Fha Collection Guidelines 5% Of Balance Payment Option

What if my collections are over $2000, are not medical, not in a payment plan, and I cant pay them off? There is another option! Rather than paying off the collections, a lender may calculate 5% of the collection outstanding balance for payment. Lets use a $10,000 collection as an example. A 5% calculated payment is $500. Therefore, the collection does not have to be paid off if the borrower qualifies with this payment.

Can I Get A Mortgage With Student Loans In Collections

Defaulting on a student loan can put a hold on your dream of homeownership. Federal student loan debt is not dischargeable and does not have a statute of limitations. FHA mortgage loans will certainly not be approved for anyone with defaulted student loans. If you have defaulted there are options to get back on track. These include loan rehabilitation, loan consolidation, and repayment in full.

Using Credit Cards To Pay A Debt

Using a credit card for medical debt is the last resort of last resorts.

Only use credit cards to consolidate medical debt if you can pay the credit card bills promptly. If you cant, first discuss whether the medical provider might offer an interest-free payment plan, which would be more manageable than a credit card debt that accrues interest.

Some patients opt to use medical credit cards, which are like conventional cards but are designed exclusively for medical expenses. Application forms are sometimes available in doctors offices.

Before applying for a medical card, especially one that advertises no interest on balances, carefully review the terms. You probably will discover that the no-interest grace period ends in several months and the interest rate charged after that is quite high.

