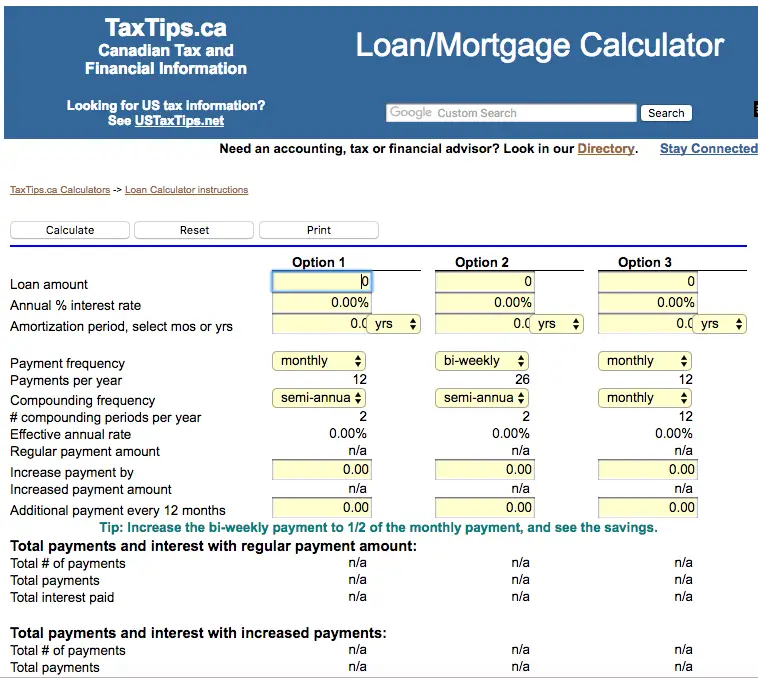

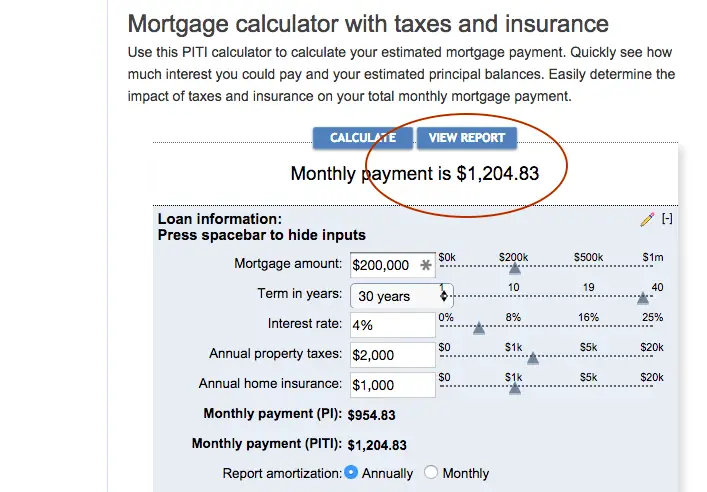

Calculating mortgage payments used to be complex, but mortgage payment calculators make it much easier. Our mortgage payment calculator gives you everything you need to test different scenarios, to help you decide what mortgage is right for you. Heres a little more information on how the calculator works.

Is Pmi Worth It

The answer to that question largely depends on how quickly home prices are rising in the area where you want to purchase. What PMI essentially buys you is the ability to cash in on appreciating values before youve saved the lump sum needed for a 20% down payment.

Of course, it brings other homeownership benefits, too. But, from a financial standpoint, its that early ability to benefit from home price inflation thats key. Suddenly, you see rising real estate prices as a plus, rather than something to watch with dread.

Read Also: Chase Mortgage Recast Fee

What Is Lmi And How Does It Work

LMI is an insurance policy that some home loan borrowers need to pay for. The purpose of LMI is to protect the lender from financial loss if the borrower cant afford to meet their home loan repayments.

If the borrower defaults on their loan and the sale of the property doesnt equal the unpaid value of the mortgage, lenders can claim on the LMI policy to make up the difference.

Many people believe that LMI is designed to protect the borrower in the case of loan default, but this is actually mortgage protection insurance, which is a different product. The true purpose of LMI is to protect and potentially benefit the lender. Additionally, by reducing the risk to the lender, LMI can allow banks and other financial institutions to lend larger amounts and approve more home loan applications.

If your lender requires you to take out LMI, it can typically be paid upfront or capitalised into your home loan. If the LMI amount is capitalised into your loan, you would generally be charged interest on it by your lender, along with the rest of your loan. LMI premiums are typically non-refundable which means if you switch your loan to another provider in the future, you generally wont be able to transfer your LMI to another lender. Depending on the situation, you may have to pay for a new policy through the new lender.

What Does Lmi Cost

How much LMI actually costs will depend on a range of factors that collectively affect your lenders risk assessment of you as a borrower.

To give you a rough idea, weve used the LMI calculator available through one of Australias largest LMI providers, Genworth, to give you some hypothetical ballpark cost calculations. This is based on the upfront premiums payable for a first home borrower. If you decide to capitalise your LMI into your home loan, youll also have to factor in the additional interest you would be charged on the insurance amount over the life of the loan.

Recommended Reading: Rocket Mortgage Qualifications

What Is Homeowners Insurance

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home.

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral in case of fire or other damage-causing events.

Monthly Private Mortgage Insurance

The most commonpmiplan is the borrower paid monthly pmi premium. The following pmi chart illustrates the calculation variables for the borrower paid pmi cost.

fixed-rate 30-YEAR| 29% | 33% |

Along the left side of the chart is the loan to value. Loan is value is a simple calculation that determines the equity in the home. The calculation is simple for a purchase. Simply subtract the down payment number from 100 and you have the loan to value. For example, with a 5% down payment, 100 – 5 = 95%. For a 10% down payment, 100 – 10 = 90%. Another way to determine the loan to value is to divide the loan amount by the sales price . For example, if the sales price is $100,000 and the mortgage amount is $95,000, the loan to value is 95%

You May Like: Can You Do A Reverse Mortgage On A Mobile Home

How To Lower Your Mortgage Payments

There are a few ways to lower your monthly mortgage payments. You can reduce the purchase price, make a bigger down payment, extend the amortization period, or find a lower mortgage rate. Use the calculator to see what your payment would be in different scenarios.

Keep in mind that if your down payment is less than 20%, your maximum amortization period is 25 years. As for finding a lower mortgage rate, its a good idea to speak to a mortgage broker for assistance.

Why Does Your Monthly Calculator Have Four Columns

We think it’s important for you to compare your options side by side. We start the calculator by outlining the four most common options for down payment scenarios, but you are not limited to those options. We also allow you to vary amortization period as well as interest rates, so you’ll know how a variable vs. fixed mortgage rate changes your payment.

You May Like: How To Get Preapproved For A Mortgage With Bad Credit

Home Insurance Calculator: Estimate Your Homeowners Cost

For many people, purchasing a home is the most significant financial decision of their lives. Because your home is such an important and valuable possession, you should make sure that your investment is protected. Home insurance protects your house and personal property from damage and ensures that you receive adequate compensation if anything goes wrong.

MoneyGeek’s homeowners insurance calculator can help you quickly and easily estimate the cost of your homeowners insurance. Its a useful tool whether youre considering insurance for a property you already own or for a future purchase.

How To Buy A House Directly From An Owner

- Determine your budget. Either way, buying a home starts with what you can afford.

- See if you qualify for a loan. If your current financial situation does not allow you to finance the house of your dreams, you should apply for a loan.

- To investigate.

- We visit the FSB at home.

- Schedule a home visit.

- Let the house be appreciated.

Don’t Miss: Recasting Mortgage Chase

How Do You Calculate A 30 Year Mortgage

- Divide the interest by 12 to get the monthly interest.

- Add 1 to your monthly rate. In this example add 1 to get

- When you make 360 ââpayments on a 30-year mortgage, you increase the net income to 360. In this example, you increase the degree to 360 to

- Multiply thisStep 3 due to the monthly interest. In this example, you multiply by om. to get

- Subtract 1 fromStep 3 Results. In this example, subtract 1 from to get

- PartStep 4 It results inStep 5 Results. In this example, share to get

- Multiply thisStep 6 the result of the mortgage amount to quantify the monthly payments.

Whats The Difference Between Pmi And Mip

There are two types of mortgage insurance: PMI and MIP . Heres how those differ:

- PMI: PMI is what youll need on a conventional mortgage, and your lender will choose the policy.

- MIP: MIP is the insurance required on FHA loans.

With USDA loans, the Department of Agriculture is the guarantor, so your premiums will be paid directly to the USDA as part of your mortgage payment.