Read Also: Are Mortgage Rates Predicted To Go Up Or Down

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

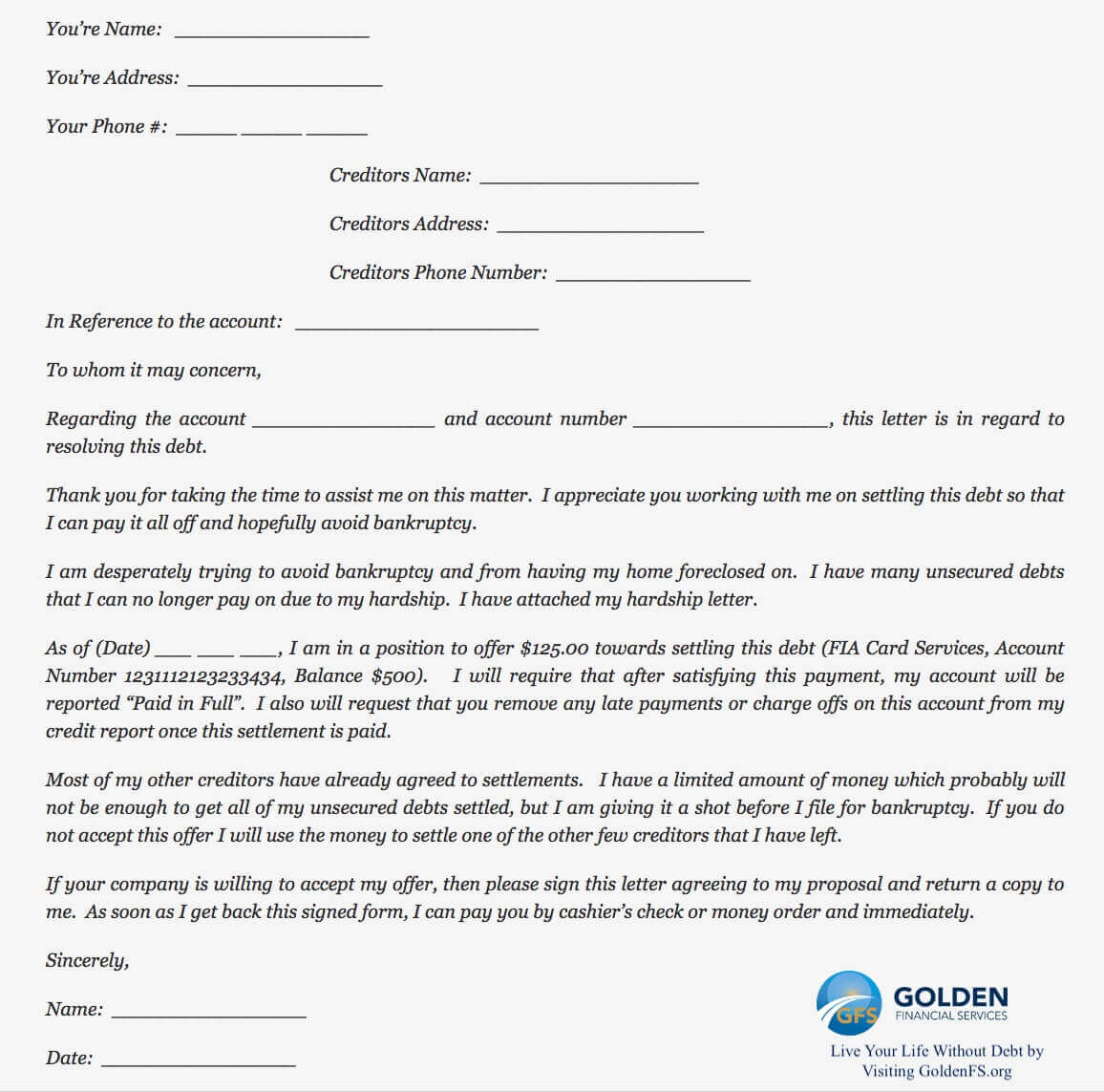

How To Negotiate Medical Collections

Medical collections go away as soon as you pay them. But what if you need a payment plan or wish to negotiate a lower payoff? You might be able to negotiate a deletion or keep a collection from appearing after 180 days by agreeing to regular payments or a lump sum settlement. Medical collections accrue no interest, so a payment plan might work well for you.

Conduct your negotiations in writing and don’t send money until you have a signed agreement in hand. If the collection agency insists on reporting your collection to credit bureaus, at least it will come off once the account is paid.

Check out this sample pay for delete letter

Recommended Reading: What Is Loan To Value Mortgage

Don’t Reactivate The Account

Collections are serious delinquencies and damage your FICO score heavily. However, the harm diminishes over time. Settling an old collection or starting a payment plan makes it appear new again to credit bureaus, and you can actually drop your score.

How should you deal with an old collection? First, do not talk to any bill collector who contacts you about an old debt. You don’t want to accidentally restart that clock. Request documentation proving that you owe the debt and indicating that the collector is authorized to collect it. State plainly that you do no acknowledge the debt as yours. If they can’t prove you owe it, dispute it with the credit bureaus.

If a collector tries to report an old debt to credit bureaus as though it were new, that’s a violation of the Fair Credit Reporting Act, and you can have it removed. You can also make the creditor stop contacting you about a debt with a written request.

Related: How Private Is Your Mortgage Information?

Pros And Cons Of Medical Loans For Bad Credit

Pros

- Loans can be funded quickly, sometimes the same day of loan approval.

- Payments are generally the same every month.

- Lenders offer a variety of repayment terms.

cons

- Interest rates can be high, sometimes 35.00% or more.

- Fees may be applicable for this product.

- Your credit score may take a dip from a hard credit inquiry during the application process.

Don’t Miss: What Is Verifiable Income For A Mortgage

Medical Debt Collections: Cchis Deep Dive

Savanah McDaniel, Policy Fellow

Medical debt is the number one cause of bankruptcy in the United States. After recent local media coverage and the sheer frequency of medical debt issues, Coloradans may not find this surprising. According to a 9News investigation, eight hospitals in the Denver area have placed liens on peoples houses to collect medical debt. Earlier this year, CCHI did our own research on medical debt collections in order to shed some light on how it might be affecting Coloradans.

Medical debt is often a result of urgent or emergency medical services that health insurance will not cover- either because a patient does not have insurance, or because the doctor or hospital was out-of-network. It is easy to understand that without insurance, or with a high deductible plan, an unplanned illness can easily become a huge expense. However, when a patient does have comprehensive insurance, and they go to an in-network health care facility, they may still be treated by an out-of-network provider without their knowledge. In this situation, patients can receive an expensive, out-of-network bill, also known as a balance bill.

All these factors make it difficult for consumers to know what they owe, for what service, to whom, and when its due.

What We Found:

How Does this Affect consumers?

According to the 2017 Colorado Health Access Survey, of the 14% of Coloradans who reported having problems paying medical bills:

How Medical Bills Affect Credit When Buying A House

Unpaid medical bills can affect your credit when buying a house, if they appear on your consumer report if the scoring equations subtract points, and if the mortgage lender guidelines pertain to your situation.

That introductory sentence includes three big ifs, which we explore in detail below. Remember, every persons situation is unique, as are the lenders evaluating your application.

Also Check: Are Mortgage Rates Going To Rise

Negotiate With The Hospital Or Healthcare Provider

If youve received medical care and receive a bill from the hospital or healthcare provider that you cant afford to repay, dont panic. Depending on your circumstances, you may be able to negotiate the bill with the hospital or your healthcare provider. In some cases, you could enter into a payment plan and spread the payments over several years, or the hospital or healthcare provider may waive some or all of the cost. 100% forgiveness is possible, but it depends on the provider, the clients income, the persons employment status, their age, and lots of other factors, says Linden. Its worth contacting your healthcare provider to see what help they can offer you.

What Happens To Your Credit

Generally, your credit score will drop as a result of a new collection reporting. It typically depends on the amount of the collection as well as the status of your credit beforehand when it comes to how much your credit is affected. You can guarantee, however, that it will be negatively impacted in some manner. For example, a $2,000 collection would hurt your credit much more than a $100 collection, but they are both still negative marks on your credit report.

Don’t Miss: How Long Does Fha Mortgage Insurance Last

Can I Stop Medical Bills From Landing On My Credit Report

You can take some steps to prevent future medical bills from affecting your credit.

-

Follow up with your insurance company. Understand your insurance policy and follow up by phone or email to make sure the company is paying the bills it has agreed to cover.

-

Negotiate unmanageable bills. When you cant afford to pay a bill, contact your medical provider and try to negotiate it down or ask for a payment plan. If youre successful, get the new amount you owe in writing so that you have a record of your agreement in case of a future dispute.

-

Consider hiring a billing advocate. If youre overwhelmed by your bills and arent sure how to proceed, think about hiring a medical billing advocate. This professional can sort through your bills and try to negotiate them on your behalf.

-

Crowdfund your medical bill. Set up a fundraiser with a crowdfunding site such GiveForward to get help with your bills from family, friends and strangers though it’s not a surefire way to pay off medical debt.

Can You Get A Mortgage With Medical Collections

The largest question is whether or not you can secure a mortgage if you have medical collections reporting on your credit report. The answer is not as cut and dry as you would probably hope, though.

Some loan programs, such as the FHA loan does not get affected by medical collections. You can still get approved for an FHA loan if you have unpaid medical bills. That being said, not every lender is going to agree with that. Because the FHA does not fund the loans, but rather guarantees them, they have their own rules, but the lender supplying the funds can add additional rules to the mix. This means one lender might give you a mortgage with collections on your credit report while another might not.

Depending on the size of the collection, though, your credit score could be negatively impacted enough that the score dips too low to get approved for any type of loan. Typically 620 is the lowest score able to be used for loans, such as the FHA loan. However, every program has a different threshold as does each lender, so you might find different answers with each program/lender.

Read Also: What Documents Do I Need To Get A Mortgage

Hud Agency Guidelines On Credit Disputes

- Mortgage Process will be halted if borrowers have any disputes on non-medical collections, late payments, or other derogatory credit tradelines

- Borrowers need to retract the credit dispute in order for mortgage process to continue

- Unfortunately, when credit disputes are retracted on a derogatory item with balance, scores will most likely drop

- There have been cases where a credit dispute retraction has dropped applicantâs credit score by almost 100 points

- Borrowers with collections that have zero credit balances, then the above rules on dispute retraction does not apply

- Zero balance credit disputes on non-medical collections do not have to be removed

Borrowers can dispute negative derogatory credit items with zero balances as well as medical collections.

Medical Debt Relief Options For Special Circumstances

Seniors, veterans and people in recovery may benefit from special options for relieving medical debt. Its important to stay educated on different advantages available that are unique to your situation.

Seniors

Approximately 85% of seniors aged 65 and above live with chronic conditions, which can lead to increased medical debt. Medicare and Medicaid are both designed to help seniors with their health care. Not only can they help provide relief for long-term health care, but they can also help lower out-of-pocket payments for medical expenses and bills. You can learn more about both of these programs on the official Medicare/Medicaid website.

The State Health Insurance Assistance Program, or SHIP, is a state-based program that offers local counseling and assistance to Medicare recipients and their families. SHIP can help with many different issues arising from medical care and costs, including advice on how to deal with medical bills.

Veterans

Depending on the situation, the Department of Veterans Affairs may provide reimbursement for medical care for service-connected veterans. In general, the two qualifying aspects include:

- If a VA or other federal facility is not feasibly available for treatment.

- The medical care was for a service-related disability.

Veterans can work with their local VA health care facility to learn more and for additional relief options.