You May Like: Does Rocket Mortgage Service Their Own Loans

When Can I Stop Paying Pmi

PMI for home loans can be removed if you satisfy at leastone of the following:

You achieve a 78% Loan-To-Value ratio of the purchase price of the home If you make enough payments such that your LTV is 78%, then PMI should automatically be removed by the insurer. You can also get PMI manually removed when you have 20% ownership in the house, but you will have to reach out to your insurer to get it removed. In most cases, it takes homeowners 11 years to own enough equity in the home to get PMI removed. For example, on a $300,000 home price, if you have $234,000 outstanding in your mortgage, then you have achieved 78% LTV and PMI would be removed.

An Example Quote For Private Mortgage Insurance

Check out this PMI example quote. This is from the private mortgage insurance company, Radian.

When calculating this rate, we put in a 5% down loan, a $200,000 loan amount, one borrower, a 760 credit score, single family residence, and we selected it to be a primary residence. With this, youd be looking at $60 a month at a mortgage insurance factor of 0.36%. They calculate the amount by taking 0.36% of the loan amount and dividing it by 12, to get your monthly amount. Youll pay mortgage insurance monthly and then there is an adjustment period after the 10th year. In this example, the MI rate would go down to 0.2% at the 10 year mark however, the adjustment period isnt always hit because a lot of people refinance before that 10th year.

Also Check: Does Prequalifying For A Mortgage Affect Your Credit

What Are Some Of The Hidden Costs Of Selling A House

- Closing costs for the seller. If you’ve ever bought a home, you may be vaguely familiar with the final cost.

- Operation costs.

What does pre foreclosure meanWhat is the difference between foreclosure and pre-foreclose? Foreclosure is the initial stage of a potential foreclosure in which the owner still controls the property, and foreclosure is the process where the lender takes over management of the property.What happens if my house goes into foreclosure?If your house is in foreclosure, it means that you, the borrower, have not paid your mortgage loan and the bank or fâ¦

How Do You Pay Mortgage Default Insurance

Mortgage default insurance is financed through your mortgage. Unlike closing costs, such as legal fees and land transfer tax, it does not require a lump sum cash outlay at the time you purchase your home. Instead, your mortgage default insurance premium is added to your mortgage amount and paid off over the life of your loan. Continuing with the above example, the revised mortgage amount would be $260,000 + $8,060 = $268,060 this is how much you would need to borrow from your lender, in order to purchase your home.

Don’t Miss: Reverse Mortgage Manufactured Home

Is Mortgage Life Insurance Mandatory

Again there can be some confusion here. Mortgage life insurance is not mandatory. It is optional. However, mortgage loan insurance can be mandatory. It depends on the amount of the down payment on the home. If the down payments were less than 20% then the sale price of the home, the insurance is mandatory. Its referred to as mortgage default insurance. Some mortgage lenders may not lend the money if there is no mortgage life insurance in place.

Mortgage Life Insurance Calculator

Mortgage life insurance calculator as its name suggests, can calculate the complete mortgage payment. It is needed in case something unexpected happens to the insurance policy holder. Mortgage calculators use the internal interest rates and combine other charges automatically, too. They can also tell you how much the mortgage life insurance you will need, and what should be your annual mortgage payment. Mortgage life insurance calculator requires several inputs from you in order to accurately calculate the mortgage payments. You will have to render details regarding your age, policy term, gender, and even personal habits like smoking and drinking. You will need to know your property value to the last details and you will also need to fill the loan amount. After filling your zip code and address details, you can calculate your amount. Your smoking and drinking habits can make a lot of difference.

You May Like: Rocket Mortgage Launchpad

How To Stop Paying Pmi

You can remove private mortgage insurance in the following ways:

- Build equity in your home over time. Your mortgage servicer is legally required to stop charging PMI premiums once your balance hits 78 percent of the original loan.

- Contact your servicer when you have 20 percent equity. You can press fast-forward on that automatic PMI cancellation when your balance reaches 80 percent of the original loan. At this point, you can request to cancel PMI.

- Get your home appraised. Reaching that magic 20 percent equity marker doesnt just involve paying down your principal over time. If your homes value has appreciated since you purchased it, you can contact your lender to request a professional appraisal. According to HomeAdvisor, an appraisal will cost around $350 a small price that can quickly be recouped after a few months of cheaper payments.

- Refinance your mortgage. Refinancing your mortgage is another option that will include an appraisal. This process costs quite a bit more, but it can make sense if your original mortgage had a high interest rate. Use Bankrates refinance calculator to estimate if refinancing is the right move for you.