People Recovering from Addiction or Serious Illness

Recommended Reading: What Day Of The Week Are Mortgage Rates Lowest

Can Medical Bills Stop You From Buying A House

September 22, 2020 by Josephine Nesbit

Can medical bills stop you from buying a house? The short answer is, maybe. You might think youre in the clear from medical bills, but one in five Americans covered by health insurance receives a surprise medical bill, even if the hospital was in-network. With millions of Americans struggling to pay off medical debt, many are concerned as to whether medical bills can stop them from buying a house. A 2019 Zillow report on housing trends found that 38% of homebuyers denied a mortgage were denied due to medical debt. Although medical debt is a barrier when it comes to mortgage application approval, it doesnt mean its impossible to get a home loan.

What To Do If A Lender Refuses Your Mortgage Application

A lender could refuse you for a mortgage even if youve been preapproved.

Before a lender approves your loan, theyll verify that the property you want meets certain standards. These standards will vary from lender to lender.

Each lender sets their own lending guidelines and policies. A lender may refuse to grant you a mortgage if you have a poor credit history. There may be other reasons. If you dont get a mortgage, ask your lender about other options available to you.

Other options may include:

- approving you for a lower mortgage amount

- charging you a higher interest rate on the mortgage

- requiring that you provide a larger down payment

- requiring that someone co-sign with you on the mortgage

Don’t Miss: Is It A Good Idea To Pay Off Your Mortgage

Can Medical Bills In Collections Hurt Your Mortgage Chances

Much like how we take care of our homes, we also need to take care of our bodies. However, medical costs can get pretty expensive. In fact, the average cost of health care is around $3,949 per day. A nightâs stay at the hospital, however, costs an average of $15,734.

To that end, itâs no surprise that many consumers struggle to keep up with their medical payments. But, if you neglect your medical debt long enough, it may just end up in collections. A collection account is an unpaid debt sent to a collection agency.

In this article, weâll be taking a look at what happens when medical bills end up in collections. Specifically, how it affects your credit and mortgage chances, and the things you can do.

Can I Get Medical Bills Off Of My Credit Reports

If your medical bill is in collections by error and is hurting your credit score, youre probably wondering if it can be removed. If the bill is less than 180 days old or if it has now been paid by insurance, you should be able to dispute the error with the credit bureau.

Theres no guarantee the error will be removed from your credit report. But the effort is worth it because poor credit scores can make borrowing money really expensive.

Here are the steps to take:

Gather evidence. Collect as much documentation as you can to prove the bill was paid. Ask for payment records from your doctors office, find copies of canceled checks or dig up old credit card statements.

File your dispute with any credit bureau that’s reporting the error. Make sure to check your credit reports from all the three bureaus. Through April 2022, you can get a free copy of your credit report weekly from each bureau.

Keep communicating. The Fair Credit Reporting Act requires the credit bureaus to follow up on all credit reporting error disputes. Keep communicating with the companies to check on the status of your dispute, and be prepared to provide additional documentation if requested.

You May Like: Why Would A Mortgage Be Declined

How To Pay Off Medical Debt

Treat medical bills like any other debt: Honestly and responsibly. Experts advise to pay the mortgage and credit card bills first, but do not ignore the medical bills.

If the bill becomes onerous or burdensome, do not be afraid to speak up and advocate for yourself. One approach to avoid, or use only as an extreme last resort: Putting medical bills on a credit card. That could lead to a spiral fueled by high credit card interest rates.

Jinnifer Ortquist, who works in Money Management Education for the Michigan State University Extension, emphasizes the importance of verifying bills and date of service.

For complicated services, request an itemized bill from your provider to see how much you were charged for each service, she writes online about dealing with medical debt. Also, make sure that your medical services were submitted to your insurance company.

Ortquist emphasizes keeping extensive documentation, to send a written notice to the provider with a copy of all relevant records and to send the dispute via certified mail with return receipt to ensure you have proof the letter was received.

She advises responding quickly to bills, and to pay what you can and what you owe as promptly as you can.

How To Deal With Medical Bills On Your Credit Report

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A serious illness or injury can be disruptive. You need to heal, and you may be overwhelmed for a while as you put your work and family life back together.

Theres a strong chance your finances will be affected, too. If an unpaid medical bill makes its way to your credit reports, your credit scores could suffer for years. .

Here’s how unpaid medical bills affect your credit and how to deal with the fallout if you end up in collections.

Recommended Reading: What Is The Lowest Fixed Rate Mortgage